Hvac Rebates 2024 California There s also a 1 750 rebate for heat pump water heaters 840 cash back for induction stoves and heat pump clothes dryers and 4 000 for electrical system upgrades The federal government wants

The beauty of these heat pump incentives in California is that you can combine the rebates and tax credits Install a heat pump and potentially r educe your energy bills by up to 50 Claim the federal tax credit for 30 of the installation cost up to 2 000 Receive additional rebates from your local utility like SMUD s 3 500 offer South Coast AQMD is developing a program to help residents replace existing space and water heating equipment with zero emission units Expecting program to launch in the second half of 2024 Incentive program will be funded by Rule 1111 and Rule 1121 mitigation fees 75 percent of the funding will be allocated for overburdened communities

Hvac Rebates 2024 California

Hvac Rebates 2024 California

https://www.ernstheating.com/wp-content/uploads/2020/10/hvac-rebates-1024x683.jpg

HVAC Rebates Available In 2021 Indoor Air Quality Inc

https://iaqcolorado.com/wp-content/uploads/2021/06/2021-hvac-rebates-768x512.jpg

Tri Cities HVAC Rebates To Take Advantage Of Before The Summer

https://apolloheatingandair.com/wp-content/uploads/2022/08/carrier-experts-hvac-rebates.jpg

The Inflation Reduction Act of 2022 set aside more than 4 billion in federal funding for two new home energy efficiency rebate programs that will be administered by each state California is expected to receive more than 580 million to fund these two programs Income dependent rebates of up to 8 000 earmarked in the Inflation Reduction Act are slated to become available in California beginning in summer 2024 Many utility companies in California offer rebates for heat pumps ranging from 100 to 3 000 Use the incentive finder tool at The Switch Is On to figure out what s available in your zip code

2024 Rebates for Heating and Cooling Equipment These rates apply to equipment installed January 1 2024 through May 31 2024 Applications must be submitted within 60 days of installation and no later than June 30 2024 Rebates are subject to change Check focusonenergy for current rebate amounts 2024 Application Download the 2024 mail in form PDF for measures purchased and installed January 1 2024 December 31 2024 Applications must be postmarked no later than December 31 2024 to be eligible for the rebate Rebate amounts are subject to change and may be modified without prior notice Please be sure the email address you provide on your application is accurate

Download Hvac Rebates 2024 California

More picture related to Hvac Rebates 2024 California

Guide To HVAC Rebates In 2023

https://www.myczi.com/img/corporate/images/HVACRebates-19-LNX_UCS_FAM_THERM_IAQ_AC_FURN-945x532-12333.jpeg?t=1669154152

Current HVAC Rebates Air Conditioning Myrtle Beach Heating Residential Commercial HVAC

https://www.tricountymechanicalinc.com/wp-content/uploads/2021/02/Hvac-Rebates.jpeg

HVAC Rebates Carrier Cool Cash Rebate Allison Air Conditioning

https://www.allisonhvac.com/wp-content/uploads/2020/07/2020-Fall-Carrier-Cool-Cash.jpg

Today s Homeowner Tips To qualify for the maximum credit you must have your upgrades installed by 2032 Beginning in 2033 the maximum percentage of your installation cost you can deduct is 26 which drops to 22 in 2034 Beyond 2034 the credit expires you cannot claim any percentage credit for new installations 2024 BUSINESS REBATE GUIDE INTRODUCTION The Energy Efficiency Rebates for Business EERB Ventilating and Air Conditioning HVAC system performs and how much it costs to operate depends in part on the proper installation of California Energy Wise website is qualified for the EERB program

2024 Government Rebates for HVAC Replacements The terms and conditions of government rebates or grants can differ depending on the time of year location and other variables Modernize recommends checking with the Database of State Incentives for Renewables Efficiency to see if you re eligible before applying or hiring a contractor Starting in 2023 homeowners will be able to claim a 30 tax credit with annual limits that vary by service on qualifying energy efficiency home improvements including Heat pumps and mini splits Heat pump water heaters Energy audits Energy efficient windows and doors Insulation and air sealing Electrical panel upgrades

Austin HVAC Rebates McCullough Heating Air Conditioning

http://coolmenow.com/wp-content/uploads/2021/06/JBEN268-Hexagons-Revised-v22.png

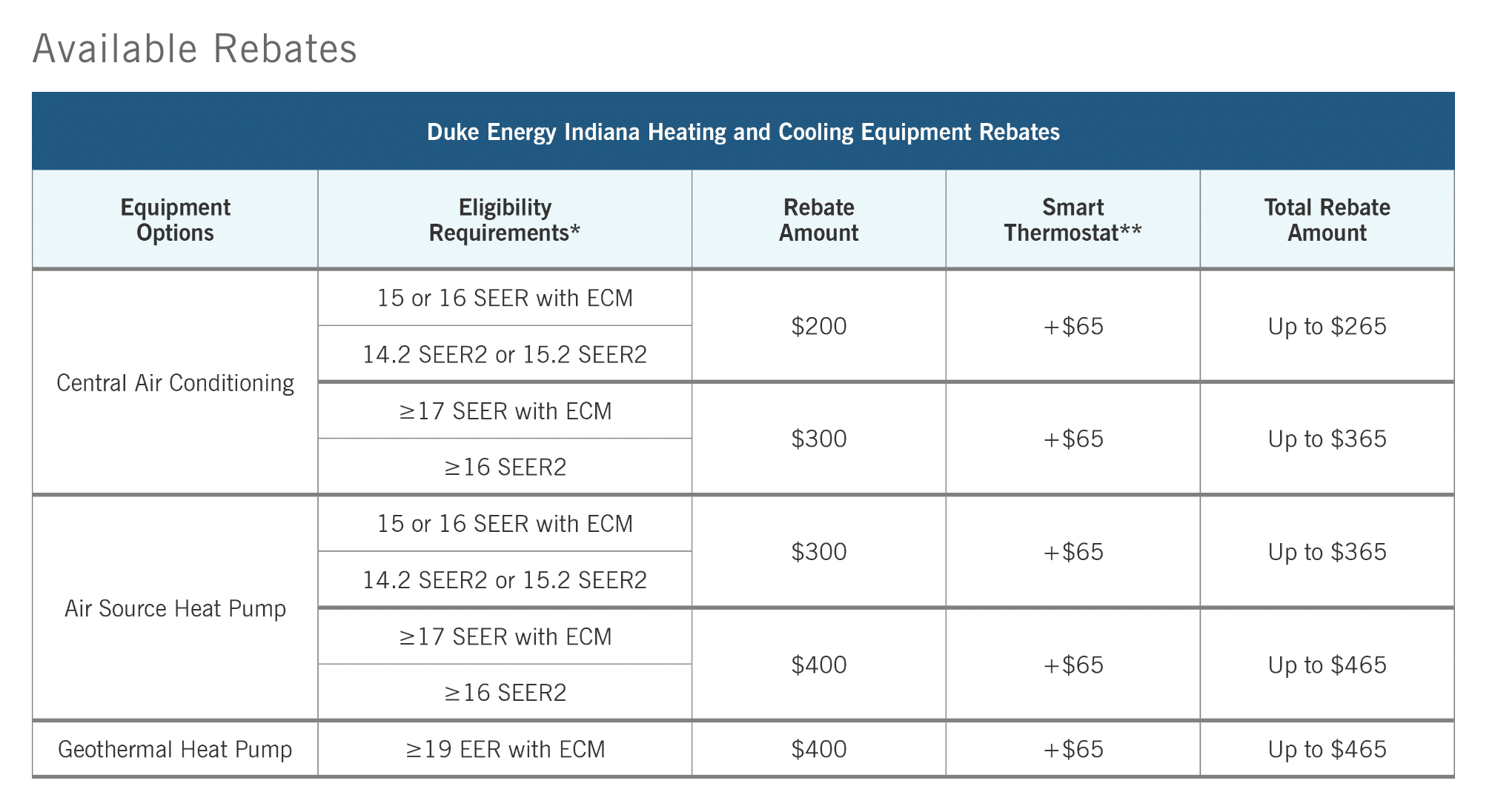

Indiana HVAC Utility Rebates For 2023 HVAC Indiana

https://trusthomesense.com/wp-content/uploads/2023/07/Duke-HVAC-Rebates-2023-Homesense.png

https://www.latimes.com/business/story/2023-01-27/looking-for-inflation-reduction-act-rebates-to-go-green-get-ready-to-wait

There s also a 1 750 rebate for heat pump water heaters 840 cash back for induction stoves and heat pump clothes dryers and 4 000 for electrical system upgrades The federal government wants

https://alphamechanicals.com/blog/heat-pump-rebates-california/

The beauty of these heat pump incentives in California is that you can combine the rebates and tax credits Install a heat pump and potentially r educe your energy bills by up to 50 Claim the federal tax credit for 30 of the installation cost up to 2 000 Receive additional rebates from your local utility like SMUD s 3 500 offer

HVAC Rebates For You Now 24 7 Furnace AC Tankless Attic Insulation GTA Rebates Repairs

Austin HVAC Rebates McCullough Heating Air Conditioning

Why Carrier Cool Cash Is The Best 2023 HVAC Rebate Apollo

Heat Pump Rebates In California Incentives For HVAC Upgrades Aire Tech AC Heating

Taking Advantage Of HVAC Rebates Federal Tax Credits With An Efficient HVAC System In Dallas

Guide To 2023 HVAC Rebates In California Simpson Sheet Metal Heating Air Conditioning

Guide To 2023 HVAC Rebates In California Simpson Sheet Metal Heating Air Conditioning

2023 Rebates And Tax Credits For HVAC Upgrades Alsip IL

Are Rebates Available With A Newer HVAC System Pasterkamp For Denver HVAC Services

HVAC System Rebates Incentives A Guide To Saving Money

Hvac Rebates 2024 California - Income dependent rebates of up to 8 000 earmarked in the Inflation Reduction Act are slated to become available in California beginning in summer 2024 Many utility companies in California offer rebates for heat pumps ranging from 100 to 3 000 Use the incentive finder tool at The Switch Is On to figure out what s available in your zip code