Hvac Tax Credit Inflation Reduction Act Learn how you may qualify for rebates or tax credits on your HVAC installation thanks to the Inflation Reduction Act IRA

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022

Hvac Tax Credit Inflation Reduction Act

Hvac Tax Credit Inflation Reduction Act

https://unisonenergy.com/wp-content/uploads/2023/03/Deadlines-for-the-Inflation-Reduction-Act.jpg

Inflation Reduction Act Of 2022 The Hollander Group

https://static.twentyoverten.com/60dcacac52410e1095fd898c/TPPpgK25c7/Inflation-Reduction-Act-of-2022-pic.jpg

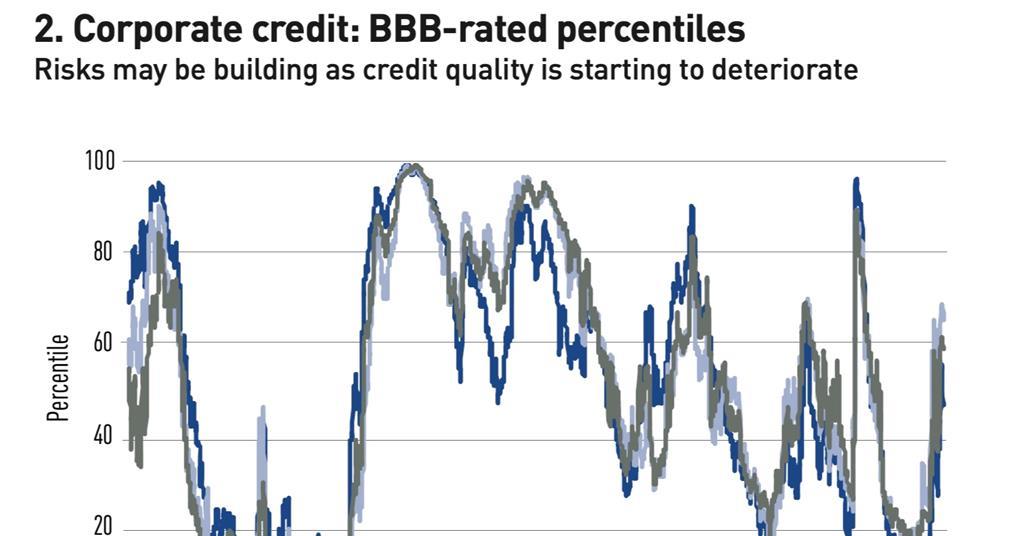

Credit Inflation And The Bond Markets Asset Class Reports IPE

https://d3ese01zxankcs.cloudfront.net/Pictures/1024x536/0/0/2/127002_bloombergboamerrilllynchglobalcorporateindexasat20.5.2022_698797_crop.jpg

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements The inflation Reduction Act IRA includes tax credits that reward homeowners for purchasing qualifying high efficiency HVAC systems including

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate

Download Hvac Tax Credit Inflation Reduction Act

More picture related to Hvac Tax Credit Inflation Reduction Act

The Inflation Reduction Act pumps Up Heat Pumps Hvac

https://www.hvac.com/wp-content/uploads/2022/09/heat-pump-rebates-2023.png

Inflation Reduction Act Explained Save Big On HVAC Systems

https://s3.us-east-1.amazonaws.com/uniqueheatingandcooling/inflation-reduction-act-chart.png

Inflation Reduction Act Summary What It Means For New HVAC Systems

https://www.ecicomfort.com/hubfs/IRA Heat Pump Rebates %26 Tax Credits-png.png

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses

Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act of 2022 IRA amended the credits for energy efficient The Inflation Reduction Act of 2022 features tax credits for consumers and businesses that save money on energy bills create jobs make homes and buildings

Carrier HVAC Federal Tax Credits And Rebates

https://www.pineapplemoney.com/img/Carrier-Tax-Credit.jpg#header-image

Will The Inflation Reduction Act Raise Your Taxes Flipboard

https://aurn.com/wp-content/uploads/2022/08/AP22209625086601-scaled.jpg

https://www.bosch-homecomfort.com/us/en/...

Learn how you may qualify for rebates or tax credits on your HVAC installation thanks to the Inflation Reduction Act IRA

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

Is A New HVAC Unit Tax Deductible Christiansonco

Carrier HVAC Federal Tax Credits And Rebates

Ductless HVAC Tax Credits Through The Inflation Reduction Act IRA

The Inflation Reduction Act Is A Victory For Working People AFL CIO

New Carrier EcoHome Program Helps Maximize Inflation Reduction Act s

Inflation Reduction Act Could Provide Major Boost For Renewable Energy

Inflation Reduction Act Could Provide Major Boost For Renewable Energy

Clean Hydrogen And Energy Investments From The Inflation Reduction Act

Democrats Didn t Achieve All Their Goals But Inflation Reduction Act

What Is The Inflation Reduction Act Financial Joy School

Hvac Tax Credit Inflation Reduction Act - On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate