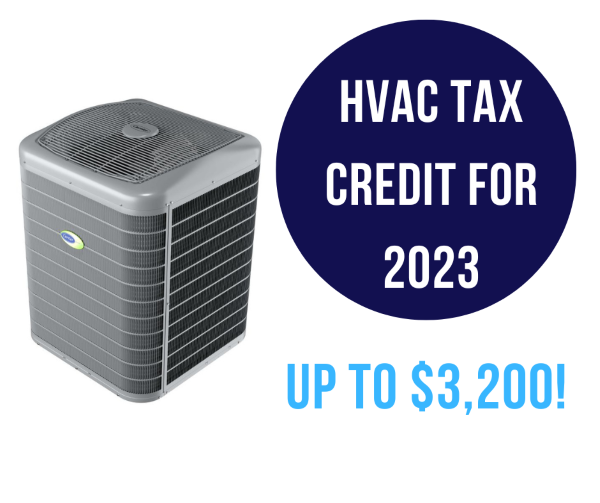

Hvac Tax Credit 2022 Form The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system

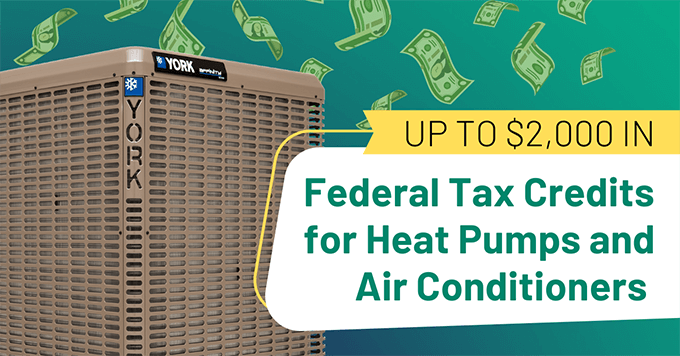

A credit limit for residential energy property costs for 2022 of 50 for any advanced main air circulating fan 150 for any qualified natural gas propane or oil furnace or hot water Central Air Conditioners Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal

Hvac Tax Credit 2022 Form

Hvac Tax Credit 2022 Form

https://media.valuethemarkets.com/img/Whatisataxcredit__685660f27b96fbc6e0edb67eb5c59039.jpg

Georgia And Federal Tax Credits For HVAC 2023 Reliable Heating Air

https://octanecdn.com/reliableairnew/reliableairnew_782044049.png

SSC CGL Online Form 2022 Kaise Bhare How To Fill SSC CGL 2022 Form

https://i.ytimg.com/vi/x9HAieh_Dfo/maxresdefault.jpg

Under the Consolidated Appropriations Act of 2021 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step The credit rate for property placed in service in 2022 through 2033 is 30 See here for more information To generate the Energy efficient home improvement credit starting in

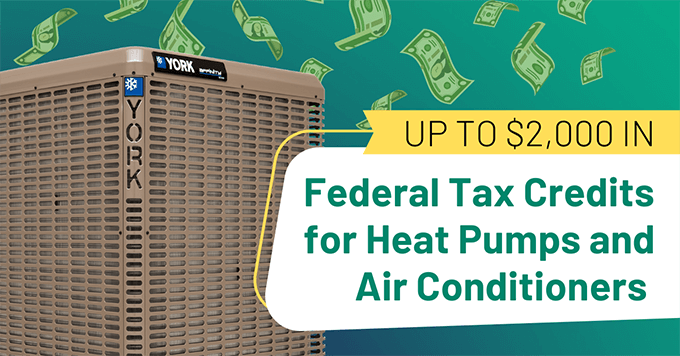

Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air

Download Hvac Tax Credit 2022 Form

More picture related to Hvac Tax Credit 2022 Form

SAVE BIG With HVAC Tax Credits Sun Heating Cooling Inc

https://www.sunheating.com/media/hvac-tax-credits.jpg

Pakistan Reinsurance Company Limited PRCL Jobs 2022 Form Download

https://jobsbox.pk/wp-content/uploads/2022/02/Pakistan-Reinsurance-Company-Limited-PRCL-Jobs-2022-Form-Download.jpg

2022 DIO Implant LA Open LPGA Ladies Professional Golf Association

https://www.lpga.com/-/media/images/lpga/tournaments/la-open/2022/rd4/hataokan_1393446614_2000x1125.jpg?w=154

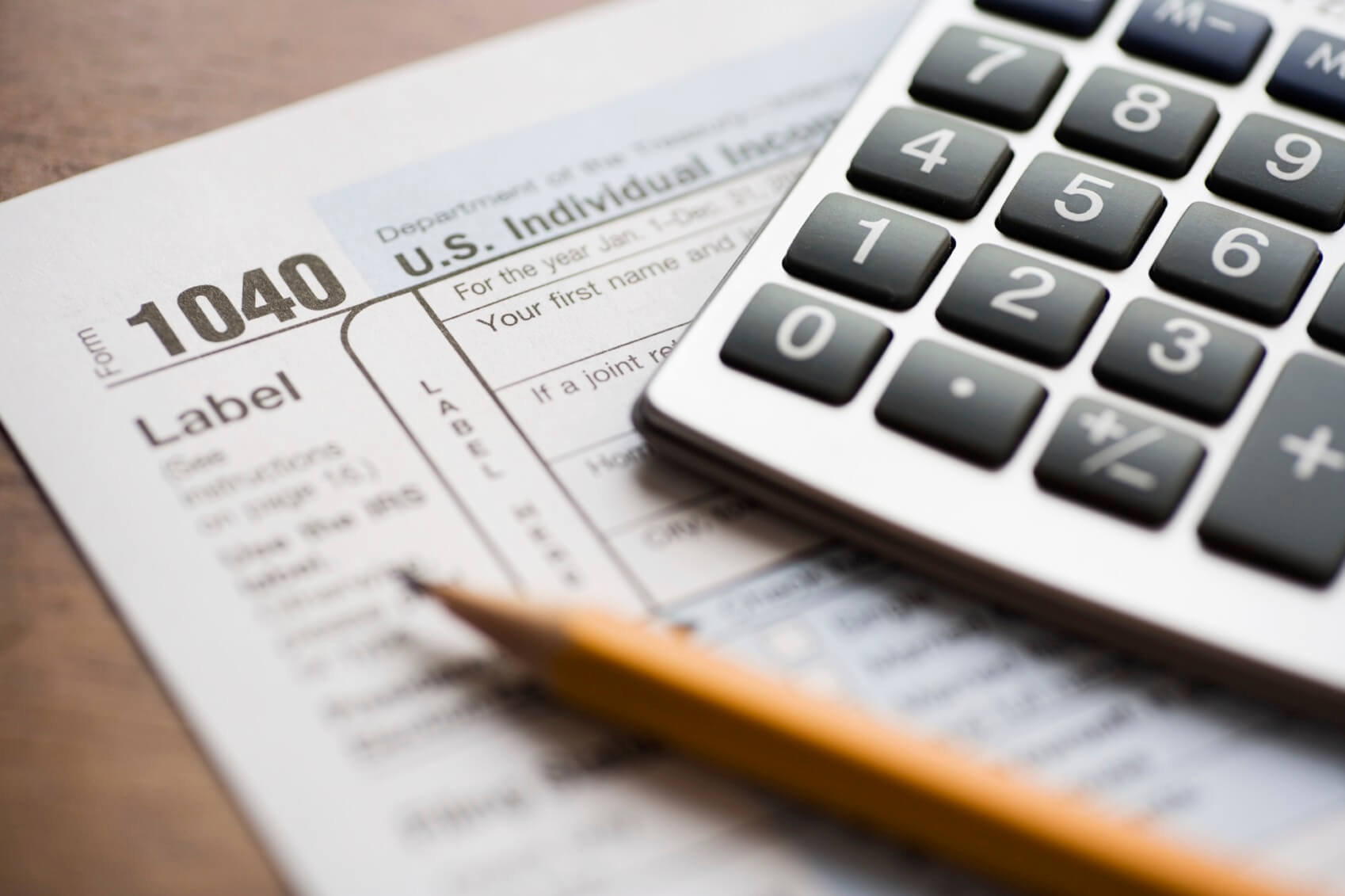

To claim a federal tax credit for energy efficient HVAC systems you ll need to file an IRS Form 5695 You submit this form with the rest of your annual income tax returns If you Two types of credits are reported on Form 5695 Residential Clean Energy Credit 5695 screen Part I tab Energy Efficient Home Improvement Credit 5695 screen Part II

The Energy Efficient Home Improvement Tax Credit 25C provides a federal tax credit to homeowners who install high efficiency equipment this includes HVAC equipment The OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE

Federal Tax Credits For Air Conditioners Heat Pumps 2023

https://kobiecomplete.com/wp-content/uploads/2023/01/federal-tax-credits-2023-graphic-white-web.png

What Is The ERC Tax Credit 2022 Updated For 2023 Qualifications For

https://i.ytimg.com/vi/p5Q7tlyoXzE/maxresdefault.jpg

https:// todayshomeowner.com /hvac/guides/hvac-tax-credit

The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system

https://www. taxact.com /support/797/2022

A credit limit for residential energy property costs for 2022 of 50 for any advanced main air circulating fan 150 for any qualified natural gas propane or oil furnace or hot water

HVAC Tax Credits 2018 2019 Magic Touch Mechanical

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Commercial HVAC Tax Changes In Section 179 For Business Owners Energy

2022 Inflation Reduction Act News And Events For Air Inc Heating And

Carrier HVAC Federal Tax Credits And Rebates

What HVAC Tax Credit Is Available When Filing This Year

What HVAC Tax Credit Is Available When Filing This Year

What HVAC Systems Qualify For Tax Credits In 2021 Commons credit

HVAC Tax Credit For Jackson TN Residents 2023 Cagle Service Heating

HVAC Tax Credits Incentives For Energy Efficient HVACs

Hvac Tax Credit 2022 Form - For qualified HVAC improvements installed prior to Dec 31 2022 homeowners may be able to claim 25C tax credit equal to 10 percent of the installed costs up to 500