Idaho Rebate September 2024 Idahoans who qualify for the 2022 tax rebate can track their payment online at tax idaho gov rebate To get the status of their rebate they ll need their Social Security number and either their Idaho driver s license state issued identification number or their 2021 income tax return

Governor Brad Little and the Idaho Legislature authorized the rebate during a special legislative session in September The rebate automatically goes to people who were full year Idaho residents for 2020 and 2021 and who filed income tax returns for those years This includes those who filed Form 24 to get the grocery credit refund Effective January 3 2023 the tax rate imposed on individuals trusts and estates is 5 8 of taxable income over 2 500 over 5 000 for joint returns surviving spouses and heads of household For electing small business trusts as defined in IRC 1361 the tax rate is 5 8 of taxable income over 2 500

Idaho Rebate September 2024

Idaho Rebate September 2024

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pump-water-heater-existing-homes-idaho-power.jpg

Final Chance To Get One time Rebates Between 300 To 600 From 500million Pot See If You re

https://www.the-sun.com/wp-content/uploads/sites/6/2023/03/nk_IdahoRebate_offplatform.jpg?strip=all&quality=100&w=1920&h=1080&crop=1

One time Tax Rebate Checks For Idaho Residents KLEW

https://klewtv.com/resources/media2/16x9/full/1015/center/80/bcd0e069-efe3-406d-b87f-b52ab4b43fd3-large16x9_IdahoTaxRebateCheckpic.jpg

Governor Brad Little and the Idaho Legislature authorized the rebate during a special legislative session in September The rebate automatically goes to people who were full year Idaho residents for 2020 and 2021 and who filed income tax returns for those years This includes those who filed Form 24 to get the grocery credit refund Idaho is giving eligible taxpayers two rebates in 2022 2022 Special Session rebate On September 1 2022 a Special Session of the Idaho Legislature passed and Governor Brad Little signed House Bill 1 authorizing a tax rebate to full year residents of Idaho

The single subject bill on inflation that will be considered by the Idaho Legislature on Sept 1 includes Immediate TAX CUTS FOR ALL 500 million in immediate one time income tax rebates Idahoans will get back 10 percent of 2020 income taxes paid with minimum rebates of 300 for individuals and 600 for joint filers Seniors who apply for September 1 2022 by Logan Finney Idaho Reports In a single day special session the Idaho Legislature approved a new law that will reduce income tax rates send out another round of rebate checks and provide additional funding for education The Senate voted 34 1 to pass the bill Thursday evening

Download Idaho Rebate September 2024

More picture related to Idaho Rebate September 2024

How I Almost Threw Away My Idaho Rebate Check

https://townsquare.media/site/95/files/2022/11/attachment-Check.jpg?w=980&q=75

IDAHO STIMULUS CHECK IDAHO TAX REBATE 2022 WHEN TO EXPECT PAYMENT WHO QUALIFIES YouTube

https://i.ytimg.com/vi/ZTkcd2lfnfM/maxresdefault.jpg

Wondering About Your Idaho Tax Rebate Track Its Status With A New Online Tool Idaho Capital Sun

https://idahocapitalsun.com/wp-content/uploads/2021/04/Tax-2048x1326-1-1536x995.jpg

You can check the status of your rebate using the State Tax Commission s Where s My Rebate tool You can also call the commission at 208 334 7660 or the toll free number 800 972 7660 to The Legislature will consider the bill on Thursday Sept 1 The proposed one time income tax rebates would equal approximately 500 million and see Idahoans get back 10 of their 2020 taxes paid

BOISE Idaho Statesman If you re still waiting for a 300 tax rebate promised by the Idaho Legislature don t worry The Idaho State Tax Commission will begin processing the payments in On May 10 2021 Governor Brad Little signed House Bill 380 which created the 2021 Idaho Tax Rebate Fund to provide a tax rebate to full year residents Idahoans are starting to receive a one time tax relief check 20 Jan 2024 06 18 42 GMT 1705731522130 One time tax rebate check for Idaho residents by KLEW News Staff Wed September

Here s How You Can Track Your Idaho Special Session Tax Rebate East Idaho News

https://s3-us-west-2.amazonaws.com/assets.eastidahonews.com/wp-content/uploads/2016/08/18070025/48cab73958.jpg

Some Idaho Residents To See One time Tax Rebate This Summer Ktvb

https://media.ktvb.com/assets/KTVB/images/537945594/537945594_1920x1080.jpg

https://tax.idaho.gov/pressrelease/track-your-tax-rebate-at-tax-idaho-gov/

Idahoans who qualify for the 2022 tax rebate can track their payment online at tax idaho gov rebate To get the status of their rebate they ll need their Social Security number and either their Idaho driver s license state issued identification number or their 2021 income tax return

https://klewtv.com/news/local/heres-how-to-track-your-idaho-special-session-rebate

Governor Brad Little and the Idaho Legislature authorized the rebate during a special legislative session in September The rebate automatically goes to people who were full year Idaho residents for 2020 and 2021 and who filed income tax returns for those years This includes those who filed Form 24 to get the grocery credit refund

File Flag map Of Idaho svg Wikimedia Commons

Here s How You Can Track Your Idaho Special Session Tax Rebate East Idaho News

September 2024 Single Occupancy Upgrade

Free Images Community Street Sign Signage Odyssey Idaho Traffic Sign 4661x3107 223171

Menards 2022 11 Rebate Menardsrebate11

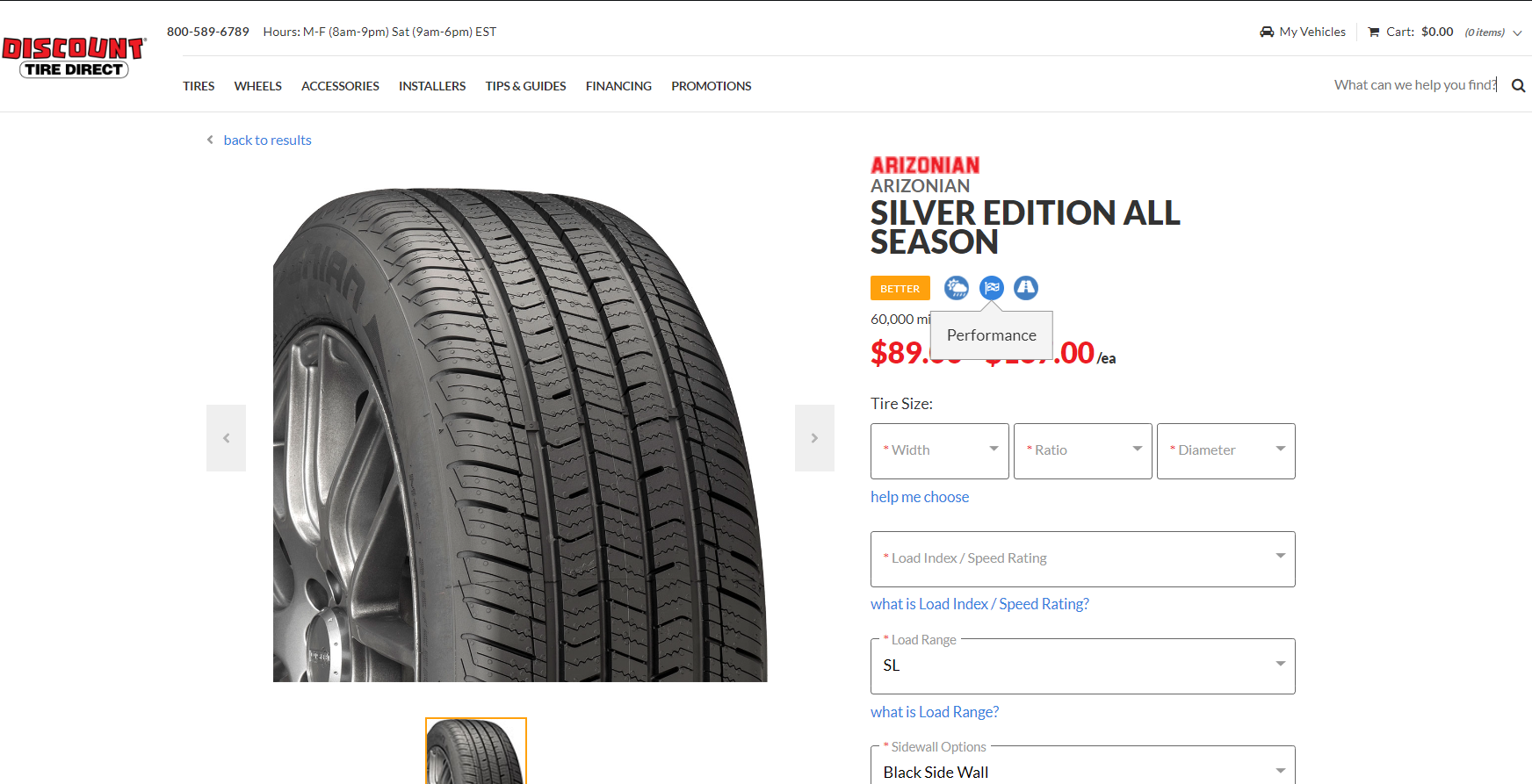

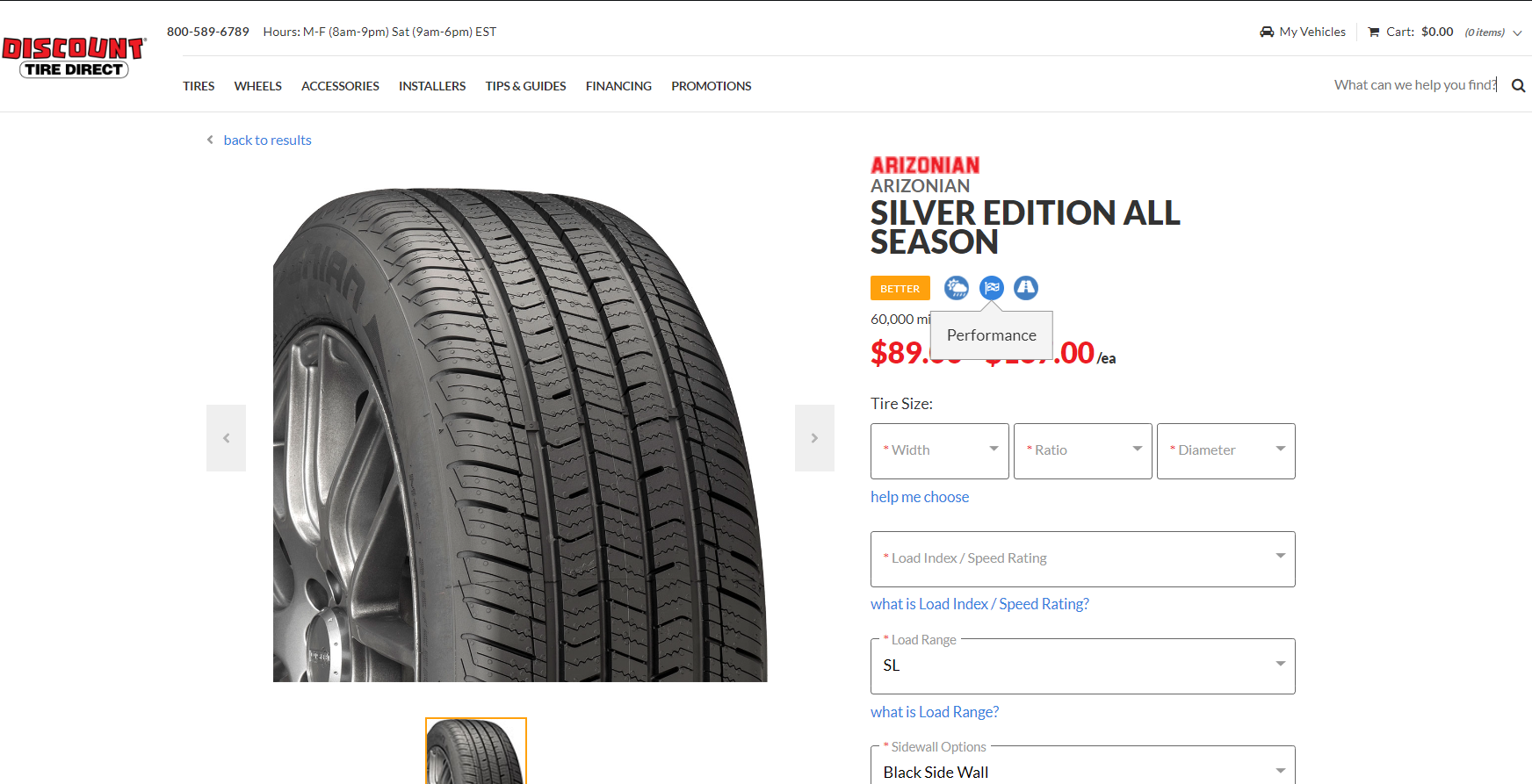

Arizonian Tire Rebate 2023 A Comprehensive Guide To Saving Big On Your Next Tire Purchase

Arizonian Tire Rebate 2023 A Comprehensive Guide To Saving Big On Your Next Tire Purchase

Idaho pl

Government Solar Rebate QLD Everything You Need To Know

Idaho YouTube

Idaho Rebate September 2024 - Property Tax Reduction Program 2024 Apply from January 1 through April 15 2024 Pub 135 If you re a qualified Idaho homeowner you might be eligible for the Property Tax Reduction program also known as the Circuit Breaker program