Hsa Qualified Medical Expenses Find more information on IRS qualified medical expenses from irs gov If you have an HRA or FSA your employer s plan may only reimburse a subset of expenses Please refer to your Plan Document for confirmation of

Learn what counts as an eligible health savings account expense and how to use your HSA to cover medical dental and vision care costs Find out the IRS approved list of expenses and the rules for using HSAs with a high View a list of all the Health Savings Account HSA Qualified Expenses for 2025 You can also see a list of all Non HSA Qualified Expenses

Hsa Qualified Medical Expenses

Hsa Qualified Medical Expenses

https://blog.bernardbenefits.com/hs-fs/hub/131307/file-2217117013-png/HSA_expenses-1.png

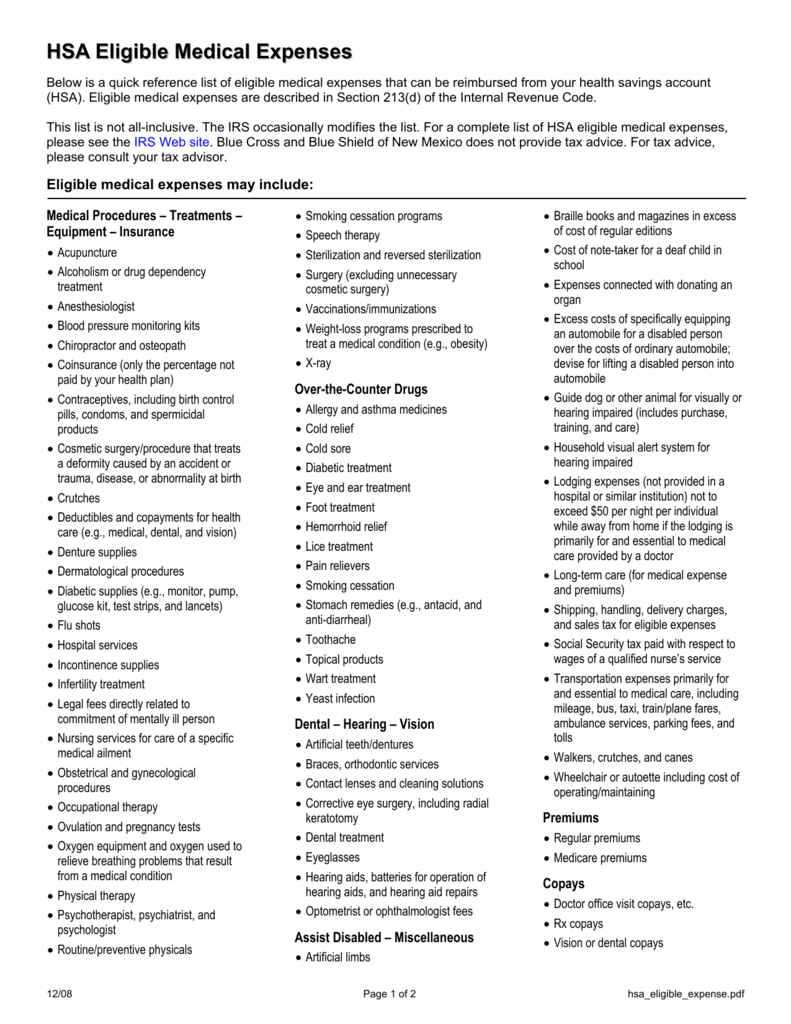

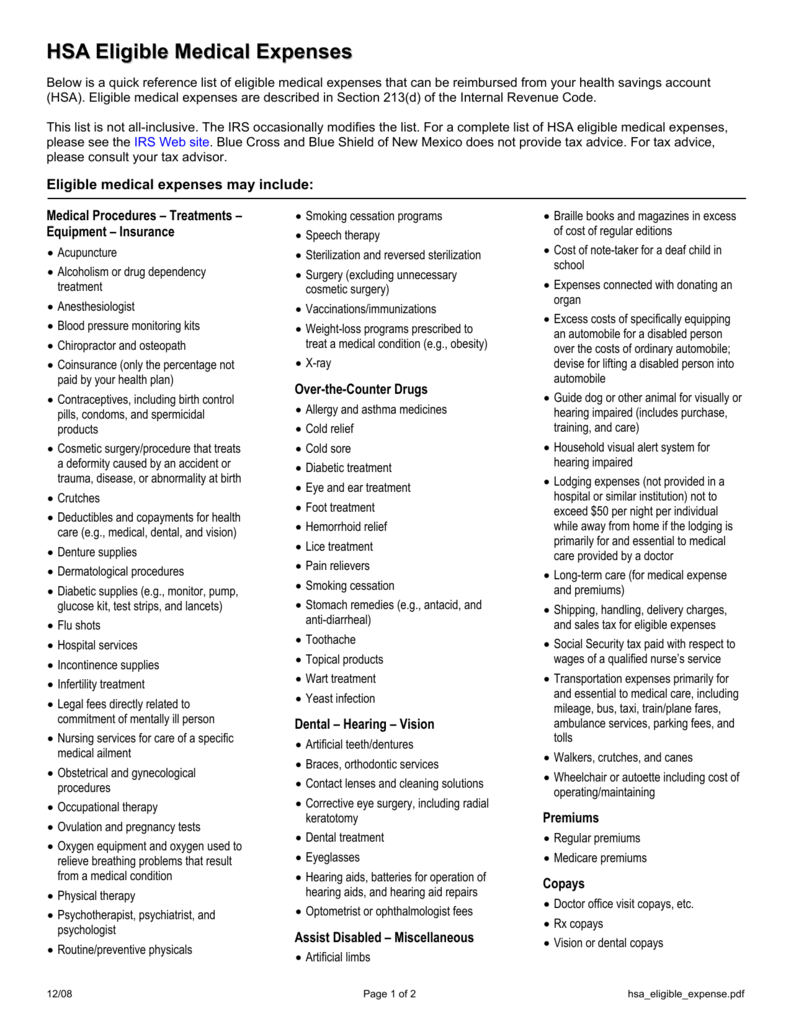

HSA Eligible Medical Expenses Blue Cross And Blue Shield Of

https://s3.studylib.net/store/data/008072584_1-f67bb7e2411878f7633392284637e518.png

20 Copay Icon Stock Illustrations Royalty Free Vector Graphics Clip

https://media.istockphoto.com/id/967287904/vector/medical-tax-savings-health-savings-account-or-flexible-spending-account-has-hsa-fsa-tax.jpg?s=612x612&w=0&k=20&c=DCjzQzylMyJ81UMyW4BTSzA6Oq8CZaWHsoLEmeohI1s=

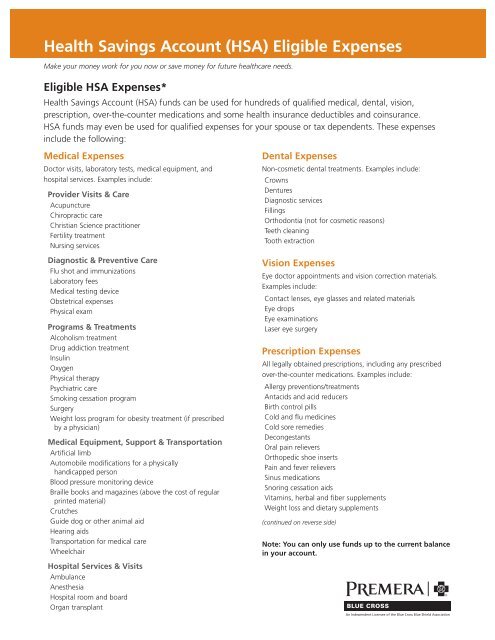

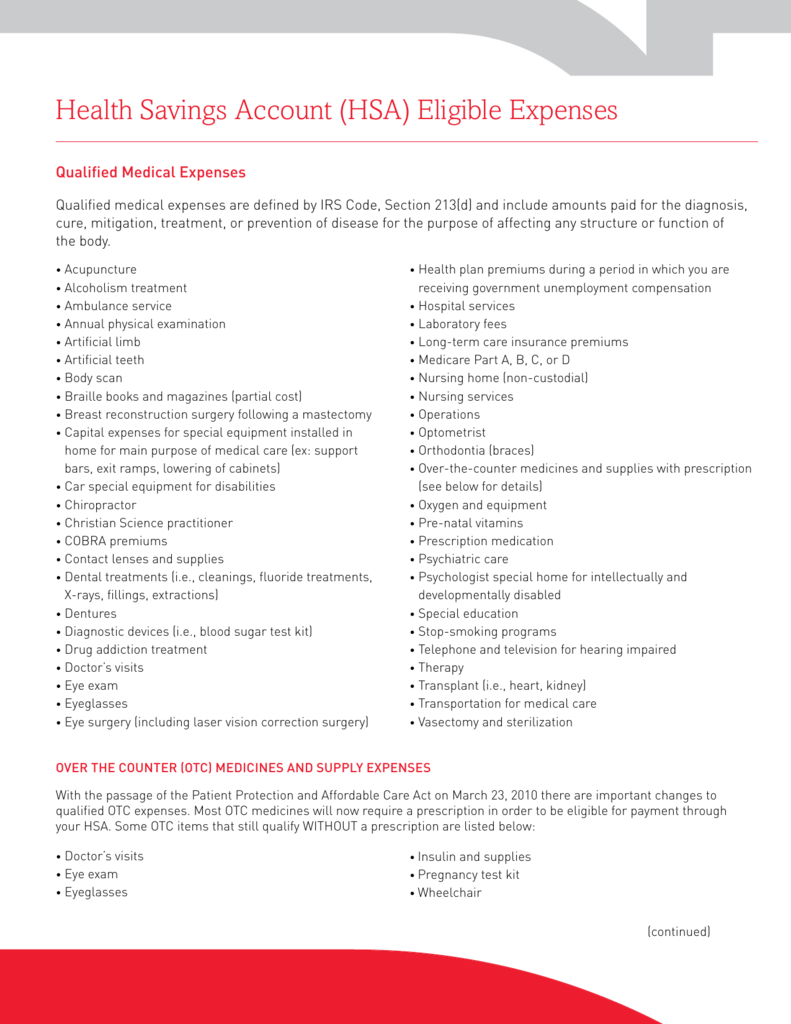

HSA qualified medical expenses QME Discover what medical expenses your HSA may cover from prescriptions to fitness programs Can t find what you re looking for See our Non The taxpayer can receive tax free distributions from an HSA to pay or be reimbursed for qualified medical expenses incurred after the taxpayer establishes the HSA Qualified medical

Individuals can withdraw money from their HSA to pay for eligible medical expenses also known as qualified medical expenses for the account holder their spouse or their dependents Once you ve contributed money to your health savings account HSA you can use it to pay for qualified medical expenses for yourself your spouse and your eligible dependents In general

Download Hsa Qualified Medical Expenses

More picture related to Hsa Qualified Medical Expenses

2022 HSA Eligible Expenses SmartAsset Health Savings Account

https://i.pinimg.com/736x/0b/7d/6a/0b7d6a419e534849db35671b64946b5f.jpg

Who Candid Gov Directions Splits Blue Long standing Disables Among Who

https://img.yumpu.com/36834512/1/500x640/health-savings-account-hsa-eligible-expenses.jpg

Hsa Eligible Expenses 2024 Dee Libbey

http://austinbenefits.com/wp-content/uploads/ABG-Twitter-HSA-Eligible-Purchases.png

Qualified medical expenses are designated by the IRS They include certain medical dental vision and prescription expenses you can pay for with your HSA or other healthcare savings accounts funds Some qualifying What medical expenses does my HSA cover To be considered a qualified medical expense QME the expense must be incurred after the HSA is established and must qualify for the medical and dental expense tax deduction

Understanding qualified medical expenses is paramount to maximizing your HSA s potential and ensuring compliance with IRS regulations By educating yourself on eligible This article details how qualified medical expenses function for an HSA Covers both tax benefits and who when and what are considered qualified

Qualified HSA Expenses By Big Oak Benefits Group Issuu

https://image.isu.pub/181209223808-fe34f933a78b49b82c8a9168a0fc824f/jpg/page_1.jpg

11 Eligible HSA Expenses Infographic Further

https://hellofurther.com/wp-content/uploads/2019/07/11-Eligible-HSA-Expenses-Infographic.png

https://hsabank.com › ... › IRS-qualified-m…

Find more information on IRS qualified medical expenses from irs gov If you have an HRA or FSA your employer s plan may only reimburse a subset of expenses Please refer to your Plan Document for confirmation of

https://www.fool.com › ... › plans › hsa …

Learn what counts as an eligible health savings account expense and how to use your HSA to cover medical dental and vision care costs Find out the IRS approved list of expenses and the rules for using HSAs with a high

Health Savings Account HSA Qualified Medical Expenses YouTube

Qualified HSA Expenses By Big Oak Benefits Group Issuu

Qualified Medical Expenses

Health Savings Account HSA Eligible Expenses

What Counts As A Qualified Medical Expenses Under An HSA Pro Flex

Qualified Medical Expenses HSACenter Medical Health Savings

Qualified Medical Expenses HSACenter Medical Health Savings

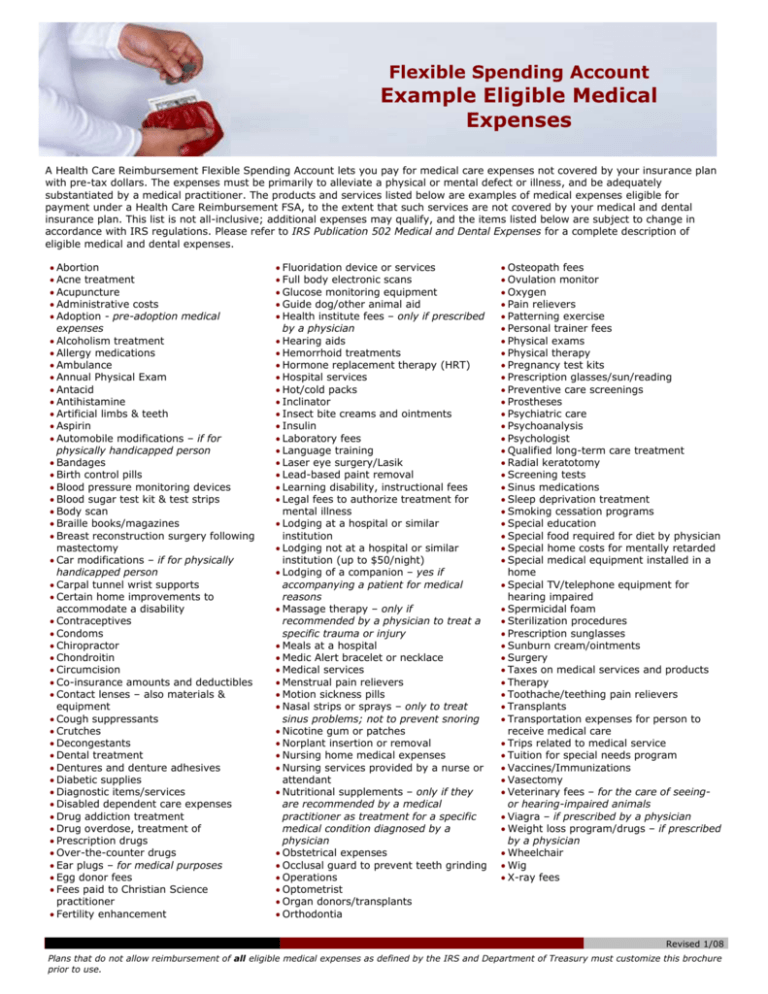

Flexible Spending Account Example Eligible Medical Expenses

HSA Eligible Expenses Medicare United States Over The Counter Drug

HSA Account What Is A Health Savings Account How It Works

Hsa Qualified Medical Expenses - The taxpayer can receive tax free distributions from an HSA to pay or be reimbursed for qualified medical expenses incurred after the taxpayer establishes the HSA Qualified medical