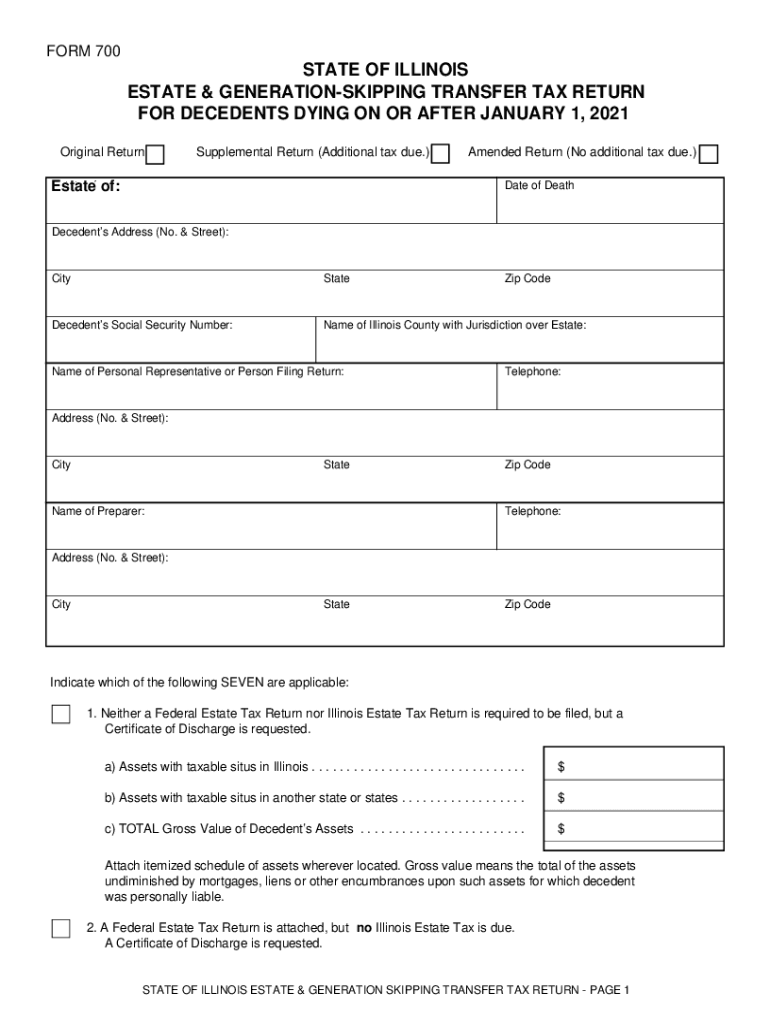

Illinois Estate Tax Return Form 700 Verkko Form 700 estate and generation skipping tax 2009 Decedents Estate Tax Calculator 187 2008 Decedents Estate Tax Instruction Sheet for 2006 2008 Decedents Form 700 estate and generation skipping tax 2007 2008 Decedents Estate Tax Calculator 187 2007 Decedents Estate Tax Instruction Sheet for 2006 2008 Decedents Form 700 estate

Verkko Extension Request Form Form700 EXT1 Inheritance Tax Releases An Illinois Inheritance Tax Release may be necessary if a decedent died before January 1 1983 If a release is required please call Chicago 312 814 2491 or Springfield 217 524 5095 for further assistance Estate Tax Forms Verkko the estate representative is to prepare and file the Illinois Estate Tax Return Form 700 together with a Federal Form 706 Federal Estate Tax Return or any other form containing the same information even though the Federal return is not required to be filed with the Internal Revenue Service

Illinois Estate Tax Return Form 700

Illinois Estate Tax Return Form 700

https://www.signnow.com/preview/577/674/577674402/large.png

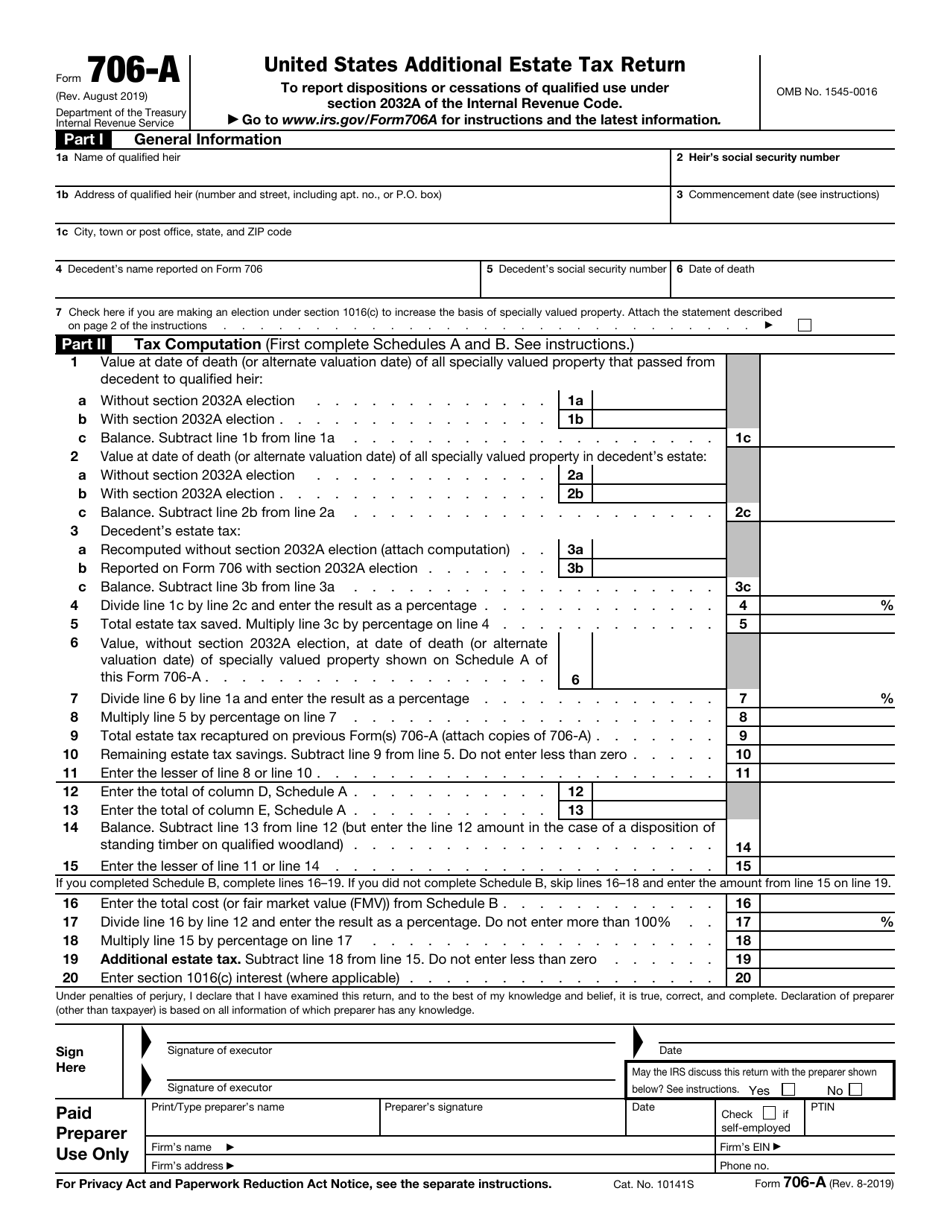

Form 706 Free Fillable Form Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/1932/19321/1932180/irs-form-706-a-united-states-additional-estate-tax-return_print_big.png

Taxes Tax Office Return Free Image On Pixabay

https://cdn.pixabay.com/photo/2015/02/23/20/11/taxes-646510_1280.png

Verkko 1 A Form 700 Illinois Estate and Generation Skipping Transfer Tax Return available on the Attorney General s website https illinoisattorneygeneral gov estate taxes 2 A pro forma Federal Form 706 United States Estate and Generation Skipping Transfer Verkko ILLINOIS FORM 700 EXT REQUEST FOR EXTENSION OF TIME TO FILE A RETURN AND OR PAY ILLINOIS ESTATE AND GENERATION SKIPPING TRANSFER TAXES Estate of Date of Death Decedent s Address No amp Street City State Zip Code Decedent s Social Security Number Name of Illinois County with Jurisdiction over

Verkko An Estate Tax Payment Form must be completed when submitting payments Estate Tax Payment Form PDF fill in form If you wish to submit payment electronically through an e check ePay will facilitate faster processing without having to submit an Estate Tax Payment Form Verkko 3 elok 2022 nbsp 0183 32 Taxpayers must file an Illinois Form 700 if an estate s gross value exceeds 4 million after the inclusion of adjusted taxable gifts regardless of IRS requirements The original estate tax return must be filed with the AG s Office by U S mail courier or hand delivery

Download Illinois Estate Tax Return Form 700

More picture related to Illinois Estate Tax Return Form 700

How To Compute And File The 2nd Quarter Income Tax Return TRAIN

http://www.myfinancemd.com/wp-content/uploads/2018/08/Q2-ITR-b-myfinancemd.jpg

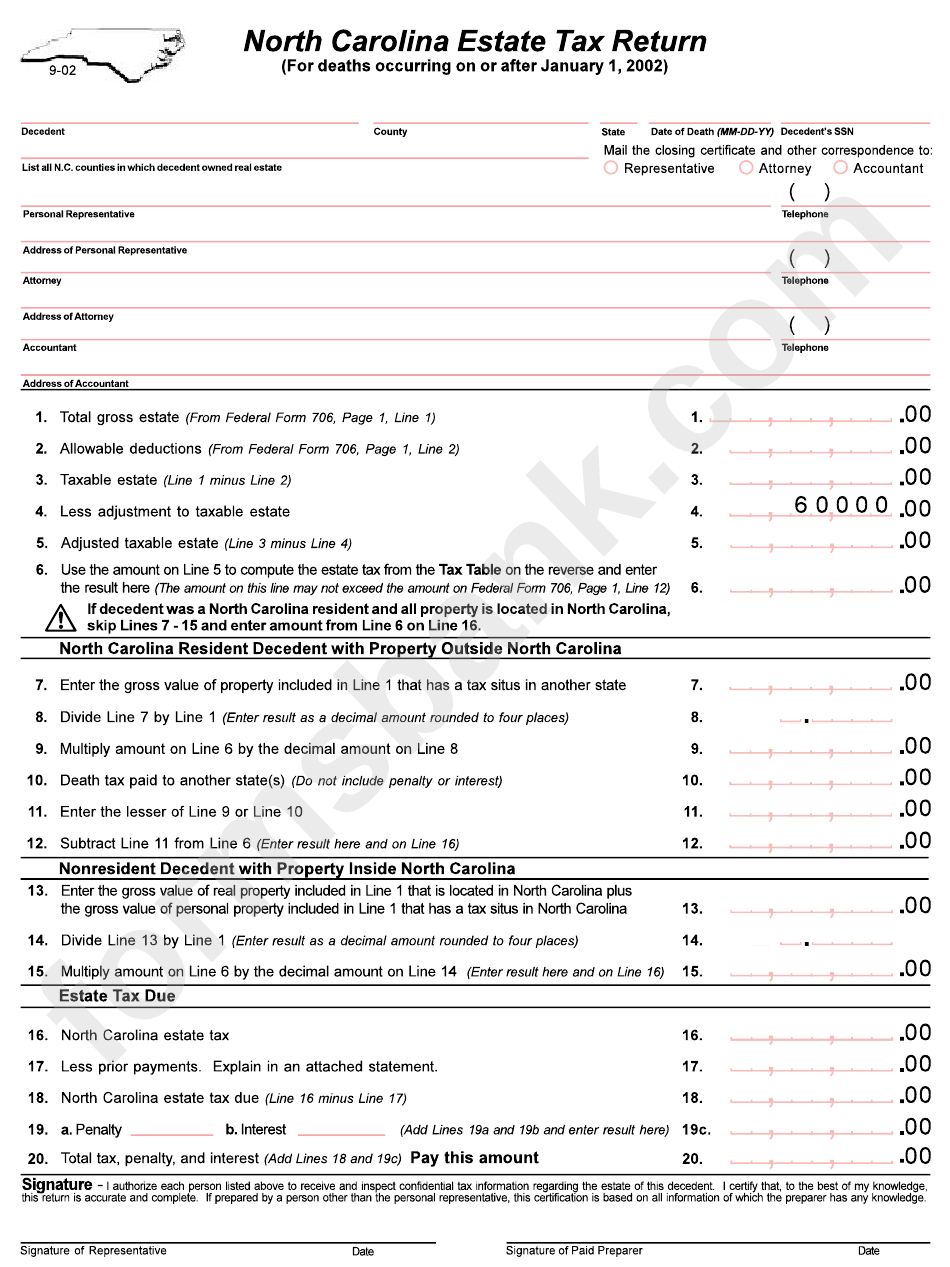

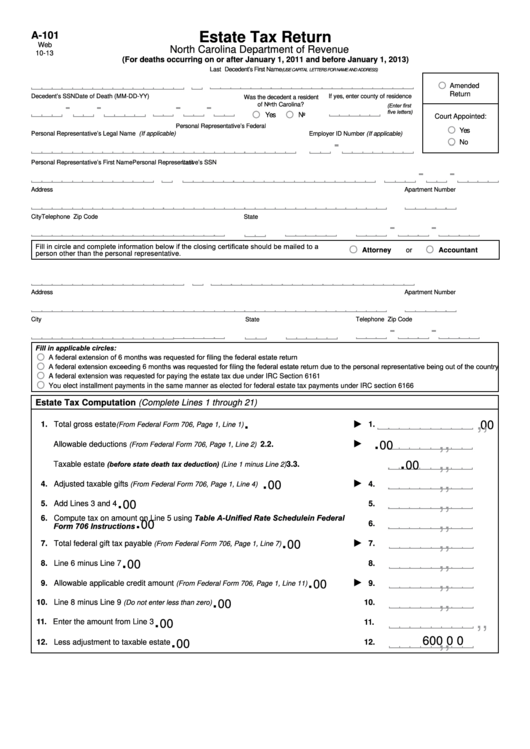

North Carolina Estate Tax Return Form Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/286/2868/286802/page_1_bg.png

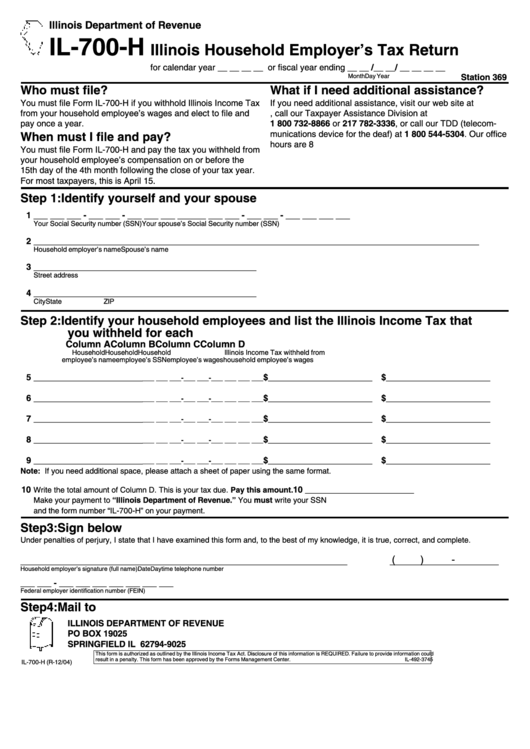

Form Il 700 H Illinois Household Employer S Tax Return Printable Pdf

https://data.formsbank.com/pdf_docs_html/221/2210/221058/page_1_thumb_big.png

Verkko Lines 6 through 9 Follow the instructions on the form IL 1310 R 12 20 Printed by authority of the State of Illinois web only 1 59712201W This form is authorized as outlined under the Illinois Income Tax Act Disclosure of this information is required Failure to provide information could result in a penalty Verkko When the tentative taxable estate plus adjusted taxable gifts exceeds 11 580 000 the Illinois Estate Tax Return Form 700 must include a copy of the Federal Form 706 with all schedules and attachments For both resident and nonresident decedents a preliminary tax prior to apportionment should be calculated assuming all assets are

Verkko 14 huhtik 2020 nbsp 0183 32 April 13 2020 10 00 PM PDT Illinois AG Extends Form 700 Filing Estate Tax Payment Deadline to July 15 Due to COVID 19 The Illinois Attorney General AG April 1 extended the dates for filing Form 700 and paying the state estate tax to July 15 The AG s office will operate with reduced staff due to closures related to the Verkko 12 elok 2020 nbsp 0183 32 The FORM 700 STATE OF ILLINOIS TRANSFER TAX ESTATE Illinois Attorney General form is 4 pages long and contains 0 signatures 9 check boxes 55 other fields Country of origin US File type PDF U S A forms for Illinois Attorney General BROWSE ILLINOIS ATTORNEY GENERAL IL FORMS Related forms

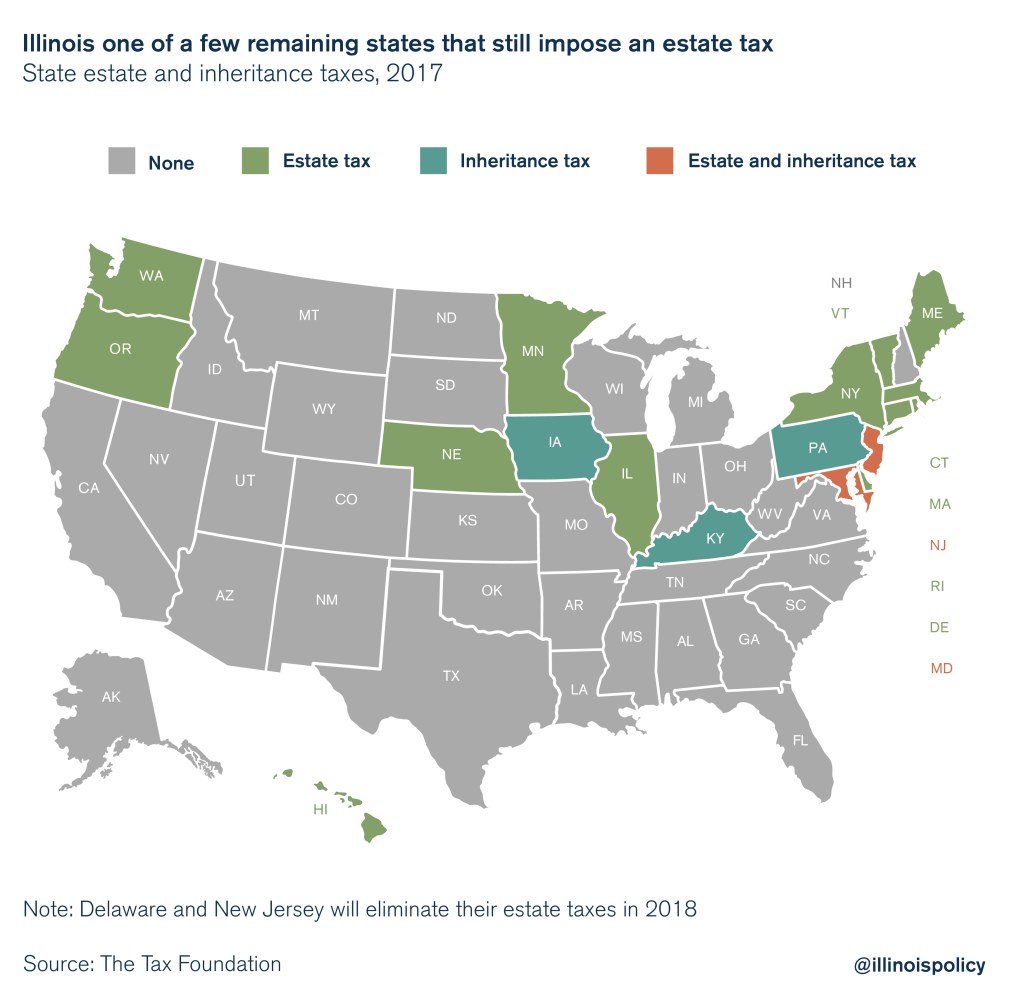

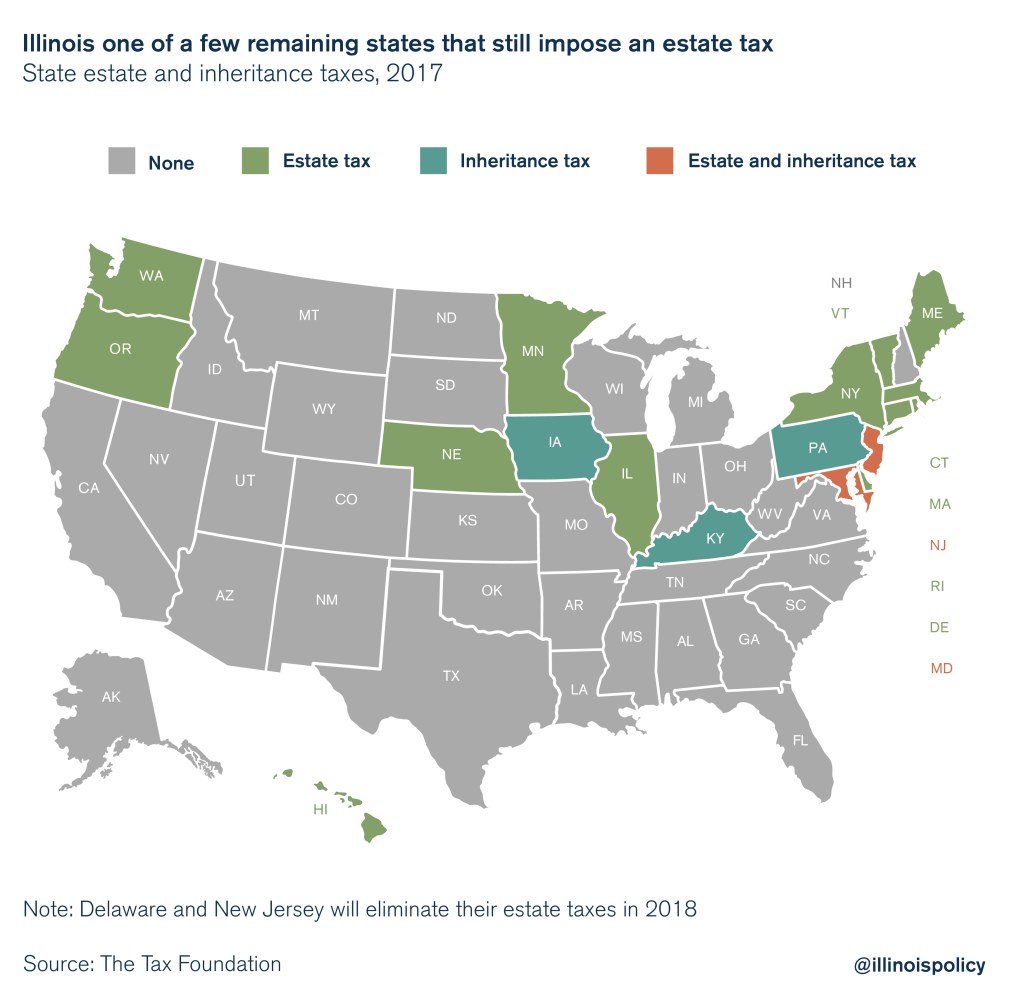

As Other States Repeal Illinois Death Tax Remains

https://files.illinoispolicy.org/wp-content/uploads/2017/11/Estate-tax_Graphic-2-1024x1000.png

Here s When IRS Will Start Accepting Tax Returns In 2023 Al

https://www.al.com/resizer/krc8eeQr-0G_LEI9_f5VjPi3P8o=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/XTF5BGYTKZCIZABPEIAPM6BJ3Y.jpg

https://ag.state.il.us/publications/estatetax.html

Verkko Form 700 estate and generation skipping tax 2009 Decedents Estate Tax Calculator 187 2008 Decedents Estate Tax Instruction Sheet for 2006 2008 Decedents Form 700 estate and generation skipping tax 2007 2008 Decedents Estate Tax Calculator 187 2007 Decedents Estate Tax Instruction Sheet for 2006 2008 Decedents Form 700 estate

https://illinoisattorneygeneral.gov/estate-taxes

Verkko Extension Request Form Form700 EXT1 Inheritance Tax Releases An Illinois Inheritance Tax Release may be necessary if a decedent died before January 1 1983 If a release is required please call Chicago 312 814 2491 or Springfield 217 524 5095 for further assistance Estate Tax Forms

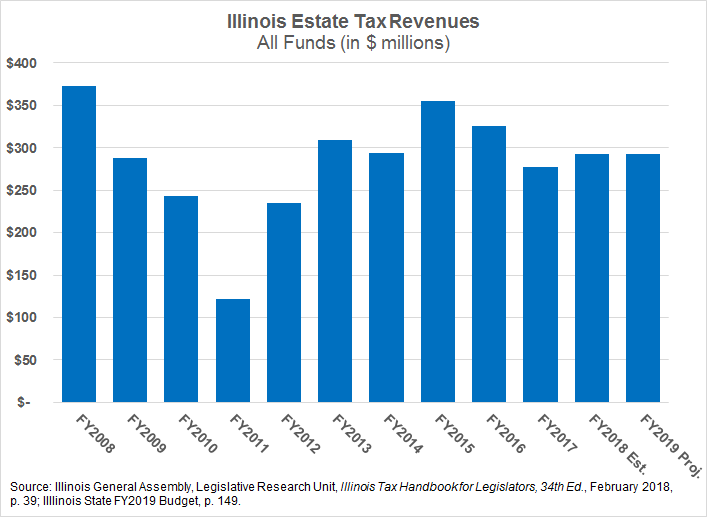

Whither The Illinois Estate Tax Civic Federation

As Other States Repeal Illinois Death Tax Remains

Fillable Form A 101 Estate Tax Return Printable Pdf Download

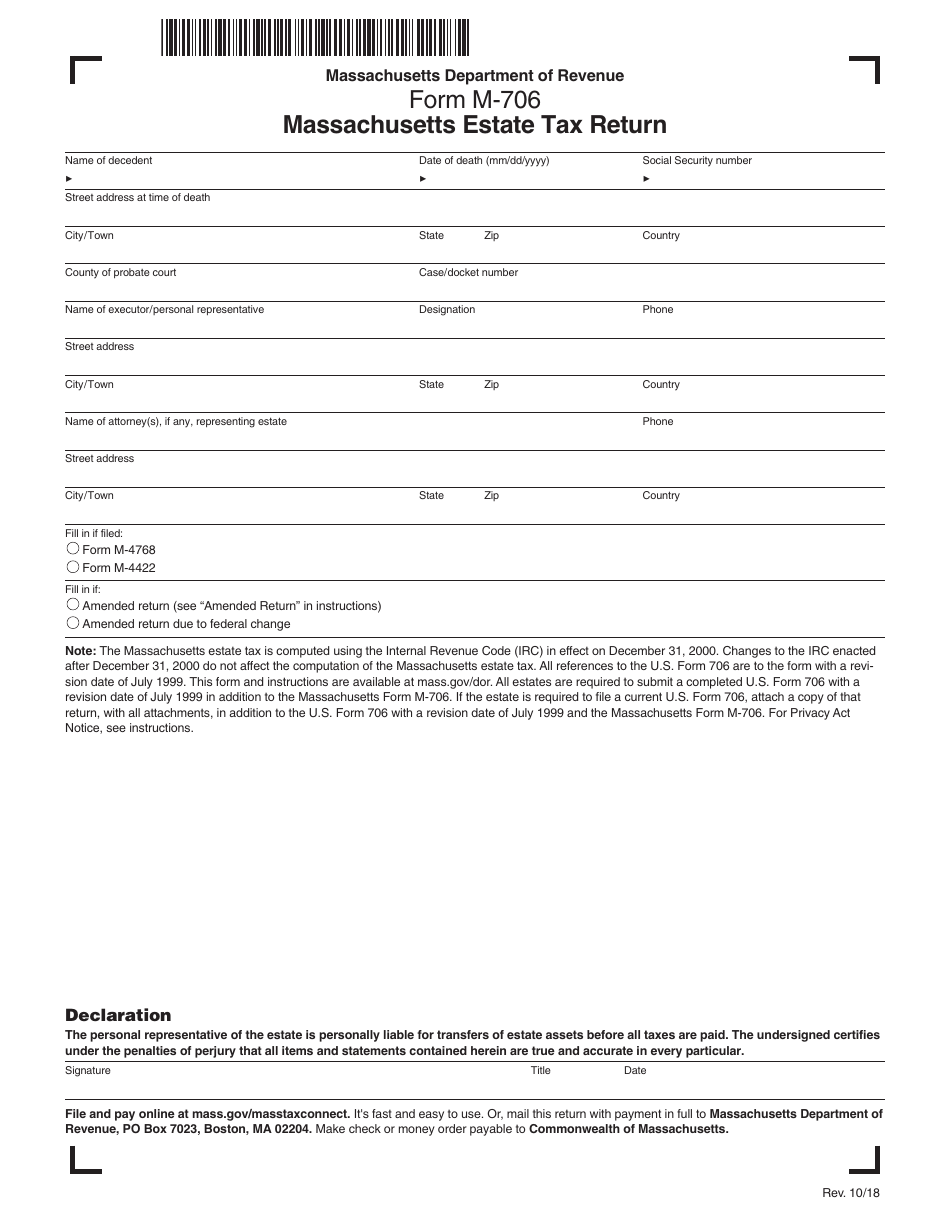

Ma Fillable Tax Forms Instructions Printable Forms Free Online

How To Transfer Land Title To Heirs In The Philippines Extrajudicial

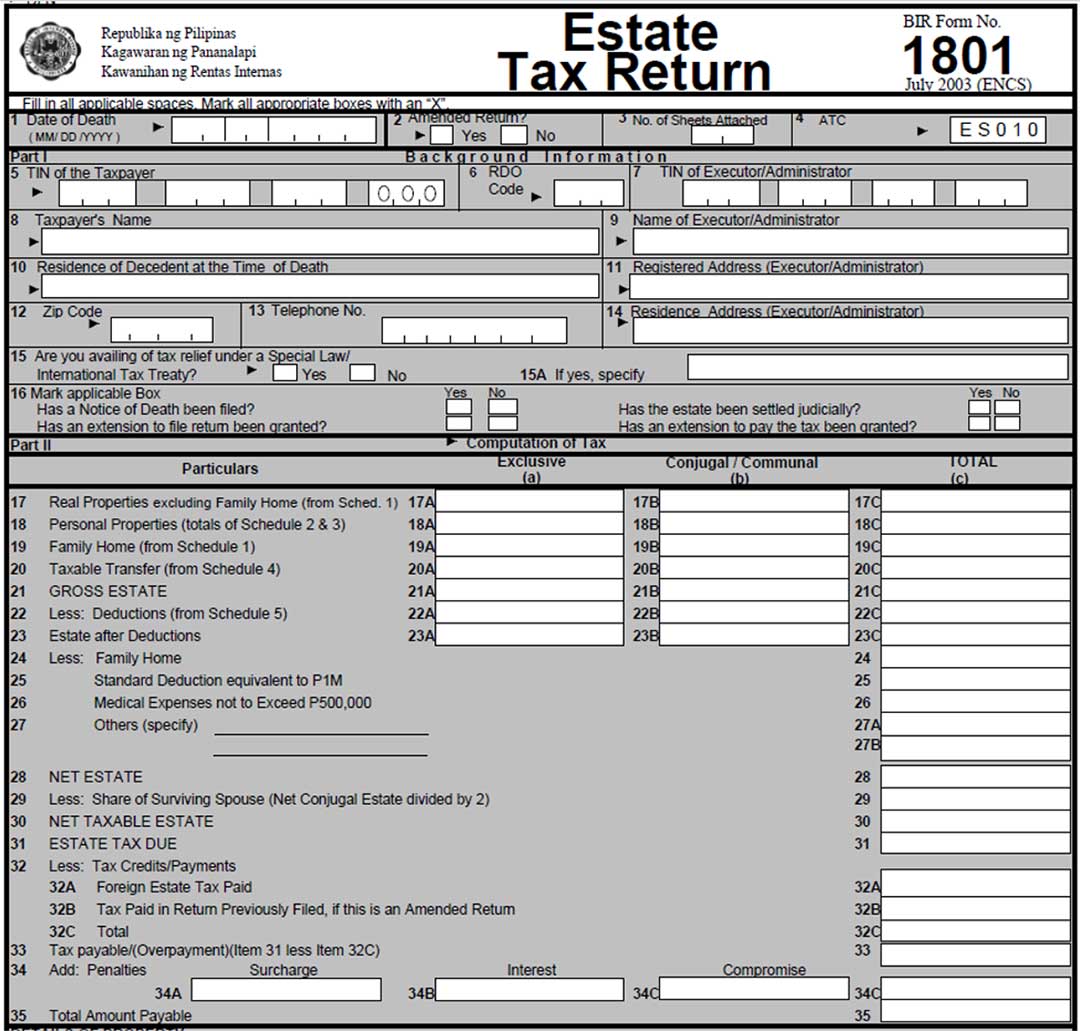

Estate Tax

Estate Tax

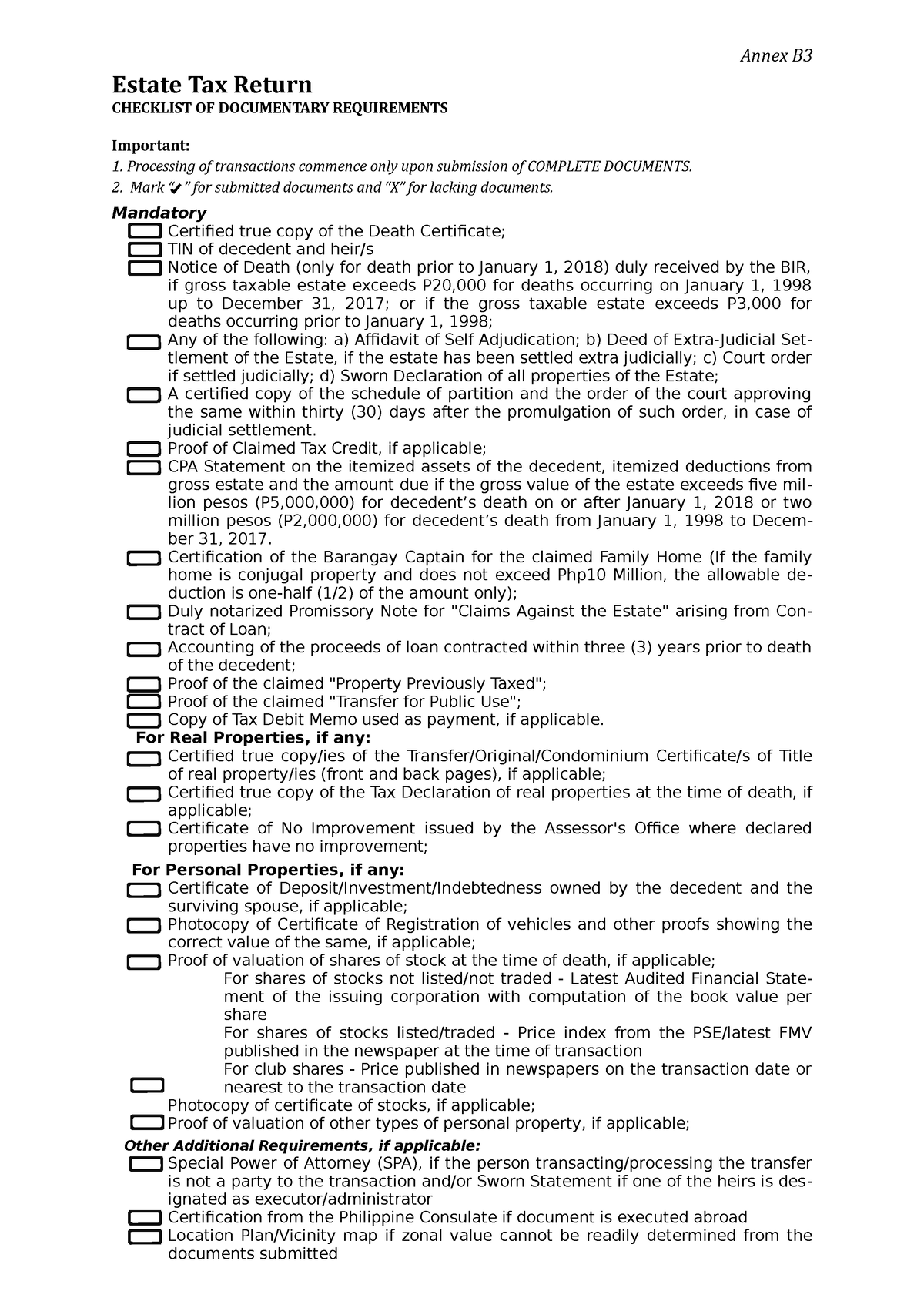

Annex B3 2022 Form Very Useful Annex B Estate Tax Return CHECKLIST OF

Illinois 1040 2017 2024 Form Fill Out And Sign Printable PDF Template

2016 Estate Tax Update Fairview Law Group

Illinois Estate Tax Return Form 700 - Verkko When the tentative taxable estate plus adjusted taxable gifts exceeds 5 450 000 the Illinois Estate Tax Return Form 700 must include a copy of the Federal Form 706 with all schedules and attachments For both resident and non resident decedents the tax base will be calculated assuming all assets are located within Illinois Line 6