Huf Tax Rebate 87a Web Income Tax rate Upto Rs 2 50 000 Nil Nil 5 20 30 5 20 30 AY 2022 23 Rs 2 50 000 Rs 5 00 000 Rs 5 00 000 Rs 10 00 000 Above Rs 10 00 000 AY 2021 22

Web 39 lignes nbsp 0183 32 A Tax Rates and Relief B Income Exempt from Tax For detailed conditions Web 10 f 233 vr 2023 nbsp 0183 32 According to the Income tax Act the rebate under section 87A is available to only resident individuals Taxpayers such as non resident individuals NRIs Hindu Undivided Family HUF and firms are

Huf Tax Rebate 87a

Huf Tax Rebate 87a

https://financialcontrol.in/wp-content/uploads/2018/06/Rebate-87A.jpg

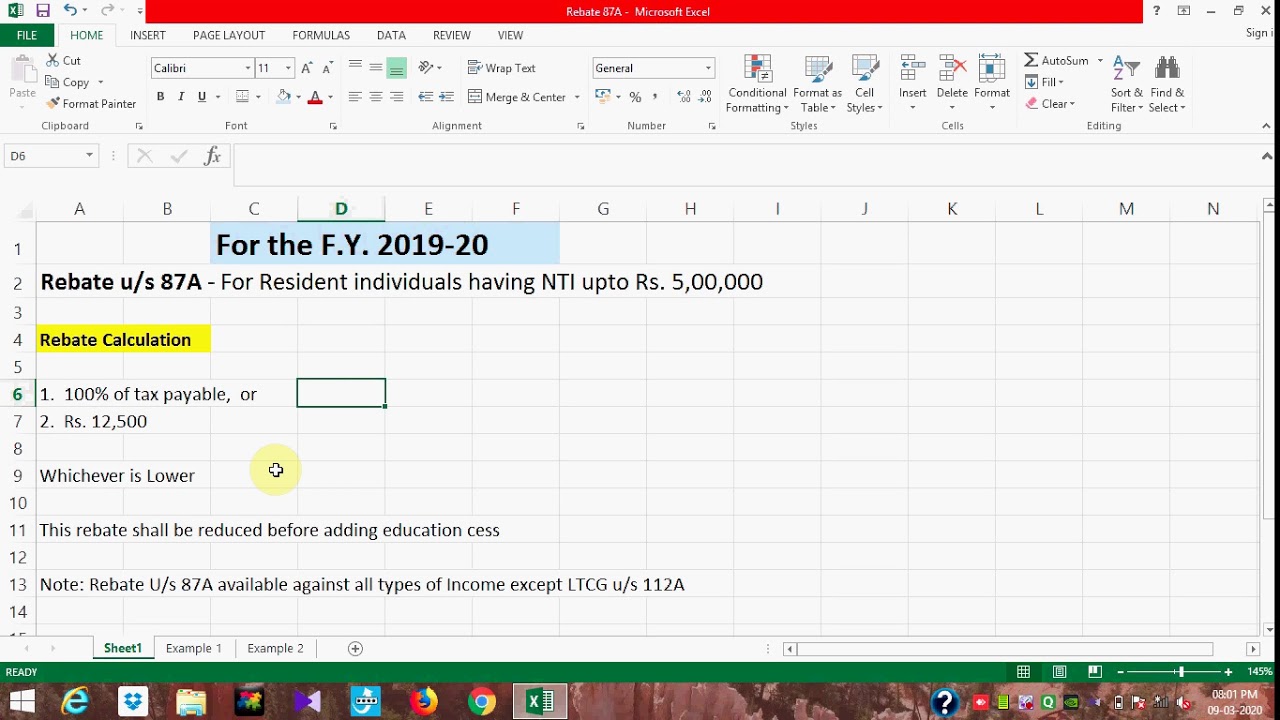

Examples Of Rebate U s 87A For A Y 2020 21 And A Y 2019 20 Fully

https://i.ytimg.com/vi/R8TJaxFoAE8/maxresdefault.jpg

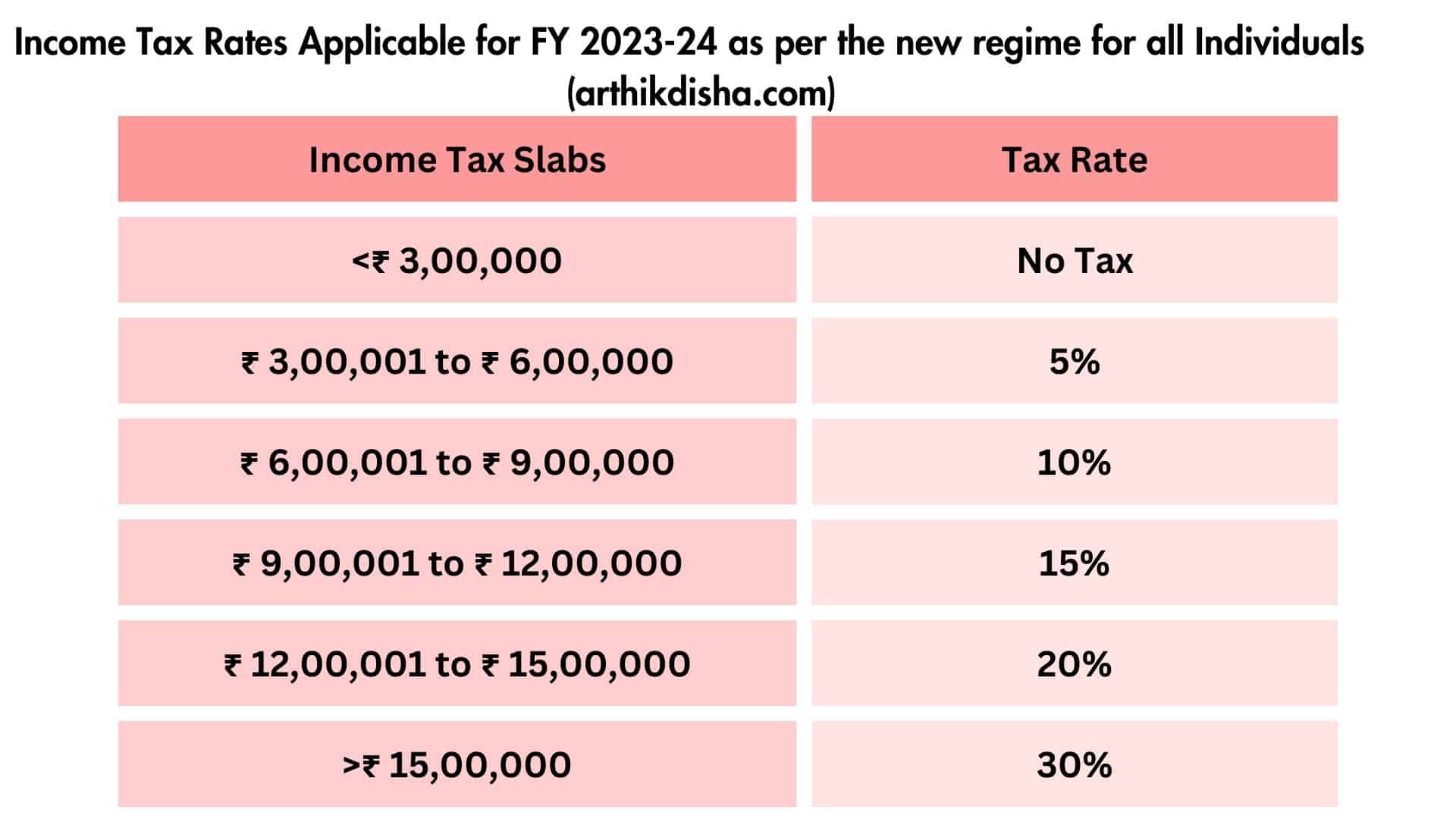

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rates-Applicable-for-FY-2023-24-as-per-the-new-regime-for-HUF-and-all-Individuals-1.jpg

Web 3 f 233 vr 2023 nbsp 0183 32 Who is eligible for tax rebate under Section 87A According to the Income tax Act the rebate under Section 87A is available to only resident individuals Taxpayers Web 3 ao 251 t 2023 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

Web Calculate the gross total income for the year Reduce the tax deductions for tax savings investments and much more Get to your total income after the reduction in tax Declare Web 11 ao 251 t 2019 nbsp 0183 32 1 As per sec 87A rebate will be available to a resident individual to the extent of Rs 2 500 or the amount of tax payable on his income provided his Total

Download Huf Tax Rebate 87a

More picture related to Huf Tax Rebate 87a

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

Rebate U s 87A YouTube

https://i.ytimg.com/vi/cAQv1ChkkWU/maxresdefault.jpg

Web 13 avr 2017 nbsp 0183 32 Section 87A is not applicable to HUF u s 87A Rs 2 000 only applicable for resident individuals whoses net taxable income does not exceed 5 00 000 not Web Rebate u s 87A Q1 Can a partnership firm or HUF claim rebate under section 87A 23 Aug 2022 17 48 28

Web 14 f 233 vr 2022 nbsp 0183 32 myITreturn Help Center FAQs Computation of Tax Can a partnership firm or HUF claim rebate under section 87A Debnath Mondal 2 years ago Updated Rebate Web 10 mars 2020 nbsp 0183 32 Step 1 Calculate the Net Gross Total Income and reduce it under Section 80C and 80U Separately Covered Step 2 Deduct the basic exemption limit from the

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/DECODING-SECTION-87A.png

REBATE U S 87A INCOME TAX ACT REBATE 87A Rebate 87A

https://i.ytimg.com/vi/mgUSJnyzCJA/maxresdefault.jpg

https://incometaxindia.gov.in/Booklets Pamphlets/e-PDF__K…

Web Income Tax rate Upto Rs 2 50 000 Nil Nil 5 20 30 5 20 30 AY 2022 23 Rs 2 50 000 Rs 5 00 000 Rs 5 00 000 Rs 10 00 000 Above Rs 10 00 000 AY 2021 22

https://incometaxindia.gov.in/Charts Tables/Benefits_available_to...

Web 39 lignes nbsp 0183 32 A Tax Rates and Relief B Income Exempt from Tax For detailed conditions

Rebate 87a 87a 87 A 87 A Rebate What Is 87 A Section 87a

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

Rebate Of Income Tax Under Section 87A YouTube

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

REBATE U s 87A Under Income Tax B Ca Cs Cma And Ignou Exams With

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

.png)

Rebate U s 87A Income Tax Rebate Under Section 87A JR Compliance Blogs

Huf Tax Rebate 87a - Web Calculate the gross total income for the year Reduce the tax deductions for tax savings investments and much more Get to your total income after the reduction in tax Declare