Hst Tax Rebate Bc Web If the CRA determines that you are eligible for the GST HST credit based on your 2022 tax return and that you will receive payments you will receive a GST HST credit notice in July 2023 It will show how much you will get and what information was used to calculate the

Web GST HST Find out if you are eligible for a GST HST rebate for eligible goods other than specified motor vehicles for eligible specified motor vehicles for other HST rebate how to apply for the GST HST rebate when to file the GST HST rebate application what Web Go to GST HST credit income levels and the GST HST credit payments chart to find out if you are entitled to receive the GST HST credit for the 2022 base year You can also use the child and family benefits calculator to get an estimate of your GST HST credit What can

Hst Tax Rebate Bc

Hst Tax Rebate Bc

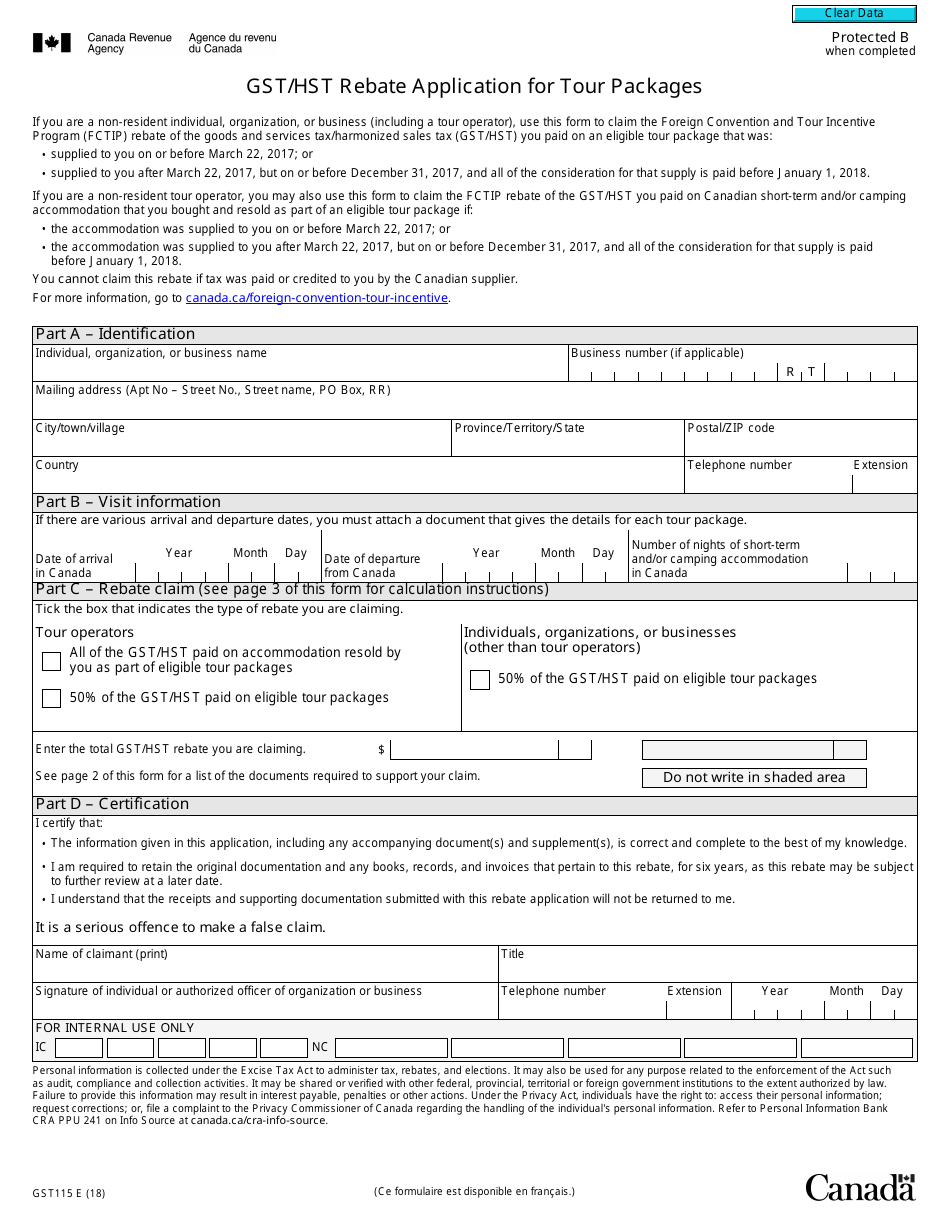

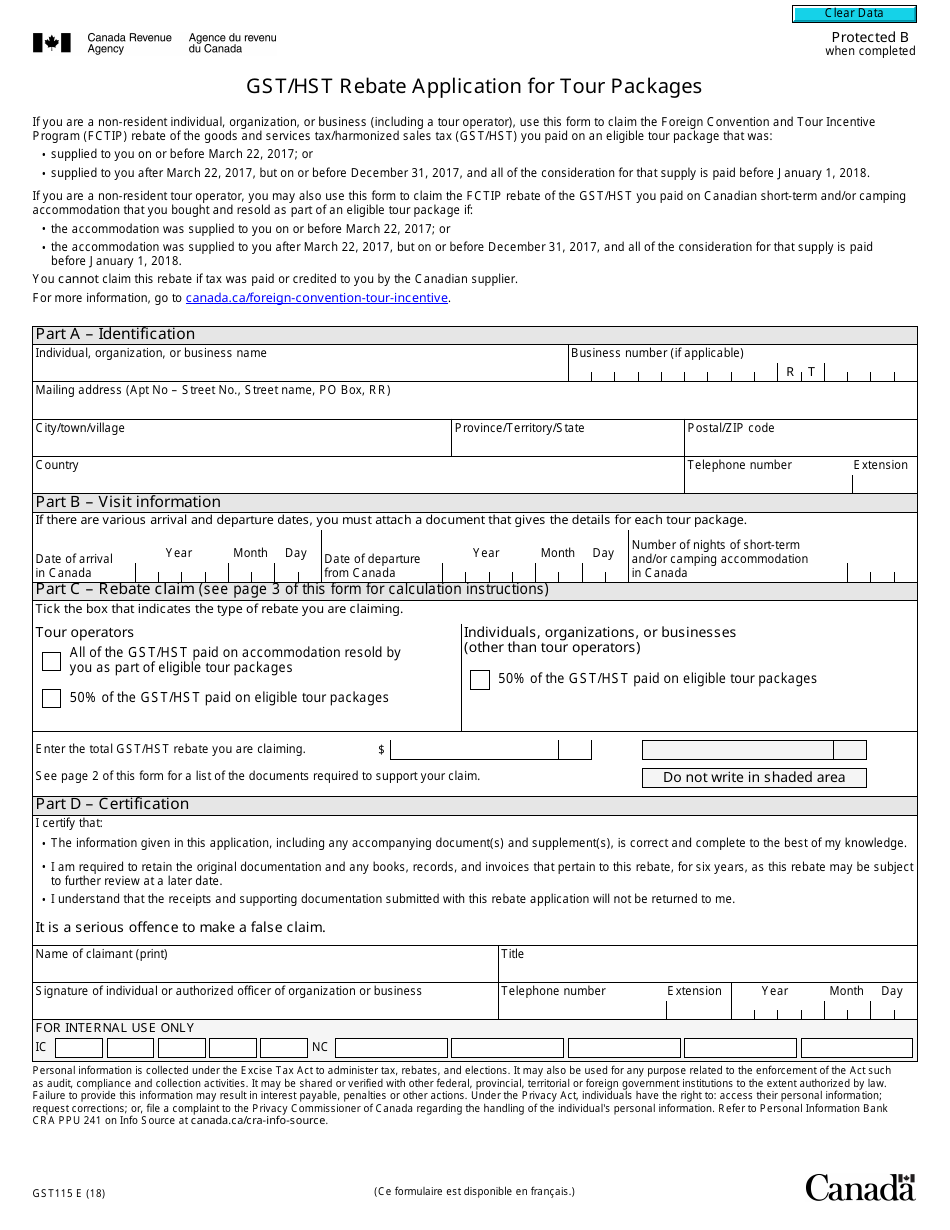

https://data.templateroller.com/pdf_docs_html/1869/18694/1869445/form-gst115-gst-hst-rebate-application-for-tour-packages-canada_print_big.png

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2022/10/form-gst524-download-fillable-pdf-or-fill-online-gst-hst-new-95.png?resize=768%2C994&ssl=1

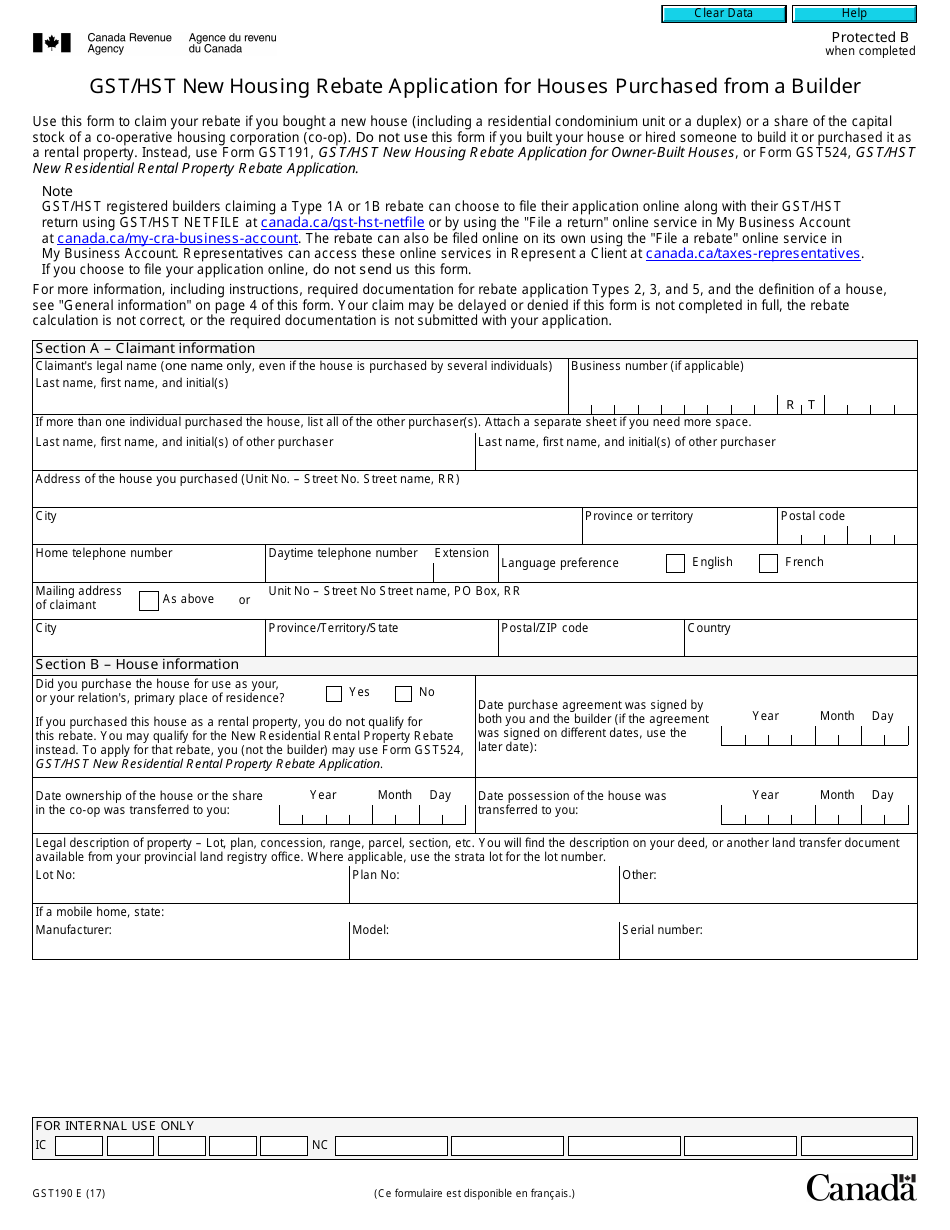

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

https://data.templateroller.com/pdf_docs_html/1867/18672/1867279/form-gst190-gst-hst-new-housing-rebate-application-for-houses-purchased-from-a-builder-canada_print_big.png

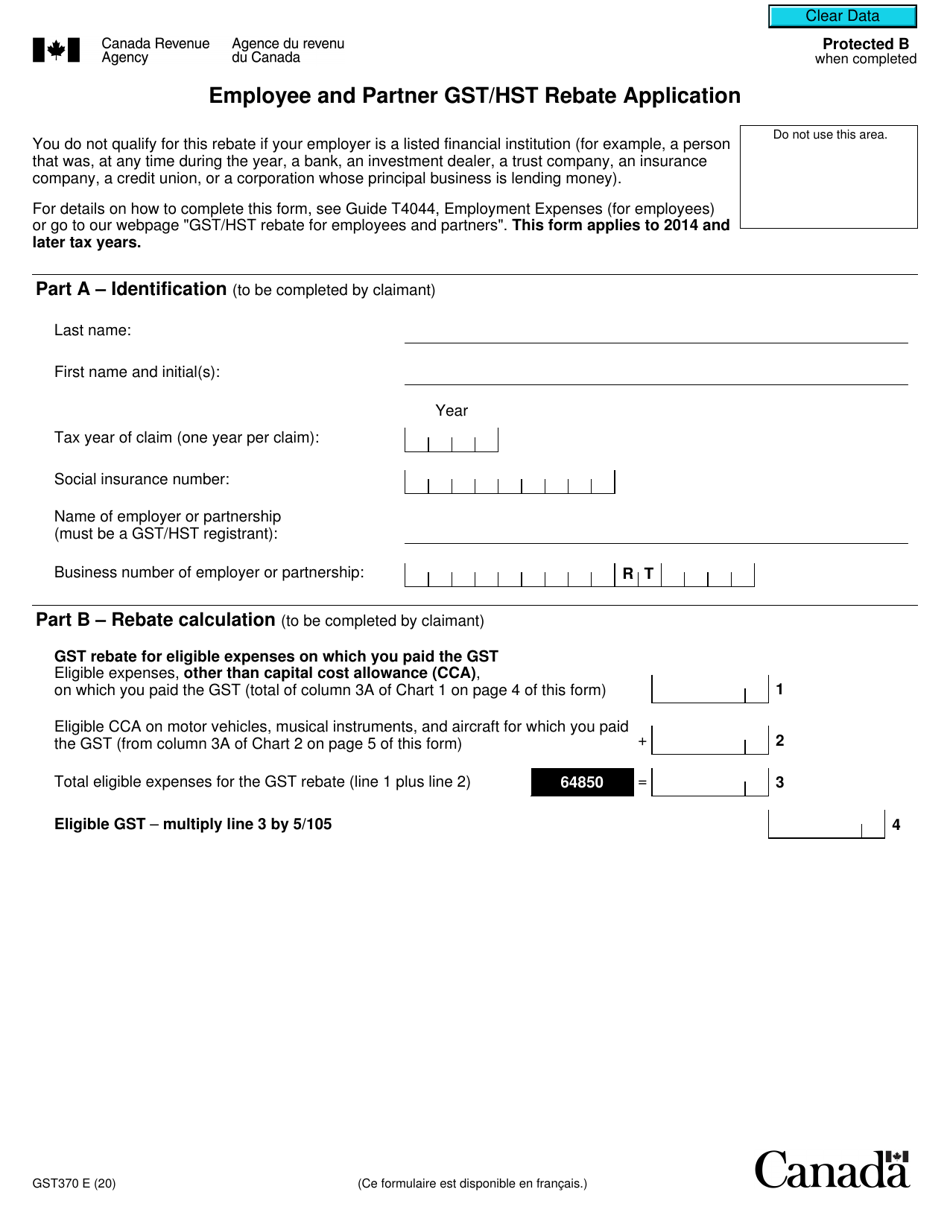

Web As an employee you may qualify for a GST HST rebate if all of the following conditions apply you paid GST or HST on certain employment related expenses and deducted those expenses on your income tax and benefit return your employer is a GST HST registrant Web Overview The goods and services tax harmonized sales tax GST HST credit is a tax free quarterly payment that helps individuals and families with low and modest incomes offset the GST or HST that they pay It may also include payments from provincial and territorial

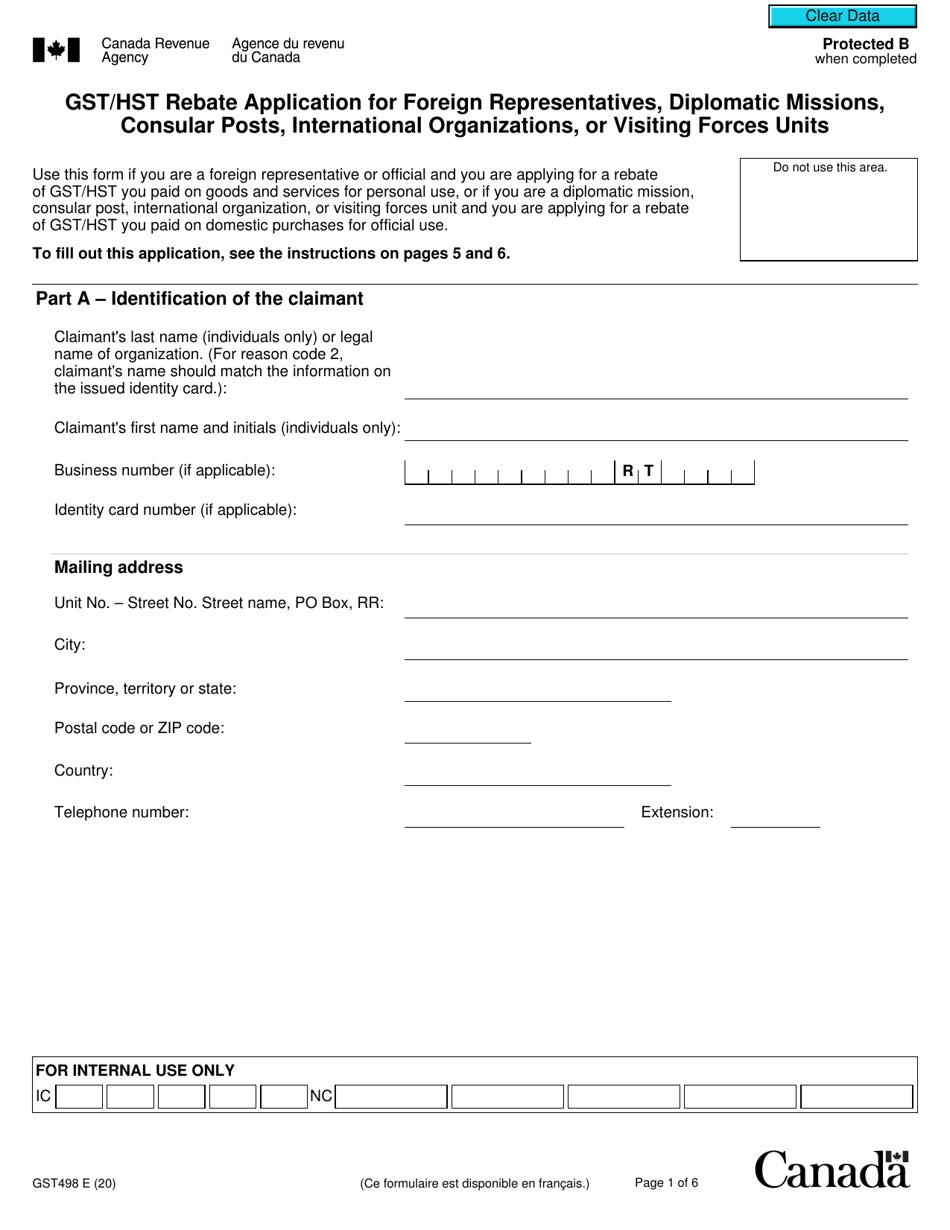

Web The Canada Revenue Agency usually send the GST HST credit payments on the fifth day of July October January and April If you do not receive your GST HST credit payment on the expected payment date please wait 10 working days before you contact us Web If you are eligible you can claim a GST HST rebate for foreign representatives diplomatic missions consular posts international organizations or visiting forces units This is a rebate of the GST HST you paid on goods and services that you bought in Canada

Download Hst Tax Rebate Bc

More picture related to Hst Tax Rebate Bc

Form GST498 Download Fillable PDF Or Fill Online Gst Hst Rebate

https://data.templateroller.com/pdf_docs_html/2169/21690/2169085/form-gst498-gst-hst-rebate-application-for-foreign-representatives-diplomatic-missions-consular-posts-international-organizations-or-visiting-forces-units-canada_print_big.png

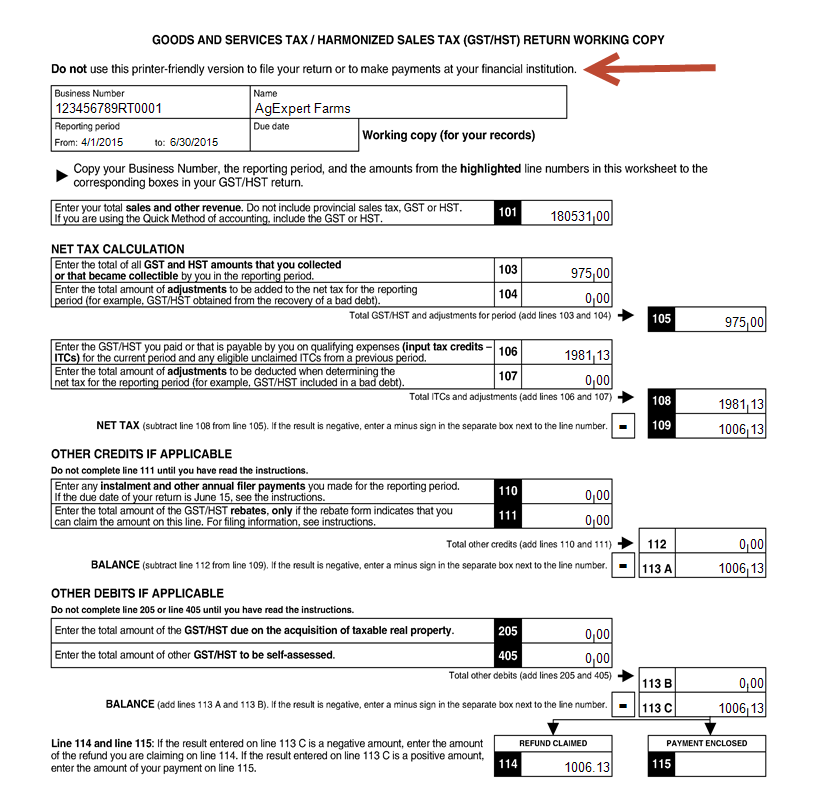

What s New FCC AgExpert Community

http://community.fccsoftware.ca/storage/GST 2 new EN.png?__SQUARESPACE_CACHEVERSION=1446229503474

Is There Hst On Property Tax Property Walls

https://www.djb.com/wp-content/uploads/2016/06/Form-34.gif

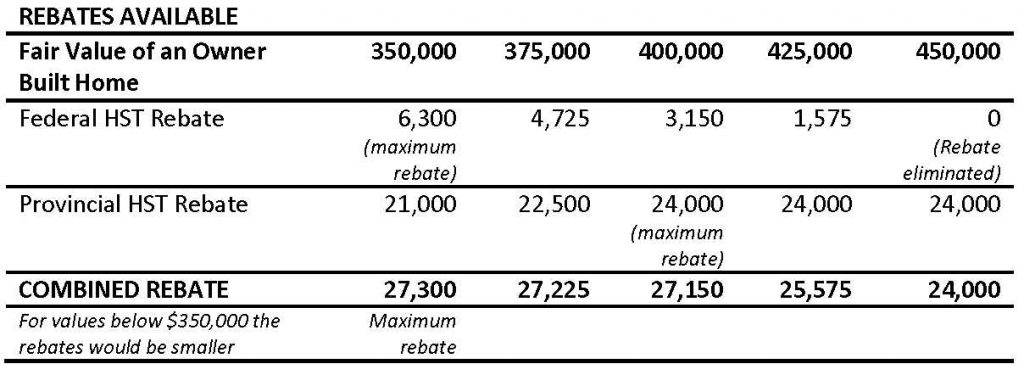

Web 30 juin 2021 nbsp 0183 32 To file your rebate application fill out Form GST66 Application for GST HST Public Services Bodies Rebate and GST Self Government Refund to claim the GST or federal part of the HST and if applicable Form RC7066 SCH Provincial Schedule Web It is estimated that the HST will remove about 1 9 billion in sales tax from business inputs and result in about 150 million in administrative savings annually for B C businesses We will guide you throughout the process of your transition Tax in Real Estate

Web The GST HST new housing rebate allows an individual to recover some of the GST or the federal part of the HST paid for a new or substantially renovated house that is for use as the individual s or their relation s primary place of residence when all of the other Web Part B Rebate calculation Calculate your rebate based on the expenses you deducted on your income tax and benefit return These expenses include GST and PST or HST and tips if the supplier included the tip in your bill For eligible expenses on which you paid GST

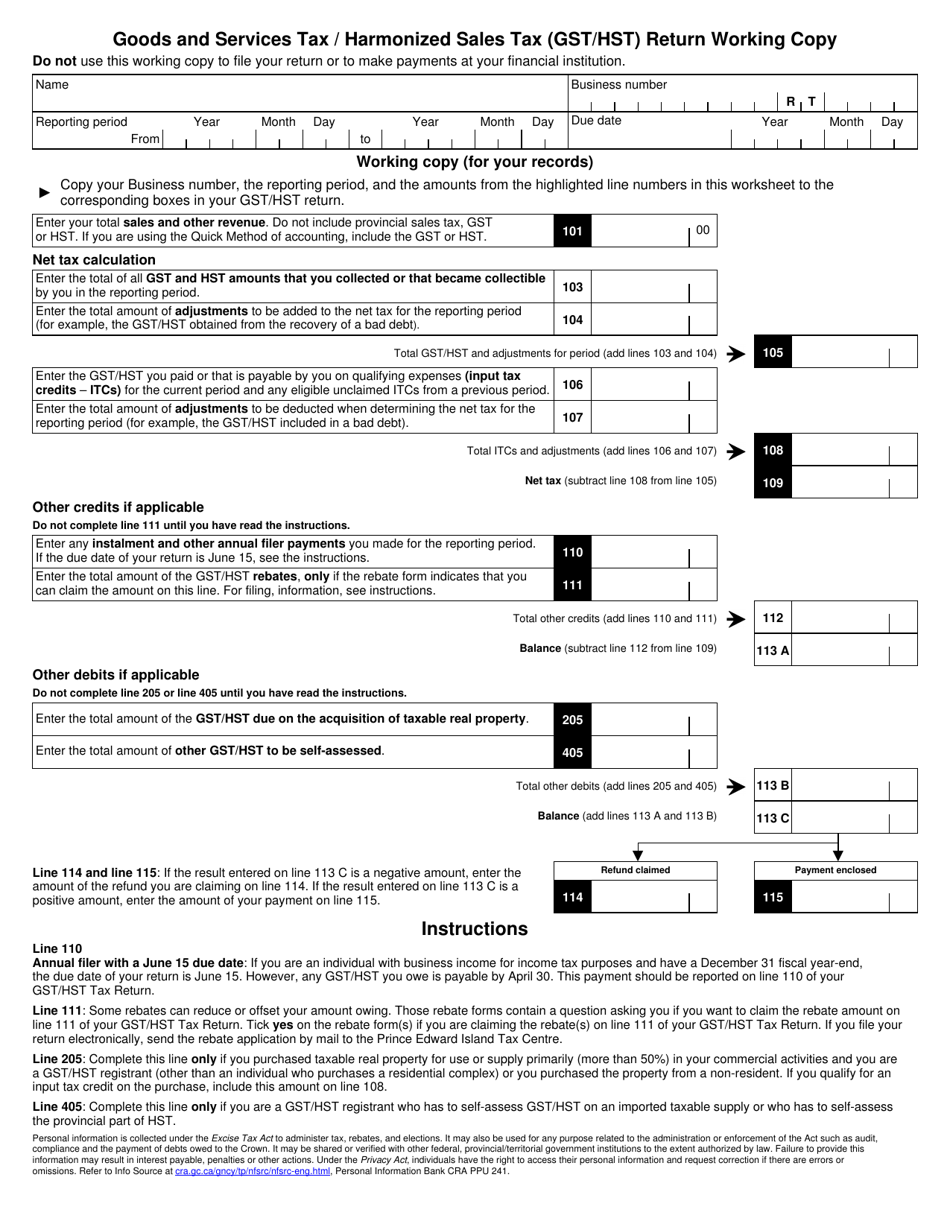

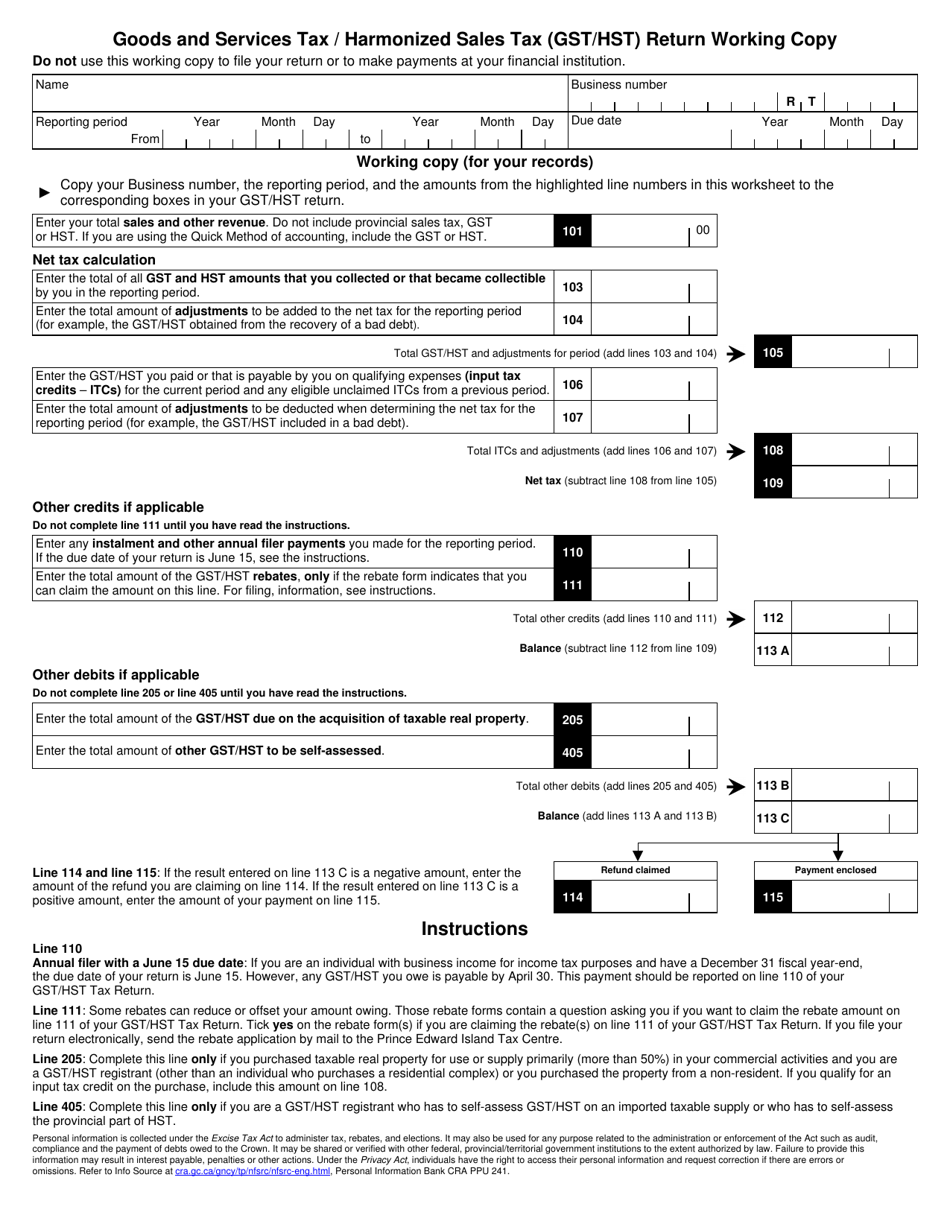

Fillable Hst Form Printable Form Templates And Letter

https://data.templateroller.com/pdf_docs_html/2108/21087/2108767/goods-and-services-tax-harmonized-sales-tax-gst-hst-return-working-copy-canada_print_big.png

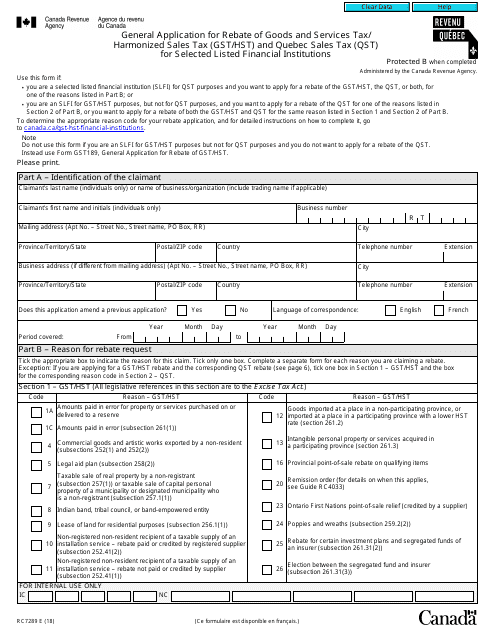

Form RC7289 Download Fillable PDF Or Fill Online General Application

https://data.templateroller.com/pdf_docs_html/1868/18689/1868988/form-rc7289-general-application-for-rebate-of-goods-and-services-tax-harmonized-sales-tax-gst-hst-and-quebec-sales-tax-qst-for-selected-listed-financial-institutions-canada_big.png

https://www.canada.ca/.../publications/rc4210/gst-hst-credit.html

Web If the CRA determines that you are eligible for the GST HST credit based on your 2022 tax return and that you will receive payments you will receive a GST HST credit notice in July 2023 It will show how much you will get and what information was used to calculate the

https://www.canada.ca/.../gst-hst-rebates/provincial-part-hst.html

Web GST HST Find out if you are eligible for a GST HST rebate for eligible goods other than specified motor vehicles for eligible specified motor vehicles for other HST rebate how to apply for the GST HST rebate when to file the GST HST rebate application what

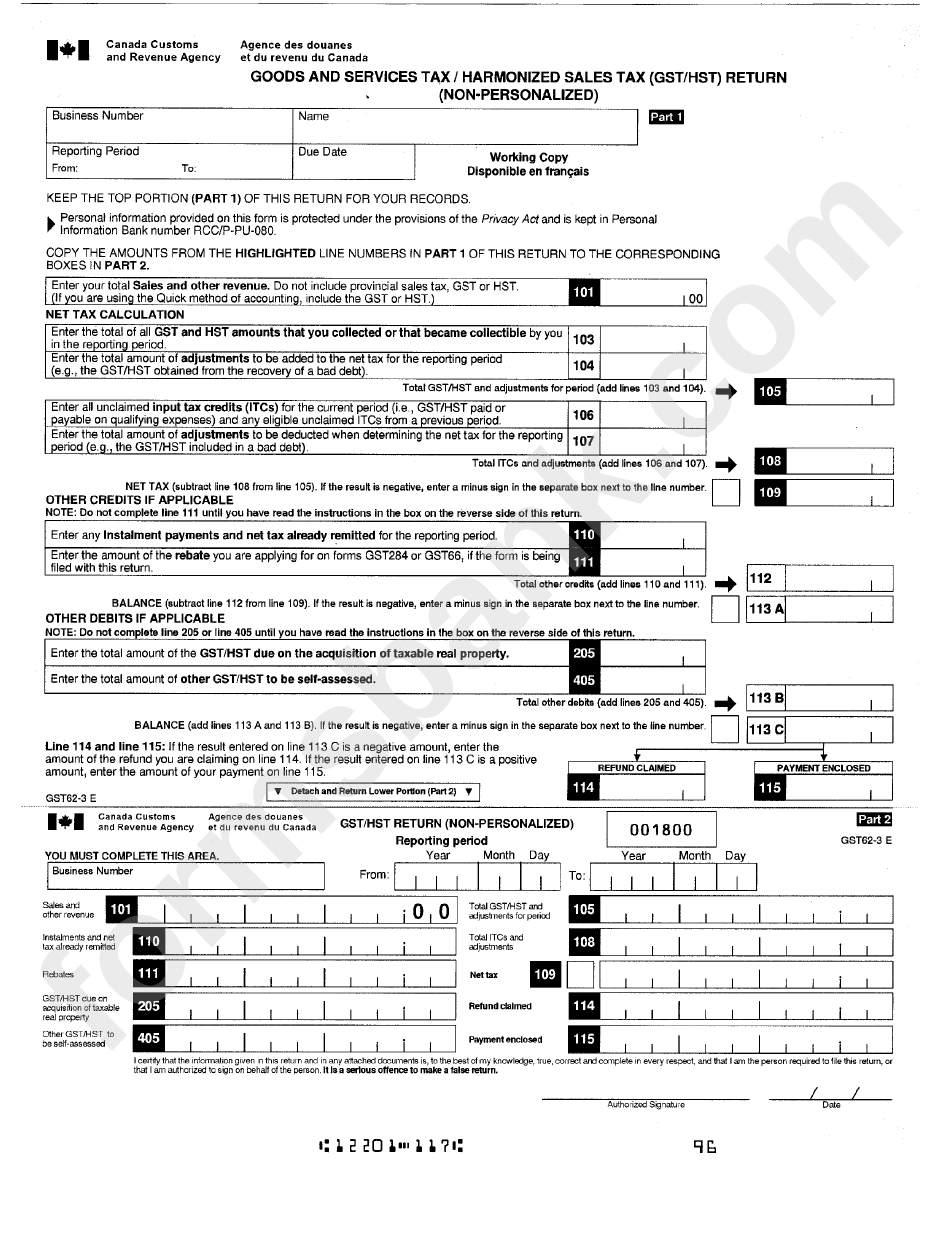

Goods And Services Tax harmonized Sales Tax Gst hst Return Non

Fillable Hst Form Printable Form Templates And Letter

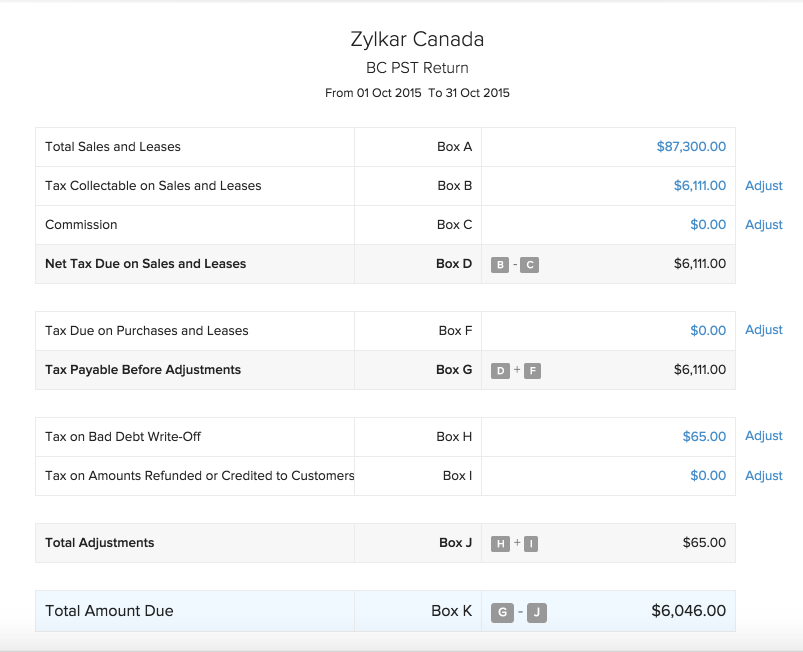

Canada GST HST Returns Help Zoho Books

Form GST370 Download Fillable PDF Or Fill Online Employee And Partner

HST New Housing Rebate Smith Sykes Leeper Tunstall LLP

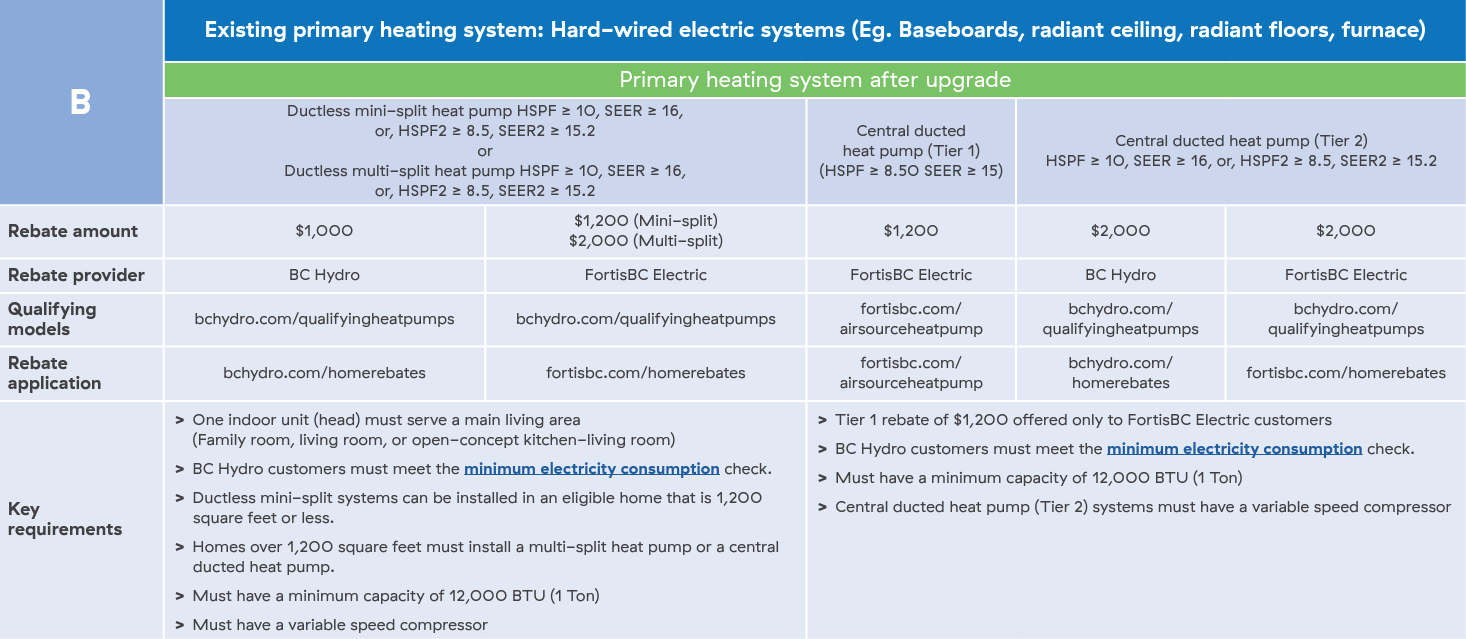

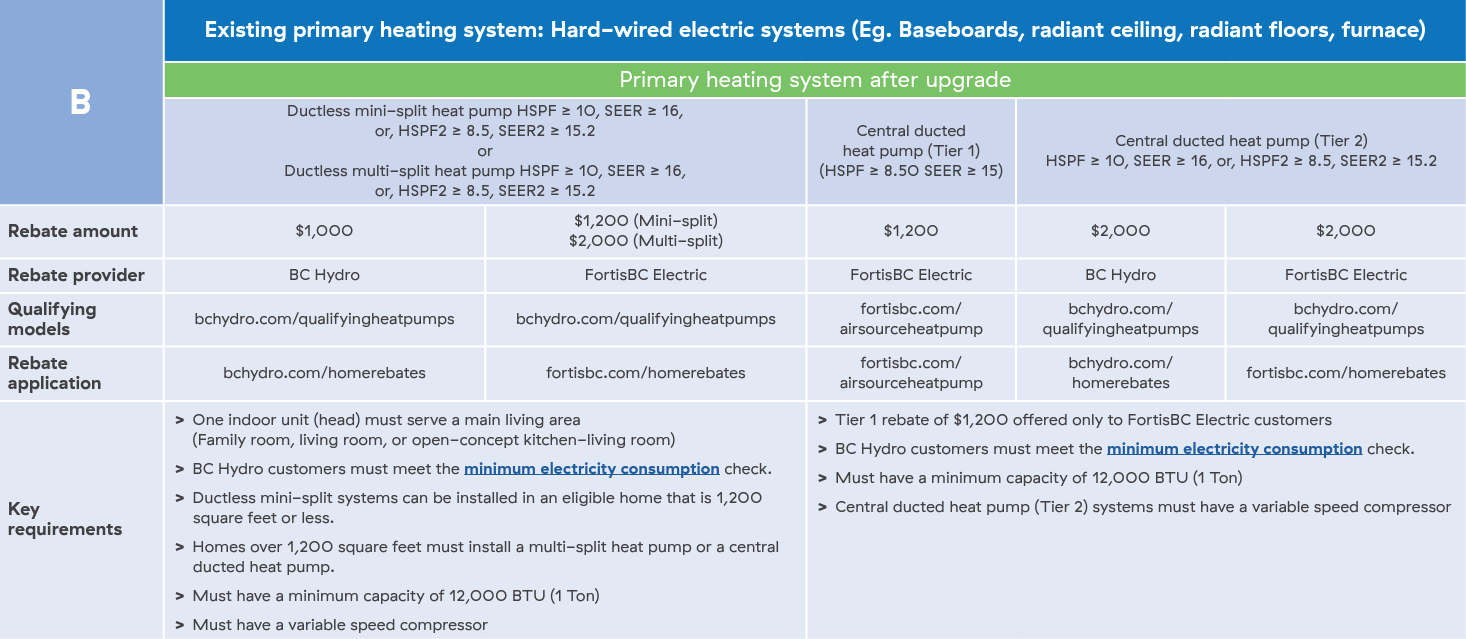

BC Heat Pump Rebates Home Heating Rebates Lockhart Industries

BC Heat Pump Rebates Home Heating Rebates Lockhart Industries

How Long Does It Take To Get Hst Housing Rebate PRORFETY

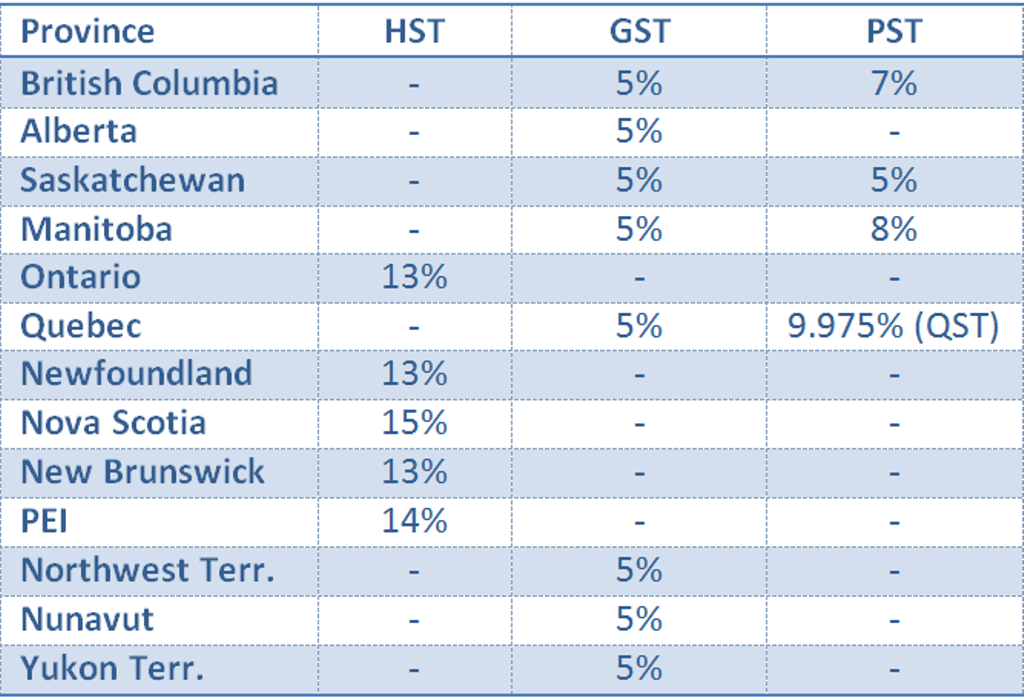

GST AND HST SALES TAX RATES BY PROVINCE IN CANADA ConnectCPA

What Does The HST Rebate Mean For Home Or Condo Purchases From A Buil

Hst Tax Rebate Bc - Web The Canada Revenue Agency usually send the GST HST credit payments on the fifth day of July October January and April If you do not receive your GST HST credit payment on the expected payment date please wait 10 working days before you contact us