Hra Tax Rebate Under Section Web 22 avr 2022 nbsp 0183 32 All you want to know about rent receipt amp its role in saving tax Conditions for claiming HRA rebate under Section 10 13A Key conditions that ought to be fulfilled

Web House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent Such allowance is taxable in the hand of the employee Web 22 sept 2022 nbsp 0183 32 HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting a

Hra Tax Rebate Under Section

Hra Tax Rebate Under Section

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

Hra Deduction Under Section 10 Design schmitt

https://blog.tax2win.in/wp-content/uploads/2019/06/Deduction-where-House-rent-is-paid-and-HRA-not-received.jpg

HRA Tax Rebate HRA In Income Tax HRA Rebate Kasie Le HRA Rebate

https://i.ytimg.com/vi/TwVhPWbbcIU/maxresdefault.jpg

Web 5 mai 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Web 9 f 233 vr 2023 nbsp 0183 32 Actual Rent Paid 10 of Basic Salary INR 1 30 000 1 80 000 10 5 00 000 INR 1 30 000 will be exempt from the total House Rent Allowance received

Web 10 f 233 vr 2023 nbsp 0183 32 Conditions to claim rebate under Section 10 13A Following are the key conditions you ought to fulfil Only salaried individuals can claim deductions under this Web House Rent Allowance HRA is a common element in the salary structure for most employees It is an amount paid to you by your employer as part of your salary As a

Download Hra Tax Rebate Under Section

More picture related to Hra Tax Rebate Under Section

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

https://live.staticflickr.com/7850/32304200437_b8b18b3f1c_b.jpg

Income Tax Rebate Under Section 87a Working And Eligibili Flickr

https://live.staticflickr.com/65535/52505443069_b5e1cbe9b9_b.jpg

Income Tax HRA

https://cdn.zeebiz.com/hindi/sites/default/files/inline-images/HRA.jpg

Web If you don t receive HRA you can now claim upto Rs 60 000 deduction under Section 80GG Click here to calculate your tax as per Budget 2023 If you receive HRA you can Web The exemption for HRA would be allowed under Section 10 13A or under Section 80GG as the case may be HRA exemption rules Here are some rules for claiming HRA

Web 6 janv 2018 nbsp 0183 32 Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Act 1961 Amount of HRA tax exemption is deductible from the Web HRA or the House Rent Allowance is one of the sub components of the employee s salary for which deductions are fully or partially taxable under Section 10 13A of the Income

Tds Slab Rate For Ay 2019 20

https://www.relakhs.com/wp-content/uploads/2019/04/Income-Tax-Calculation-for-FY-2019-20-AY-2020-21-with-revised-Section-87A-limit-illustrations-pic.jpg

Download New Form 12BB To Claim Tax Deduction On LTA And HRA With

https://3.bp.blogspot.com/-rwUhUlYzsmk/WbFpq3XMYwI/AAAAAAAABgA/czQ1dTfBPN8Mx01cK8E1iQtubiacEgKGgCLcBGAs/s1600/Arrears%2BRelief%2BPage%2B2.jpg

https://housing.com/news/hra-house-rent-allowance-tax-exemption

Web 22 avr 2022 nbsp 0183 32 All you want to know about rent receipt amp its role in saving tax Conditions for claiming HRA rebate under Section 10 13A Key conditions that ought to be fulfilled

https://taxadda.com/house-rent-allowance-hra-section-10-13a

Web House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent Such allowance is taxable in the hand of the employee

How To Get MORE Out Of Your HRA Rediff Getahead

Tds Slab Rate For Ay 2019 20

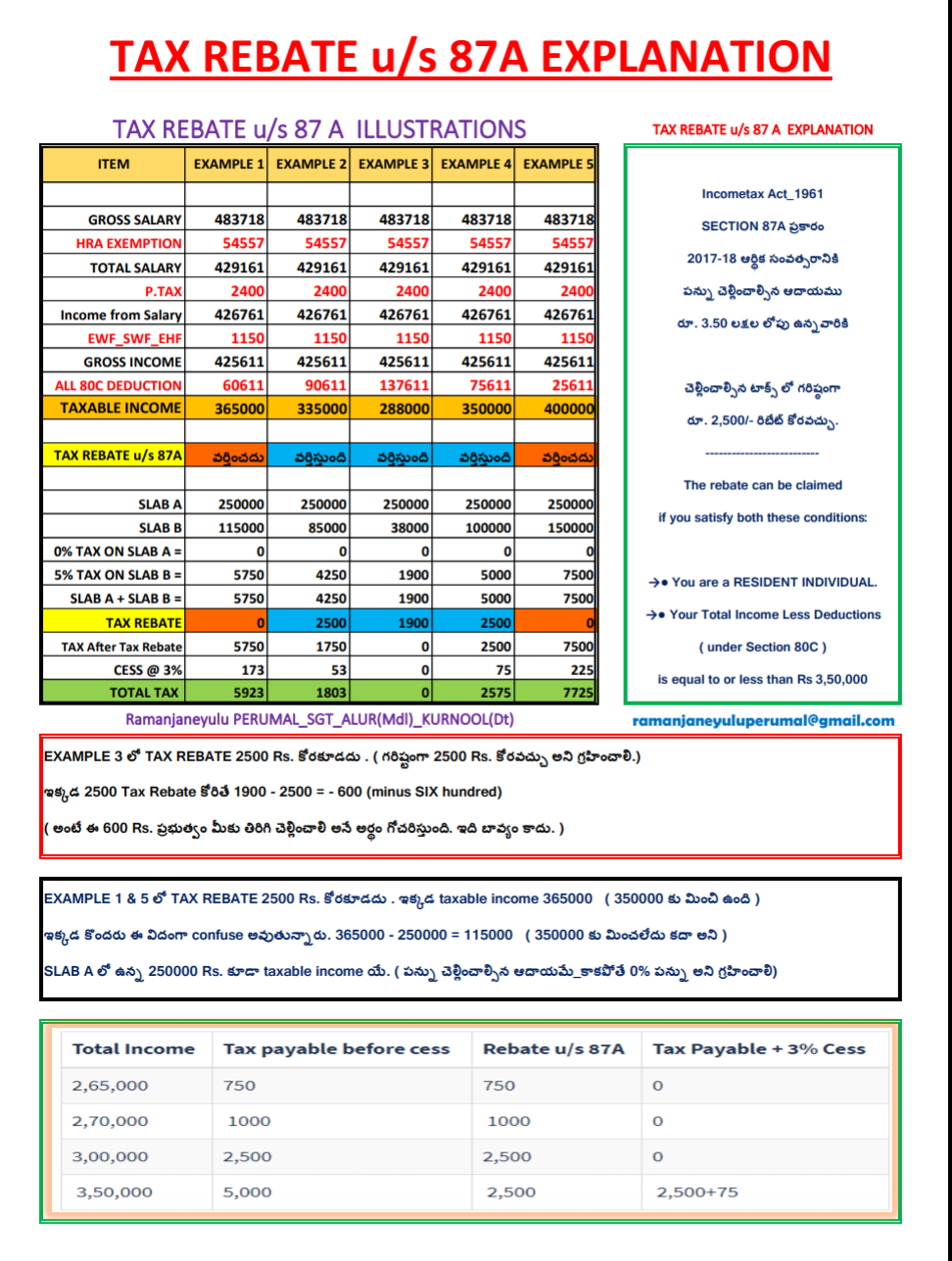

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Calculation Of HRA Exemption Under Section10 13a

Calculation Of HRA Exemption Under Section10 13a

Theme Presentation1

How To Calculate Tax Exemption On HRA Under Section 10 13A And Under

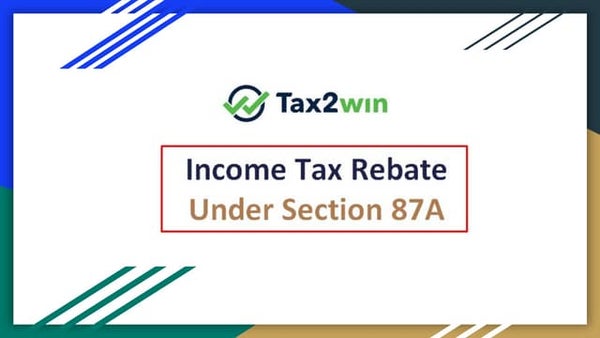

TAX REBATE 2017 18 Clarification Under Section 87 A MANNAMweb

Hra Tax Rebate Under Section - Web 26 juil 2019 nbsp 0183 32 The commonly availed existing deductions and tax exemptions are section 80C section 80D section 80TTA HRA tax exemption LTC tax exemption etc An