Illinois Income Tax Rebates Web Tax Rebate Individual Income Tax Rebate How much is the rebate If filing as a single person your rebate amount is 50 If filing as a couple married filing jointly your

Web Tax Rebate Individual Income Tax Rebate How much is the rebate If filing as a single person your rebate amount is 50 If filing as a couple married filing jointly your Web If you have already filed your 2021 IL 1040 Illinois Individual Income Tax Return and Schedule ICR Illinois Credits you do not have to take any action Your rebates will be

Illinois Income Tax Rebates

Illinois Income Tax Rebates

https://files.illinoispolicy.org/wp-content/uploads/2016/08/IL-High-Tax-Graphics2-1024x642.png

Illinois Is A High tax State Illinois Policy

https://files.illinoispolicy.org/wp-content/uploads/2016/08/IL-High-Tax-Graphics41-1024x614.png

Income Tax Rebate 2023 Illinois LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/retirees-need-to-take-action-for-latest-property-tax-rebate-npr-illinois-1-1536x836.png

Web 12 sept 2022 nbsp 0183 32 Income limits of 200 000 per individual taxpayer or 400 000 for joint filers will be attached to the checks according to officials To qualify you must have been an Web 8 d 233 c 2022 nbsp 0183 32 The size of your income tax rebate depends on your filing status and the number of dependents claimed on your 2021 Illinois tax return Each qualifying person

Web 23 ao 251 t 2022 nbsp 0183 32 The maximum for the individual income and property tax rebates is 300 with up to three dependents qualifying as a dependent for the income tax rebate Who is eligible for 2022 Web 30 juin 2022 nbsp 0183 32 Rebate amounts will vary based on qualification if you made less than 200 000 in 2021 you will see 50 income tax rebate checks automatically issued to you Couples filing jointly with incomes

Download Illinois Income Tax Rebates

More picture related to Illinois Income Tax Rebates

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

https://www.eztaxreturn.com/blog/wp-content/uploads/2022/08/Screenshot-2022-08-29-at-17-11-37-2022-State-of-Illinois-Tax-Rebates.png

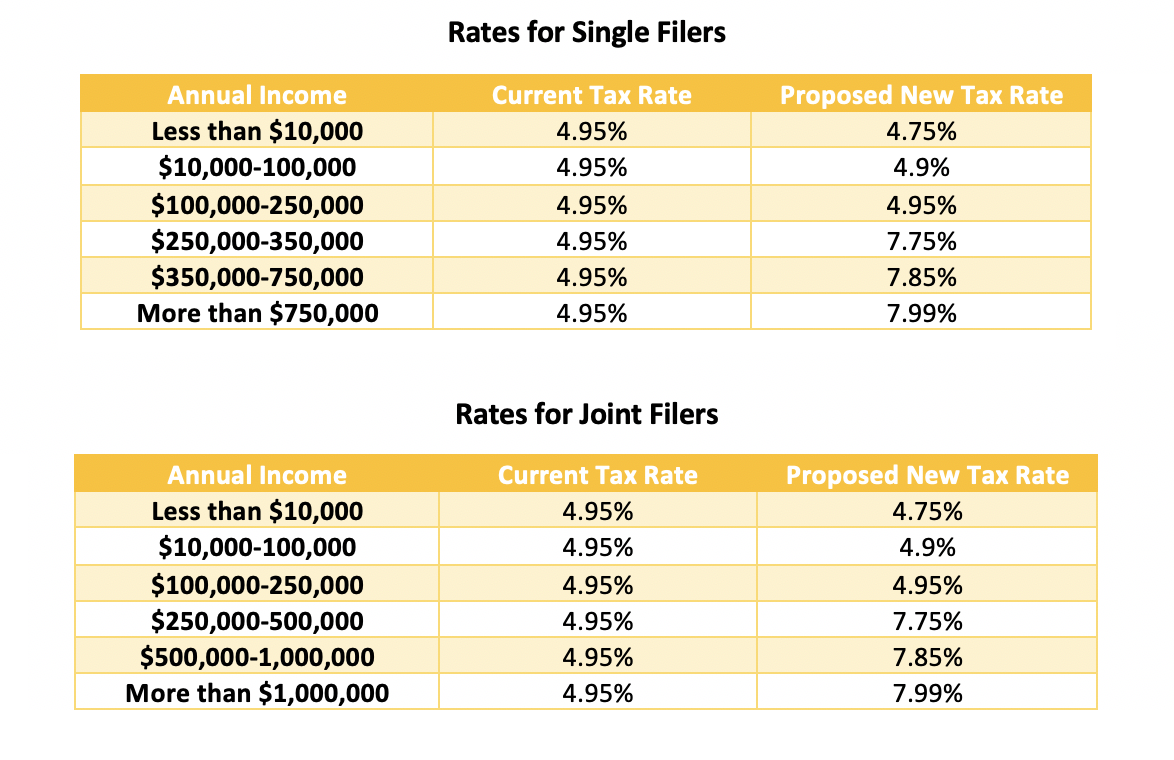

How Much Would You Pay In Illinois Income Tax Under Pritzker Plan

https://patch.com/img/cdn20/users/22915293/20190312/030741/styles/raw/public/processed_images/PRITZKER RATES-1552417661-474.jpg

Cut Taxes Raise Revenue Can Illinois Tax Plan Work For Colorado

https://www.bellpolicy.org/wp-content/uploads/2019/06/Screen-Shot-2019-06-17-at-8.49.43-AM.png

Web 13 sept 2022 nbsp 0183 32 Illinois Property Income Tax Relief Checks Are Headed to Millions When Could You Get One Under Gov J B Pritzker s Illinois Family Relief Plan one time Web 12 sept 2022 nbsp 0183 32 About 6 million Illinois taxpayers will start to receive income and property tax rebates Monday Gov JB Pritzker said Those who made less than 200 000 in

Web 29 ao 251 t 2022 nbsp 0183 32 On Sept 12 the state will start distributing one time income and property tax relief payments which were included in the Family Relief Plan a part of Illinois Gov Web 17 oct 2022 nbsp 0183 32 The income tax rebate is for Illinois residents who filed individually in 2021 and earned under 200 000 or filed jointly and made under 400 000 To be eligible for

Today Is The Final Day To Qualify For Illinois Income And Property Tax

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA133fb8.img?w=2264&h=1323&m=4&q=75

Deadline To Fill Out Form For Illinois Income And Property Tax Rebates

https://ic-cdn.flipboard.com/nbcchicago.com/743ca2ac42da3431ceb693caf903fa4244b05978/_medium.jpeg

https://tax.illinois.gov/content/dam/soi/en/web/tax/programs…

Web Tax Rebate Individual Income Tax Rebate How much is the rebate If filing as a single person your rebate amount is 50 If filing as a couple married filing jointly your

https://tax.illinois.gov/content/dam/soi/en/web/tax/programs…

Web Tax Rebate Individual Income Tax Rebate How much is the rebate If filing as a single person your rebate amount is 50 If filing as a couple married filing jointly your

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

Today Is The Final Day To Qualify For Illinois Income And Property Tax

How Illinois Income Tax Stacks Up Nationally For Earners Making 100K

Illinois Income And Property Tax Rebates Will Be Issued Starting Monday

2022 State Of Illinois Tax Rebates Scheffel Boyle

Pritzker Doubles Down On Progressive Income Tax Says Illinois Needs 3

Pritzker Doubles Down On Progressive Income Tax Says Illinois Needs 3

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

Three Chicago Fed Economists Say They Know How To Tax Illinoisans

Official Illinois Progressive Tax Explainer Ranges From Misleading To

Illinois Income Tax Rebates - Web 8 d 233 c 2022 nbsp 0183 32 The size of your income tax rebate depends on your filing status and the number of dependents claimed on your 2021 Illinois tax return Each qualifying person