Hsa Eligible Health Plan Requirements 2023 Also an eligible individual remains eligible to make contributions to its Health Savings Account HSA even if the individual has coverage outside of the HDHP during these

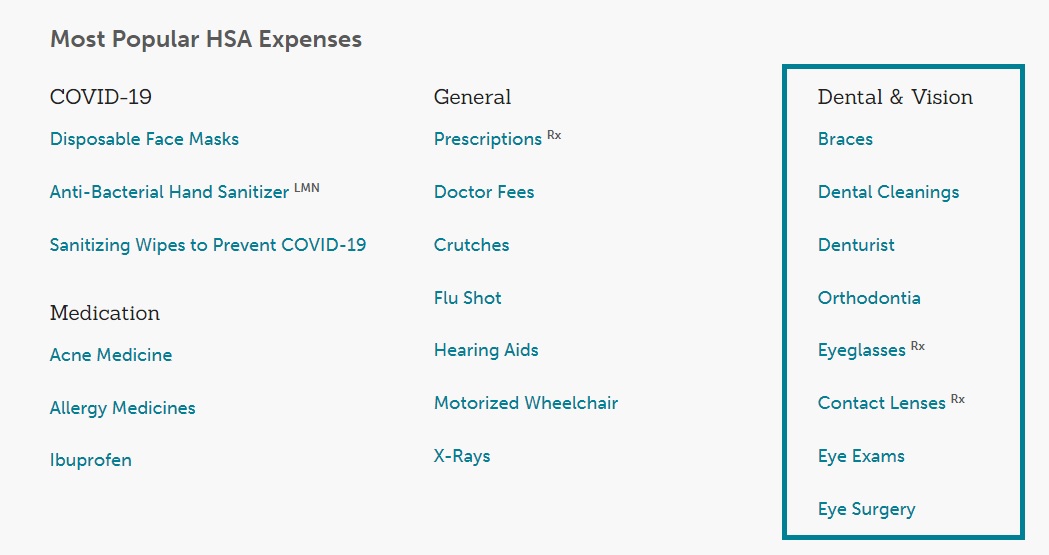

Strict rules govern who is eligible to use an HSA how much money you can contribute and what you can use withdrawals for prior to age 65 Here are the key HSA Health savings account HSA contribution limits for 2023 are going up significantly in response to the recent inflation surge the IRS announced April 29 giving

Hsa Eligible Health Plan Requirements 2023

Hsa Eligible Health Plan Requirements 2023

https://ccf.us/wp-content/uploads/2022/01/hsa-card-render.png

Blog 2023 Health Savings Account Limits Gold Standard Tax

http://www.goldstandardtax.com/wp-content/uploads/2022/09/2023-HSA-Limits.png

How To Shop At Amazon With Your FSA Or HSA Card CNET

https://www.cnet.com/a/img/resize/495e94cf6419ce474255284dc946f5530d39c875/2019/05/23/3054d0eb-7259-4fa9-9683-c45758f0f919/fsa-and-hsa-cards.jpg?auto=webp&fit=crop&height=675&width=1200

To be an eligible individual and qualify for an HSA contri bution you must meet the following requirements You are covered under a high deductible health plan HDHP The IRS has released the 2023 cost of living adjusted limits for health savings accounts HSAs high deductible health plans HDHPs and excepted benefit

To be eligible for an HSA an individual must be covered by a high deductible health plan For 2023 a high deductible health plan will be one with an annual To contribute to an HSA you must be covered under a high deductible health plan For 2023 the health plan must have a deductible of at least 1 500 for self

Download Hsa Eligible Health Plan Requirements 2023

More picture related to Hsa Eligible Health Plan Requirements 2023

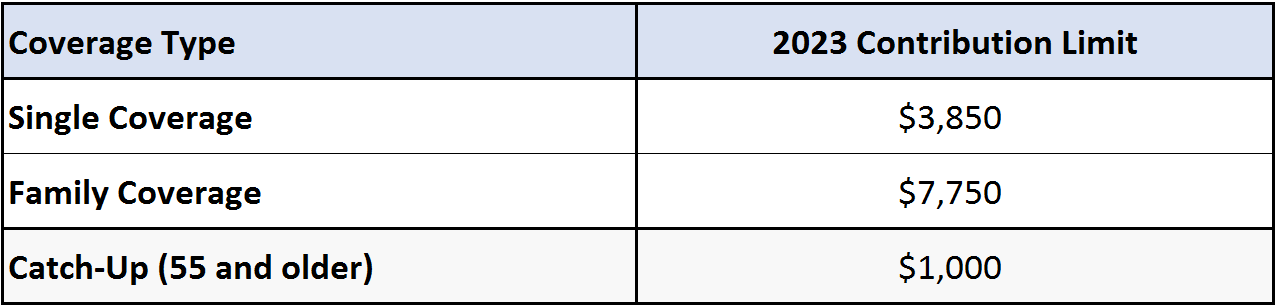

Can I Use My HSA Or FSA To Pay For Dental Services

https://images.ctfassets.net/0rtn79ifmgv3/1bnb0Zn5fUpERHP5JXJyBG/a9103b7b79e5ae60eb1e4ce388c18566/dentalexpenses.jpeg

Health Saving Account HSA 2024 Limit Thinkwiser1

https://mywhatstrending1.files.wordpress.com/2023/08/hsa-thumbnail.jpg?w=1024

2024 HSA HDHP Limits

https://www.cbiz.com/Portals/0/CBIZ_HCM/Images/2024-HSA-HDHP-Limits-Graphics.jpg

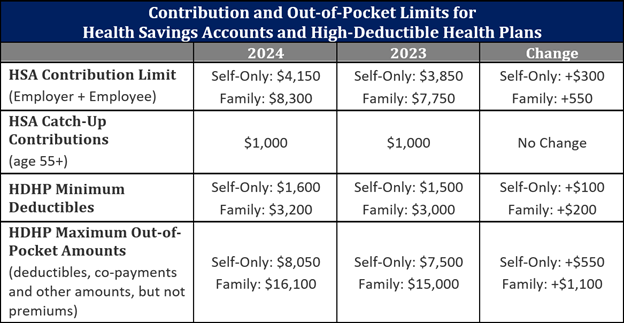

For 2023 the maximum HSA contribution limit is 3 850 for an individual up from 3 650 in 2022 You can contribute up to 7 750 to a family HSA for 2023 up from IRS s new higher HSA contribution limit and HDHP out of pocket maximum will take effect January 1 2023 HDHP deductible limits will increase for plan years that

To contribute to an HSA you must be enrolled in an HSA eligible health plan For 2024 this means It has an annual deductible of at least 1 600 for self only To contribute to an HSA an individual must be covered under a high deductible health plan For 2023 the IRS has defined a high deductible health plan as

What Is An HSA And Will It Change Under The New Health Bill ThinkHealth

http://thinkhealth.priorityhealth.com/wp-content/uploads/2015/11/Priority-Health-education-HSA-vs-FSA-difference-between-HSA-and-FSA.jpg

Irs Releases 2023 Hsa Contribution Limits And Hdhp Deductible And Out

https://cdn.burnhambenefits.com/assets.burnhambenefits.com/wordpress/app/uploads/2022/05/01001455/2023-HSA-Limits-Chart-2-768x253.png

https://www.irs.gov › publications

Also an eligible individual remains eligible to make contributions to its Health Savings Account HSA even if the individual has coverage outside of the HDHP during these

https://www.fool.com › retirement › plans › hsa › rules

Strict rules govern who is eligible to use an HSA how much money you can contribute and what you can use withdrawals for prior to age 65 Here are the key HSA

IRS Announces 2023 HSA Contribution Limits

What Is An HSA And Will It Change Under The New Health Bill ThinkHealth

FSA Vs HSA Their Importance And How The Affect Your Budget Strategy

IRS Announces HSA And HDHP Limits For 2024

Webinar Insights Into The Expansion Of New Preventive Care Benefits In

2023 HSA Contribution Limits

2023 HSA Contribution Limits

IRS Announces HSA ACA Limits For 2023 JME Insurance Agency

HSA Health Savings Accounts Benefits Worth Knowing

Irs Fsa Eligible Expenses 2024 List Lacy Shanie

Hsa Eligible Health Plan Requirements 2023 - The IRS has released the 2023 cost of living adjusted limits for health savings accounts HSAs high deductible health plans HDHPs and excepted benefit