Hra Rebate Formula In Income Tax Calculate your House Rent Allowance HRA exemption know HRA exemption Calculation Formula and download HRA Calculator in excel format for easy calculation of exempt HRA Allowance out of Total HRA received by Salaried Assessee

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance the allowance will be fully taxable

Hra Rebate Formula In Income Tax

Hra Rebate Formula In Income Tax

https://i.ytimg.com/vi/6mgwUK-ETlY/maxresdefault.jpg

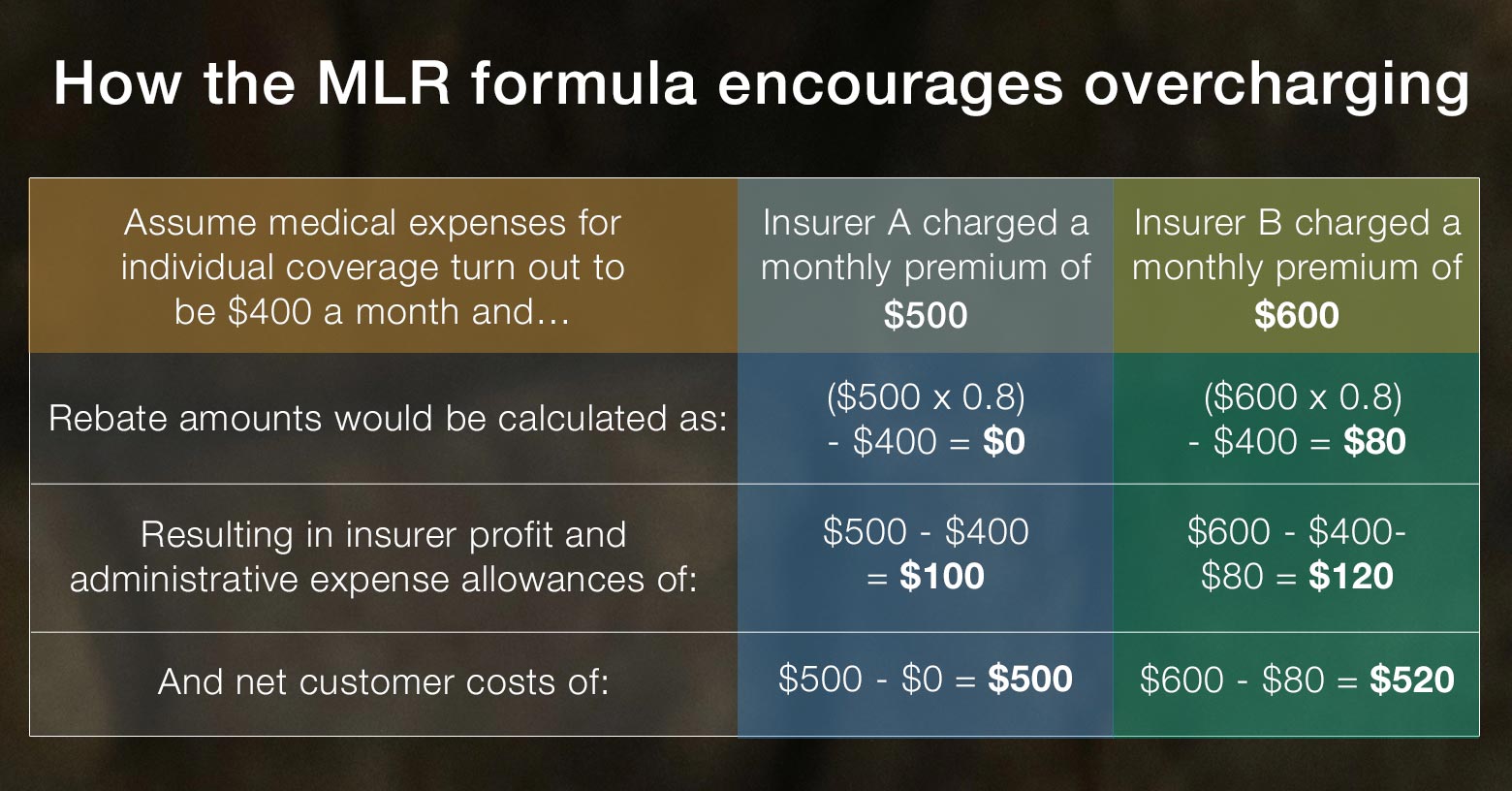

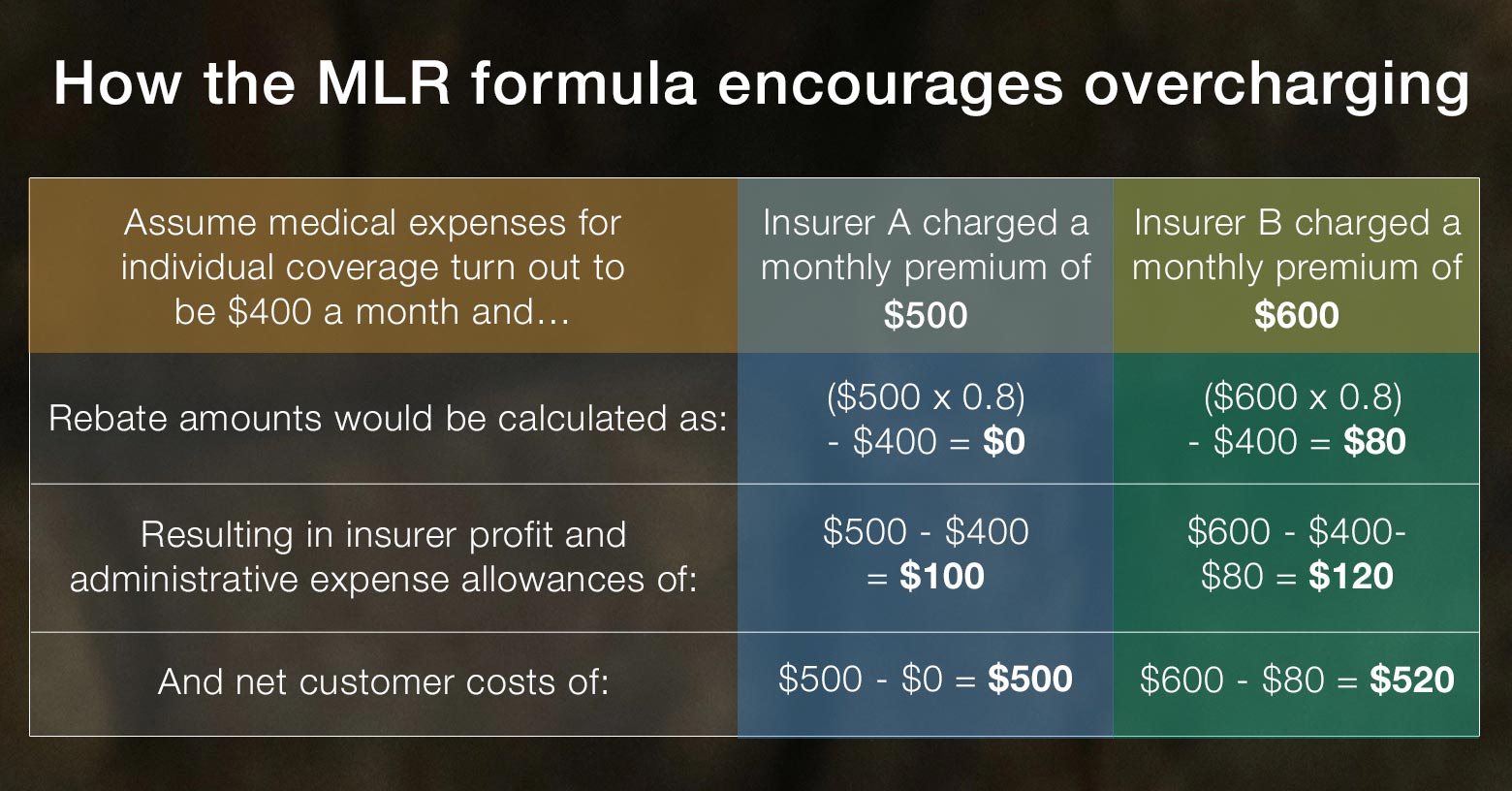

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

https://www.healthinsurance.org/wp-content/uploads/2018/04/formula-medical-loss-ratio.jpg

How To Get Full Rebate On HRA In Income Tax

https://4.bp.blogspot.com/-MstZZqwHN2I/WJs7rd_yvRI/AAAAAAAADPI/D_ZiTxYk4Vsn0NSbSomUZGbQCM6JL6AjwCLcB/w1200-h630-p-k-no-nu/hra-exemptoin.JPG

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This HRA calculator will help you determine the amount you receive as an allowance After the recommendation of the 7th Pay Commission the HRA slabs across India have been changed to a great extent

HRA can be claimed as a tax deduction under the Income Tax Act The amount of HRA received depends on factors such as the employee s salary the actual rent paid and the city of residence House Rent Allowance HRA Calculator is to help calculate HRA exemption rebate for the salaried individual from the HRA received from your Employer Salary Also consider special rebate for Metro residents such as Delhi explains the method of calculation and deduction under 80GG

Download Hra Rebate Formula In Income Tax

More picture related to Hra Rebate Formula In Income Tax

How To Calculate Rebate Formula Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/How-To-Calculate-Rebate-Formula-768x736.png

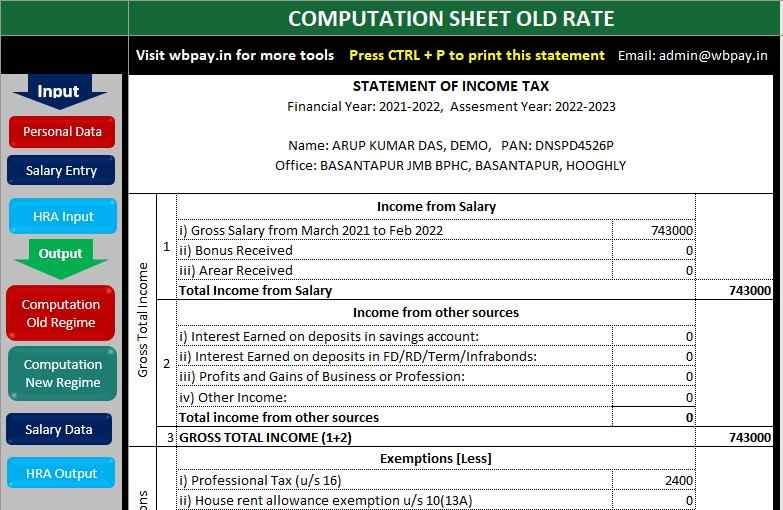

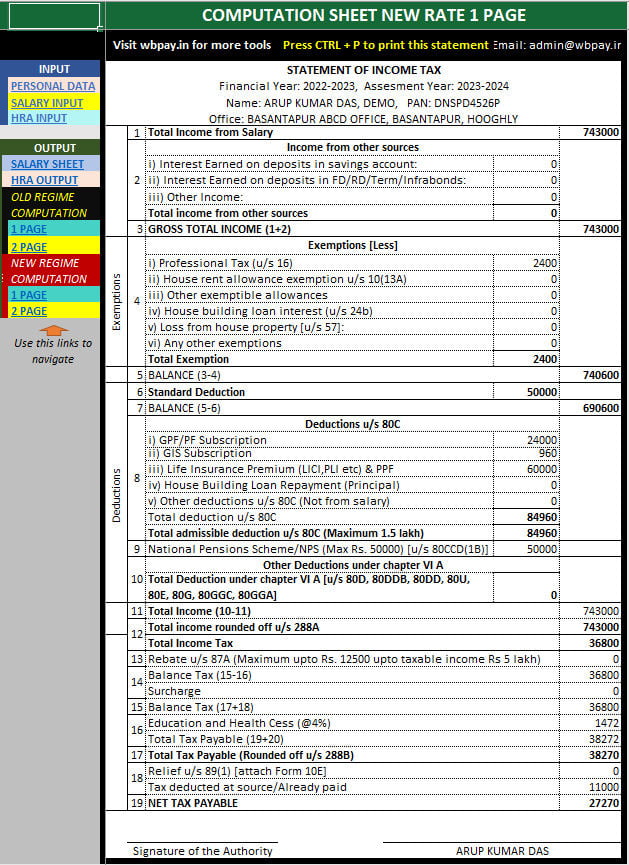

All In One Income Tax Calculator For FY 2021 22 Old New

http://wbpay.in/wp-content/uploads/2022/01/All-In-One-Income-Tax-Calculator-Excel.jpg

Rebate Formula In Excel Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/Rebate-Formula-In-Excel-768x734.png

Employees are required to submit the rent receipts to their employers to claim the tax benefit The employers in turn will calculate an exempt House Rent Allowance and deduct the same from the employee s taxable salary HRA exemption calculator helps you determine how much of the house rent allowance HRA in your salary gets exempted from tax Many employers offer house rent allowance to help employees cushion the rising cost of rental properties

The amount of HRA that can be availed as an exemption from the taxable salary is calculated using the following HRA calculation formula The least among the following Learn about House Rent Allowance HRA exemptions and how they affect tax savings Understand the rules calculations and potential benefits for salaried employees

HRA Calculator Formula Sarkari Yojana Update

https://sarkariyojanaupdate.in/wp-content/uploads/2022/06/HRA-Calculator-Online.jpg

How To Get MORE Out Of Your HRA Rediff Getahead

http://im.rediff.com/getahead/2011/jun/21table3.gif

https://taxguru.in/income-tax/house-rent-allowance...

Calculate your House Rent Allowance HRA exemption know HRA exemption Calculation Formula and download HRA Calculator in excel format for easy calculation of exempt HRA Allowance out of Total HRA received by Salaried Assessee

https://taxguru.in/income-tax/house-rent-allowance...

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION

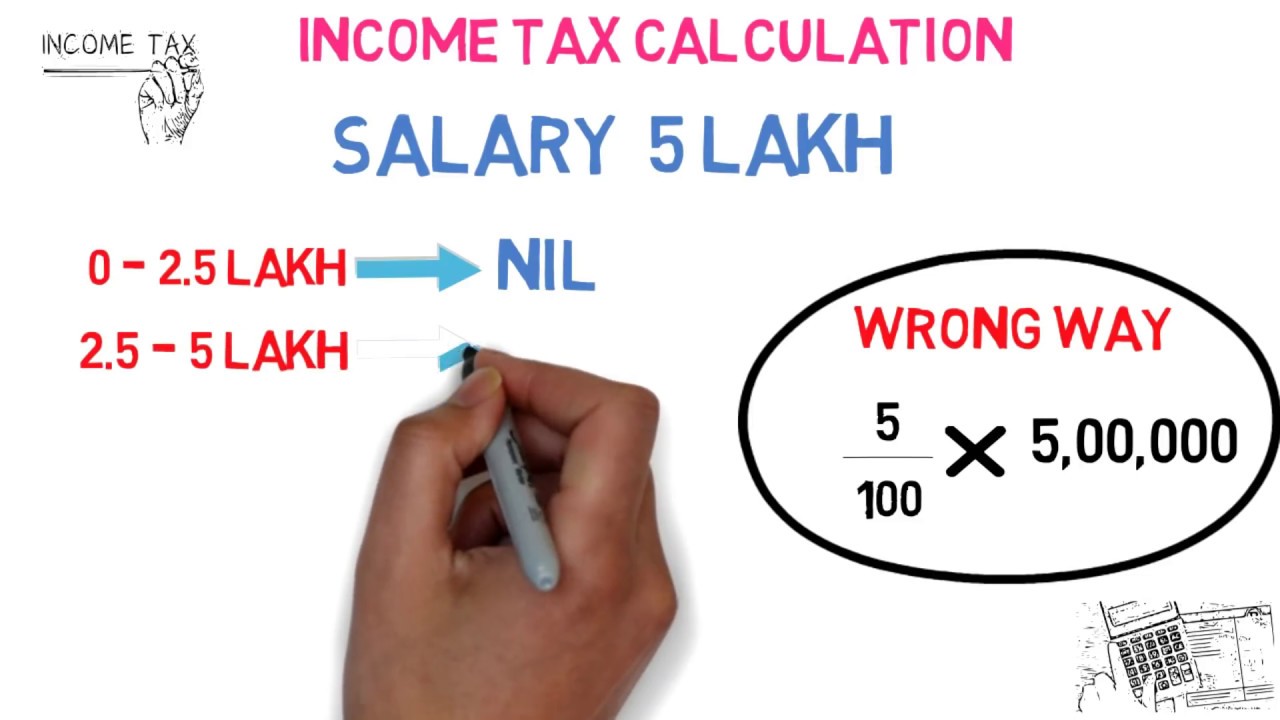

How To Calculate Income Tax FY 2021 22 New Tax Slabs Rebate

HRA Calculator Formula Sarkari Yojana Update

All In One Income Tax Calculator For The FY 2022 23

Tax Formula Math

Income Tax Calculator For 2023 To 2024 Nyc PELAJARAN

Tax Formula Math

Tax Formula Math

House Rent Allowance 80GG Of Income Tax Act HRA Rebate U S 80GG In

3 Ways To Calculate A Rebate Formula For Home Improvement

New Income Tax Calculation Rebate 2018 19 Explained YouTube

Hra Rebate Formula In Income Tax - This HRA calculator will help you determine the amount you receive as an allowance After the recommendation of the 7th Pay Commission the HRA slabs across India have been changed to a great extent