Hra Rebate Income Tax Web Income Tax Department gt Tax Tools gt House rent allowance calculator As amended upto Finance Act 2023 HOUSE RENT ALLOWANCE Basic salary DA forming part of salary

Web 22 sept 2022 nbsp 0183 32 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces your Web Calculate You can claim HRA while tax filing even if you have not submitted rent receipts to your HR clearTax will help you claim this while e filing If you don t receive HRA you can

Hra Rebate Income Tax

Hra Rebate Income Tax

https://www.knowinfonow.com/wp-content/uploads/2016/12/Download-Form-12BB-Download-New-Form-No-12BB-investment-proofs-LTA-LTC-HRA-Section-80C-income-tax-deductions-pic.jpg

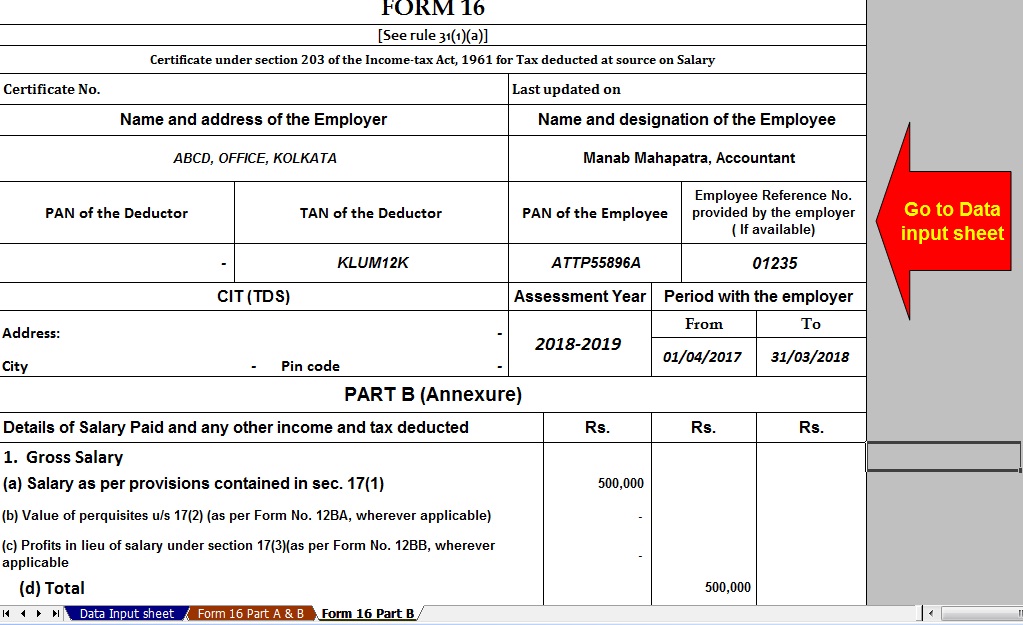

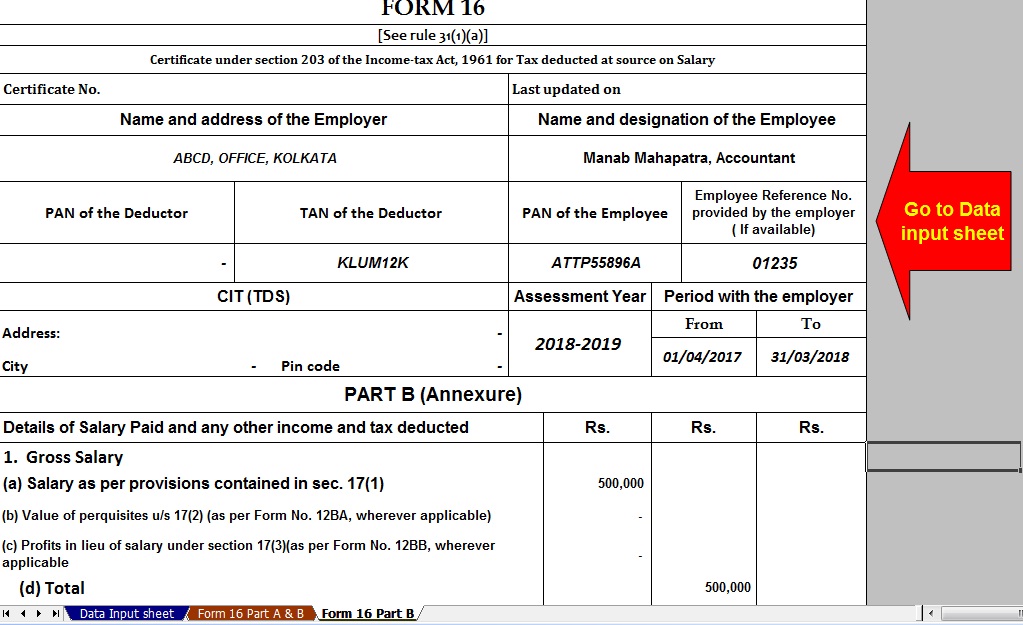

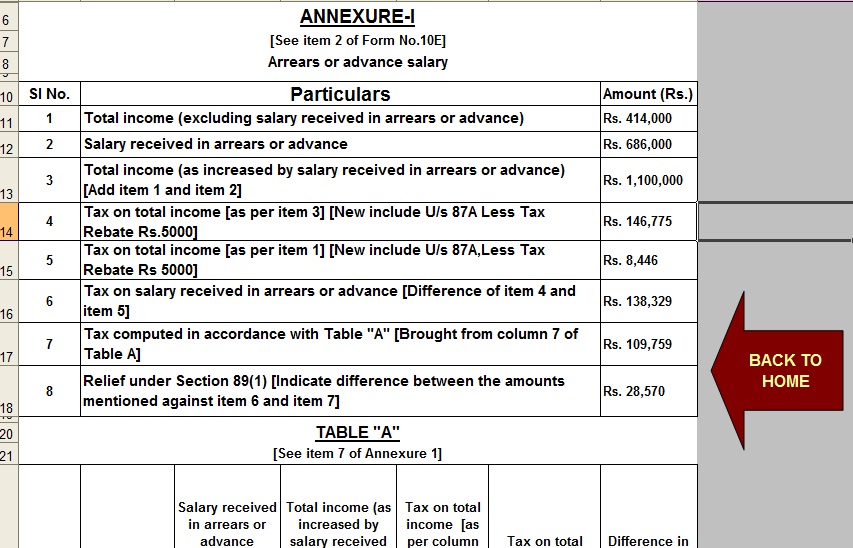

Download Automated Tax Computed Sheet HRA Calculation Arrears

https://4.bp.blogspot.com/-jcXR46JGbOw/WhOAD1L3J8I/AAAAAAAAF4A/ISuIxQnFWx4USLckHZYtmPvfE-NtuKIlwCLcBGAs/s1600/Form%2B16%2BPart%2BB.jpg

HRA Income Tax Rebate On HRA House Rent Allowance

https://i.ytimg.com/vi/I57qzsh9Q04/maxresdefault.jpg

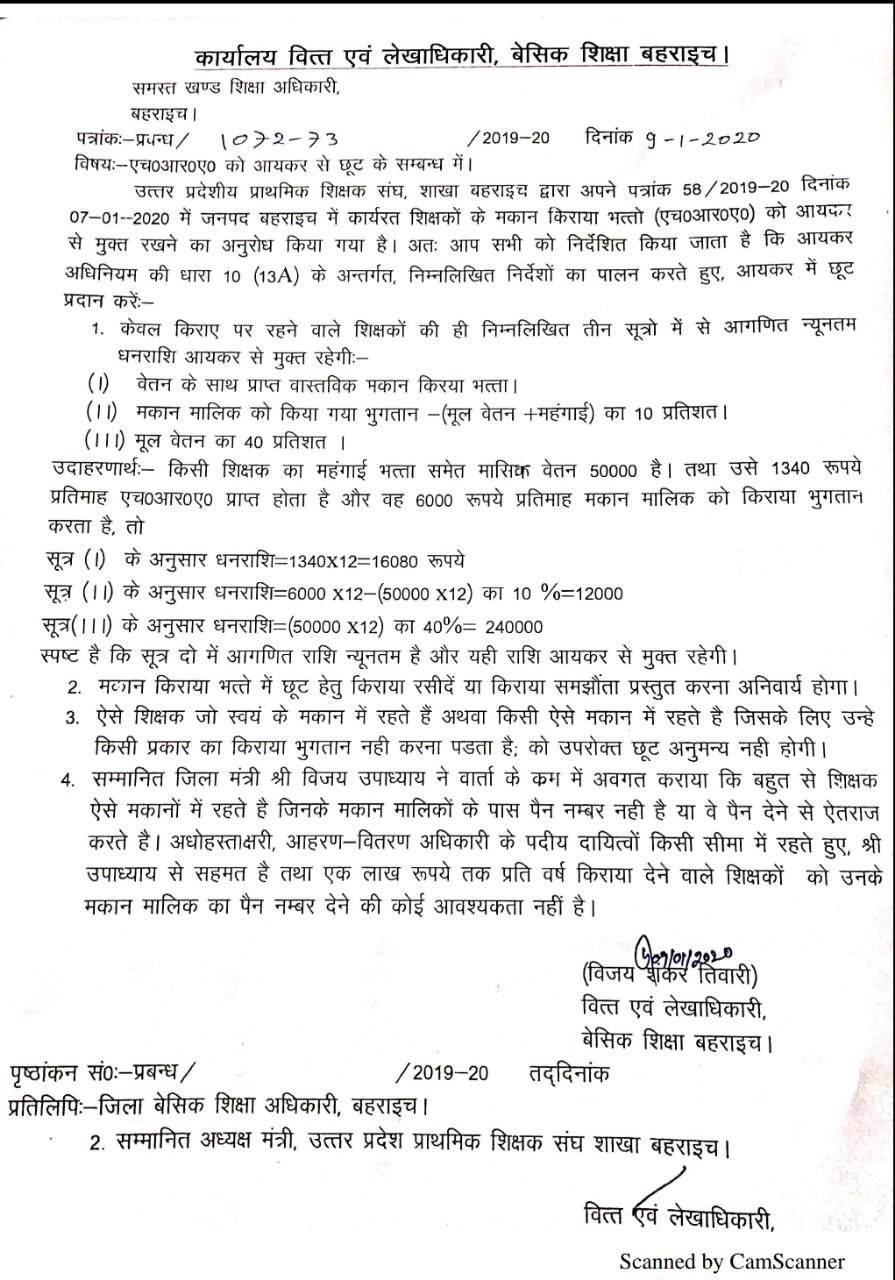

Web 22 avr 2022 nbsp 0183 32 HRA exemptions are allowed under the Income Tax IT Act Section 10 13A of the Act provides that a salaried person can claim tax benefits with respect to the Web 28 juin 2018 nbsp 0183 32 HRA is an allowance and is subject to income tax An employee can claim exemption on his House Rent Allowance HRA under the Income Tax Act if he stays in a rented house and is in receipt of

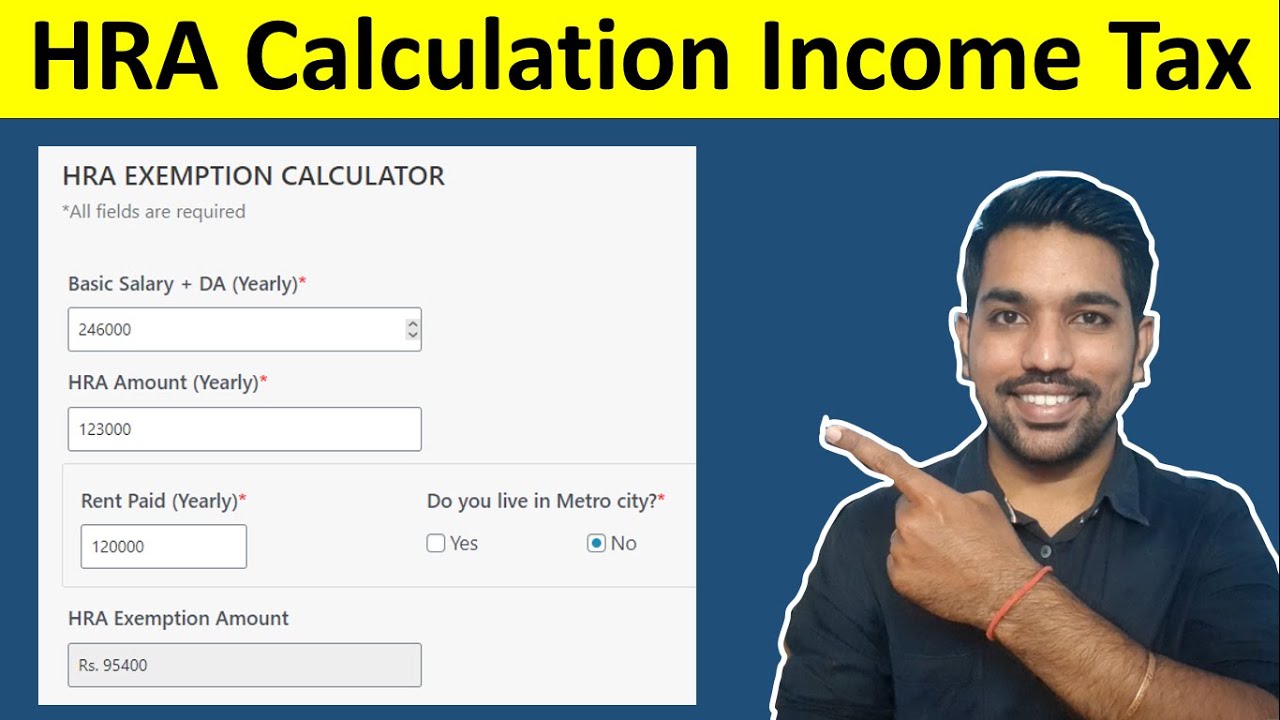

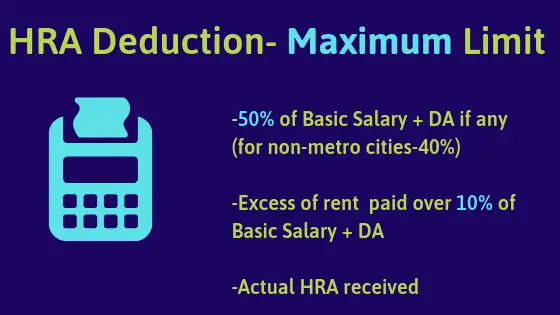

Web 5 mai 2020 nbsp 0183 32 HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA Web The Income Tax Act Section 10 13A provides for HRA exemption of tax The deduction will be the lowest among the following The House Rent Allowances that the employer

Download Hra Rebate Income Tax

More picture related to Hra Rebate Income Tax

How To Rebate In HRA In Income Tax 2022

https://blogger.googleusercontent.com/img/a/AVvXsEgXrgE31VjACIISfpSa17566pKHsUahqfZcuE_qmK0iX4jVYf9ovQSqiHrQdUT3fgPaS7c8e6f2IY-4l5UBzNH8oohEmIgyGgaSbobfCrm-vF95bGebe8RYdnj1DJUWNsR8JrN2JscJwBoe13dhI2txEHKYoyWG7omsGX7bDHFNJNpwuDZ_ejiUWnZL=s16000

Complete Guide On Rent Slips Receipts And Claim HRA Tax House Rent

https://tax2win.in/assets-new/img/guides/rent-receipt/9.jpg

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-3-1068x830.png

Web 26 janv 2022 nbsp 0183 32 Currently HRA deduction available is the least of the following Actual HRA received 50 of Basic Salary Dearness Allowance DA for those living in metro cities Web 9 f 233 vr 2023 nbsp 0183 32 House Rent Allowance HRA is paid by an employer to employees as a part of their salary to meet the accommodation expenses Salaried individuals who live in

Web Actual rent paid Rs 15 000 X 12 Rs 1 80 000 10 of salary Rs 48 000 Rs 1 32 000 50 of basic salary Rs 40 000 X 12 X 50 Rs 2 40 000 In this example Rs 1 32 Web 28 oct 2022 nbsp 0183 32 With HRA benefits That s a 3 5 tax saving on HRA on almost any salary structure in financial year 2021 22 HRA benefits are automatically exercised in the case

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

http://pmjandhanyojana.co.in/wp-content/uploads/2016/05/New-Form-12BB.png

House Rent Allowance HRA Receipt Format For Income Tax Teacher

http://1.bp.blogspot.com/-ewd4gmFZDiM/Vr60xpZ2a2I/AAAAAAAARCw/IgWwp8ctHws/s1600/IMG-20160213-WA0009-788169.jpg

https://incometaxindia.gov.in/Pages/tools/house-rent-allowance...

Web Income Tax Department gt Tax Tools gt House rent allowance calculator As amended upto Finance Act 2023 HOUSE RENT ALLOWANCE Basic salary DA forming part of salary

https://www.etmoney.com/learn/saving-schemes/house-rent-allowance

Web 22 sept 2022 nbsp 0183 32 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces your

Hra Deduction Under Section 10 Design schmitt

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

HRA Calculation In Income Tax House Rent Allowance Calculator

HRA Calculator 2019 20 In depth Guide Including HRA Agrement Format

Download New Form 12BB To Claim Tax Deduction On LTA And HRA With

Danpirellodesign Income Tax Rebate On Home Loan And Hra

Danpirellodesign Income Tax Rebate On Home Loan And Hra

How To Get MORE Out Of Your HRA Rediff Getahead

How To Get Full Rebate On HRA In Income Tax

Income Tax Department Puts House Rental Allowance HRA Exemption Rules

Hra Rebate Income Tax - Web 22 avr 2022 nbsp 0183 32 HRA exemptions are allowed under the Income Tax IT Act Section 10 13A of the Act provides that a salaried person can claim tax benefits with respect to the