Ifrs 15 Rebates And Discounts Web Discounts and rebates can be offered to purchasers in a number of ways for example trade discounts settlement discounts volume based rebates and other rebates Accounting for these reductions will vary depending on the type of arrangement

Web To entice customers to buy order more goods it is not uncommon for wholesalers to provide customers with volume discounts rebates Under IFRS 15 volume discounts rebates is a type of variable consideration Wholesalers are to record revenue at the amount it Web IFRS 15 13 If a contract meets all of the criteria at contract inception then an entity does not reassess the criteria unless there is an indication of a significant change in the facts and circumstances If on reassessment an entity determines that the criteria are no longer

Ifrs 15 Rebates And Discounts

Ifrs 15 Rebates And Discounts

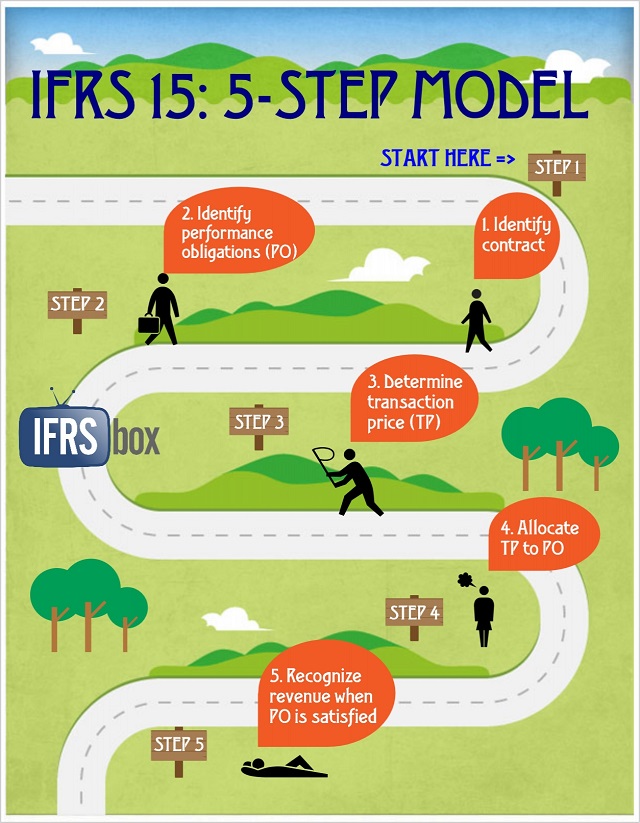

https://www.cpdbox.com/wp-content/uploads/IFRS15_5stepmodel-1.jpg

Rebates And Discounts IFRS 15 And IAS 2 IFRS MEANING

https://www.ifrsmeaning.com/wp-content/uploads/2021/03/Rebates-and-discounts-IFRS-15-and-IAS-2-768x480.jpg

Identifying Contract With Customer IFRS 15 Financiopedia

http://financiopedia.com/wp-content/uploads/2018/03/IFRS-15-Contract.png

Web Therefore logically we should look to the standard IFRS 15 Revenue from Contract with Customers for guidance This standard specifies that you should present the revenue net of discounts Just refer to IFRS 15 47 Web Ce bulletin r 233 sume les nouvelles exigences et les r 233 percussions qu elles auront sur les entit 233 s du secteur des sciences de la vie qui appliquent les Normes internationales d information financi 232 re IFRS La nouvelle norme IFRS 15 remplace l IAS 18 Produits

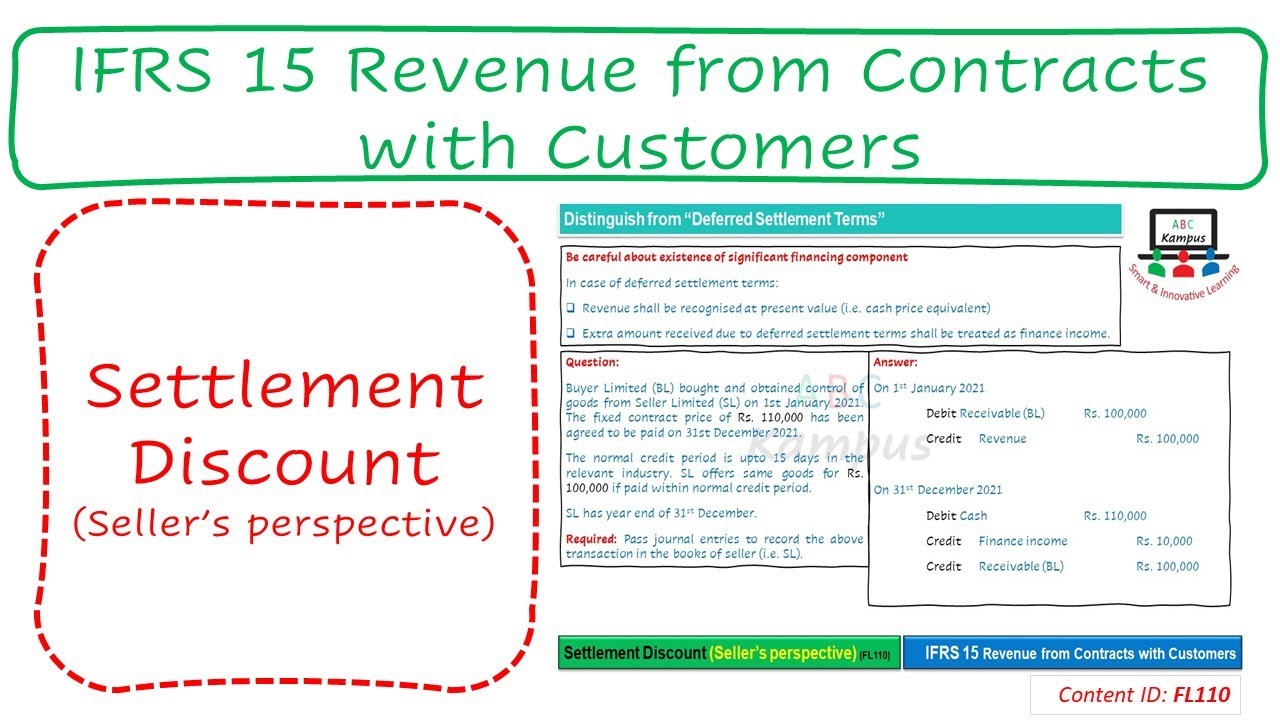

Web IFRS 15 Revenue from Contracts with Customers This article considers the application of IFRS 15 Revenue from Contracts with Customers in accounting for prompt payment early settlement discounts it is most relevant to students studying FA Web Updated September 2019 A closer look at IFRS 15 the revenue recognition standard 6 What you need to know IFRS 15 provides a single source of revenue requirements for all entities in all industries It represents a significant change from legacy IFRS IFRS 15

Download Ifrs 15 Rebates And Discounts

More picture related to Ifrs 15 Rebates And Discounts

Top 5 IFRS Changes Adopted In 2014 IFRSbox Making IFRS Easy

http://www.ifrsbox.com/wp-content/uploads/IFRS15_5stepModel.png

IFRS 15 The New Revenue Recognition Standard

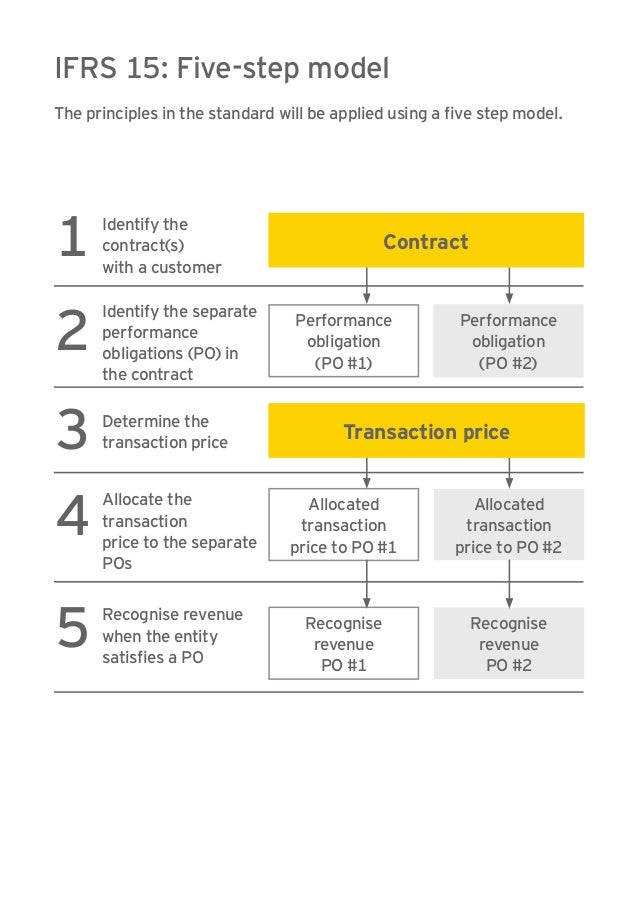

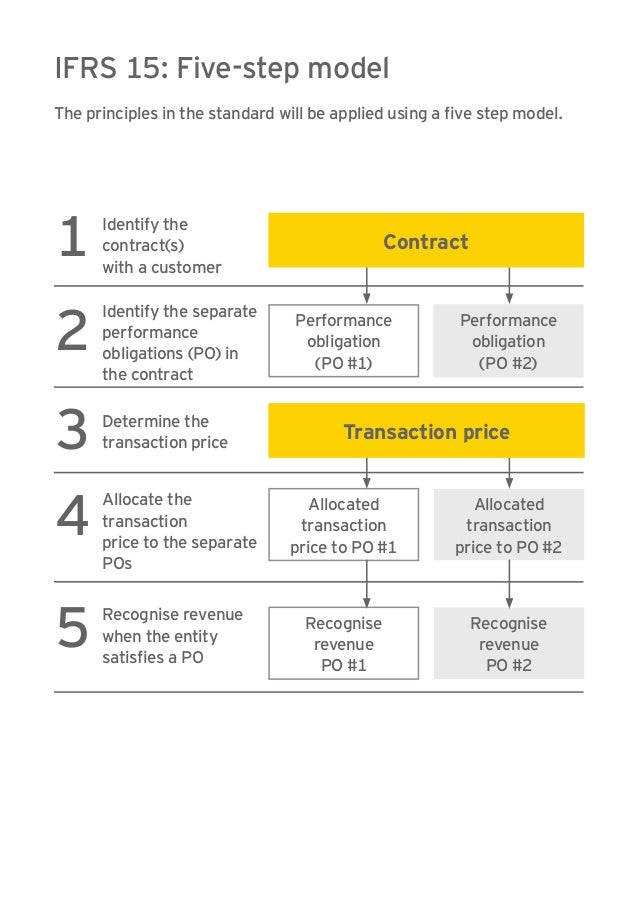

http://image.slidesharecdn.com/faasa5nospread-141210095048-conversion-gate02/95/ifrs-15-the-new-revenue-recognition-standard-6-638.jpg?cb=1418205165

IFRS 15 Examples How IFRS 15 Affects Your Company IFRSbox Making

http://www.ifrsbox.com/wp-content/uploads/IFRS15ContractModification.png

Web The issuance of IFRS 15 171 Revenue from Contracts with Customers 187 by the IASB has required R amp C preparers to consider all of their revenue and promotion models using the new five step model detailed in the standard At the same time our old publication has been Web 25 mars 2020 nbsp 0183 32 Under IFRS 15 if a contract includes variable consideration then a company estimates the amount of consideration to which it will be entitled Variable consideration includes discounts rebates refunds credits price concessions

Web 21 f 233 vr 2020 nbsp 0183 32 Under IFRS 15 volume discounts rebates is a type of variable consideration IFRS 15 50 59 IFRS 15 Volume discounts and Margin guarantees Wholesalers are to record revenue at the amount it expects to receive net of Web 27 oct 2021 nbsp 0183 32 IFRS 15 Revenue from Contracts with Customers provides a comprehensive source of revenue requirements for all entities in all industries Our updated publication analyses the revenue recognition standard It expands our discussion of certain topics

IFRS 15 The New Revenue Recognition Standard

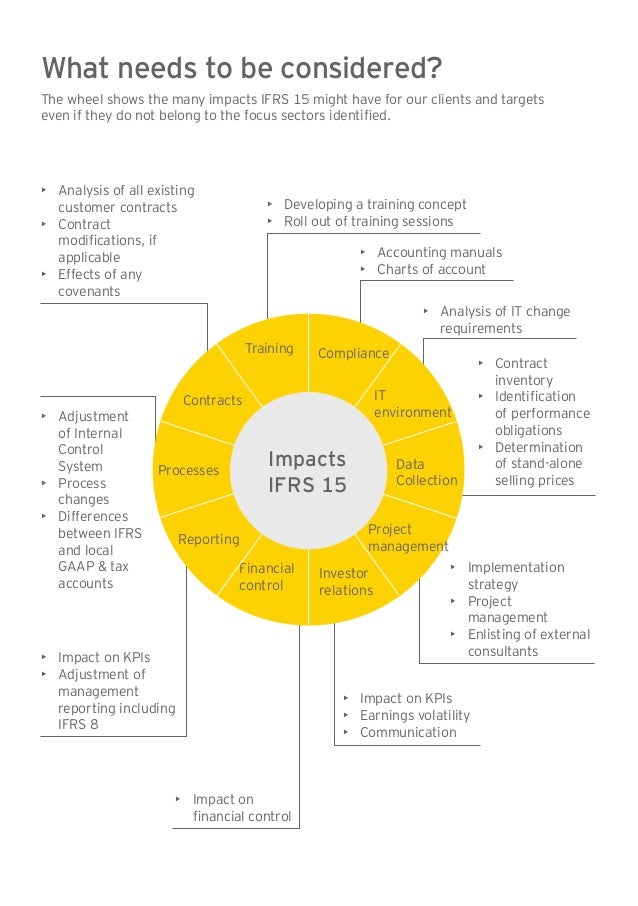

http://image.slidesharecdn.com/faasa5nospread-141210095048-conversion-gate02/95/ifrs-15-the-new-revenue-recognition-standard-3-638.jpg?cb=1418205165

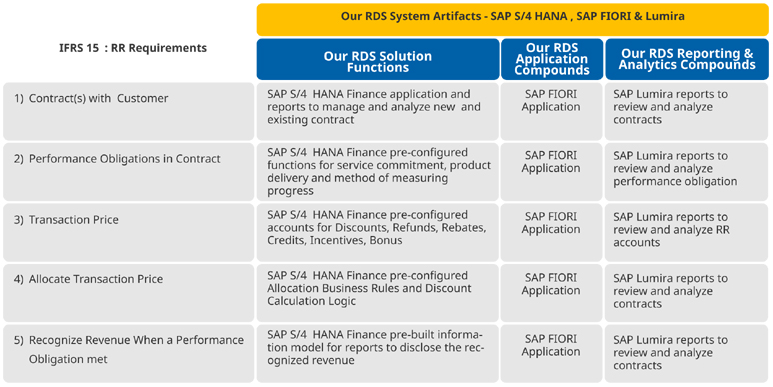

IFRS 15 ASC 606 Case Header Discounts And Invoice Deviations SAP Blogs

https://blogs.sap.com/wp-content/uploads/2017/10/19-Summary-Assets.jpg

https://www.grantthornton.global/globalassets/1.-member-fir…

Web Discounts and rebates can be offered to purchasers in a number of ways for example trade discounts settlement discounts volume based rebates and other rebates Accounting for these reductions will vary depending on the type of arrangement

https://www.bdo.com.au/en-au/insights/retail/ifrs-15-for-the-retail...

Web To entice customers to buy order more goods it is not uncommon for wholesalers to provide customers with volume discounts rebates Under IFRS 15 volume discounts rebates is a type of variable consideration Wholesalers are to record revenue at the amount it

Step 5 Of IFRS 15 Revenue Recognition Model BDO NZ

IFRS 15 The New Revenue Recognition Standard

Online Download Ifrs 15 Revenue Download Pdf

IFRS 15 ASC 606 Case Header Discounts And Invoice Deviations SAP Blogs

Lecture Settlement Discount Seller s Perspective IFRS 15 FL110

IFRS 15 Examples How IFRS 15 Affects Your Company IFRSbox Making

IFRS 15 Examples How IFRS 15 Affects Your Company IFRSbox Making

IFRS 15 Vs IAS 18 Huge Change Is Here IFRSbox Making IFRS Easy

Does IFRS 15 Or IFRS 9 Apply To Fees Charged To Customers By Lenders

IFRS 15 Revenue From Contracts With Customers

Ifrs 15 Rebates And Discounts - Web Therefore logically we should look to the standard IFRS 15 Revenue from Contract with Customers for guidance This standard specifies that you should present the revenue net of discounts Just refer to IFRS 15 47