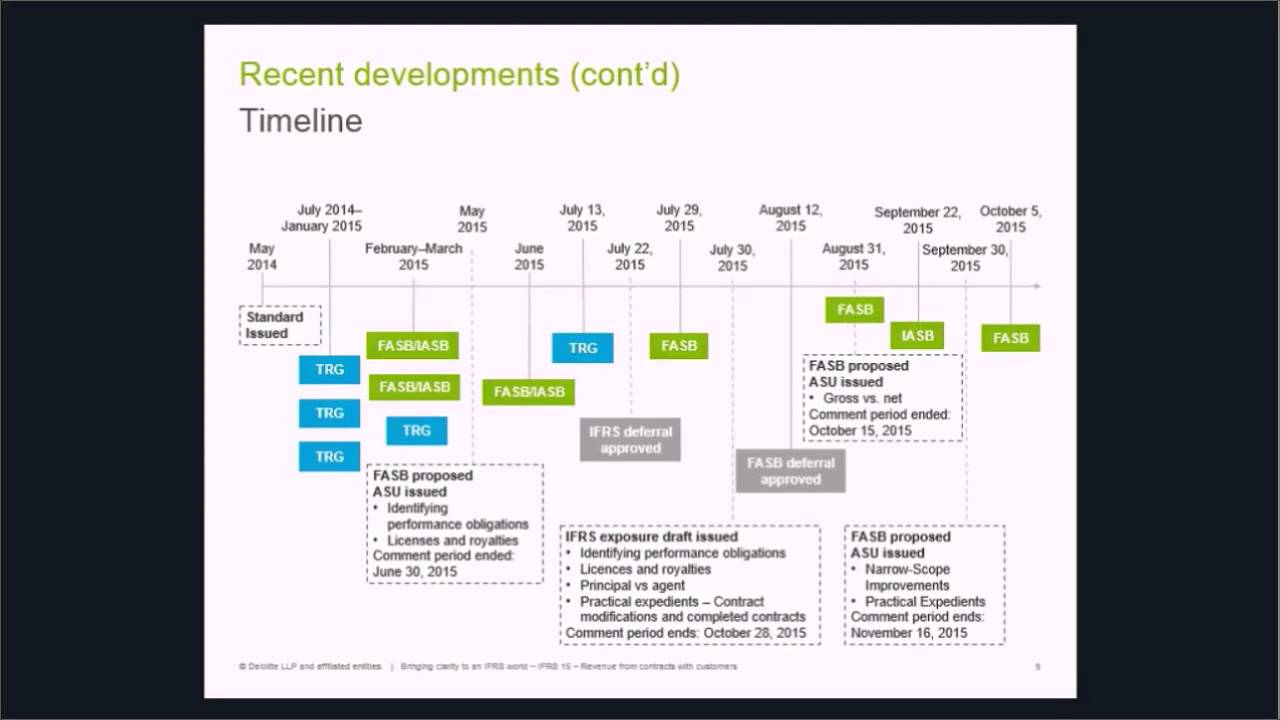

Ifrs 15 Revenue Recognition Summary IFRS 15 provides a comprehensive framework for recognising revenue from contracts with customers In September 2015 the Board issued Effective Date of IFRS 15 which deferred the mandatory effective date of IFRS 15 to 1 January 2018

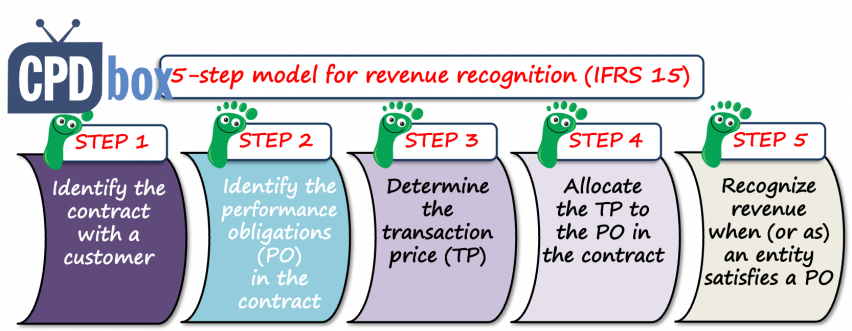

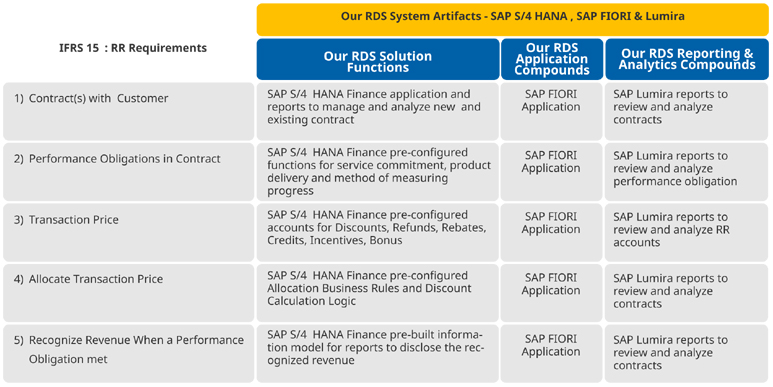

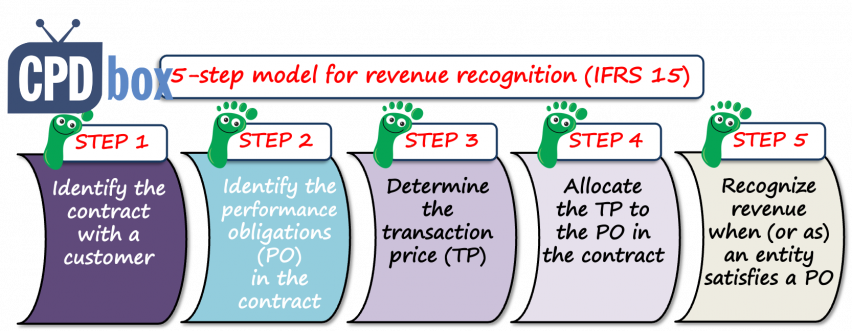

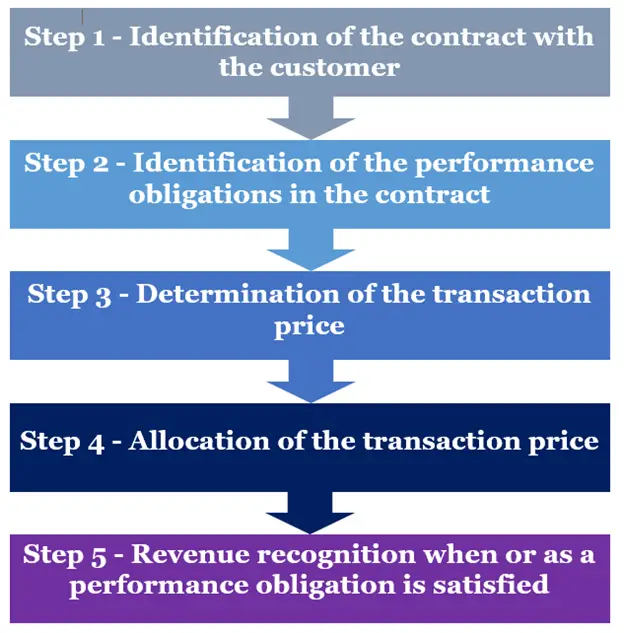

The main aim of IFRS 15 is to recognize revenue in a way that shows the transfer of goods services promised to customers in an amount reflecting the expected consideration in return for those goods or services To recognise revenue under IFRS 15 an entity applies the following five steps identify the contract s with a customer identify the performance obligations in the contract Performance obligations are promises in a contract to transfer to a customer goods or services that are distinct determine the transaction price

Ifrs 15 Revenue Recognition Summary

Ifrs 15 Revenue Recognition Summary

https://www.cpdbox.com/wp-content/uploads/5stepModelIFRS15-852x331.png

Revenue Recognition In IFRS 15 Part 2 THEACCSENSE

https://www.theaccsense.com/app/uploads/2021/06/Summary-of-revenue-recognition-in-IFRS-15.jpg

PDF The Adequacy Of IFRS 15 For Revenue Recognition In The

https://i1.rgstatic.net/publication/339483984_The_adequacy_of_IFRS_15_for_revenue_recognition_in_the_construction_industry/links/5e5533e4299bf1bdb8397911/largepreview.png

This handbook provides a detailed analysis of the revenue standard IFRS 15 Revenue from Contracts with Customers including insights and examples to help entities to navigate the revenue recognition requirements In many cases further analysis and interpretation may be needed for an entity to apply The core principle of IFRS 15 is that revenue is recognised when the goods or services are transferred to the customer at the transaction price Revenue is recognised in accordance with that core principle by applying a 5 step model as shown below

IFRS 15 has a broadened scope since it not only addresses revenue recognition but also addresses the requirements for contra t costs What exactly are con tract costs and how are these addressed in IFRS 15 33 Summary of IFRS 15 Revenue from Contracts with Customers 5 step model for revenue recognition under IFRS 15 example journal entries video IFRS 15 vs IAS 18 Huge change is here this article compares the accounting under IAS 18 and IFRS 15 on a simple example

Download Ifrs 15 Revenue Recognition Summary

More picture related to Ifrs 15 Revenue Recognition Summary

IFRS 15 Revenue From Contracts With Customers YouTube

https://i.ytimg.com/vi/IvcDJFISmEY/maxresdefault.jpg

Online Download Ifrs 15 Revenue Download Pdf

https://www.sierratec-us.com/wp-content/uploads/2016/06/IFRS-15-Revenue-11.jpg

IFRS 15 Summary Updated Link In The Description YouTube

https://i.ytimg.com/vi/xS0R1T7ZZBw/maxresdefault.jpg

IFRS 15 Revenue from Contracts with Customers was issued on 28 May 2014 It supersedes SIC 31 Revenue Barter Transactions Involving Advertising Services IFRS 15 will improve comparability of reported revenue over a range of industries IFRS 15 created a uniform way of recognizing revenue and standardized reporting across the board This consistent reporting method has improved comparative reporting and analysis and has simplified how financial statements are prepared What is the Core Principle of IFRS 15

[desc-10] [desc-11]

Index Of wp content uploads 2016 06

http://www.sierratec-us.com/wp-content/uploads/2016/06/IFRS-15-Revenue-12.jpg

Implementing IFRS 15 The New Revenue Recognition Standard

https://image.slidesharecdn.com/slideshareifrs15march202017-170321034242/95/implementing-ifrs-15-the-new-revenue-recognition-standard-8-638.jpg?cb=1490068548

https://www.ifrs.org › ... › issued › part-a

IFRS 15 provides a comprehensive framework for recognising revenue from contracts with customers In September 2015 the Board issued Effective Date of IFRS 15 which deferred the mandatory effective date of IFRS 15 to 1 January 2018

https://www.cpdbox.com

The main aim of IFRS 15 is to recognize revenue in a way that shows the transfer of goods services promised to customers in an amount reflecting the expected consideration in return for those goods or services

IFRS 15 Revenue Recognition From Contracts With Customers YouTube

Index Of wp content uploads 2016 06

IFRS 15 Revenue Recognition CPA Exam Prep YouTube

IFRS 15 Revenue From Contracts With Customers Insights

IFRS 15 Summary Document IFRS 15 Revenue From Contracts With

IFRS 15 Five Step Model Revenue Recognition All Inclusive

IFRS 15 Five Step Model Revenue Recognition All Inclusive

Revenue Recognition The Five Steps Approach Under IFRS 15 Accounting Hub

Performance Obligations Revenue Recongition Columbus CPA

IFRS 15 Revenue From Contract With Customers IFRS Tutorial IFRS

Ifrs 15 Revenue Recognition Summary - The core principle of IFRS 15 is that revenue is recognised when the goods or services are transferred to the customer at the transaction price Revenue is recognised in accordance with that core principle by applying a 5 step model as shown below