Il Tax Rebate 2024 CHICAGO The Illinois Department of Revenue has announced the start of the 2024 tax season accepting 2023 tax returns beginning on January 29 That aligns with when the Internal Revenue

2024 Illinois Tax Filing Season Begins January 29 The Illinois Department of Revenue will begin accepting 2023 state individual income tax returns on Monday January 29 the same date that the Internal Revenue Service begins accepting federal individual income tax returns Response Options for Identity Verification Letters The amount of the credit is determined by your eligibility for the federal EITC For tax years 2022 and earlier filed by April 2023 the Illinois Earned Income Tax Credit is 18 of the federal credit amount For tax years 2023 and beyond filed in 2024 the Illinois EITC rises to 20 To find out if you qualify for benefits check the IRS

Il Tax Rebate 2024

Il Tax Rebate 2024

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

IL Tax Rebates Set To Go Out Next Week See If You Qualify Across Illinois IL Patch

https://patch.com/img/cdn20/shutterstock/920517/20220907/124246/styles/patch_image/public/shutterstock-2064344777___07003833551.jpg

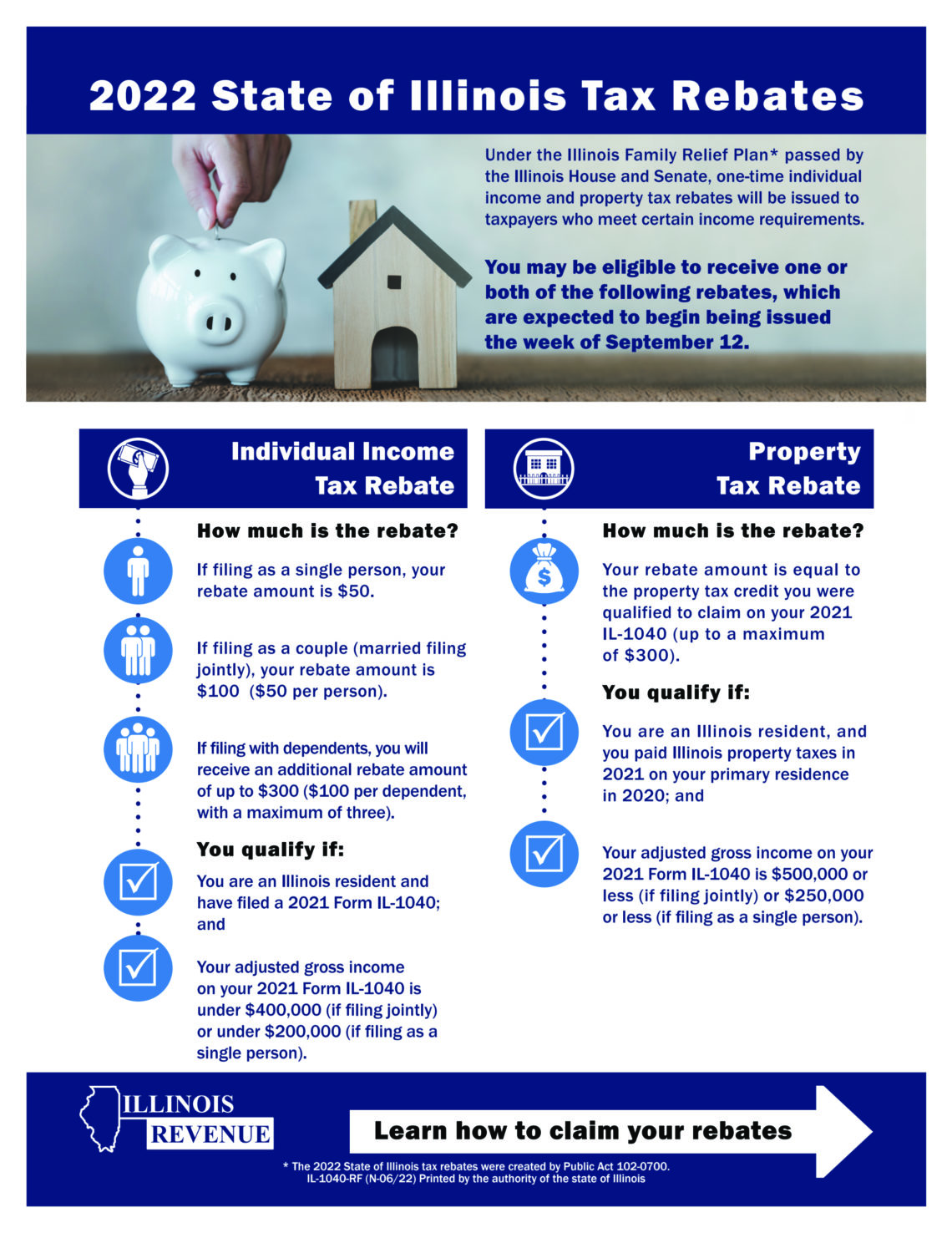

Here s everything else you need to know about the rebates Income tax rebates Who qualifies You must have been an Illinois resident in 2021 with an adjusted gross income on your 2021 Form IL To qualify you must have been an Illinois resident in 2021 and meet the specific income criteria The income limit is 200 000 per individual taxpayer or 400 000 for joint filers So earlier this year there was a sales tax relief There was also a relief on the grocery tax there was a relief on the gas tax as well

If filing jointly 500 000 is the maximum income permitted to receive the property tax rebate while 400 000 is the limit for income tax rebates Single filers can have adjusted gross incomes of The individual income tax rebate is 50 per individual 100 for couples who file married filing jointly provided their federal adjusted gross income is less than 200 000 or 400 000 married filing jointly An additional 100 per dependent up to three dependents will be included in the rebates

Download Il Tax Rebate 2024

More picture related to Il Tax Rebate 2024

Tax Rebate Payments Begin For Millions Of Illinoisans

https://chicagocrusader.com/wp-content/uploads/2022/09/IL-Tax-Rebate-1140x1476.jpg

Property Tax Rebate Program Montgomery IL Official Website

https://ci.montgomery.il.us/ImageRepository/Document?documentID=4523

Il 1040 Instructions Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/453/14/453014487/large.png

By Payroll Office January 12 2024 The Internal Revenue Service IRS has set the official start date for the 2024 tax filing season The IRS announced it will begin accepting and processing 2023 tax returns on January 29 2024 The deadline to file 2023 federal and Illinois tax returns or an extension is April 15 2024 The Tax tables below include the tax rates thresholds and allowances included in the Illinois Tax Calculator 2024 Illinois provides a standard Personal Exemption tax deduction of 2 625 00 in 2024 per qualifying filer and qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2024

Updated Jan 25 2024 03 51 PM CST ROCKFORD Ill WTVO The Illinois Department of Revenue IDOR announced Thursday that it will begin accepting and processing 2023 tax returns on January Illinois federal income tax season 2024 opens Monday Dave Dawson Assistant editor Jan 26 2024 The Illinois Department of Revenue is providing taxpayers with tips and alerting them to

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

https://news.yahoo.com/illinois-tax-season-2024-heres-210017466.html

CHICAGO The Illinois Department of Revenue has announced the start of the 2024 tax season accepting 2023 tax returns beginning on January 29 That aligns with when the Internal Revenue

https://tax.illinois.gov/

2024 Illinois Tax Filing Season Begins January 29 The Illinois Department of Revenue will begin accepting 2023 state individual income tax returns on Monday January 29 the same date that the Internal Revenue Service begins accepting federal individual income tax returns Response Options for Identity Verification Letters

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Up To 1 044 Tax Rebate 2023 Arriving In Colorado Today See If You re Eligible South

Property Tax Rebate Pennsylvania LatestRebate

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Are You Due A Tax Rebate Leitrim Live

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine Optometry

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

Il Tax Rebate 2024 - If filing jointly 500 000 is the maximum income permitted to receive the property tax rebate while 400 000 is the limit for income tax rebates Single filers can have adjusted gross incomes of