Hsa Reimbursement Time Limit Irs Learn about HSA reimbursement rules how to track expenses in case of an IRS audit how distributions are taxed and what is reimbursable under the rules

Health FSA contribution and carryover for 2022 Rev enue Procedure 2021 45 November 10 2021 provides that for tax years beginning in 2022 the dollar limitation under Because there is no reimbursement time limit taxpayers can wait until the time of their choosing to be reimbursed from the HSA for medical expenses even if it is

Hsa Reimbursement Time Limit Irs

Hsa Reimbursement Time Limit Irs

https://helpdesksuites.com/wp-content/uploads/2022/05/2023-IRS-HSA-Limits-V8z6Yv.png

An Employers Guide To Reimbursement

https://w3ll.com/wp-content/uploads/2021/12/test-blog-4-scaled-2.jpg

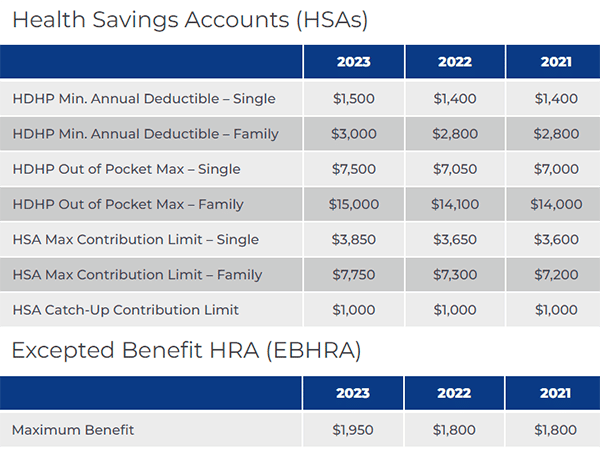

IRS Announced 2023 Health Savings Account HSA Contribution Limits HRPro

https://www.hrpro.com/wp-content/uploads/2022/05/HSA-Limits-Chart-600.png

HSA contribution limits Every year the Internal Revenue Service IRS sets the maximum that can be contributed to an HSA For example if your HSA contribution According to the IRS there is no time limit for paying yourself back but there are some rules we ll explain more below You can t reimburse yourself for expenses incurred

Complete and up to date information on the IRS guidelines for eligible expenses and contribution limits surrounding Health Savings Accounts Toggle Strict rules govern who is eligible to use an HSA how much money you can contribute and what you can use withdrawals for prior to age 65 Here are the key HSA

Download Hsa Reimbursement Time Limit Irs

More picture related to Hsa Reimbursement Time Limit Irs

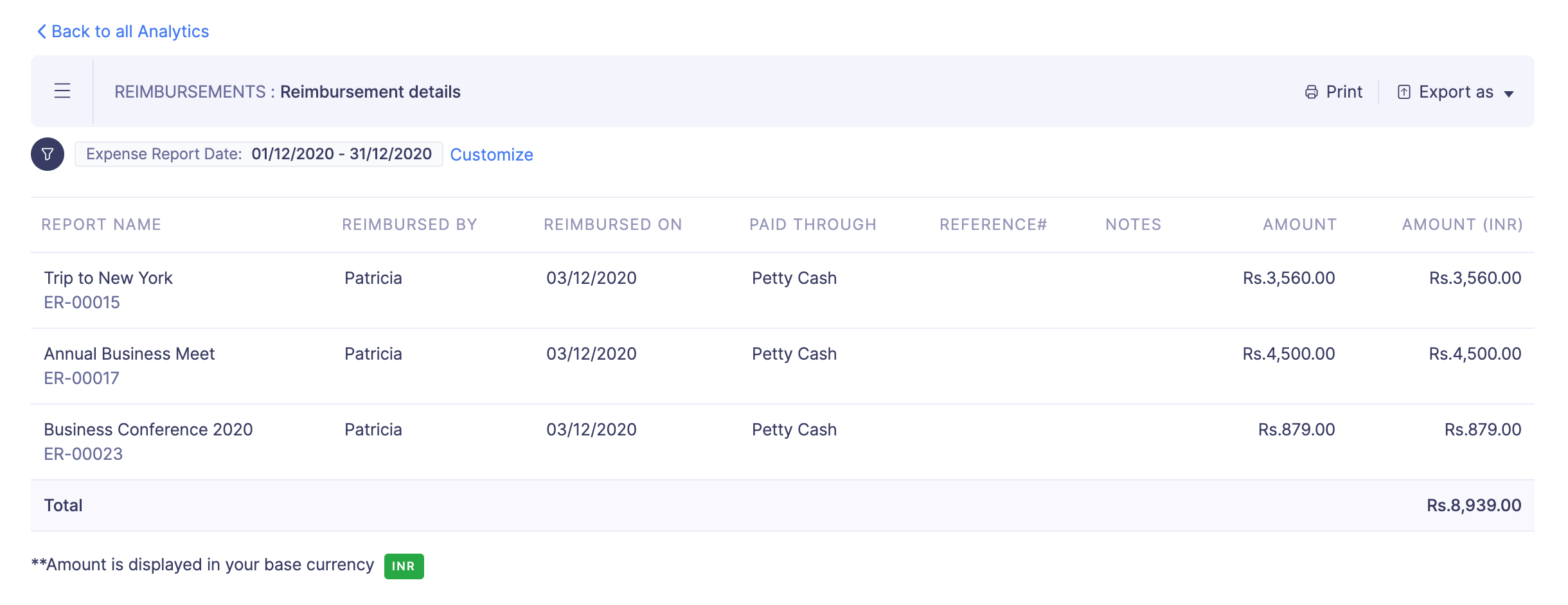

Reimbursement Analytics User Guide Zoho Expense

https://www.zoho.com/expense/help/analytics/reimbursement/reimbursement-details.png

2024 HSA HDHP Limits

https://www.cbiz.com/Portals/0/CBIZ_HCM/Images/2024-HSA-HDHP-Limits-Graphics.jpg

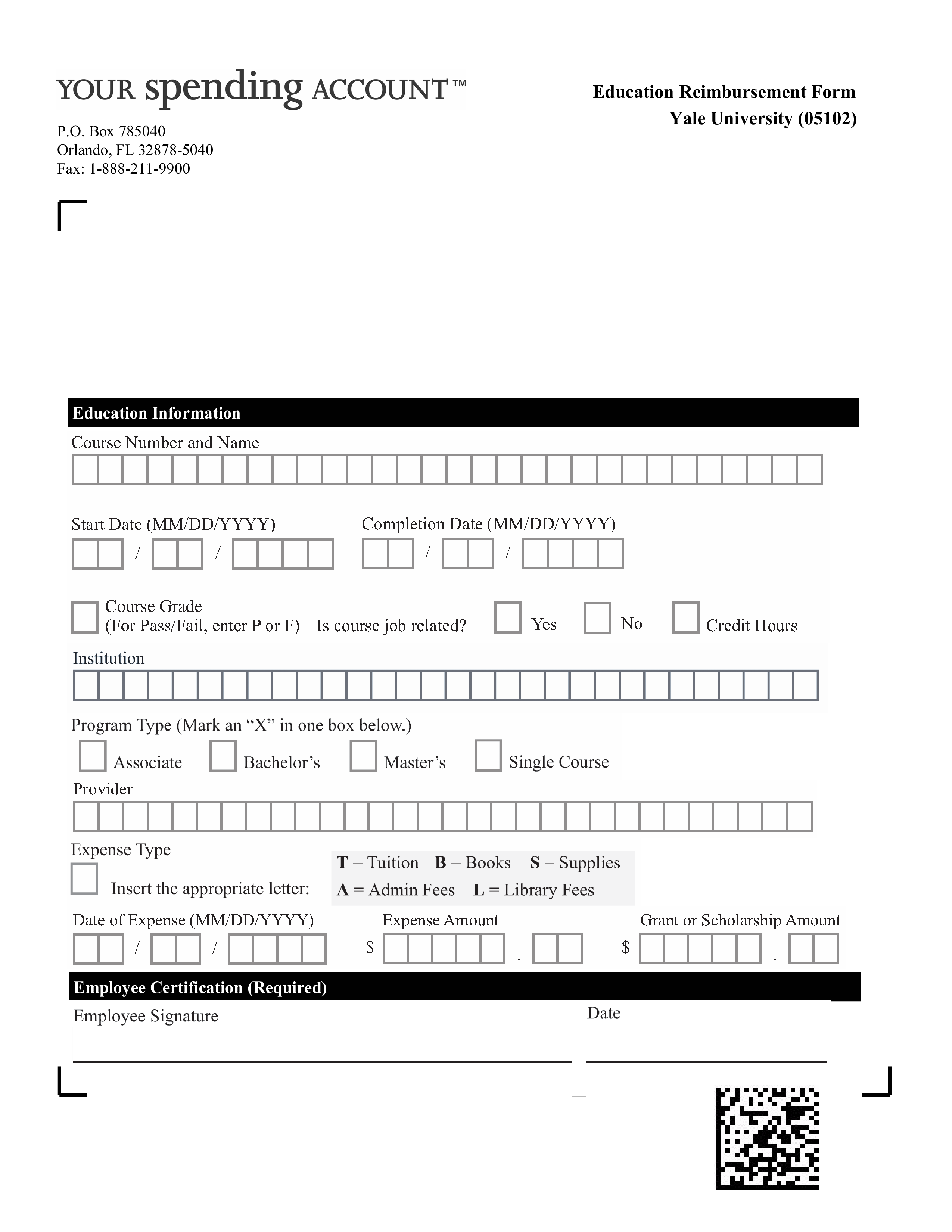

Education Reimbursement Form Templates At Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/c5b720e2-7c3a-4fd4-ad0b-b598af070302_1.png

Information about Publication 969 Health Savings Accounts HSA and Other Tax Favored Health Plans including recent updates Publication 969 explains HSA Contribution Limits The 2025 annual HSA contribution limit is 4 300 for individuals with self only HDHP coverage up from 4 150 in 2024 and 8 550 for

Learn the ins and outs of HSA reimbursements and how to pay for qualified expenses using your HSA funds whether paying directly from your HSA account or by You can only deduct your total medical expenses that exceed 7 5 of your adjusted gross income AGI For example if your AGI is 100 000 and you have

10 Tips On California Law Expense Reimbursement Time Limit Nakase Law

https://nakaselawfirm.com/wp-content/uploads/expense-reimbursement.jpg

.png)

Irs Announces Updated Hsa Limits For First Dollar 19257 Hot Sex Picture

http://assets-global.website-files.com/6196c9b83c53033a4eb4e1d5/6297b496ea3a82e3ae0718b2_2023 HSA Contribution Limits (4).png

https://livelyme.com › blog › hsa-reimbursement-rules

Learn about HSA reimbursement rules how to track expenses in case of an IRS audit how distributions are taxed and what is reimbursable under the rules

https://www.irs.gov › pub › irs-pdf

Health FSA contribution and carryover for 2022 Rev enue Procedure 2021 45 November 10 2021 provides that for tax years beginning in 2022 the dollar limitation under

Comparison Of HSA health Savings FSA Flexible Spending HRA

10 Tips On California Law Expense Reimbursement Time Limit Nakase Law

Who Is Eligible For Medicare Part B Reimbursement ClearMatch Medicare

:max_bytes(150000):strip_icc()/hra-vs-hsa-5190731_final-eec8d019c0a545009e049f4a96861d85.png)

Health Reimbursement Arrangement HRA Vs Health Savings Account HSA

Disbursement Vs Reimbursement Definitions And The Difference

Hsa Limit 2024 Irs Edith Walliw

Hsa Limit 2024 Irs Edith Walliw

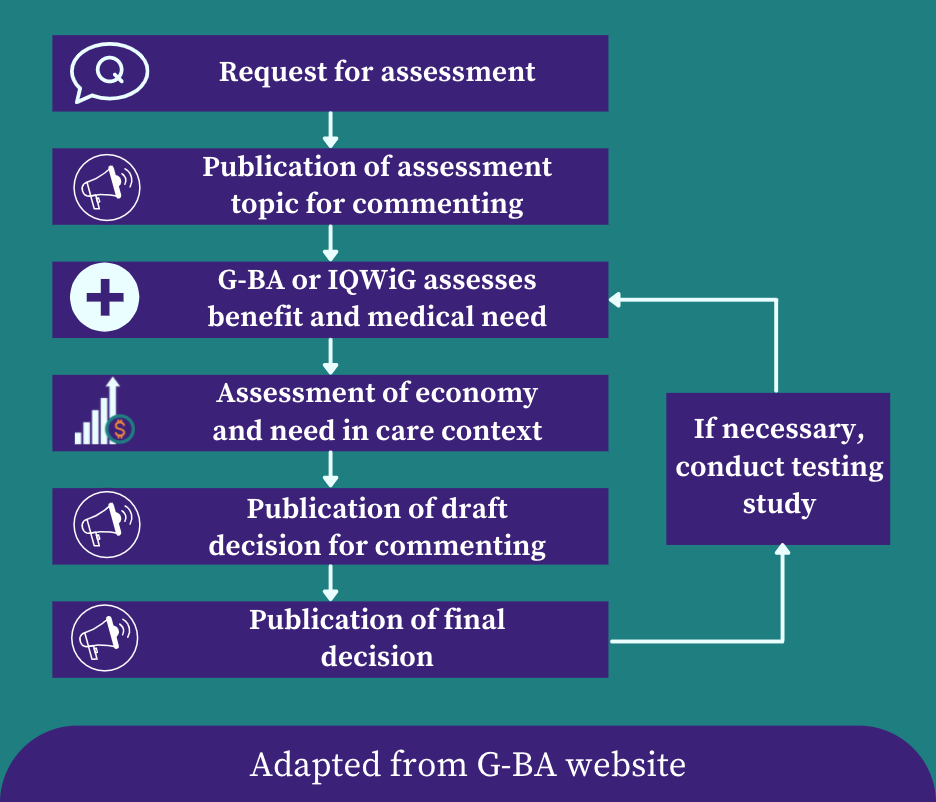

Reimbursement Of Medical Devices In Germany

Employee Reimbursement Strategy Finishing School

Tabela Atualizado Irs 2023 Hsa Imagesee Vrogue co

Hsa Reimbursement Time Limit Irs - Complete and up to date information on the IRS guidelines for eligible expenses and contribution limits surrounding Health Savings Accounts Toggle