Il Real Estate Tax Rebate 2023 Web 12 sept 2022 nbsp 0183 32 The Pritzker administration is sending income and property tax rebates to many Illinoisans struggling with inflation These tax rebates were part of the 1 8 billion

Web How to claim If you file d your 2021 IL 1040 and Schedule ICR you will automatically receive your rebate If not you have until October 17th to file a Property Tax Rebate Web 27 avr 2023 nbsp 0183 32 To qualify for the Property Tax Rebate Illinois 2023 program applicants must have an annual household income of 75 000 or less This includes all sources of

Il Real Estate Tax Rebate 2023

Il Real Estate Tax Rebate 2023

https://www.pdffiller.com/preview/552/409/552409798/large.png

Federal Tax Rebate 2023 Maximize Your Savings And Boost Your Finances

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Federal-Tax-Rebate-2023.jpg?ssl=1

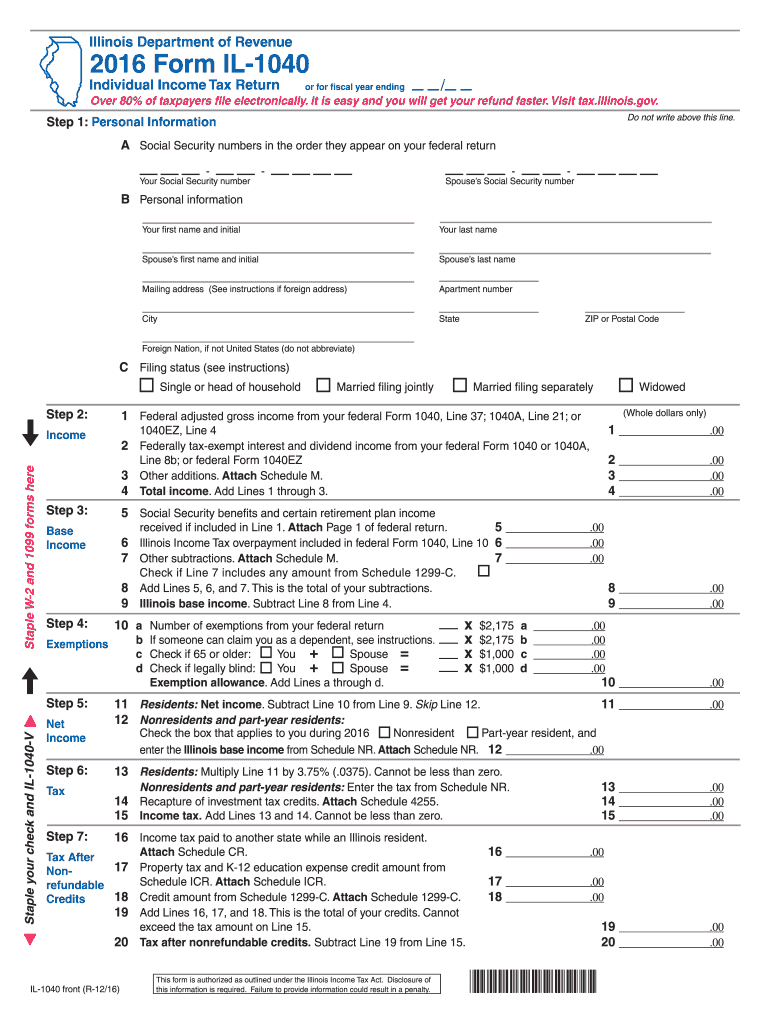

Illinois Form Tax 2016 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/396/726/396726807/large.png

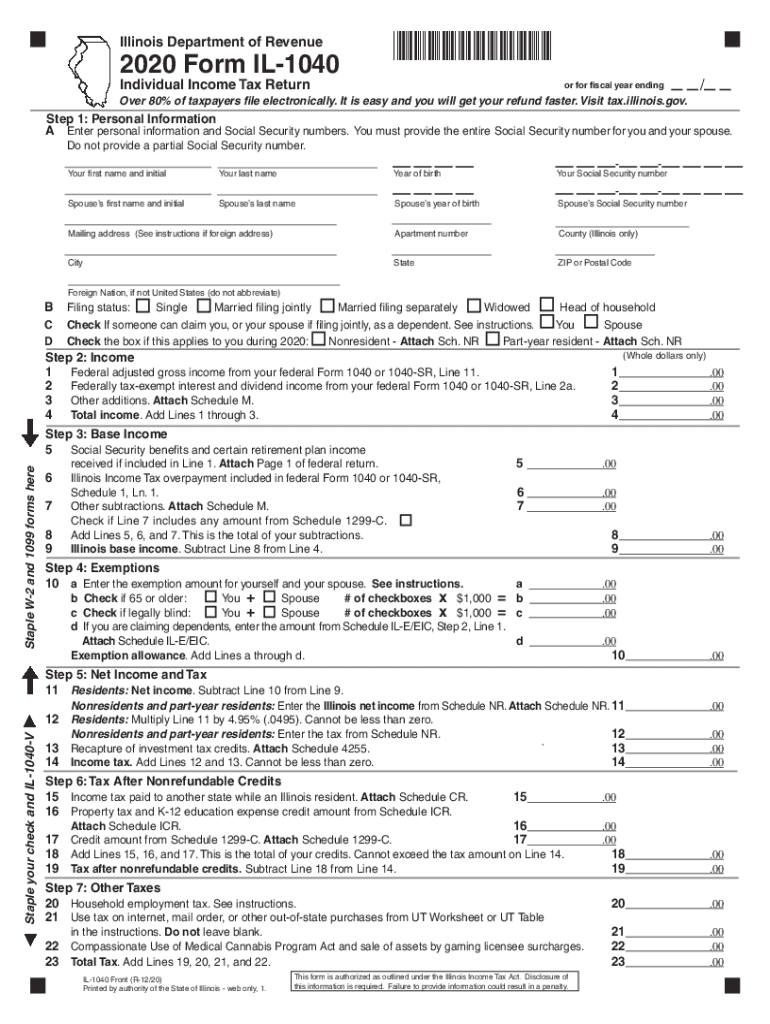

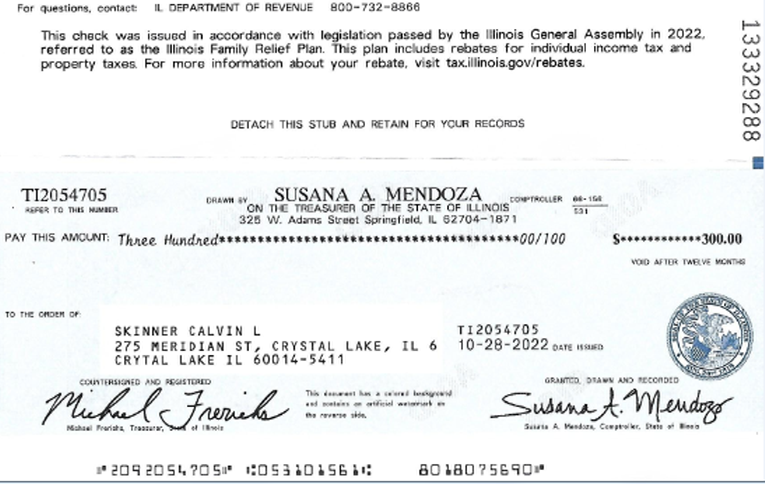

Web 17 juin 2022 nbsp 0183 32 The property tax rebate is a maximum of 300 per household that is equal to the credit claimed for residential real estate property taxes on the 2021 Illinois income Web 5 mai 2023 nbsp 0183 32 Follow these steps to claim your Illinois Tax Rebates for 2023 a Step 1 Gather necessary documents Collect the required documents including W 2 forms or

Web 11 ao 251 t 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be Web 23 sept 2022 nbsp 0183 32 The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim their

Download Il Real Estate Tax Rebate 2023

More picture related to Il Real Estate Tax Rebate 2023

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

https://npr.brightspotcdn.com/dims4/default/759130d/2147483647/strip/true/crop/758x413+0+0/resize/880x479!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2Fcf%2F92%2Fc1613a8b4b4ba9b8b28ebd901285%2Ftaxrebate.png

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim

https://printablerebateform.net/wp-content/uploads/2023/04/Michigan-Tax-Rebate-2023-768x675.png

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

Web 8 d 233 c 2022 nbsp 0183 32 So for example a qualified married couple with three children will get a 400 income tax rebate If you add on a 300 property tax rebate they could get as much as Web 12 f 233 vr 2023 nbsp 0183 32 Those rebates passed as part of the state s fiscal year 2023 budget were given to individuals who made less than 200 000 or couples who made less than

Web 8 ao 251 t 2022 nbsp 0183 32 The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a maximum Web 17 oct 2022 nbsp 0183 32 Illinois residents who paid state property taxes last year on their primary 2020 residence are eligible for the rebate if their adjusted gross income on their 2021 Form IL

Property Tax Rebate New York State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-York-Renters-Rebate-2023-768x685.jpg

Montana Tax Rebate 2023 Benefits Eligibility How To Apply

https://printablerebateform.net/wp-content/uploads/2023/04/Montana-Tax-Rebate-2023-768x684.png

https://www.wgem.com/2022/09/12/six-million-illinoisans-will-receive...

Web 12 sept 2022 nbsp 0183 32 The Pritzker administration is sending income and property tax rebates to many Illinoisans struggling with inflation These tax rebates were part of the 1 8 billion

https://tax.illinois.gov/programs/rebates.html

Web How to claim If you file d your 2021 IL 1040 and Schedule ICR you will automatically receive your rebate If not you have until October 17th to file a Property Tax Rebate

Missouri State Tax Rebate 2023 Printable Rebate Form

Property Tax Rebate New York State Printable Rebate Form

Alconchoice Rebate 2023 Printable Rebate Form

Alcon Choice Rebate Code 2023 Printable Rebate Form

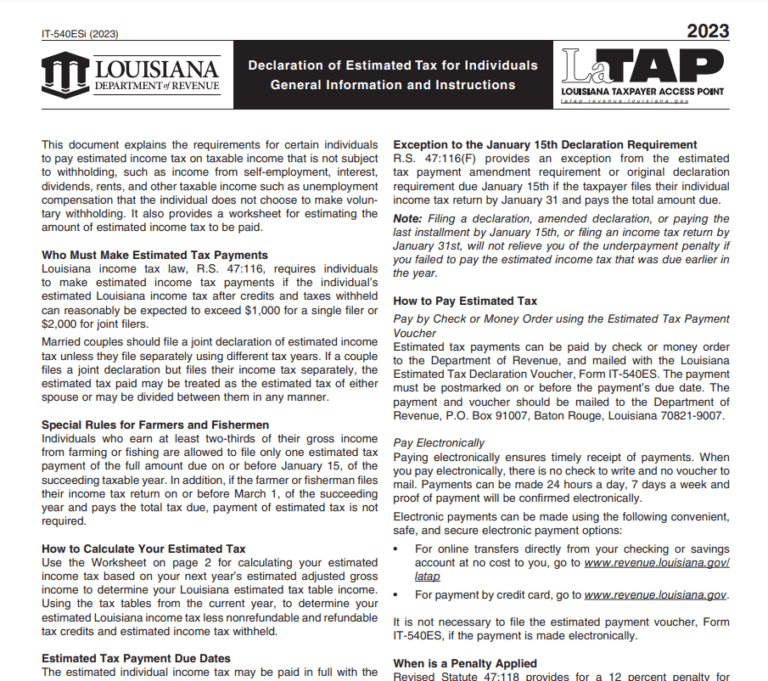

Louisiana Tax Credits 2023 Printable Rebate Form

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

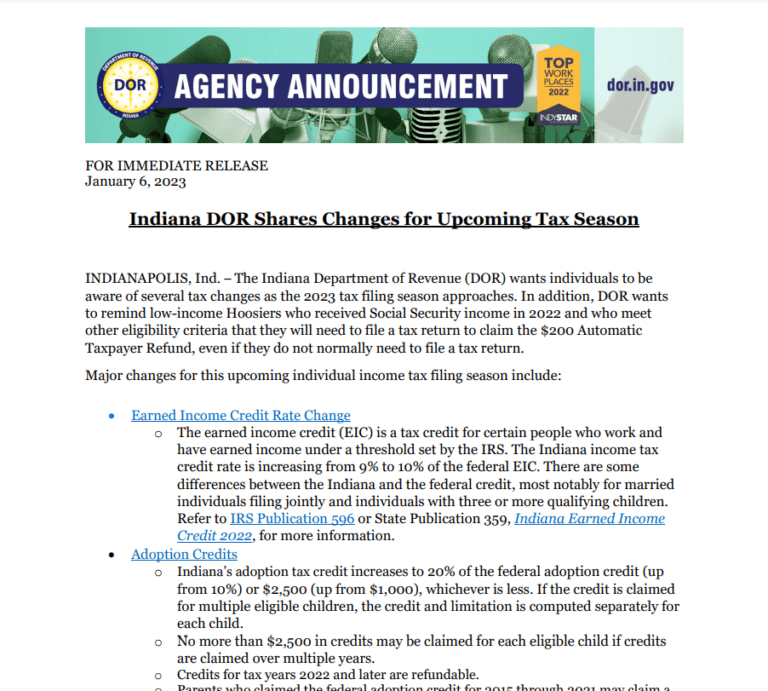

State Of Indiana Tax Rebate 2023 Printable Rebate Form

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

300 Check Allegedly A Real Estate Tax Rebate Arrives Eight Days

Il Real Estate Tax Rebate 2023 - Web 23 sept 2022 nbsp 0183 32 The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim their