Iceland Tax Rebates Web Tax free VAT refund All non Iceland residents are tax free eligible The minimum amount on one single purchase receipt must be ISK 12 000 The original purchase receipts must

Web Travelling to Iceland Cash declaration Duty free imports Gifts Tax free VAT refund Temporary import of vehicles Import and Export Vehicles Procedures for Web VAT REFUND TAX FREE Tourists who reside abroad can claim a proportional VAT refund when shopping in Iceland The refund is limited to purchases that are intended to

Iceland Tax Rebates

Iceland Tax Rebates

http://freedomandprosperity.org/wp-content/uploads/2010/11/fig1b-600x410.gif

The Iceland Tax System Key Features And Lessons For Policy Makers

http://freedomandprosperity.org/wp-content/uploads/2010/11/fig7b-600x409.gif

Iceland Corporate Tax Rate 2023 Take profit

https://img.take-profit.org/graphs/indicators/corporate-tax-rate/corporate-tax-rate-iceland.png

Web 26 mars 2018 nbsp 0183 32 About five weeks give or take How Much Money Will You Get Back The value added tax in the country is always already included in your purchase price of any Web Tax liability An individual that stays in Iceland for less than six months in a twelve month period has limited tax liability in Iceland This means he has to pay tax on income

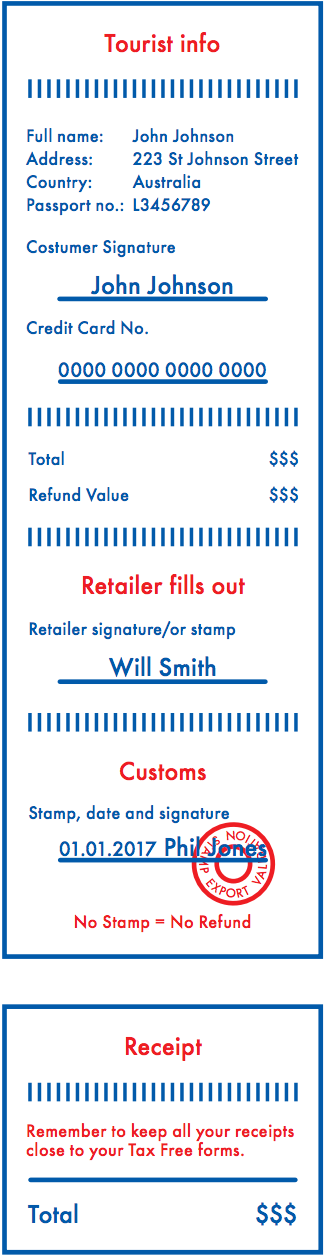

Web 18 d 233 c 2017 nbsp 0183 32 What is tax free shopping in Iceland Tax free shopping in Iceland applies to goods that are purchased in Iceland for 6 000 ISK 56 USD or 46 00 or more In other words the original receipt must show Web Iceland Tax Free Shopping in Iceland Shop in Iceland in three easy steps Check the country rules for Tax Free shopping and get your refund Go Shopping Get Customs

Download Iceland Tax Rebates

More picture related to Iceland Tax Rebates

Iceland Income Taxation In 2009 And 2011 2009 2011 Download Table

https://www.researchgate.net/profile/Bruno-Martorano/publication/264556817/figure/tbl2/AS:392524586864650@1470596562154/Iceland-Income-taxation-in-2009-and-2011-2009-2011.png

Iceland Tax Free Log In

https://icelandtaxfree.is/img/page_2.png

The Iceland Tax System Key Features And Lessons For Policy Makers

http://freedomandprosperity.org/wp-content/uploads/2010/11/fig8b-600x410.gif

Web The annual personal tax credit 646 740 ISK 2018 equals to non taxation of the first 1 750 782 ISK Children under 16 years must pay 6 income tax if their annual income Web Any reimbursement of Value Added Tax to foreign enterprises shall be only to the same extent as Icelandic enterprises can include the Value Added Tax on purchases of a

Web Tax refunds If an exemption or a partial relief according to a Double Taxation Agreement has been accepted but tax has been withheld an application for a refund can be Web Les taux d imposition en Islande bar 232 me 2017 0 si le revenu annuel est inf 233 rieur 224 ISK 1 718 678 36 94 d imposition pour les revenus situ 233 s entre ISK 0 834 707

The Iceland Tax System Key Features And Lessons For Policy Makers

http://freedomandprosperity.org/wp-content/uploads/2010/11/fig4b.gif

Iceland Tax Revenue current LCU 1972 2018 Data 2020 Forecast

https://tradingeconomics.com/charts/iceland-tax-revenue-current-lcu-wb-data-.png?s=isl.gc.tax.totl.cn%3aworldbank&lbl=0

https://www.skatturinn.is/.../travelling-to-iceland/tax-free-vat-refund

Web Tax free VAT refund All non Iceland residents are tax free eligible The minimum amount on one single purchase receipt must be ISK 12 000 The original purchase receipts must

https://www.skatturinn.is/english

Web Travelling to Iceland Cash declaration Duty free imports Gifts Tax free VAT refund Temporary import of vehicles Import and Export Vehicles Procedures for

The Iceland Tax System Key Features And Lessons For Policy Makers

The Iceland Tax System Key Features And Lessons For Policy Makers

Iceland Sales Tax Rate VAT 2022 Data 2023 Forecast 2010 2021

Shop Tax Free In Iceland The Complete Guide Iceland Close Up

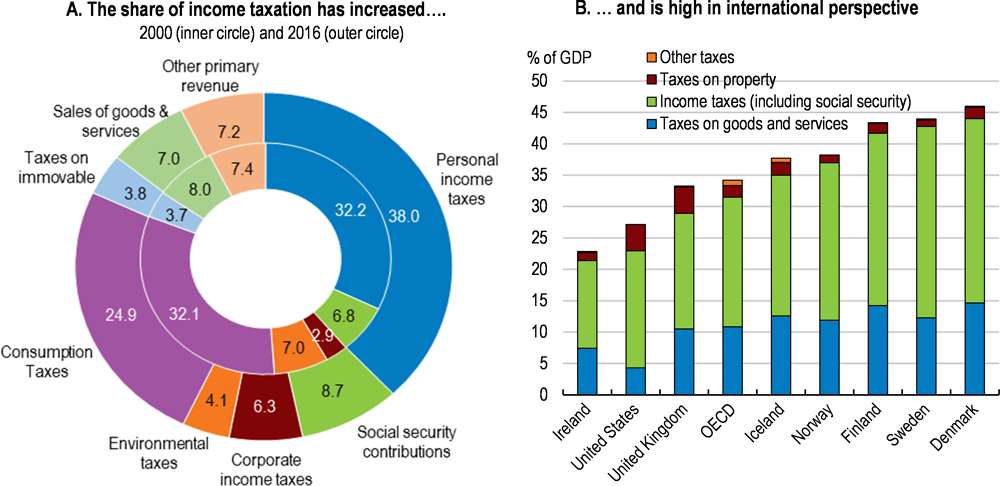

Key Policy Insights OECD Economic Surveys Iceland 2019 OECD ILibrary

Iceland Tax Revenue Of GDP 2023 Data 2024 Forecast 1972 2020

Iceland Tax Revenue Of GDP 2023 Data 2024 Forecast 1972 2020

Pin By Mary Beth Young On Iceland Tax Free Shopping Bullet Journal

Iceland Personal Income Tax Rate 2022 Data 2023 Forecast 1995

Income 2018 Tax Returns Statistics Iceland

Iceland Tax Rebates - Web Iceland now offers up to 35 reimbursement of costs incurred in Iceland All productions for feature films TV shows and documentaries in Iceland are eligible for a 25 refund