Illinois Income Tax Rebate 2024 The Illinois Department of Revenue IDOR announced that it will begin accepting and processing 2023 tax returns on January 29 the same date the Internal Revenue Service begins accepting federal income tax returns For more information see the Illinois Department of Revenue Announces Start to 2024 Income Tax Season press release

Illinois federal income tax season 2024 opens Monday Dave Dawson Assistant editor Jan 26 2024 Routing and account number if due a refund and choose to deposit refund directly into Agency says it expects to receive more than 6 2 million individual tax returns this year The Illinois Department of Revenue IDOR announced it will begin accepting and processing 2023 tax returns for the 2024 tax season on January 29 the same date the Internal Revenue Service IRS begins accepting federal income tax returns Filing Returns

Illinois Income Tax Rebate 2024

Illinois Income Tax Rebate 2024

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Illinois-Income-Tax-Rebate-2023.jpg

How Illinois Income Tax Stacks Up Nationally For Earners Making 100K Center For Illinois

https://assets.website-files.com/5c2678bffd28a75624f00dde/5cd31a526475f07f02aced80_State Income Tax Rates for those Earning %24100%2C000-5.png

Illinois Tax Tables Brokeasshome

https://www.cmap.illinois.gov/documents/10180/36912/understanding-state-income-tax-increase_1-13-11.jpg/7f79b81f-2fbd-4d56-969c-ac40a3f00e73?t=1376341769000

ROCKFORD Ill WTVO The Illinois Department of Revenue IDOR announced Thursday that it will begin accepting and processing 2023 tax returns on January 29th 2024 That is also the same day The Illinois Department of Revenue IDOR announced on Thursday Jan 25 that it will begin accepting and processing 2023 tax returns on Monday Jan 29 the same date the Internal Revenue Service IRS begins accepting federal income tax returns In addition individuals may also use the site to

Thirty four states will ring in the new year with notable taxA tax is a mandatory payment or charge collected by local state and national governments from individuals or businesses to cover the costs of general government services goods and activities changes including 17 states cutting individual or corporate income taxes and some cutting both Illinois has a flat income tax rate of 4 95 without any higher tax brackets for those who earn greater incomes Taxpayers were required to submit their 2022 state income taxes on or before April 18 2023 And the rate remains the same for 2024

Download Illinois Income Tax Rebate 2024

More picture related to Illinois Income Tax Rebate 2024

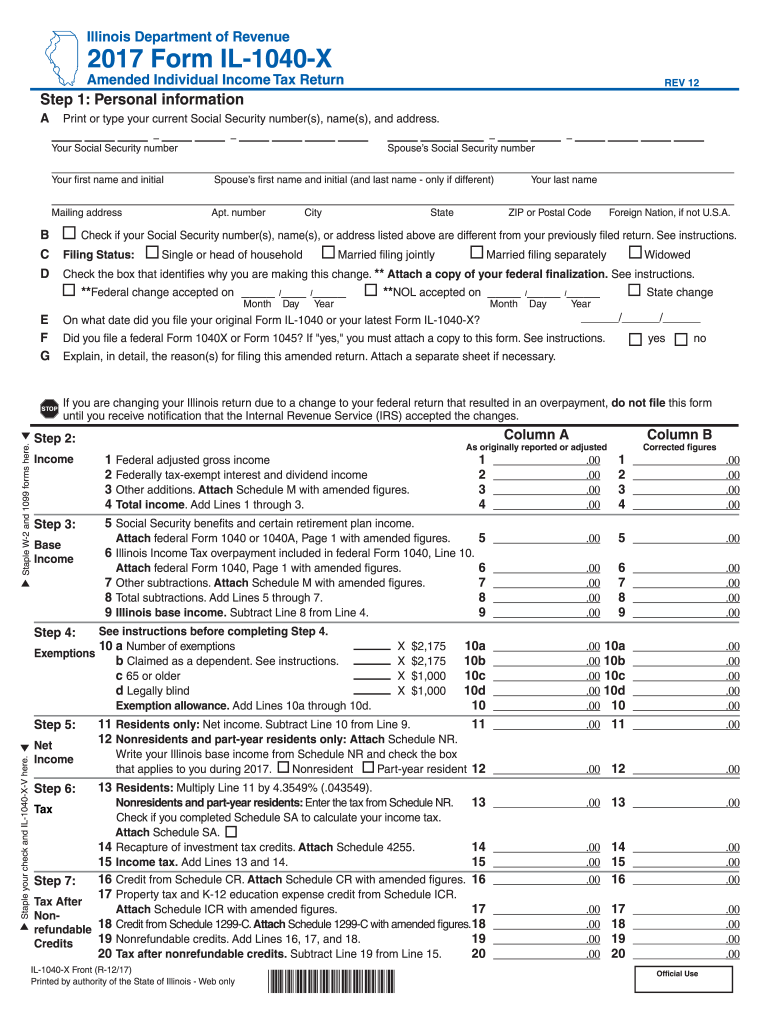

Illinois 1040 2017 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/453/14/453014487/large.png

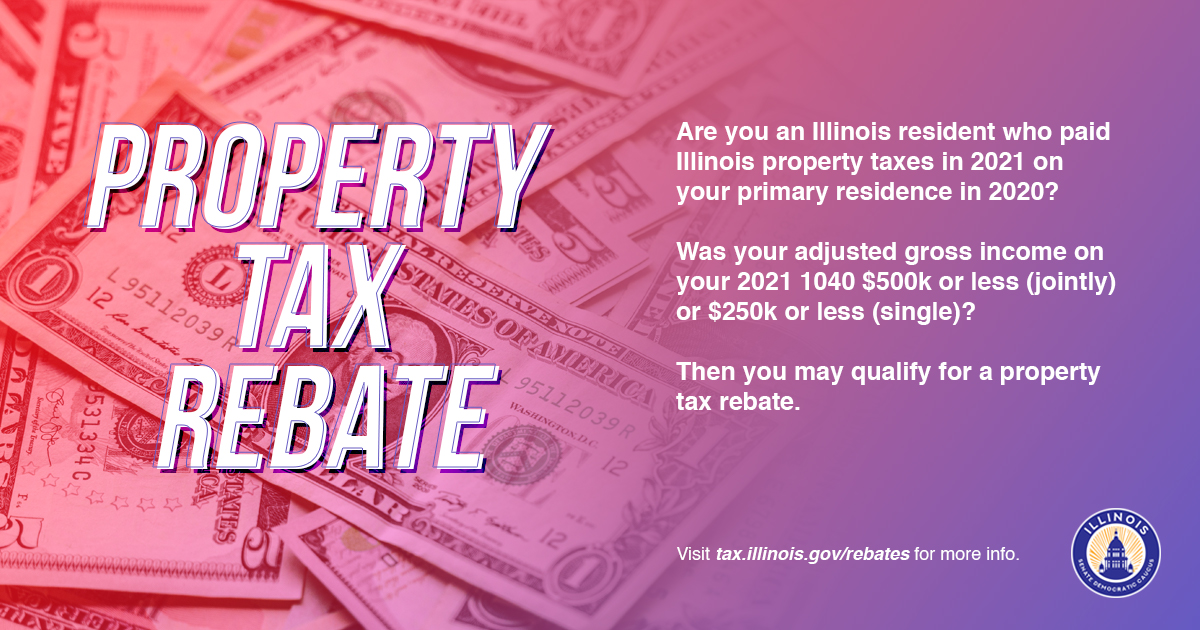

4 Things To Know About Illinois Income Property Tax Rebates

https://townsquare.media/site/723/files/2022/09/attachment-You.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

Illinois Tax Rebates 2022 Property Income Rebate Checks Being Sent To 6M Taxpayers Governor

https://cdn.abcotvs.com/dip/images/12224518_091222-wl-pritzker-img.png?w=1600

The individual income tax rebate is 50 per individual 100 for couples who file married filing jointly provided their federal adjusted gross income is less than 200 000 or 400 000 married filing jointly An additional 100 per dependent up to three dependents will be included in the rebates 2024 Income Tax Calculator Illinois State Income Tax Tables in 2024 The Income tax rates and personal allowances in Illinois are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in the Illinois Tax Calculator 2024

Income limits of 200 000 per individual taxpayer or 400 000 for joint filers will be attached to the checks according to officials To qualify you must have been an Illinois resident in Understanding the Illinois Income and Property Tax Rebates is important for CPAs or Enrolled Agents because your tax clients will be inquiring about eligibility You must file the Property Tax Rebate Form IL 1040 PTR either electronically through MyTax Illinois or by paper form by October 17 if your client s 2021 IL 1040 has not been

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Illinois Tax Rebate 2023 Everything You Need To Know Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/03/Illinois-Tax-Rebate-2023.png

https://tax.illinois.gov/research/news/illinois-department-of-revenue-announces-start-to-2024-income-ta.html

The Illinois Department of Revenue IDOR announced that it will begin accepting and processing 2023 tax returns on January 29 the same date the Internal Revenue Service begins accepting federal income tax returns For more information see the Illinois Department of Revenue Announces Start to 2024 Income Tax Season press release

https://www.myjournalcourier.com/news/article/income-tax-filing-season-2024-officially-opens-18628435.php

Illinois federal income tax season 2024 opens Monday Dave Dawson Assistant editor Jan 26 2024 Routing and account number if due a refund and choose to deposit refund directly into

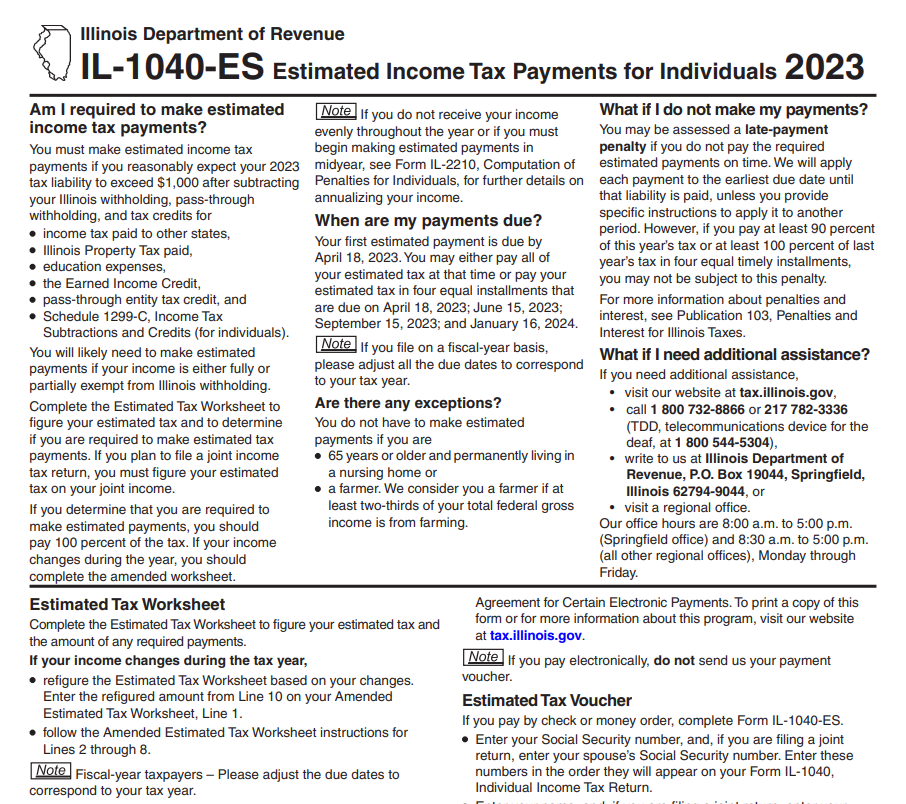

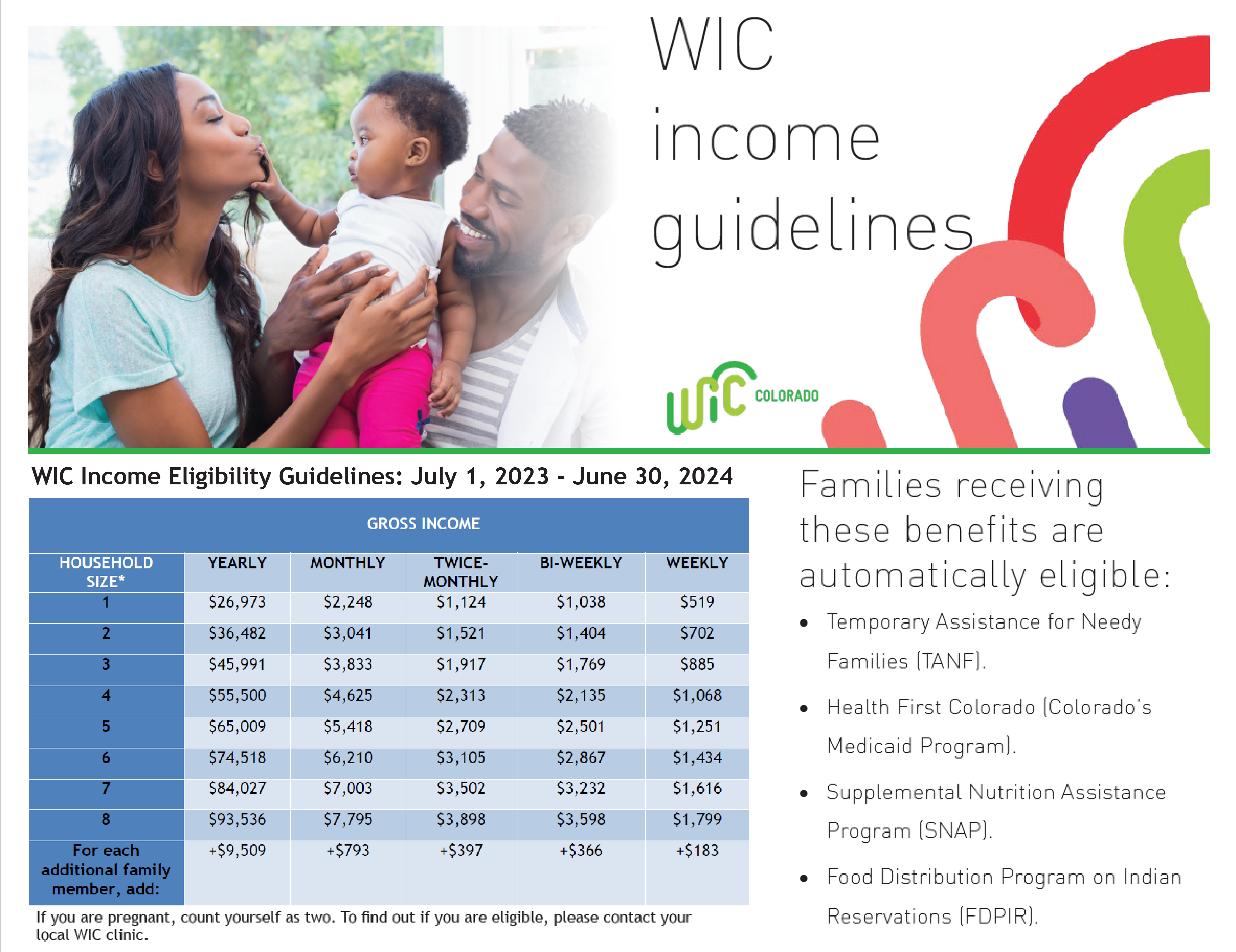

2023 2024 Income Eligibility Guidelines CDPHE WIC

Individual Income Tax Rebate

Stadelman Encourages Older Adults To Claim Their Property Tax Rebate

Tax Rebate FAQs Rep Thaddeus Jones

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

Illinois Tax Rebate Tracker Rebate2022

Illinois Tax Rebate Tracker Rebate2022

/cloudfront-us-east-1.images.arcpublishing.com/gray/JWN5HIT5AZABVOENKVEEIJW4GM.jpg)

Illinois Rolls Out Income Property Tax Rebates

Income Tax Rebate U s 87A For The Financial Year 2022 23

Illinois Income And Property Tax Rebate Distribution Begins Next Month Here s How Much Relief

Illinois Income Tax Rebate 2024 - FY 2024 18 December 2023 Bulletin What s New for Illinois Income Taxes This bulletin summarizes changes for 2023 Illinois Income Tax forms and schedules for individuals and businesses 2024 Withholding Income Tax forms and schedules and tax preparers and software developers General Tips and Information for the Filing Season