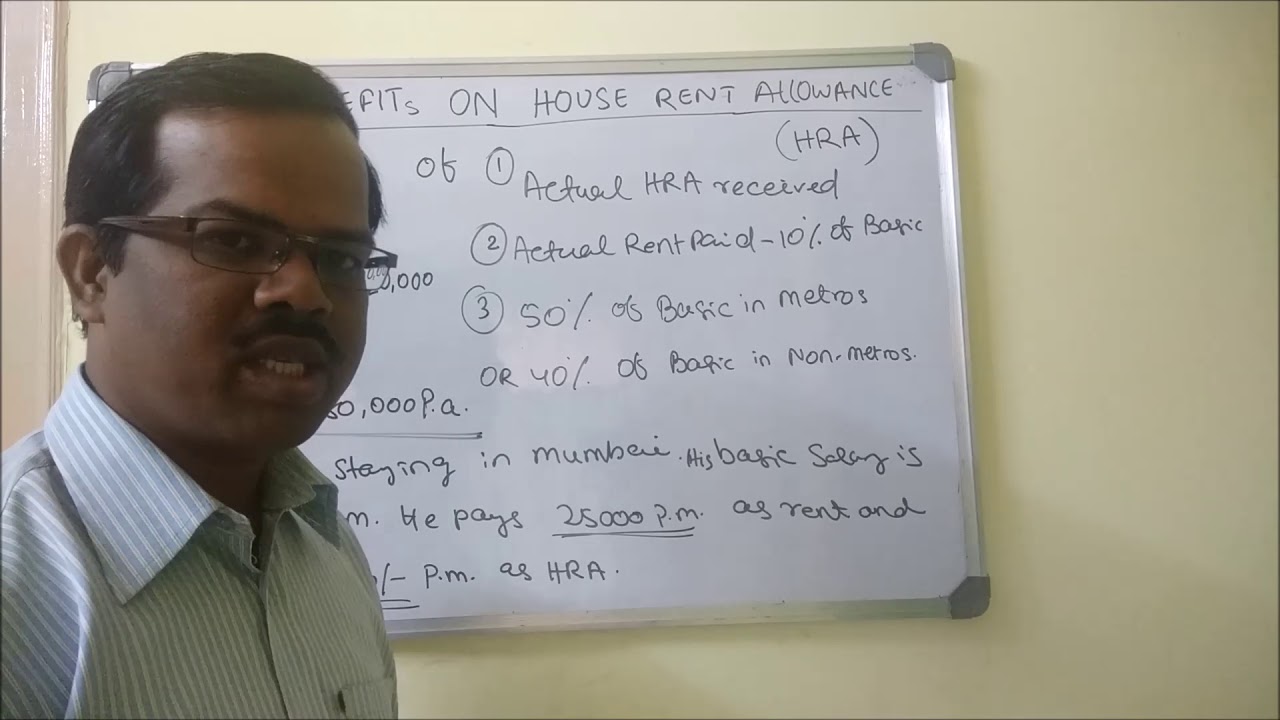

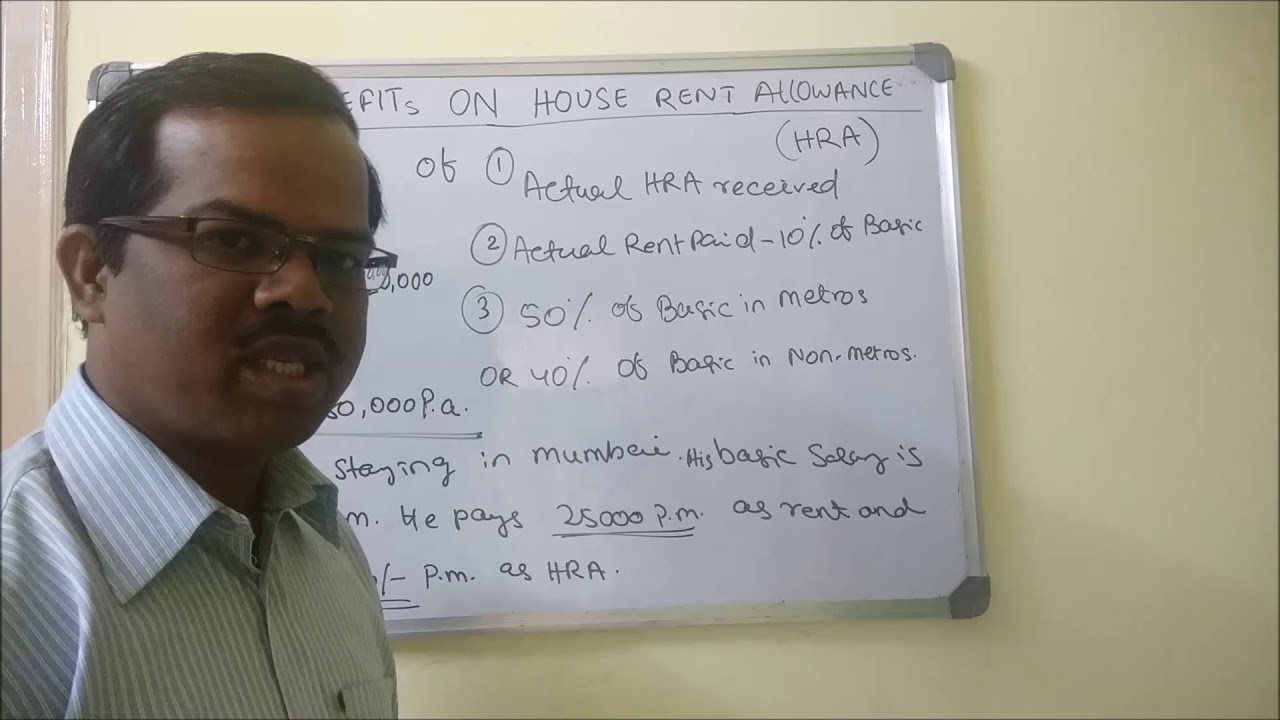

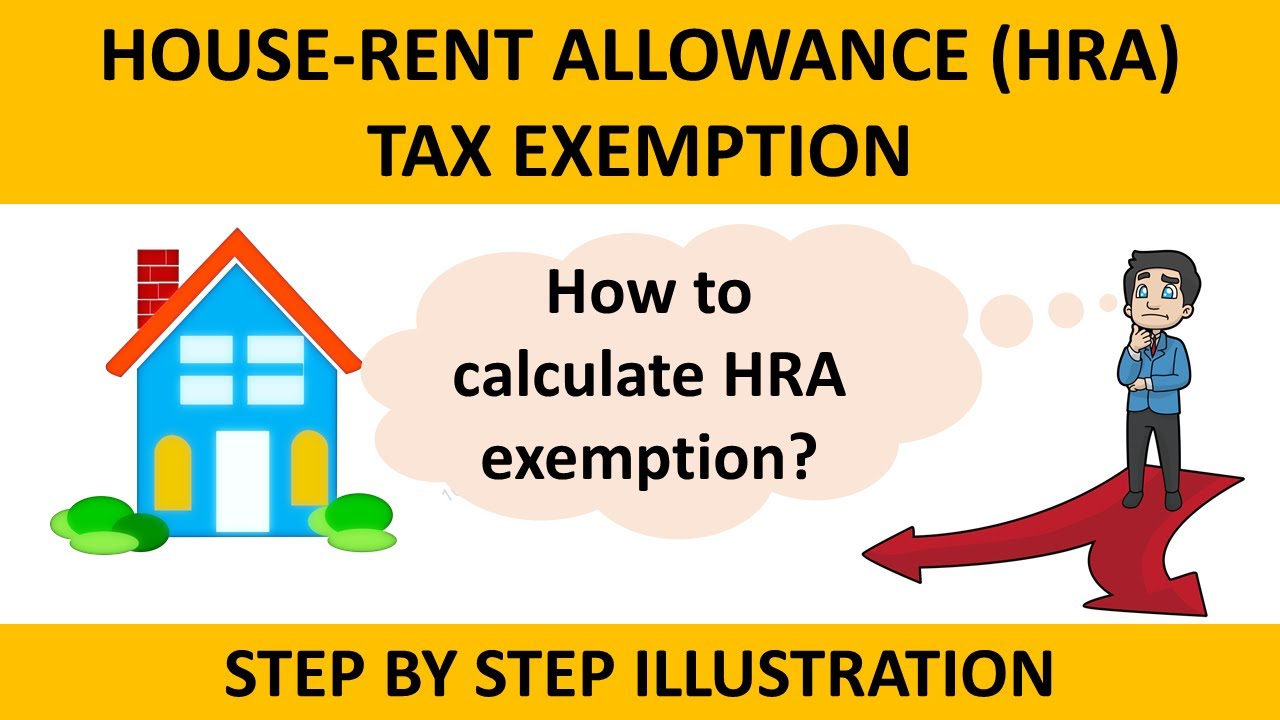

Hra Exemption 3 Conditions 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Section 80GG of Income Tax Act 1961 Stay in Rented Accommodation Not living in a self owned Rent paid exceeds 10 of

You can claim HRA exemption for the period during which you stayed in a rented accommodation if the following conditions are fulfilled You should be a salaried employee The tax benefits related to HRA exemption are available only to salaried individuals A self employed person cannot take advantage of this exemption Salaried individuals who live in a rented house can claim House Rent Allowance or HRA to lower taxes This can be partially or completely exempt from taxes The allowance is for expenses related to rented accommodation If you don t live in a rented accommodation this allowance is fully taxable

Hra Exemption 3 Conditions

Hra Exemption 3 Conditions

https://i.ytimg.com/vi/e3BGjtnrDuY/maxresdefault.jpg

House Rent Allowance Hra Tax Exemption Hra Calculation Rules Free

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-3-1024x796.png

Can I Claim HRA For Rent That Parents Pay Mint

https://www.livemint.com/lm-img/img/2023/06/04/1600x900/HRA-exemption-is-not-available-from-your-taxable-i_1685902165159.jpg

There are 3 conditions on which you can claim an exemption under HRA You have to be salaried and the HRA must be a part of the salary You cannot use this calculator if you are a self employed individual Second you must reside in rented premises INR 1 90 000 will be exempt from the total House Rent Allowance received and the remaining INR 60 000 2 50 000 1 90 000 will be taxable Use the HRA calculator to find taxable and tax exempt House Rent Allowance

Know the HRA Exemption Rules how to calculate HRA on your salary Check out the eligibility criteria understand how HRA helps you to utilise Section 80C For an individual to claim HRA exemption he she must meet the below listed conditions Live in rented housing Receive HRA as part of the CTC Cost To Company Provide correct rent receipts and also proof of rent payments

Download Hra Exemption 3 Conditions

More picture related to Hra Exemption 3 Conditions

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-1.jpg

Exemption Request Form June 2015

https://s2.studylib.net/store/data/015426834_1-65bfca52b0937b0852d7580bb2be5837-768x994.png

Claim For Exemption

https://s2.studylib.net/store/data/015290925_1-c28b6785682afa346c6300cf0893f532-768x994.png

Salaried people residing in rental housing are eligible to claim the HRA tax exemption HRA exemption is calculated based on multiple things like the actual rent paid the base pay or salary of the individual and the location of the rental housing House Rent Allowance is an employer granted allowance for employee housing rent HRA is usually included in employee CTC Only rent paid amount can be claimed for a tax free HRA exemption HRA Allowance without actual rent paid is taxable HRA does not cover maintenance

The least of the following three will be taken to exempt from tax HRA received from your employer Actual rent paid minus 10 of salary 50 of basic salary for those living in metro cities 40 of basic salary for those living in non metro cities 1 HRA exemption towards rent payment 2 Deduction on home loan interest as per Section 24 3 Principal Repayment under Section 80C 4 Deduction for interest on home loan under Section 80EE or Section 80EEA Conclusion Navigating the complexities of HRA exemptions requires a comprehensive understanding of tax laws

HRA Exemption Calculator EXCEL House Rent Allowance Calculation To

https://i.ytimg.com/vi/J04no0lpYJA/maxresdefault.jpg

Hra Calculation In Income Tax House Rent Allowance Calculator Hot Sex

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

https://taxguru.in/income-tax/house-rent-allowance...

1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Section 80GG of Income Tax Act 1961 Stay in Rented Accommodation Not living in a self owned Rent paid exceeds 10 of

https://tax2win.in/guide/hra-house-rent-allowance

You can claim HRA exemption for the period during which you stayed in a rented accommodation if the following conditions are fulfilled You should be a salaried employee The tax benefits related to HRA exemption are available only to salaried individuals A self employed person cannot take advantage of this exemption

Exemption

HRA Exemption Calculator EXCEL House Rent Allowance Calculation To

Here s How To Claim HRA Exemption At The Time Of Fiing ITR By Corwhite

How To Calculate HRA Exemption Income Tax YouTube

Authors Alliance Petitions For New Exemption To Section 1201 Of The

Conditions And Calculation Of House Rent Allowance HRA Exemption

Conditions And Calculation Of House Rent Allowance HRA Exemption

HRA Tax Exemption Or Section 80GG TAXVER

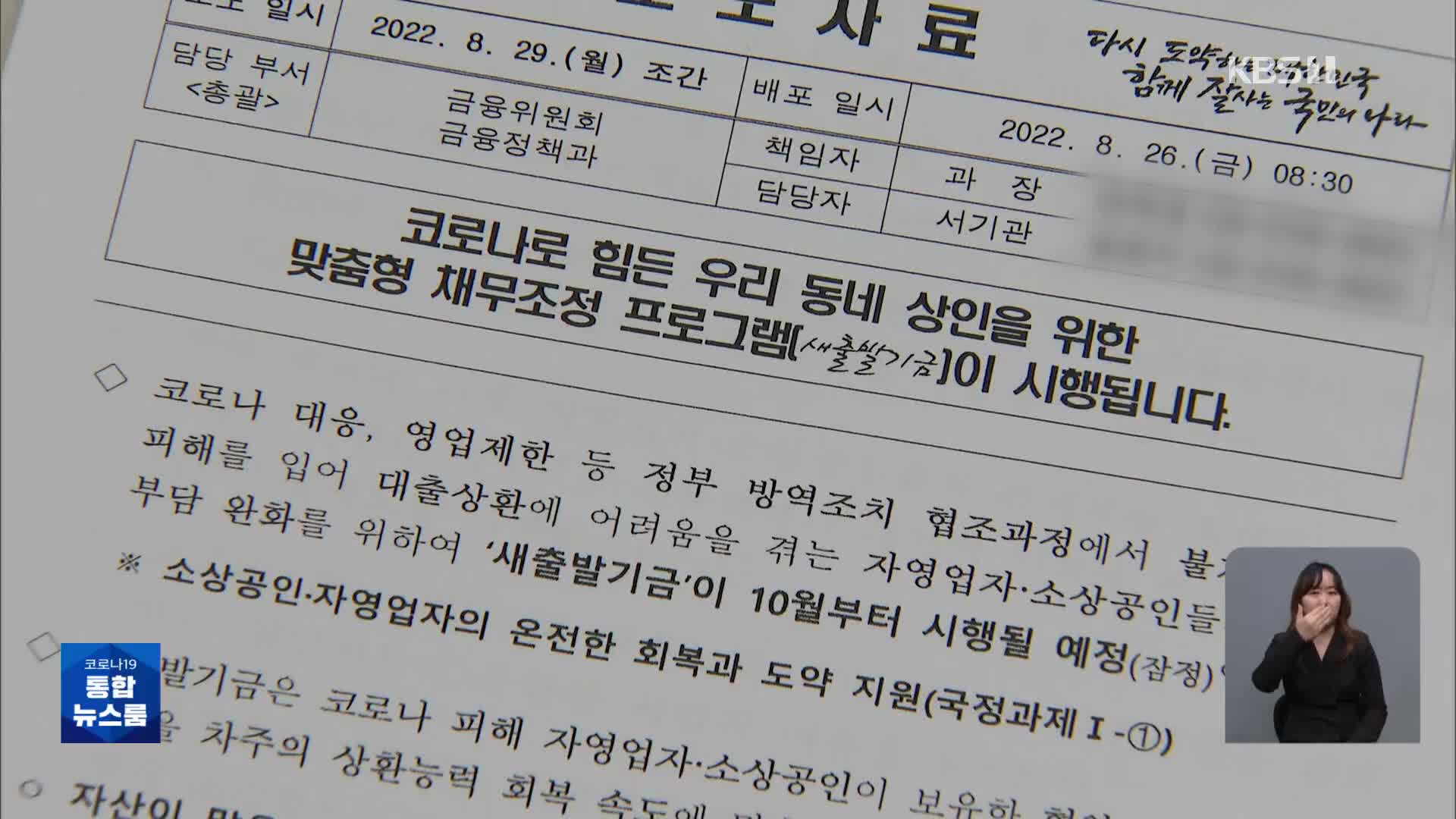

Debt Adjustments Such As principal Reduction Or Exemption For Small

How To Calculate HRA Exemption For Income Tax Step by Step

Hra Exemption 3 Conditions - Know the HRA Exemption Rules how to calculate HRA on your salary Check out the eligibility criteria understand how HRA helps you to utilise Section 80C