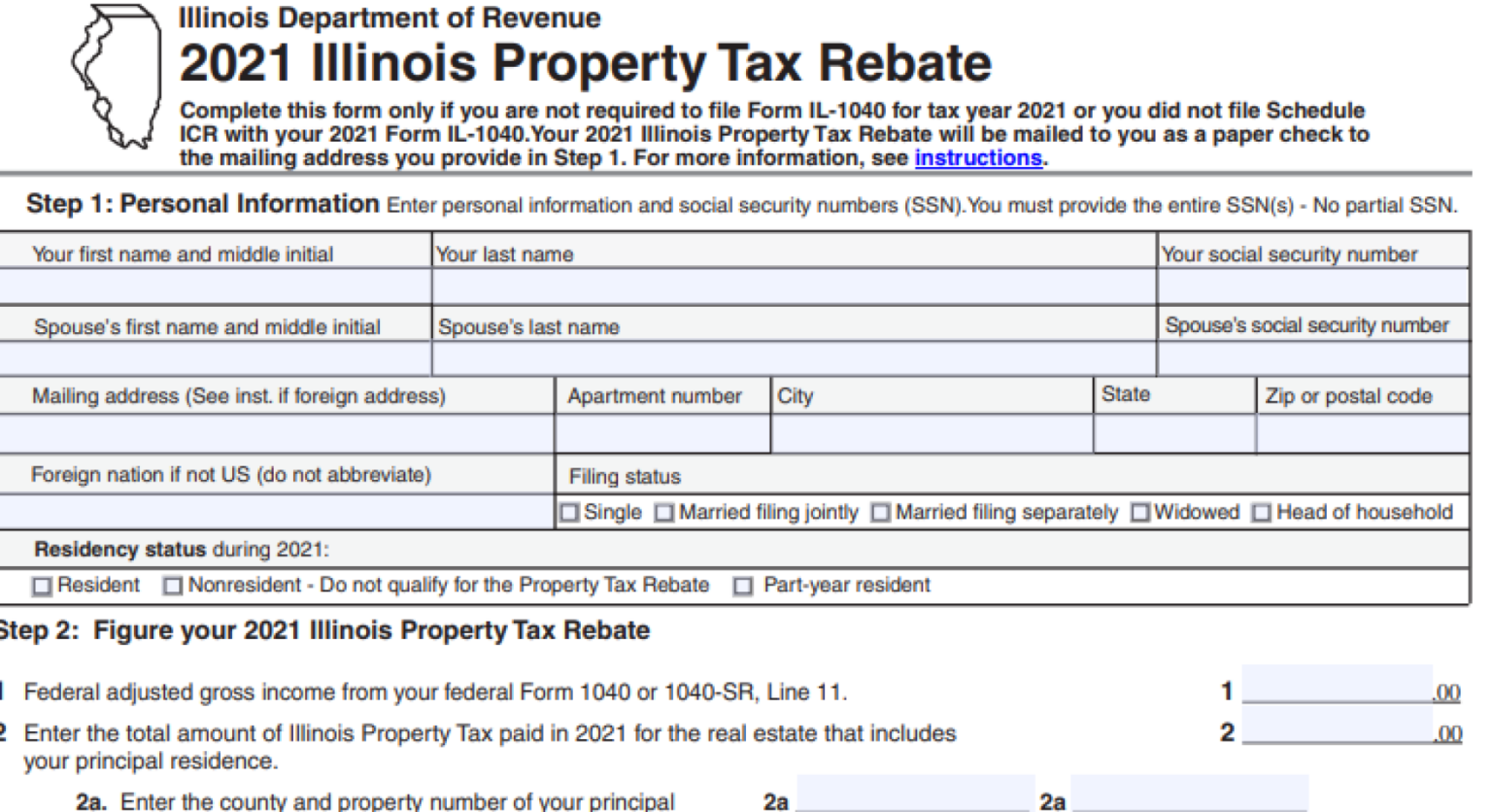

Illinois Income Tax Rebate Taxable Web 12 f 233 vr 2023 nbsp 0183 32 The IRS said in a press release that in the interest of sound tax administration residents in most states including Illinois will not be required to report

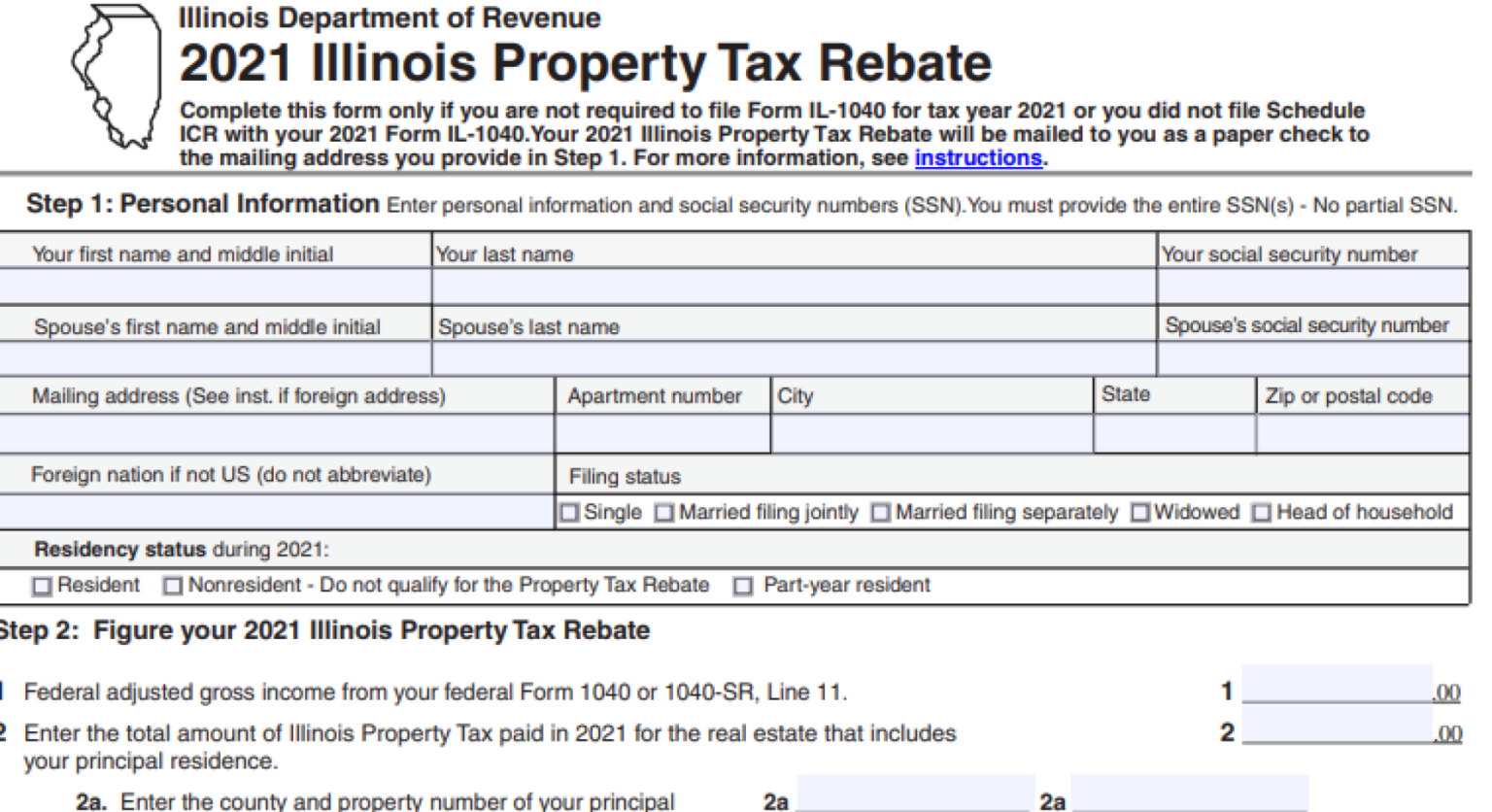

Web 20 janv 2023 nbsp 0183 32 The Illinois Property Tax and Income Tax Rebates are not taxable by Illinois and do not have to be reported on your Illinois tax return However if you Web The state of Illinois is providing an individual income tax rebate in the amount of 50 00 per person 100 00 per couple for married filing jointly and 100 00 per dependent

Illinois Income Tax Rebate Taxable

Illinois Income Tax Rebate Taxable

https://www.latestrebate.com/wp-content/uploads/2023/02/retirees-need-to-take-action-for-latest-property-tax-rebate-npr-illinois-1-1536x836.png

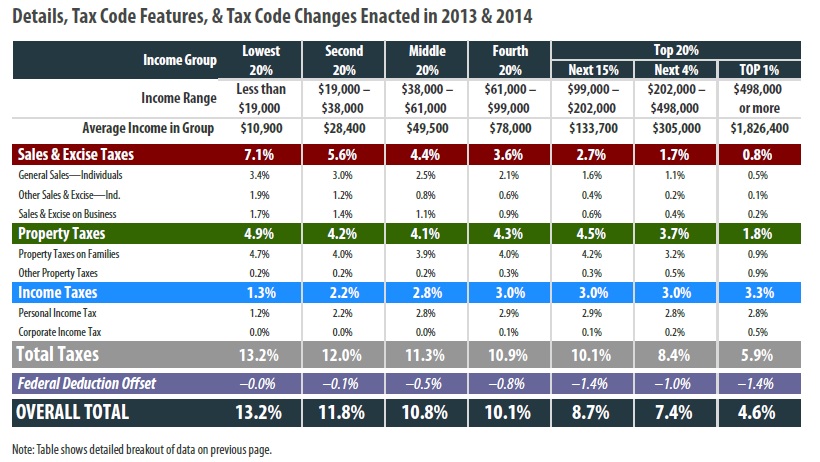

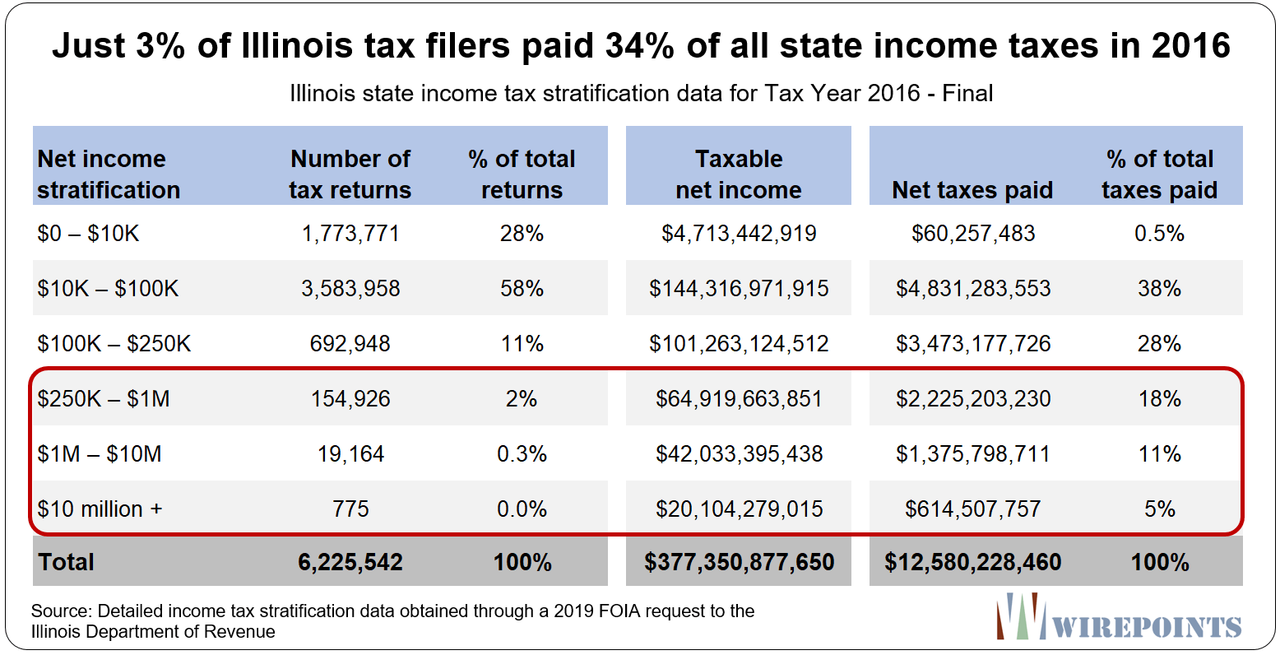

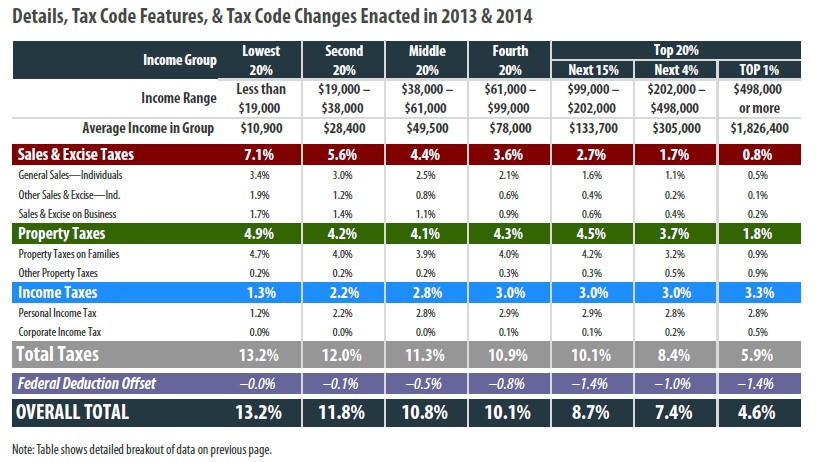

Illinois ITEP

https://itep.org/wp-content/uploads/IllinoisTable.jpg

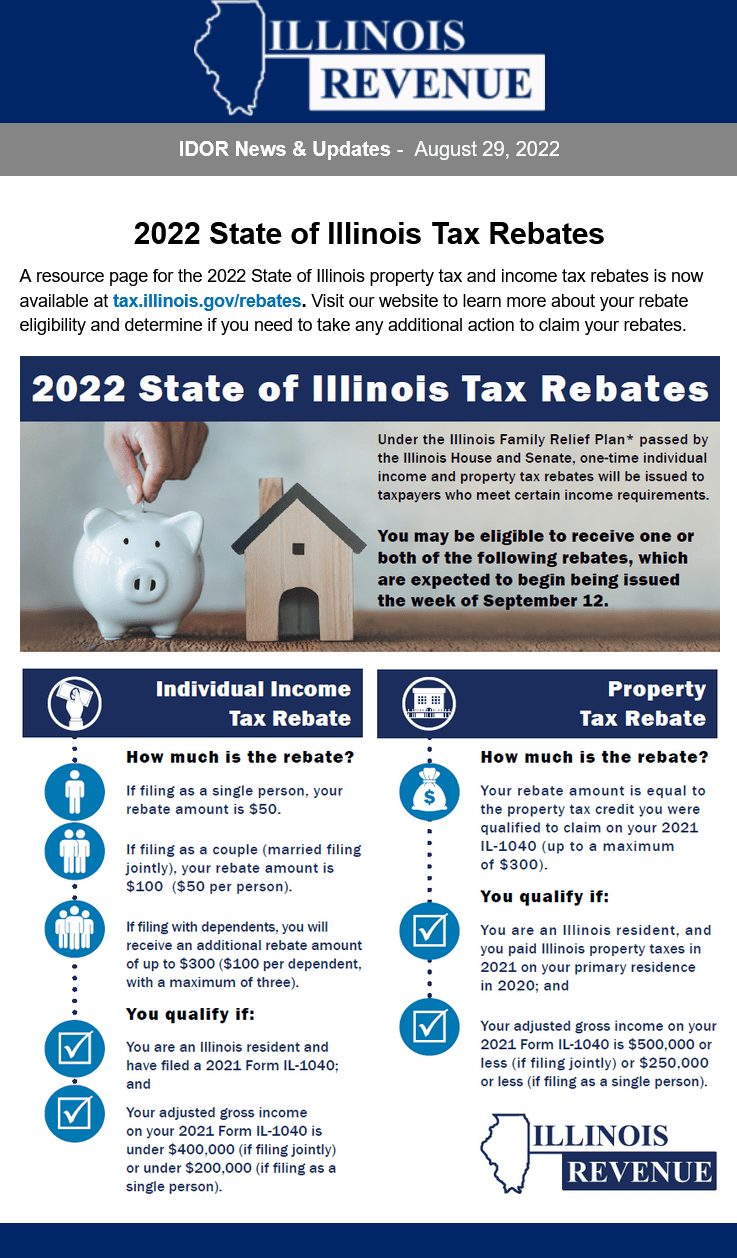

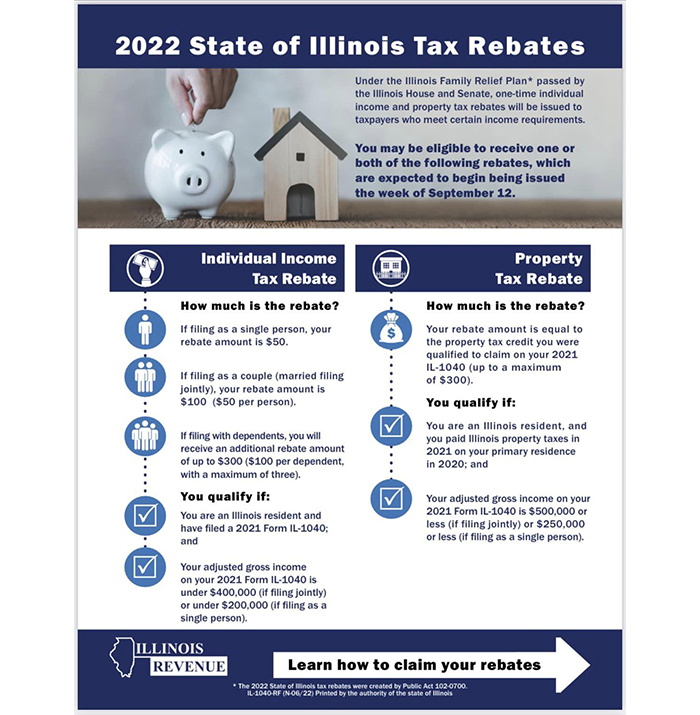

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

https://www.eztaxreturn.com/blog/wp-content/uploads/2022/08/Screenshot-2022-08-29-at-17-11-37-2022-State-of-Illinois-Tax-Rebates.png

Web 100 50 per person If filing with dependents you will receive an additional rebate amount of up to 300 100 per dependent with a maximum of three You qualify if You Web 10 f 233 vr 2023 nbsp 0183 32 This means that people in the following states do not need to report these state payments on their 2022 tax return California Colorado Connecticut Delaware

Web 8 ao 251 t 2022 nbsp 0183 32 The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a maximum Web 12 sept 2022 nbsp 0183 32 The rebate is not allowed if a taxpayer s adjusted gross income for the taxable year exceeds 500 000 for returns with a federal filing status of married filing

Download Illinois Income Tax Rebate Taxable

More picture related to Illinois Income Tax Rebate Taxable

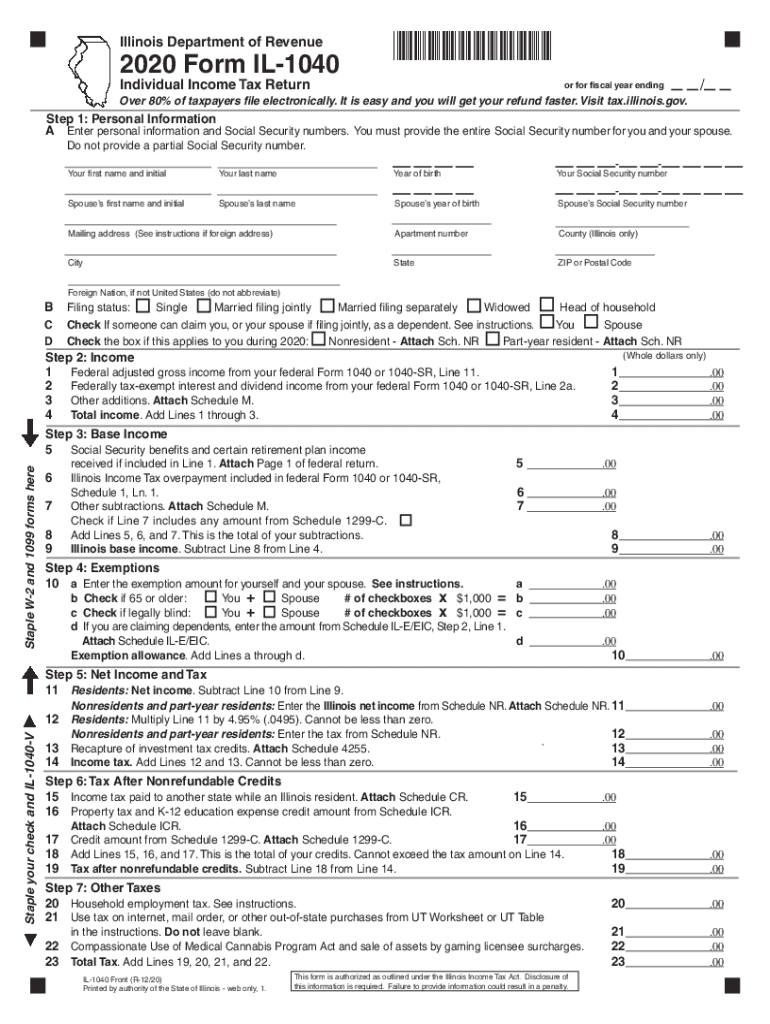

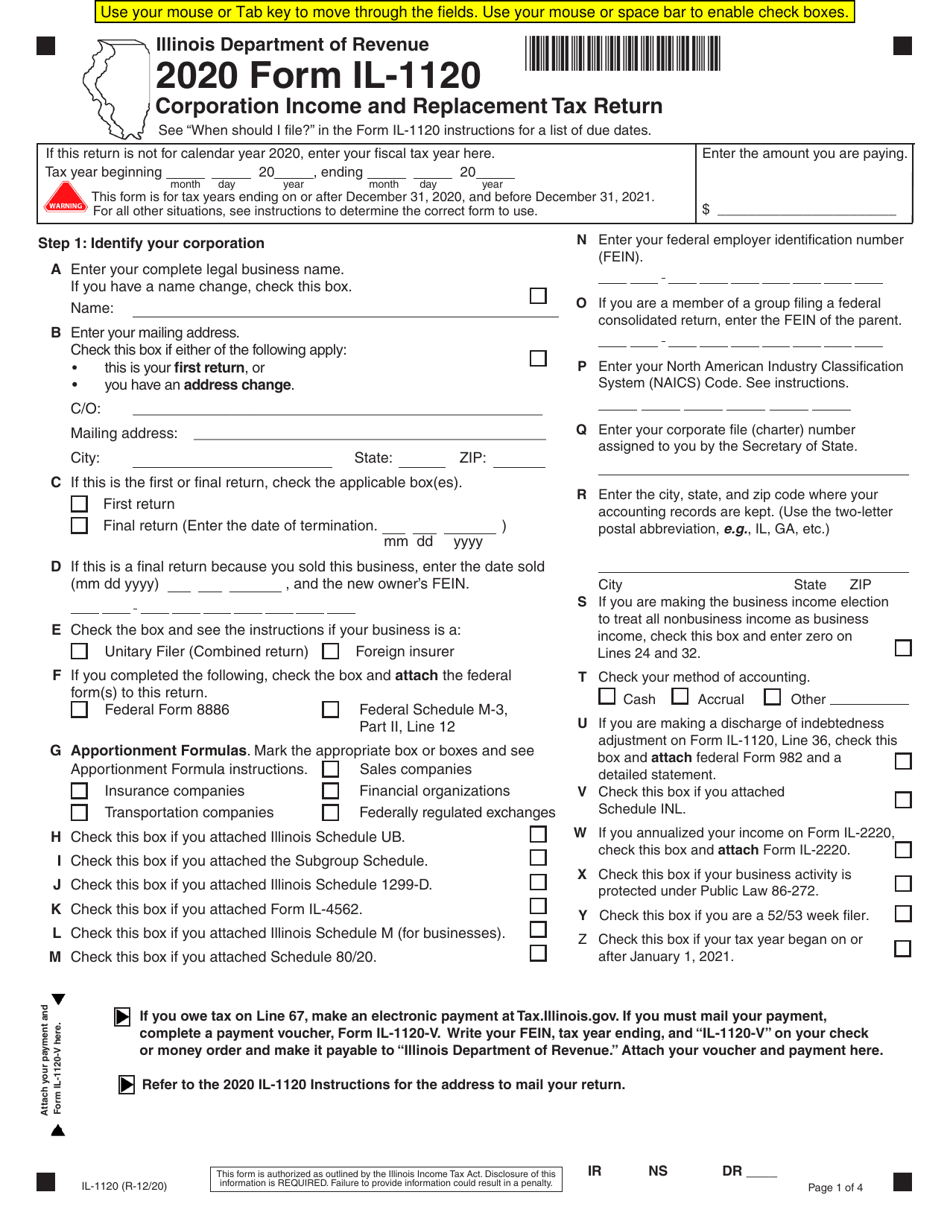

Illinois Tax Forms Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/552/409/552409798/large.png

Who Will Want To Be A Millionaire In Illinois Zero Hedge

https://zh-prod-1cc738ca-7d3b-4a72-b792-20bd8d8fa069.storage.googleapis.com/s3fs-public/inline-images/Just-3-of-Illinois-tax-filers-paid-34-of-all-state-income-taxes-in-2016.png

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

https://repsnessil66.com/wp-content/uploads/2022/09/2022-State-Tax-Rebate-Info_1-post.jpg

Web 8 f 233 vr 2023 nbsp 0183 32 The Internal Revenue Service is recommending that taxpayers hold off on filing their tax returns for 2022 if they received a special tax refund or payment from their Web Filing Help for Requesting Individual Income Tax Rebate and Property Tax Rebate By law Monday October 17 2022 was the last day to submit information to receive the Illinois

Web 23 ao 251 t 2022 nbsp 0183 32 Illinois Tax Rebates for 2022 A provision in this year s Illinois Family Relief Plan allows for one time rebates for Illinois residents for both individual income taxes Web 12 sept 2022 nbsp 0183 32 Income limits of 200 000 per individual taxpayer or 400 000 for joint filers will be attached to the checks according to officials To qualify you must have been an

38 Best Reboot Illinois Infographics Images On Pinterest Info

https://i.pinimg.com/736x/0f/1f/e4/0f1fe40a01a0a91ad973038876ace0e8--infographics-illinois.jpg

Form IL 1120 Download Fillable PDF Or Fill Online Corporation Income

https://data.templateroller.com/pdf_docs_html/2126/21266/2126633/form-il-1120-corporation-income-and-replacement-tax-return-illinois_print_big.png

https://www.nbcchicago.com/news/local/irs-issues-clarification-on...

Web 12 f 233 vr 2023 nbsp 0183 32 The IRS said in a press release that in the interest of sound tax administration residents in most states including Illinois will not be required to report

https://ttlc.intuit.com/community/taxes/discussion/illinois-income-tax...

Web 20 janv 2023 nbsp 0183 32 The Illinois Property Tax and Income Tax Rebates are not taxable by Illinois and do not have to be reported on your Illinois tax return However if you

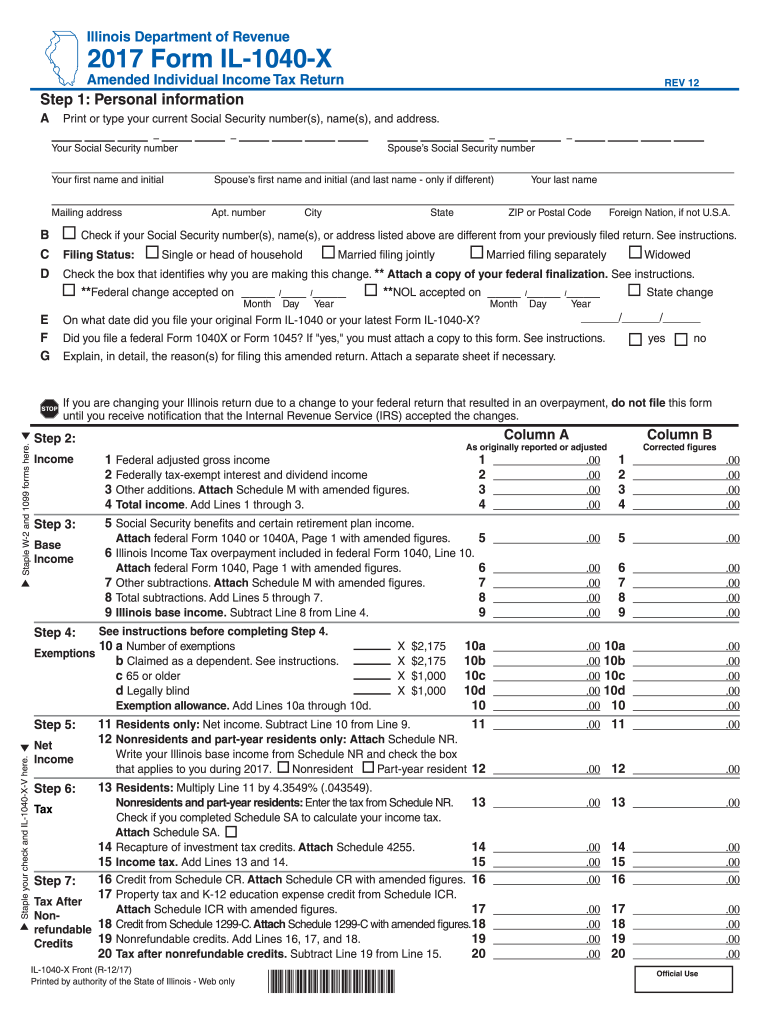

2017 Form IL DoR IL 1040 X Fill Online Printable Fillable Blank

38 Best Reboot Illinois Infographics Images On Pinterest Info

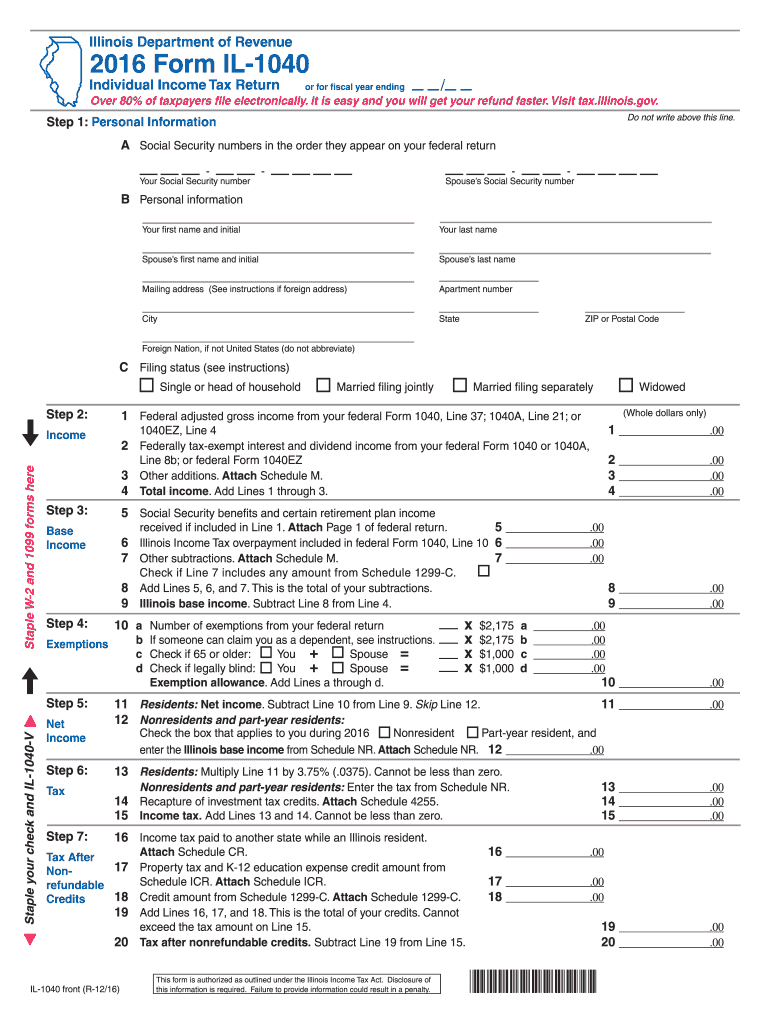

Illinois Form Tax 2016 Fill Out Sign Online DocHub

Illinois Property Tax Rebate Form 2023 Printable Rebate Form

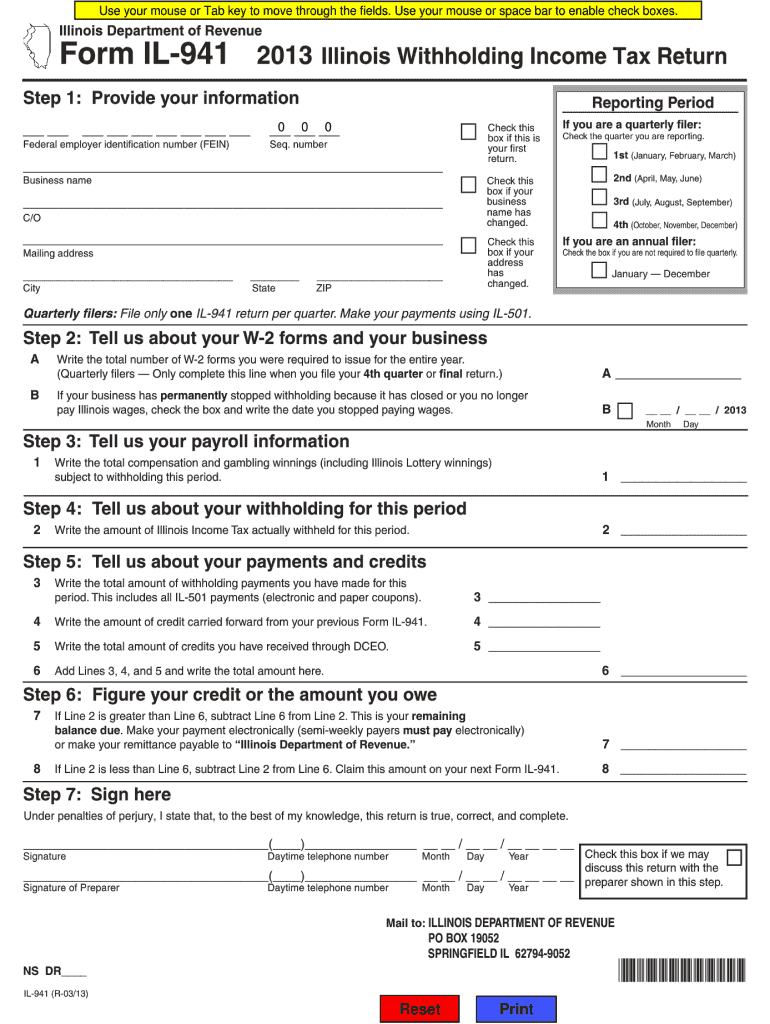

Illinois With Holding Income Tax Return Wikiform Fill Out And Sign

The Latest Stimulus Checks Illinois 2022 Tax Rebates

The Latest Stimulus Checks Illinois 2022 Tax Rebates

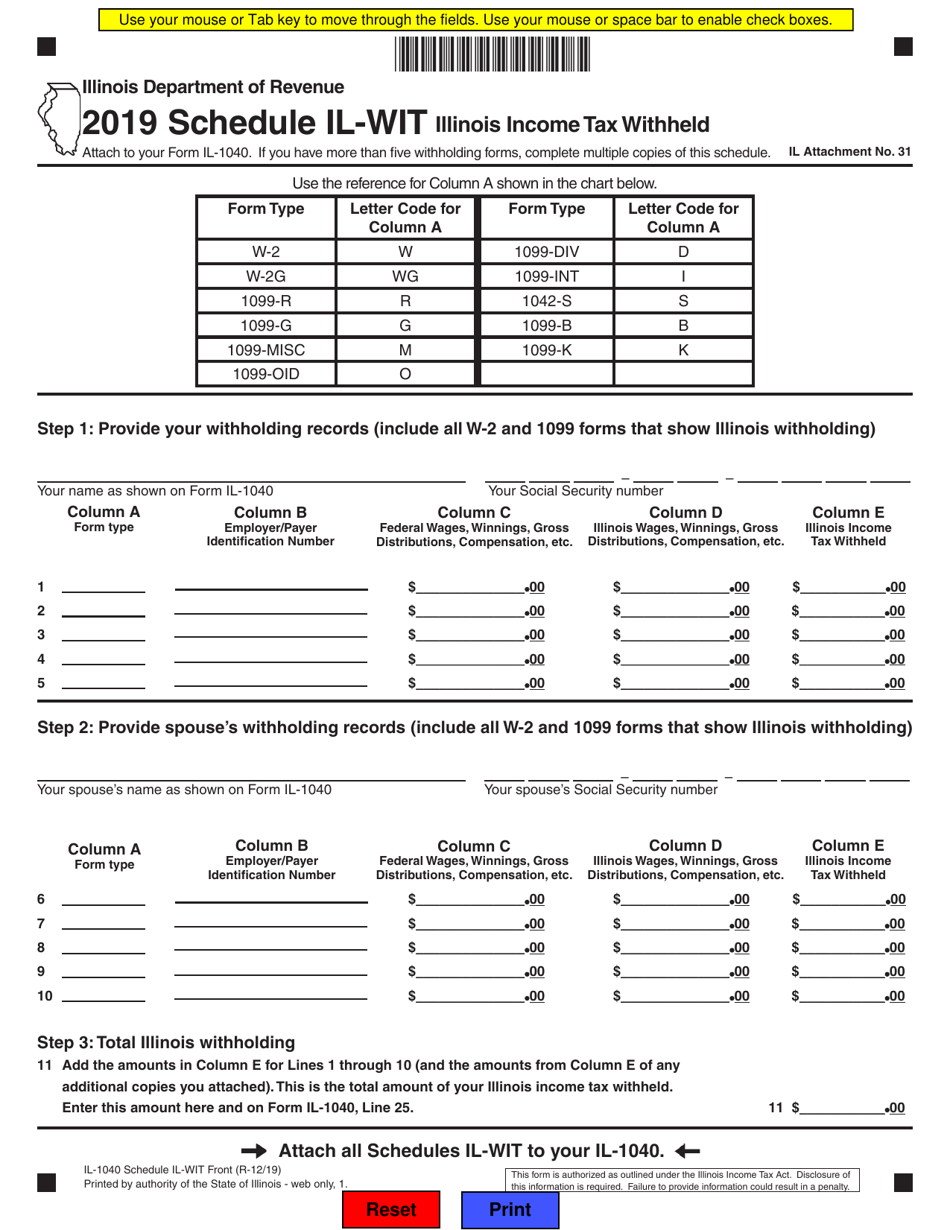

Form IL 1040 Schedule IL WIT Download Fillable PDF Or Fill Online

Three Chicago Fed Economists Say They Know How To Tax Illinoisans

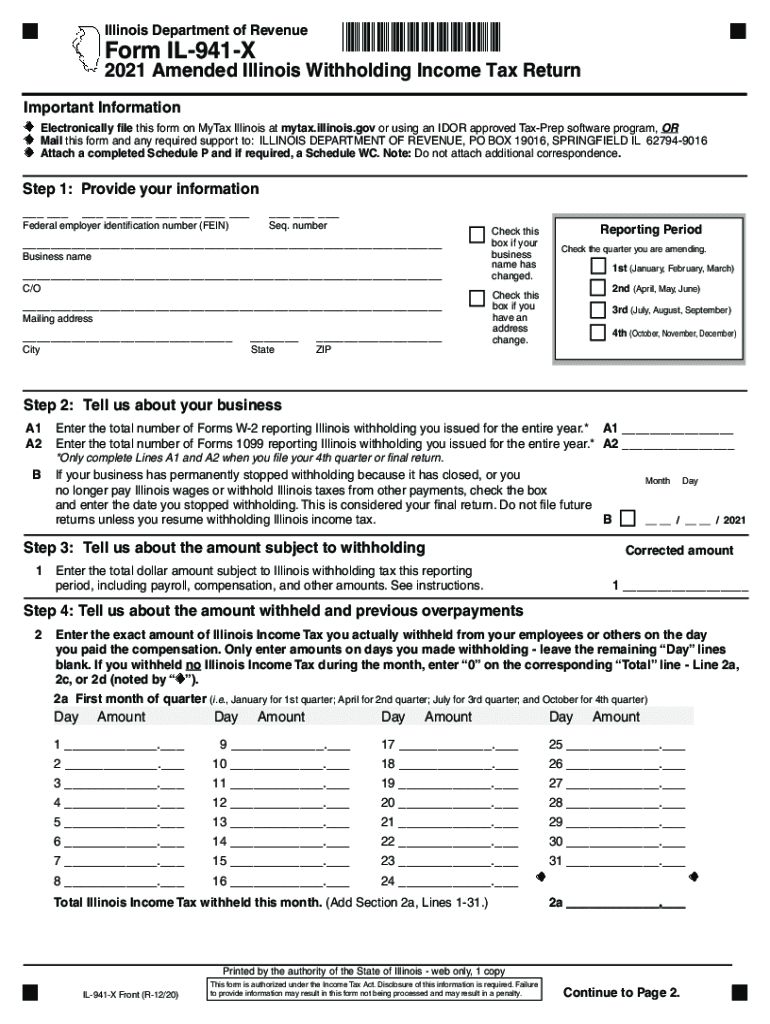

Illinois Unemployment 941x Fill Out Sign Online DocHub

Illinois Income Tax Rebate Taxable - Web Effective June 7 2023 Public Act 103 0009 maintained the 2022 Individual Income Tax personal exemption allowance at 2 425 for 2023 Resources pertaining to this change