Hra Tax Rebate Web 4 avr 2017 nbsp 0183 32 House Rent Allowance HRA is an exemption in the Income Tax Act that can help lower taxes partially or wholly This allowance is

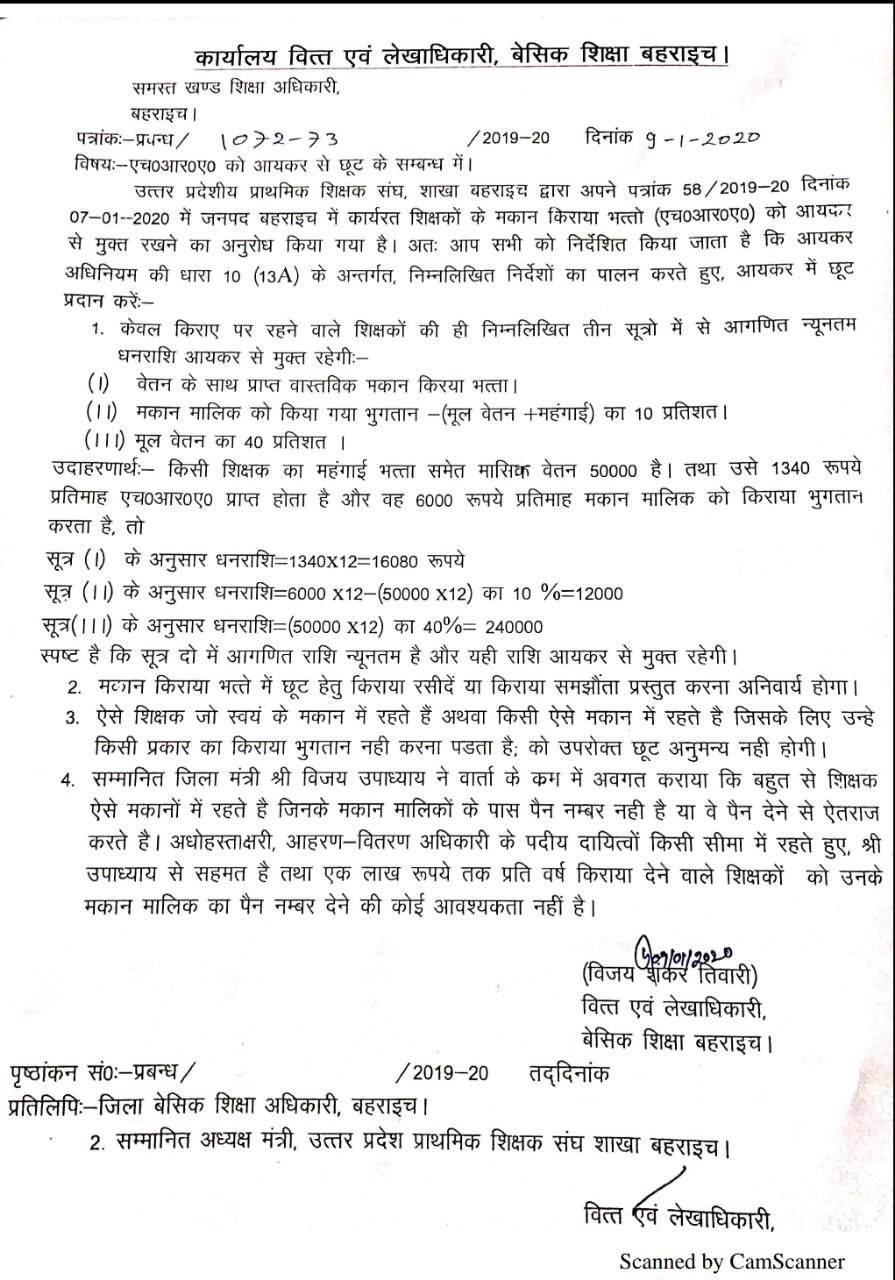

Web 22 avr 2022 nbsp 0183 32 Conditions for claiming HRA rebate under Section 10 13A Key conditions that ought to be fulfilled Only salaried individuals can claim deductions under this Web 6 sept 2022 nbsp 0183 32 Vous ne payez plus de taxe d habitation Certains contribuables recevront d 232 s ce mardi 6 septembre par virement les sommes pr 233 lev 233 es au cours de cette ann 233 e

Hra Tax Rebate

Hra Tax Rebate

https://i.pinimg.com/originals/3d/e6/36/3de636def95dfd90c5bc3274aa076c0f.jpg

How To Get Full Rebate On HRA In Income Tax

https://4.bp.blogspot.com/-MstZZqwHN2I/WJs7rd_yvRI/AAAAAAAADPI/D_ZiTxYk4Vsn0NSbSomUZGbQCM6JL6AjwCLcB/w1200-h630-p-k-no-nu/hra-exemptoin.JPG

Tax Rebate On HRA

https://images.moneycontrol.com/static-hindinews/2021/11/incometaxFB-770x430.jpg

Web Calculate You can claim HRA while tax filing even if you have not submitted rent receipts to your HR clearTax will help you claim this while e filing If you don t receive HRA you can Web 9 f 233 vr 2023 nbsp 0183 32 What is House Rent Allowance HRA House Rent Allowance HRA is paid by an employer to employees as a part of their salary to meet the accommodation

Web 6 janv 2018 nbsp 0183 32 House rent allowance HRA tax benefit is available only to salaried individuals who are planning to opt for old tax regime Further this tax benefit can be Web Allocated HRA cannot exceed 50 of your basic salary Salaried employees cannot claim for deduction of the full rental amount Instead the least amount from the three

Download Hra Tax Rebate

More picture related to Hra Tax Rebate

HRA Tax Rebate HRA In Income Tax HRA Rebate Kasie Le HRA Rebate

https://i.ytimg.com/vi/TwVhPWbbcIU/maxresdefault.jpg

Income Tax HRA

https://cdn.zeebiz.com/hindi/sites/default/files/inline-images/HRA.jpg

HRA TAX REBATE NEW NOTIFICATION AND LIMITS YouTube

https://i.ytimg.com/vi/Ej6bt4hwOm0/maxresdefault.jpg

Web HRA exempted HRA taxable Select tax slab 5 10 15 20 25 30 If you don t receive HRA you can still claim upto 60 000 deduction U S 80GG Maximize your tax Web 28 oct 2022 nbsp 0183 32 With HRA benefits That s a 3 5 tax saving on HRA on almost any salary structure in financial year 2021 22 HRA benefits are automatically exercised in the case

Web The HRA exemption of tax is covered under Income Tax Act Section 10 13A and provides for the HRA deduction based on the amount lowest amongst these The actual amount Web House Rent Allowance HRA is a common element in the salary structure for most employees It is an amount paid to you by your employer as part of your salary As a

HRA Income Tax Rebate On HRA House Rent Allowance

https://i.ytimg.com/vi/I57qzsh9Q04/maxresdefault.jpg

How To Get MORE Out Of Your HRA Rediff Getahead

http://im.rediff.com/getahead/2011/jun/21table3.gif

https://cleartax.in/s/hra-house-rent-allowance

Web 4 avr 2017 nbsp 0183 32 House Rent Allowance HRA is an exemption in the Income Tax Act that can help lower taxes partially or wholly This allowance is

https://housing.com/news/hra-house-rent-allowance-tax-exemption

Web 22 avr 2022 nbsp 0183 32 Conditions for claiming HRA rebate under Section 10 13A Key conditions that ought to be fulfilled Only salaried individuals can claim deductions under this

How To Rebate In HRA In Income Tax 2022

HRA Income Tax Rebate On HRA House Rent Allowance

Complete Guide On Rent Slips Receipts And Claim HRA Tax House Rent

How To Calculate Tax Rebate On Hra PRORFETY

Claiming Tax Rebate On HRA Being A Landlord Rebates Finance

HRA Rebate Ll How To Take Hra Rebate Ll HRA Ll Income

HRA Rebate Ll How To Take Hra Rebate Ll HRA Ll Income

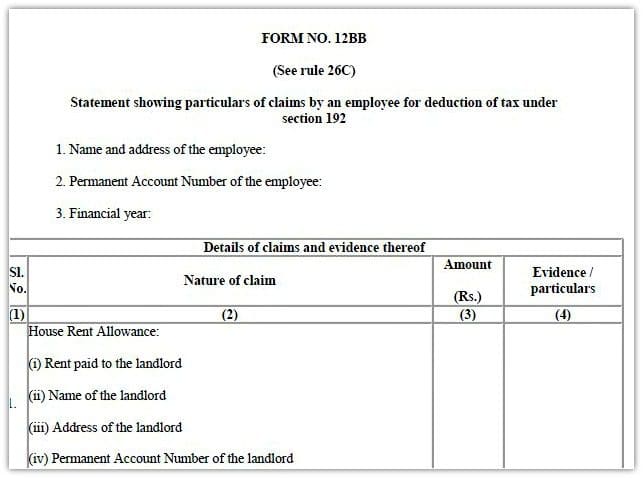

Form 12BB New Form To Claim Income Tax Benefits Rebate

Danpirellodesign Income Tax Rebate On Home Loan And Hra

Documents Required To Claim HRA CommonFloor Groups Invoice Template

Hra Tax Rebate - Web The Income Tax Act Section 10 13A provides for HRA exemption of tax The deduction will be the lowest among the following The House Rent Allowances that the employer gives