Hra Tax Rebate Section Web 22 sept 2022 nbsp 0183 32 You can claim a deduction for HRA under Section 10 13A of the Income Tax Act but remember it can be fully or partially taxable The calculation of HRA

Web 22 avr 2022 nbsp 0183 32 Conditions for claiming HRA rebate under Section 10 13A Key conditions that ought to be fulfilled Only salaried individuals can claim deductions under this Web 5 mai 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under

Hra Tax Rebate Section

Hra Tax Rebate Section

https://www.indiareviews.com/wp-content/uploads/2022/01/income-tax-rebate-section.jpg

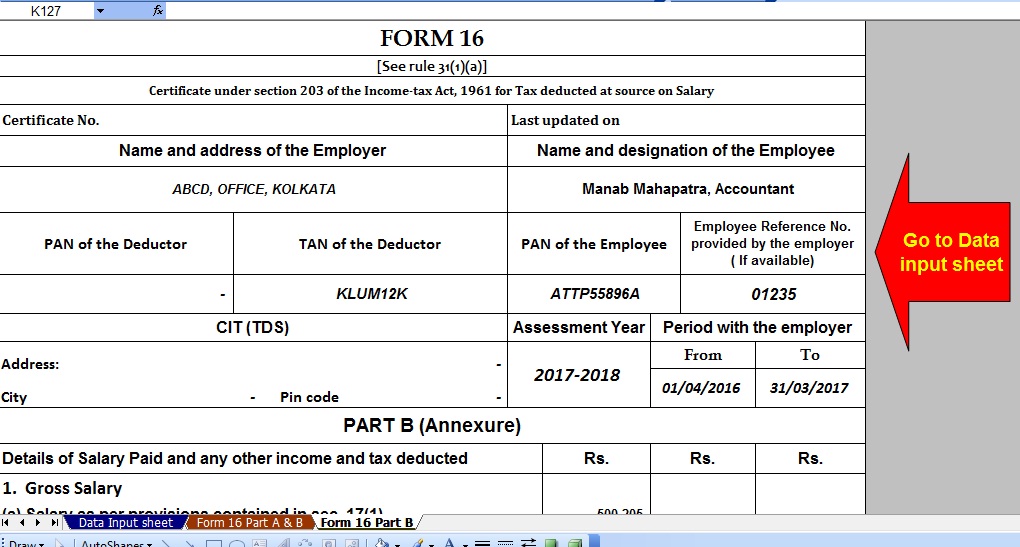

How To Claim Both HRA Home Loans Tax Deductions With Section 24 And

https://3.bp.blogspot.com/-pZ5VeMeXKq4/WFdWf7wSr7I/AAAAAAAADsQ/bmB9t4Yn_b8XW1PA-J15RmXGXB7kd0dEwCLcB/s1600/One%2Bby%2BOne%2BForm%2B16%2B4.jpg

HRA Calculation Taxability Hindi Video House Rent Allowance Tax

https://i.ytimg.com/vi/6mgwUK-ETlY/maxresdefault.jpg

Web 10 f 233 vr 2023 nbsp 0183 32 Conditions to claim rebate under Section 10 13A Following are the key conditions you ought to fulfil Only salaried individuals can claim deductions under this Web House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent Such allowance is taxable in the hand of the employee

Web 9 f 233 vr 2023 nbsp 0183 32 House Rent Allowance HRA is paid by an employer to employees as a part of their salary to meet the accommodation expenses Salaried individuals who live in Web The Income Tax Act Section 10 13A provides for HRA exemption of tax The deduction will be the lowest among the following The House Rent Allowances that the employer

Download Hra Tax Rebate Section

More picture related to Hra Tax Rebate Section

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

https://assets-news.housing.com/news/wp-content/uploads/2021/03/15192811/All-you-need-to-know-about-HRA-exemptions-792x400.jpg

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

Section 87A Income Tax Rebate

https://taxguru.in/wp-content/uploads/2018/07/Tax-rebate.jpg

Web 26 janv 2022 nbsp 0183 32 Under Section 80GG individuals can claim deduction in lieu of rent paid if they are not receiving HRA However the maximum limit allowed to claim such deduction is Rs 60 000 or Rs 5000 month Web 6 janv 2018 nbsp 0183 32 Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Act 1961 Amount of HRA tax exemption is deductible from the

Web 28 juin 2018 nbsp 0183 32 1 Actual House Rent Allowance HRA received from your employer 2 Actual house rent paid by you minus 10 of your basic salary 3 50 of your basic salary if you live in a metro or 40 of your basic Web If you don t receive HRA you can now claim upto Rs 60 000 deduction under Section 80GG Click here to calculate your tax as per Budget 2023 If you receive HRA you can

How To Claim Deductions If You Do Not Get HRA Section 80GG

https://www.taxhelpdesk.in/wp-content/uploads/2021/09/SECTION-80GG-How-to-claim-deductions-if-you-do-not-get-HRA-1.png

How To Get Full Rebate On HRA In Income Tax

https://4.bp.blogspot.com/-MstZZqwHN2I/WJs7rd_yvRI/AAAAAAAADPI/D_ZiTxYk4Vsn0NSbSomUZGbQCM6JL6AjwCLcB/s1600/hra-exemptoin.JPG

https://www.etmoney.com/learn/saving-schemes/house-rent-allowance

Web 22 sept 2022 nbsp 0183 32 You can claim a deduction for HRA under Section 10 13A of the Income Tax Act but remember it can be fully or partially taxable The calculation of HRA

https://housing.com/news/hra-house-rent-allowance-tax-exemption

Web 22 avr 2022 nbsp 0183 32 Conditions for claiming HRA rebate under Section 10 13A Key conditions that ought to be fulfilled Only salaried individuals can claim deductions under this

Documents Required To Claim HRA CommonFloor Groups Invoice Template

How To Claim Deductions If You Do Not Get HRA Section 80GG

HRA Tax Exemption Calculator House Rent Deduction In Income Tax

Income Tax Rebate Under Section 87A

Can I Claim Both Home Loan And HRA Tax Benefits

HRA TAX REBATE NEW NOTIFICATION AND LIMITS YouTube

HRA TAX REBATE NEW NOTIFICATION AND LIMITS YouTube

Rent Receipts And Its Role In Claiming HRA Tax Benefit LaptrinhX News

Section 87A Tax Rebate Under Section 87A

How To Get More Out Of Your HRA Taxpayers Forum

Hra Tax Rebate Section - Web 2 f 233 vr 2023 nbsp 0183 32 Section 80E prohibits claiming the tax deduction for interest paid on student loan debt Section 80G s tax deduction for donations to charities will no longer be