Hst Rebate Rental Property Web Which rental properties qualify for the GST HST new residential rental property rebate You generally pay the goods and services tax harmonized sales tax GST HST when

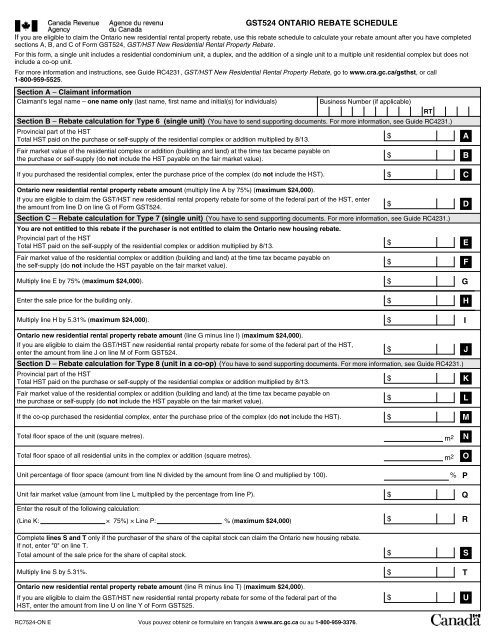

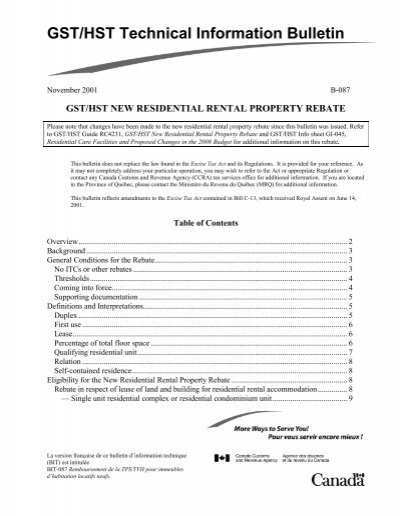

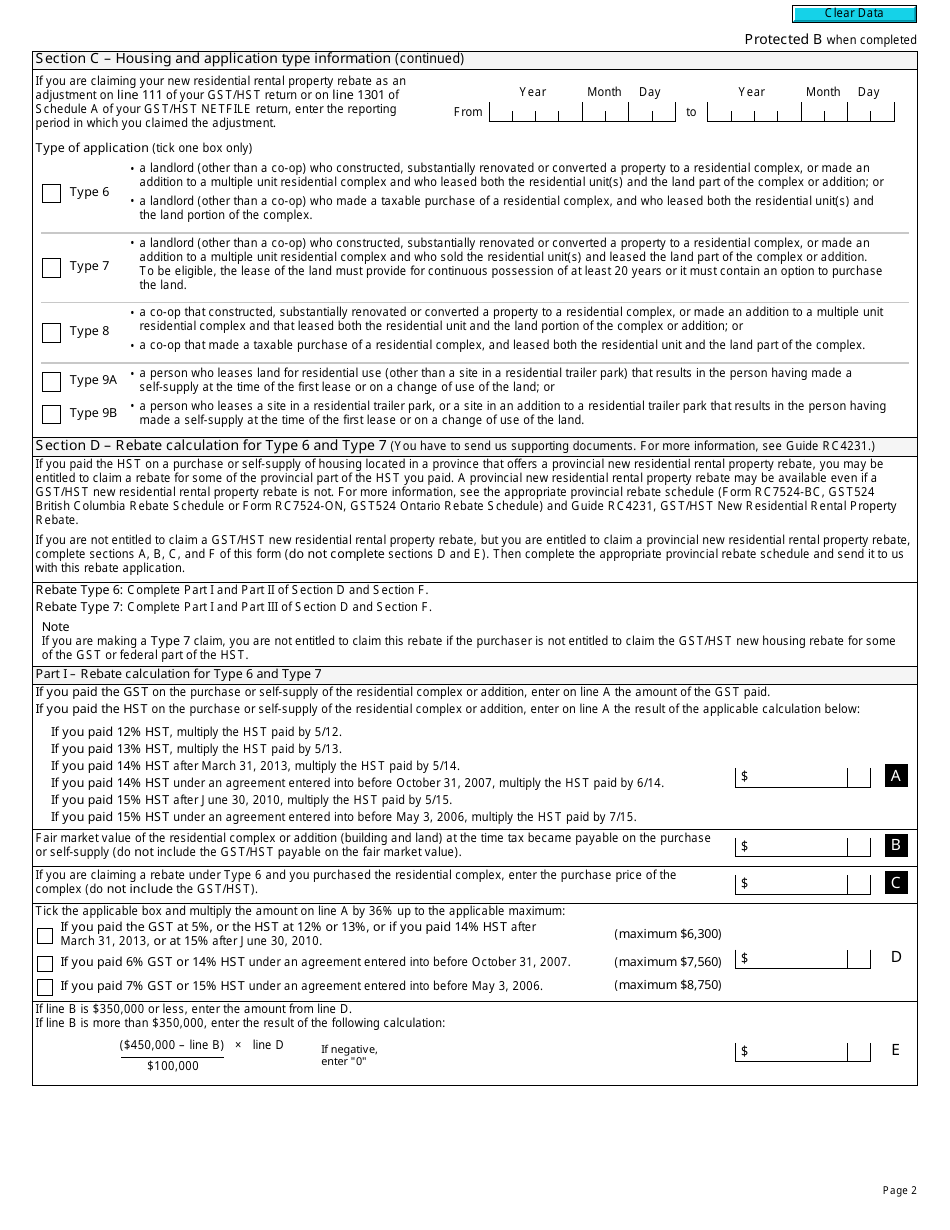

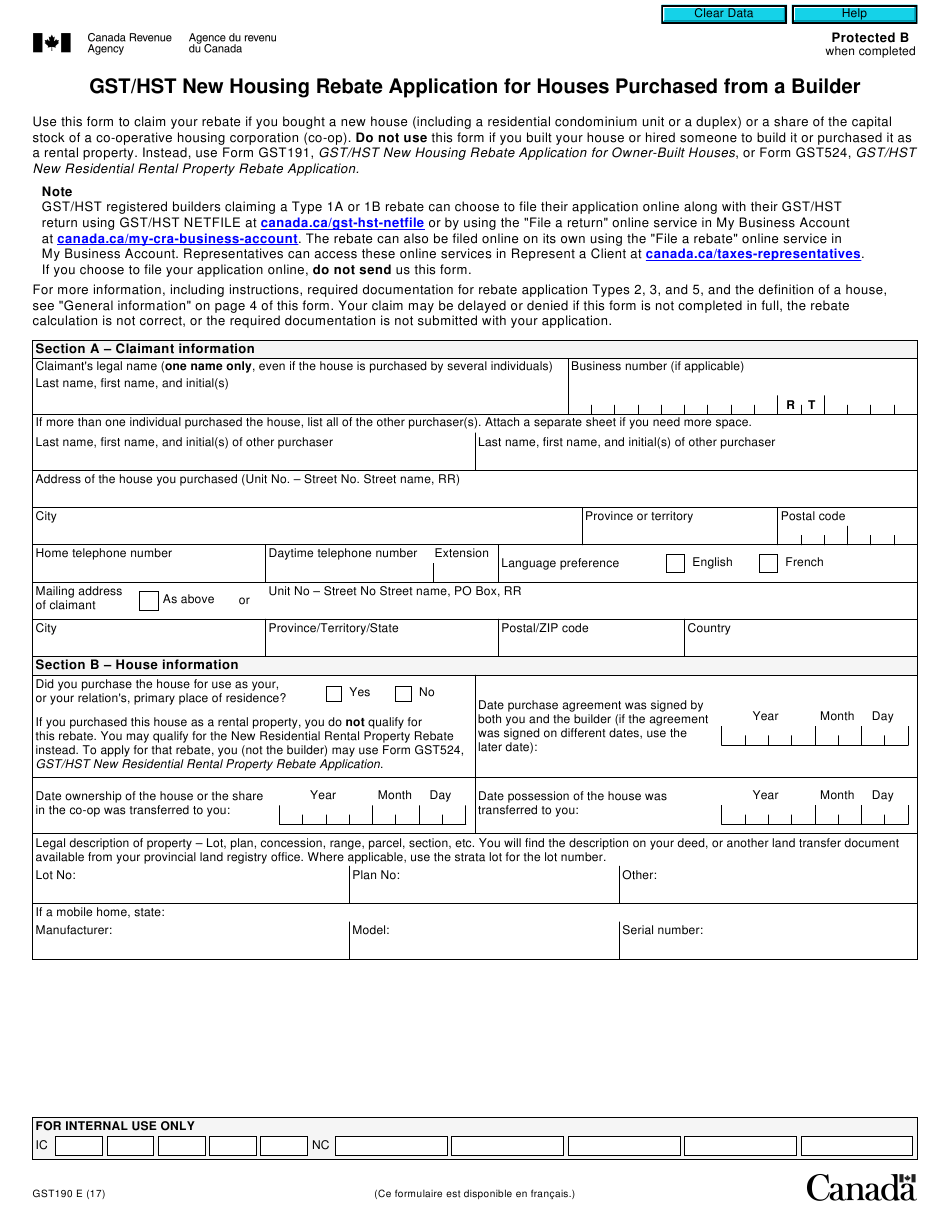

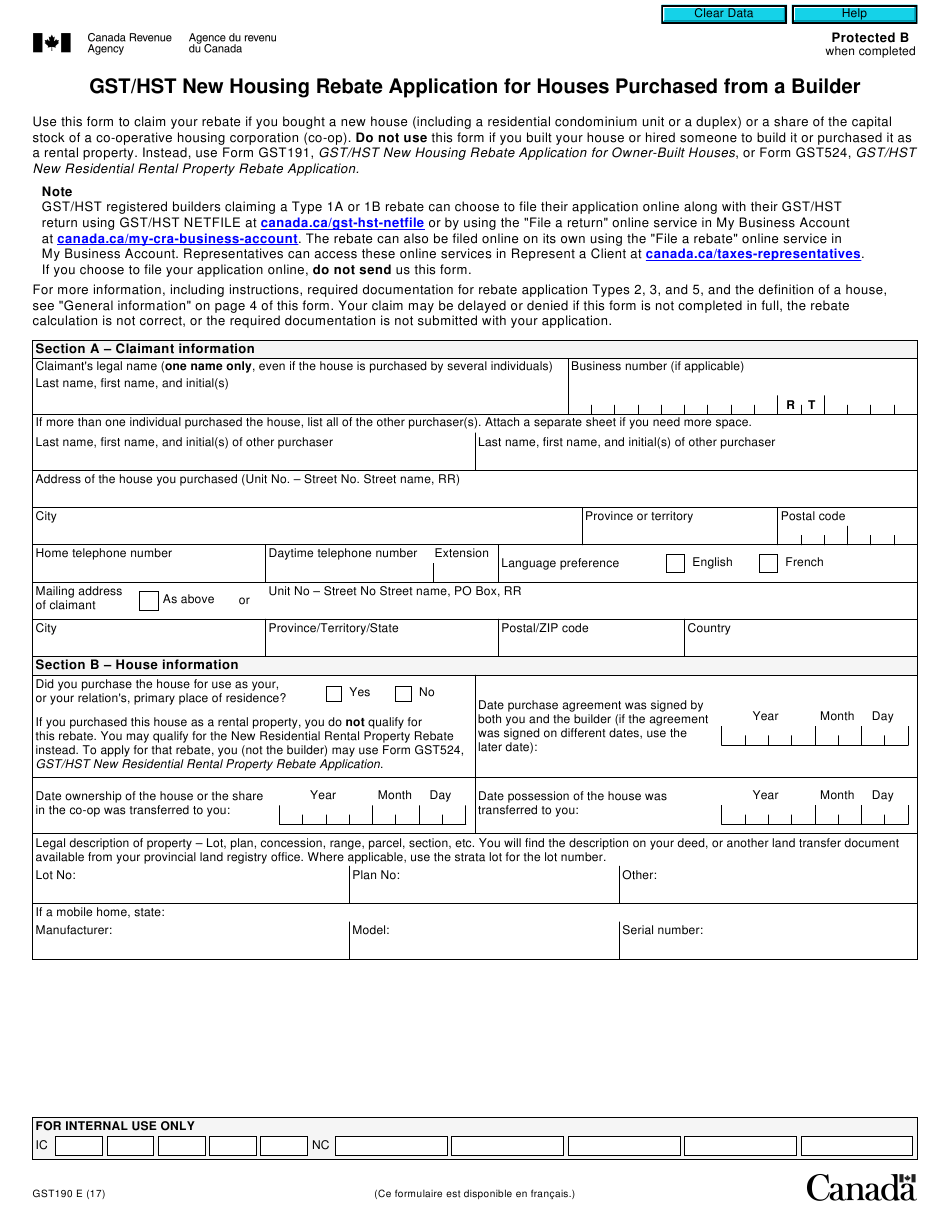

Web Definitions Important terms Determining if you are a builder for GST HST purposes Determining what is considered a house for purposes of the new housing rebate Primary Web 14 juin 2001 nbsp 0183 32 GST HST new residential rental property rebate From Canada Revenue Agency GST HST Technical Information Bulletin B 087 November 2001 Please note that

Hst Rebate Rental Property

Hst Rebate Rental Property

https://www.propertyrebate.net/wp-content/uploads/2023/05/guide-rc4231-gst-hst-new-residential-rental-property-rebate-property-4.jpg

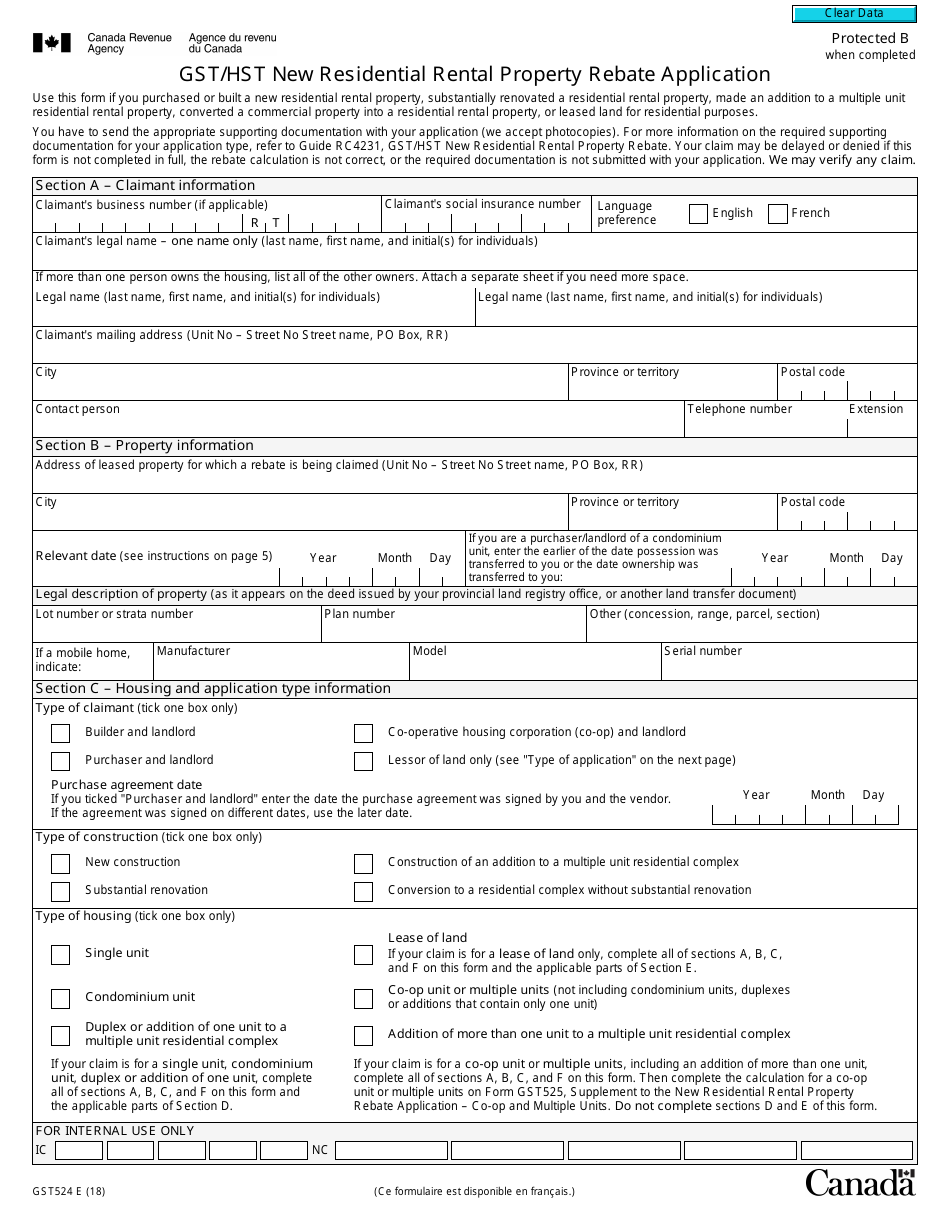

Gst Hst New Residential Rental Property Rebate Application Guide

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/gst-hst-new-residential-rental-property-rebate-application-guide.jpg?fit=358%2C506&ssl=1

GST HST New Residential Rental Property Rebate Agence Du

https://www.yumpu.com/en/image/facebook/7898976.jpg

Web 3 d 233 c 2020 nbsp 0183 32 The rebate must be claimed with the Government not obtained from the builder by way of application to the Canada Revenue Agency after closing on the Web To qualify for the New Residential Rental Property Rebate you or your corporation will need to rent out the property for at least one year In this article we break down how

Web You may be eligible for up to 30 000 in HST rebates Call to learn more Experienced tax consultants helping new home buyers in Ontario receive their maximum new home HST Web 16 sept 2020 nbsp 0183 32 Who Is Eligible For The New Residential Rental Property GST HST Rebate The New Residential Rental Property Rebate is made available to any landlord who purchases a new house or a condo for

Download Hst Rebate Rental Property

More picture related to Hst Rebate Rental Property

Guide Rc4231 Gst Hst New Residential Rental Property Rebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2022/10/guide-rc4231-gst-hst-new-residential-rental-property-rebate-property-6.png?fit=791%2C1024&ssl=1

You May Be Eligible To Cl

https://img.yumpu.com/5553203/7/500x640/gst-hst-new-residential-rental-property-rebate.jpg

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

https://data.templateroller.com/pdf_docs_html/1869/18693/1869358/page_2_thumb_950.png

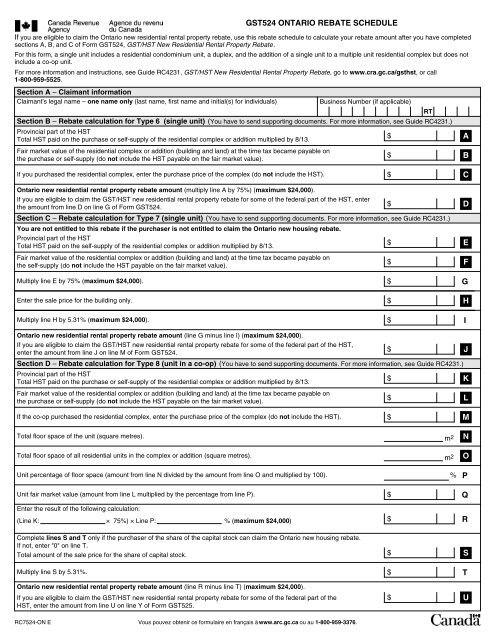

Web Calculating the rebate for qualifying new rental housing The Ontario new residential rental property rebate is equal to 75 of the provincial part of the HST paid on the purchase Web The GST HST new housing rebate allows an individual to recover some of the GST or the federal part of the HST paid for a new or substantially renovated house that is for use as

Web Get up to 30 000 HST Rebate The official program name is GST HST New Residential Rental Property Rebate If you ve purchased a new home or condo and you plan to live Web 2 mars 2022 nbsp 0183 32 To help partially offset the GST HST cost related to new housing landlords that use new housing to generate long term residential rent may be eligible for the

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

https://www.propertyrebate.net/wp-content/uploads/2022/10/form-gst190-download-fillable-pdf-or-fill-online-gst-hst-new-housing-14.png

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

https://data.templateroller.com/pdf_docs_html/1869/18693/1869358/form-gst524-gst-hst-new-residential-rental-property-rebate-application-canada_print_big.png

https://www.canada.ca/en/revenue-agency/services/forms-publications/...

Web Which rental properties qualify for the GST HST new residential rental property rebate You generally pay the goods and services tax harmonized sales tax GST HST when

https://www.canada.ca/en/revenue-agency/services/forms-publications...

Web Definitions Important terms Determining if you are a builder for GST HST purposes Determining what is considered a house for purposes of the new housing rebate Primary

HST Rebate The New Residential Rental Property Rebate

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

Top 5 Questions About The GST HST Housing Rebate PropertyRebate

New Condo HST Rebates Sproule Associates

GST HST New Residential Rental Property Rebate

The GST HST NRRP Rebate For Residential Rental Property

The GST HST NRRP Rebate For Residential Rental Property

HST New Rental Property Rebate Program HST Rebate For Landlords

HOW TO QUALIFY FOR GST HST NEW HOUSING REBATE On RENTAL PROPERTIES

Gst hst Rebate Other Property And Services PropertyRebate

Hst Rebate Rental Property - Web Property owners who purchased a newly developed home or condominium are eligible to receive up to 24 000 in GST HST rebate In order to be eligible for this GST HST