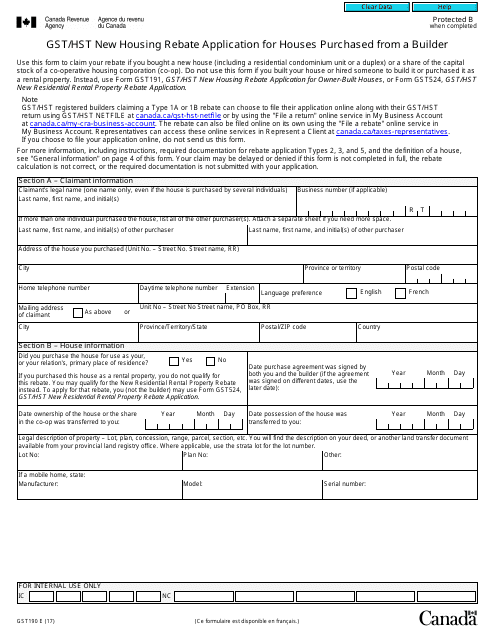

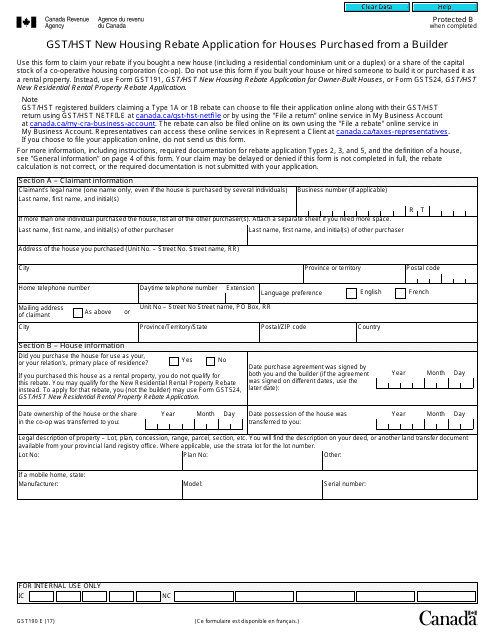

Hst Rebate Forms For New Houses In Ontario Web 9 sept 2022 nbsp 0183 32 GST191 GST HST New Housing Rebate Application for Owner Built Houses For best results download and open this form in Adobe Reader See General information for details

Web 17 juin 2021 nbsp 0183 32 Use this rebate schedule to calculate the amount of your Ontario new housing rebate for some of the provincial part of the HST if you bought a new house in Ontario including a residential condominium unit duplex or share of the capital stock of a co operative housing corporation co op Web 27 f 233 vr 2023 nbsp 0183 32 There are two ways buyers can get an HST rebate in Ontario HST New Housing Rebate when you purchase a newly built condominium unit or house or one that s undergone substantial renovation

Hst Rebate Forms For New Houses In Ontario

Hst Rebate Forms For New Houses In Ontario

https://data.templateroller.com/pdf_docs_html/1867/18672/1867279/form-gst190-gst-hst-new-housing-rebate-application-for-houses-purchased-from-a-builder-canada_big.png

Gst191 Fillable Form Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/2030/20309/2030941/form-gst191-gst-hst-new-housing-rebate-application-for-owner-built-houses-canada_print_big.png

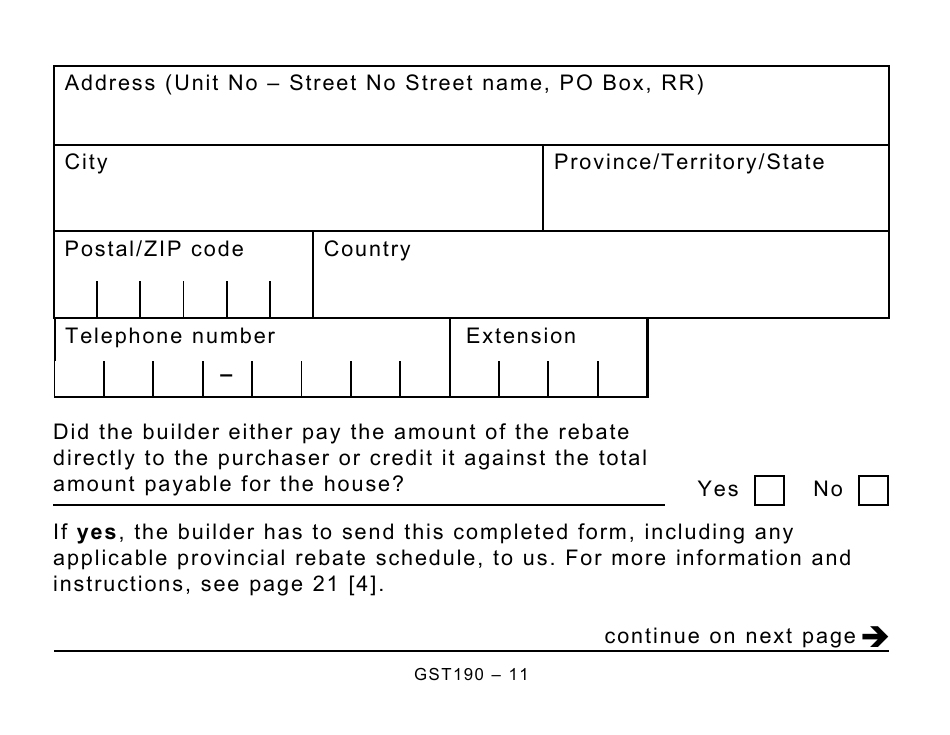

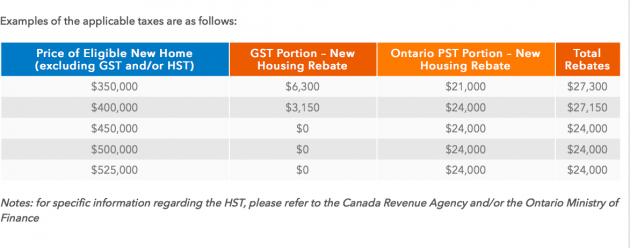

Form GST190 Fill Out Sign Online And Download Printable PDF Canada

https://data.templateroller.com/pdf_docs_html/1869/18694/1869441/page_11_thumb_950.png

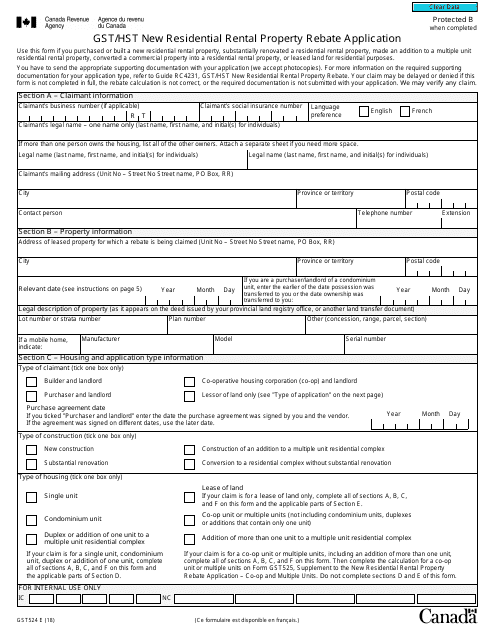

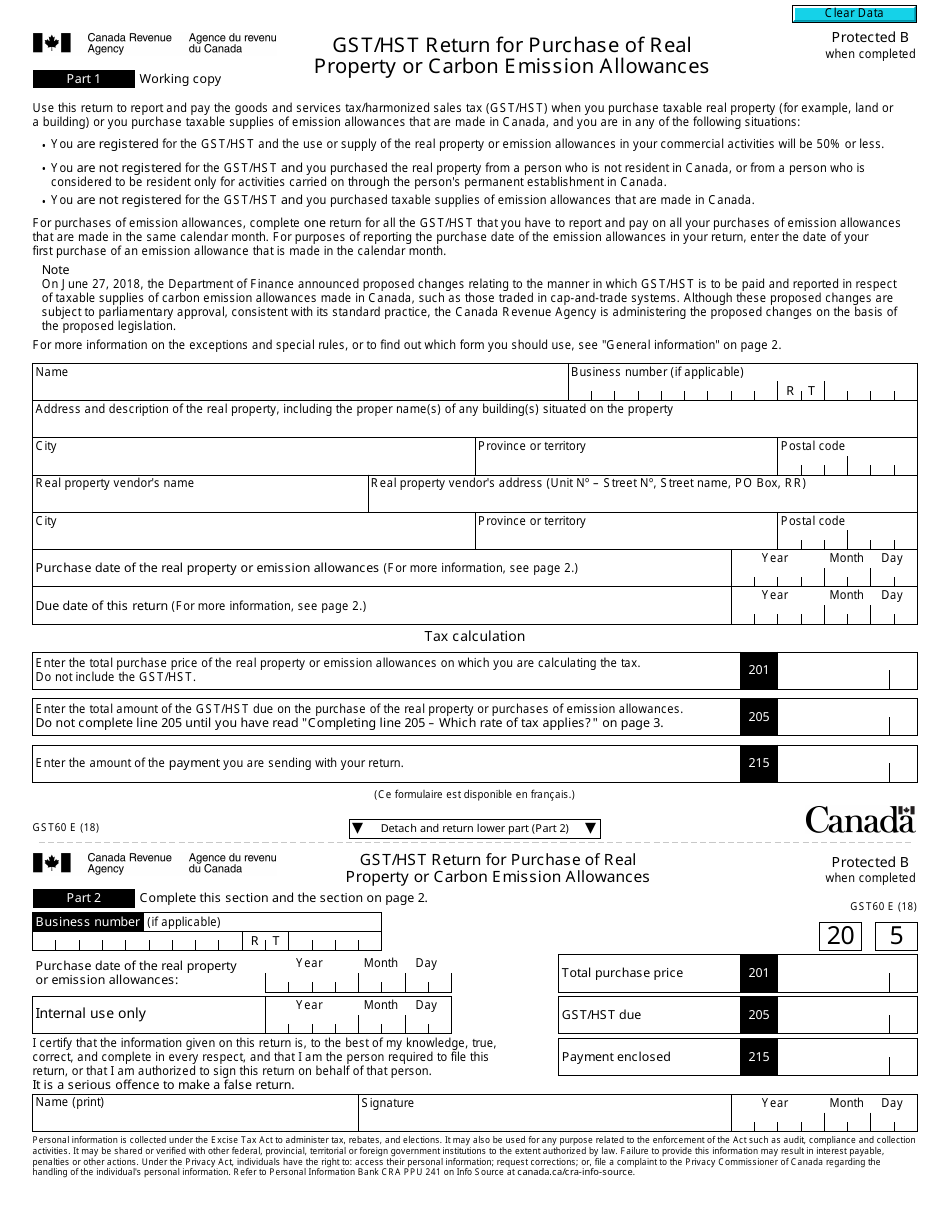

Web Fill out Form GST524 GST HST New Residential Rental Property Rebate Application to recover the GST or federal part of the HST Fill out Form RC7524 ON GST524 Ontario Rebate Schedule to recover the provincial part of the HST if your house is in Ontario Web Calculate Now Are You Eligible You may qualify for an HST rebate if you have done any of the following in Ontario in the last two years Built a house Bought a newly constructed home Bought a new condo Contracted somebody to build a house Extensively renovated a house or condominium

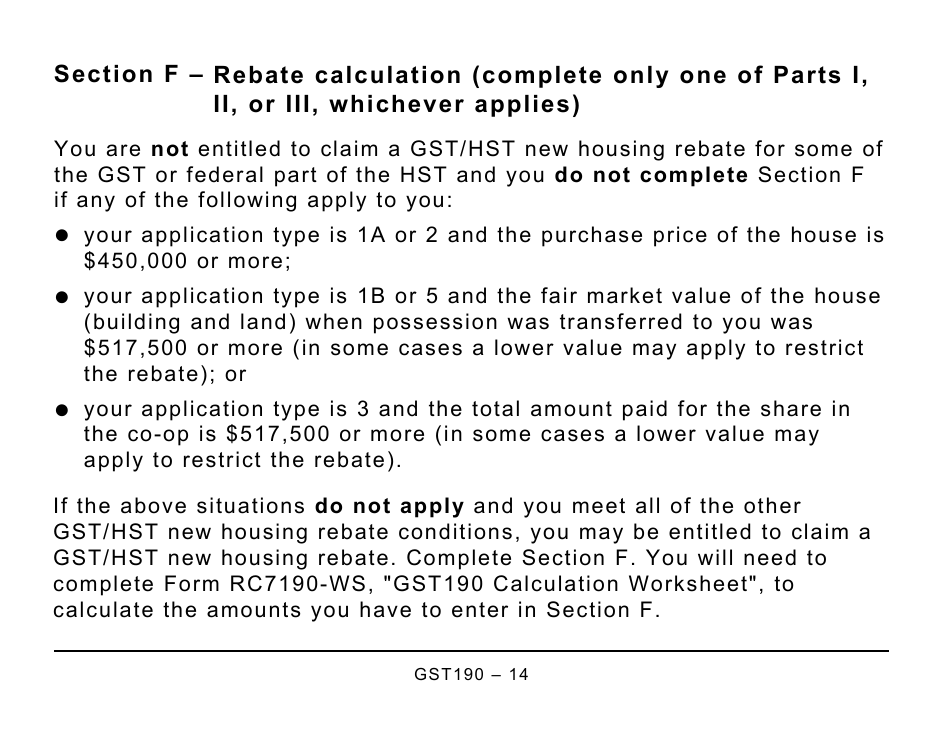

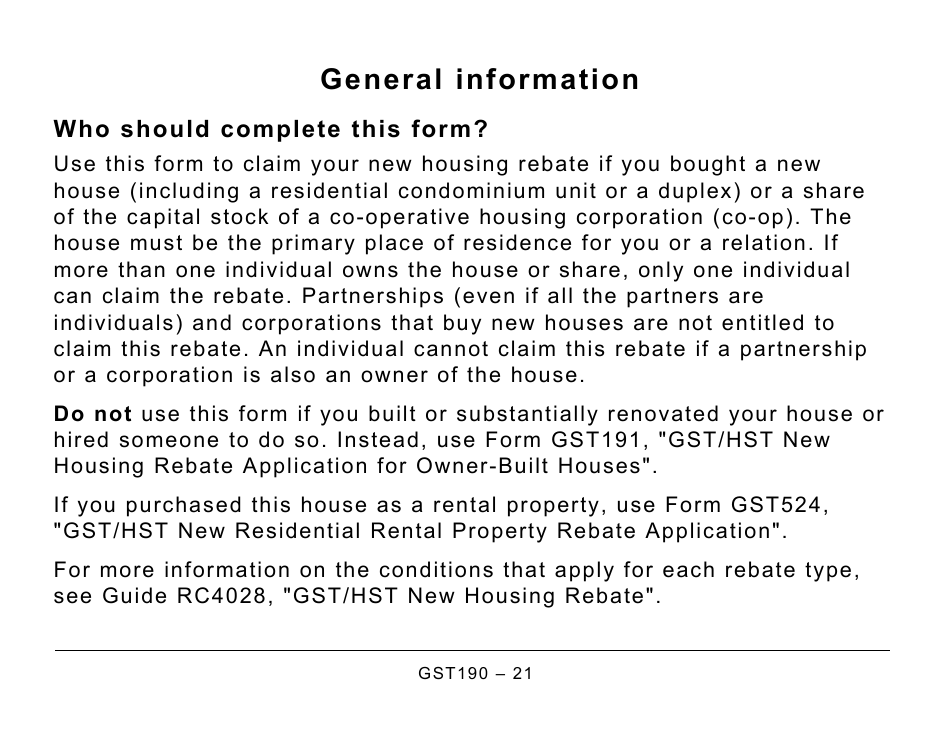

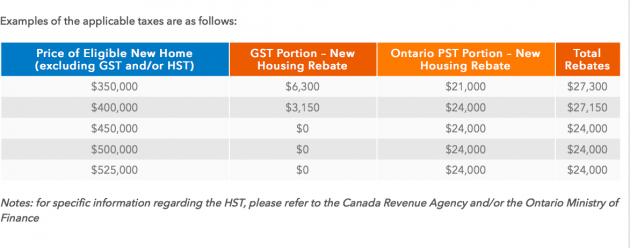

Web The federal part of the HST rebate will let the homebuyer claim 36 of the GST if the home costs 350 000 or less However if the home costs between 350 000 and 450 000 the rebate will gradually reduce until it becomes 0 when the price reaches 450 000 Web 26 oct 2022 nbsp 0183 32 The amount of federal rebate you can receive for the GST Portion is 36 of the GST tax amount up to a maximum of 6 300 and disappears entirely once the home price exceeds 450 000 Fair Market Value Province GST Rebate 4 500 HST Rebate 15 000 Best 5 Year Fixed Mortgage Rates in Canada No Rates Available Mortgage

Download Hst Rebate Forms For New Houses In Ontario

More picture related to Hst Rebate Forms For New Houses In Ontario

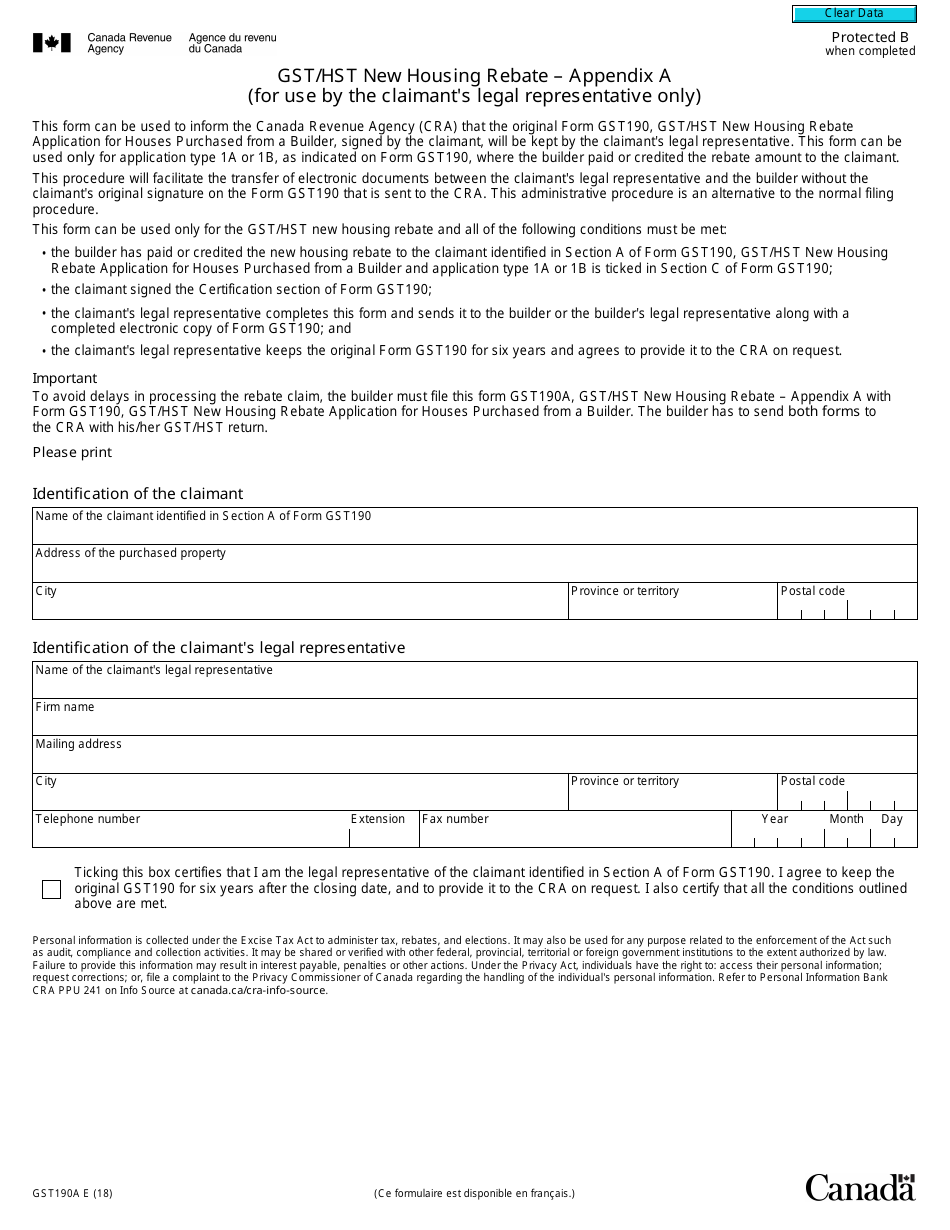

Form GST190A Schedule A Download Fillable PDF Or Fill Online Gst Hst

https://data.templateroller.com/pdf_docs_html/1869/18694/1869424/form-gst190a-schedule-a-gst-hst-new-housing-rebate-canada_print_big.png

Form GST190 Fill Out Sign Online And Download Printable PDF Canada

https://data.templateroller.com/pdf_docs_html/1869/18694/1869441/page_14_thumb_950.png

Form GST190 Fill Out Sign Online And Download Printable PDF Canada

https://data.templateroller.com/pdf_docs_html/1869/18694/1869441/page_21_thumb_950.png

Web Use this form to claim your rebate if you bought a new house including a residential condominium unit or a duplex or a share of the capital stock of a co operative housing corporation co op Do not use this area Do not use this form if you built your house or hired someone to build it Web For the record the federation govt offers adenine 36 bill on the federal portion of the HST which remains 5 on newly built or substantially renovated houses is have a show market total in up to 350 000 The limit rebate works

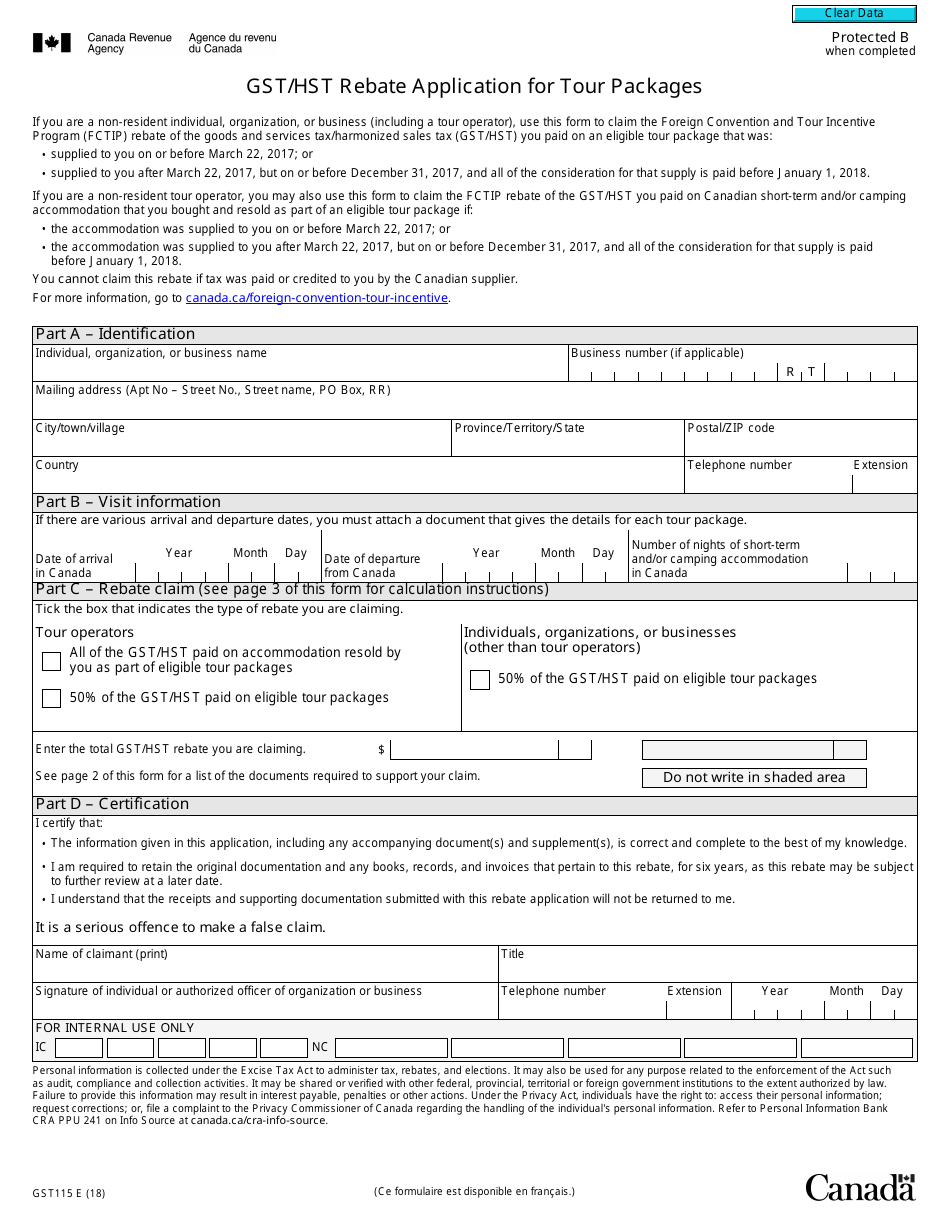

Web This results in a maximum rebate at a provincial level of 24 000 400 000 x 0 08 x 0 75 It is also possible to obtain a federal rebate of up to 6 000 In other provinces the new home rebate is clawed back for any house purchase over 450 000 Web 1 oct 2017 nbsp 0183 32 How to claim the GST HST rebate To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate application If you are eligible to claim a rebate under more than one code use a separate rebate application for each reason code

New Home HST Rebate Calculator Ontario

https://buildersontario.com/wp-content/uploads/2016/01/Untitled-630x248.png

HST Rebate Forms Ontario Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/HST-Rebate-Form-2021-768x997.png

https://www.canada.ca/en/revenue-agency/services/forms-publications/...

Web 9 sept 2022 nbsp 0183 32 GST191 GST HST New Housing Rebate Application for Owner Built Houses For best results download and open this form in Adobe Reader See General information for details

https://www.canada.ca/en/revenue-agency/services/forms-publications/...

Web 17 juin 2021 nbsp 0183 32 Use this rebate schedule to calculate the amount of your Ontario new housing rebate for some of the provincial part of the HST if you bought a new house in Ontario including a residential condominium unit duplex or share of the capital stock of a co operative housing corporation co op

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

New Home HST Rebate Calculator Ontario

Gst Fillable Form Printable Forms Free Online

Gst Fillable Form Printable Forms Free Online

Gst Hst New Housing Rebate Application For Owner Built Houses

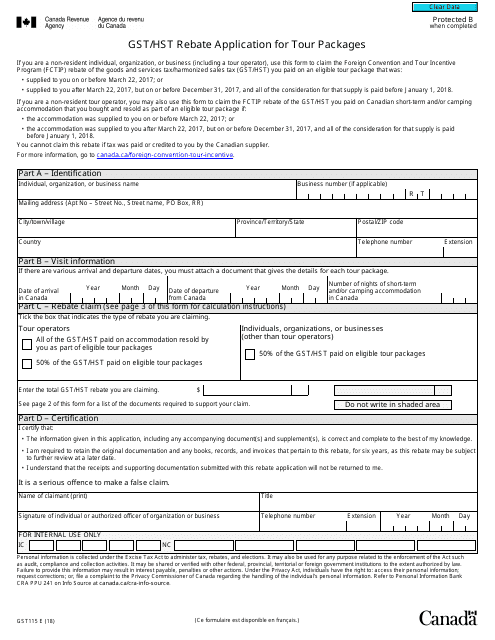

Form GST115 Fill Out Sign Online And Download Fillable PDF Canada

Form GST115 Fill Out Sign Online And Download Fillable PDF Canada

New Home HST GST Rebate By Nadene Milnes Issuu

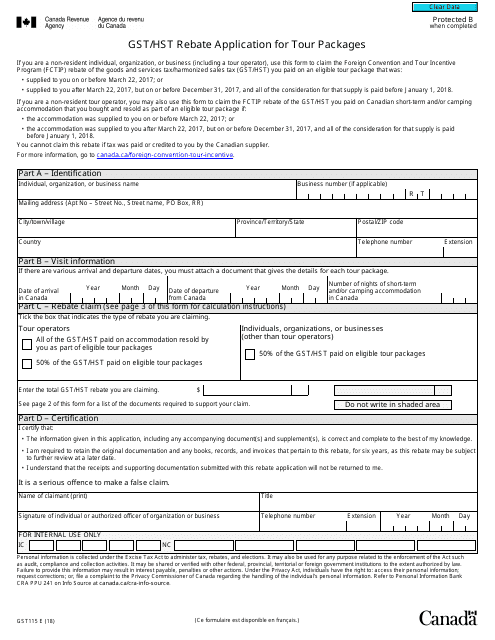

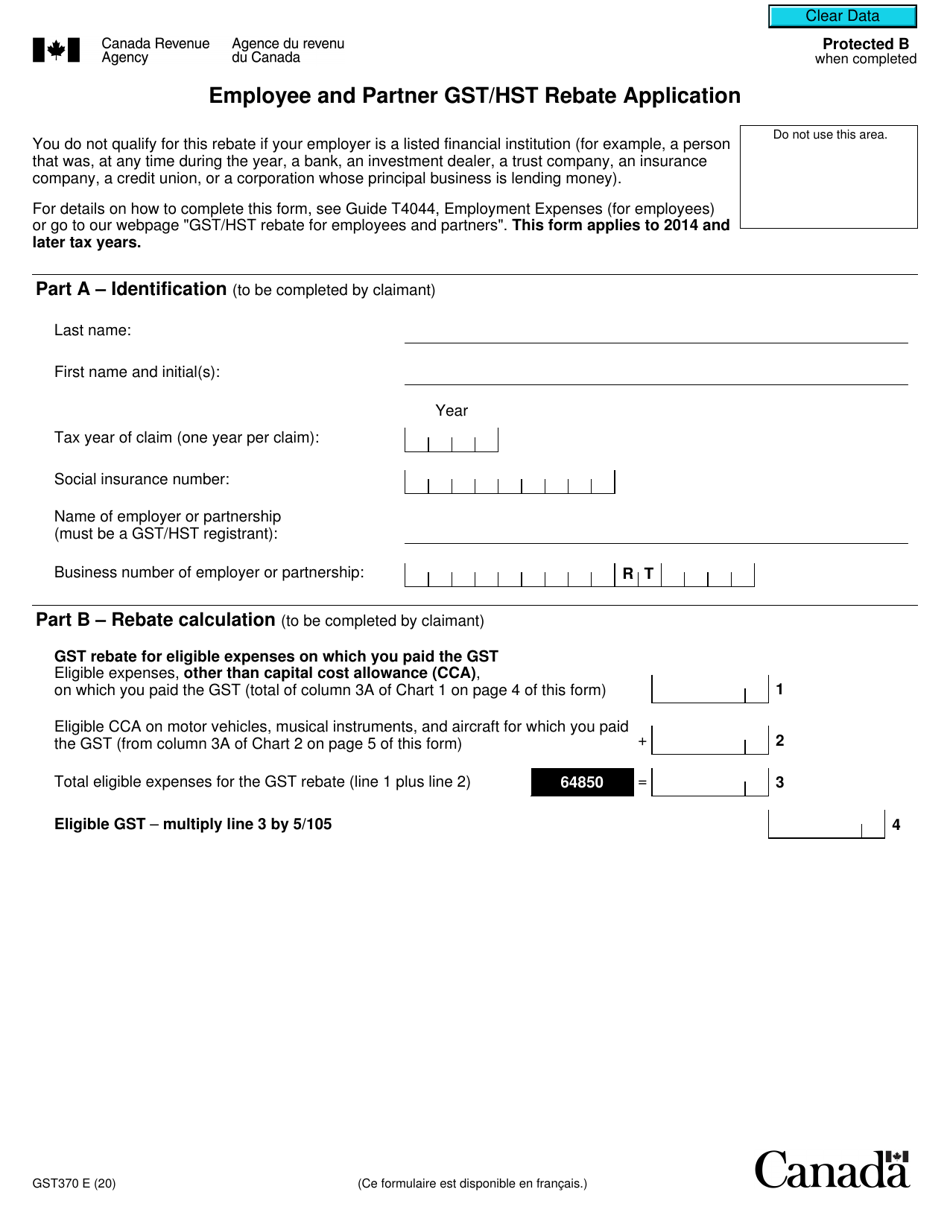

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

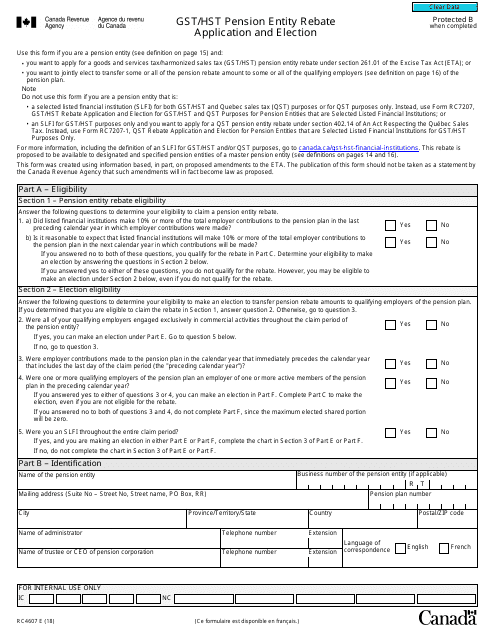

Form RC4607 Download Fillable PDF Or Fill Online Gst Hst Pension Entity

Hst Rebate Forms For New Houses In Ontario - Web October 28 Curious To Know Your Rebate Amount Use Our Calculator If You Have Built Or Renovated A Home Purchased A New Rental Home Or Condo Contact Us It starts with a simple call We will determine your eligibility and address all questions over the phone Submit Your Documents Forget complex paperwork