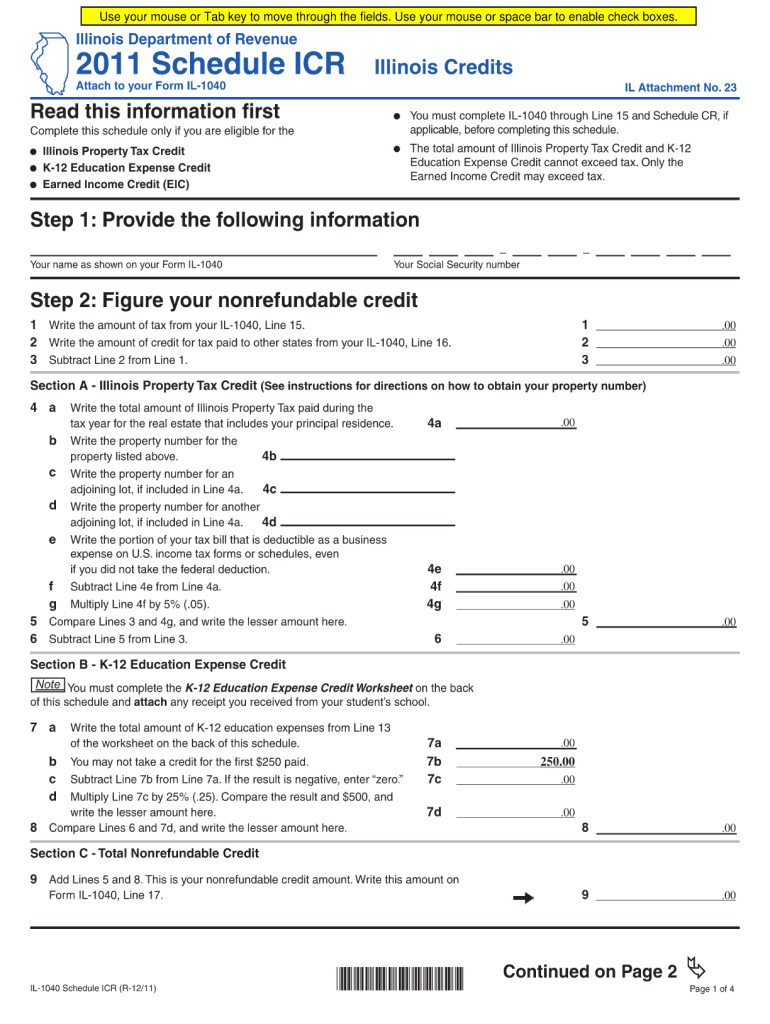

Illinois Property Tax Credit Form The Illinois Property Tax Credit is a credit on your individual income tax return Form IL 1040 equal to 5 percent of Illinois Property Tax real estate tax you paid on your

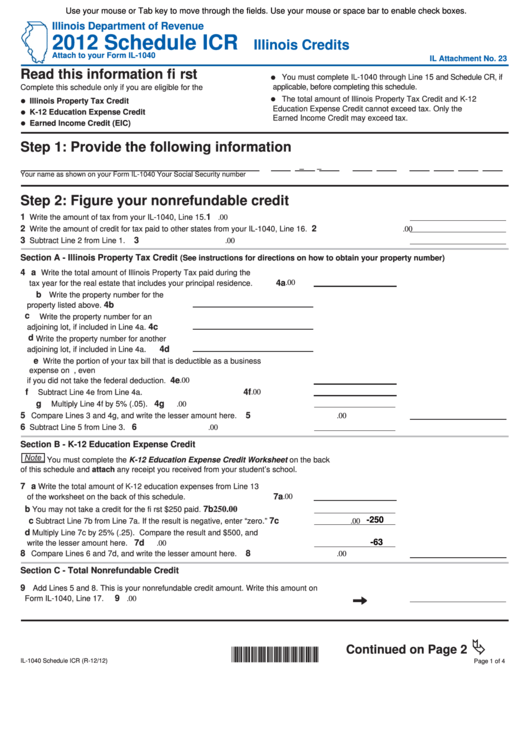

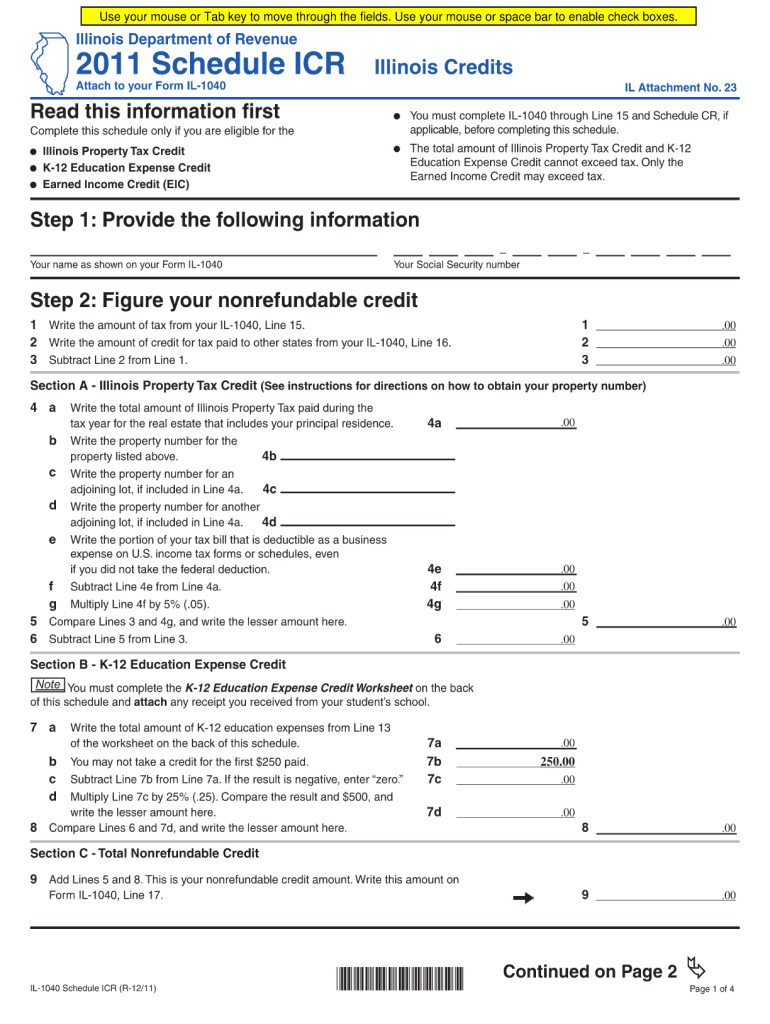

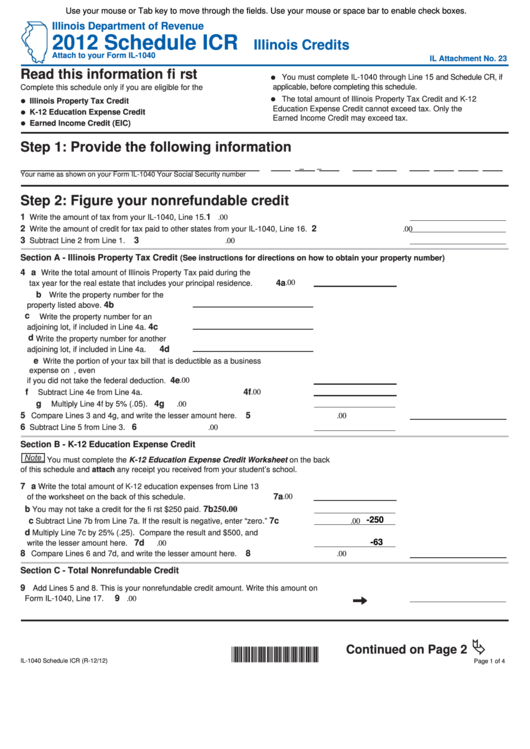

Schedule ICR Illinois Credits allows you to figure the total amount of property tax K 12 education expense and Volunteer Emergency Worker credits you may claim on Form IL Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To

Illinois Property Tax Credit Form

Illinois Property Tax Credit Form

https://storage.googleapis.com/proudcity/williamscountynd/uploads/2023/05/2023-Homestead-Credit-Program-Changes.jpg

Fillable Schedule Icr Attach To Your Form Il 1040 Illinois Credits

https://data.formsbank.com/pdf_docs_html/322/3225/322571/page_1_thumb_big.png

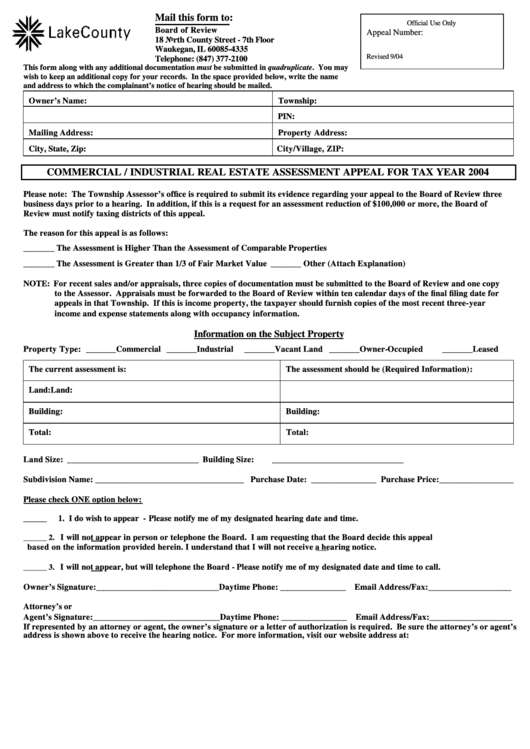

Commercial Industrial Real Estate Assessment Appeal For Tax Year 2004

https://data.formsbank.com/pdf_docs_html/289/2890/289076/page_1_thumb_big.png

Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To You must file the Property Tax Rebate Form IL 1040 PTR either electronically through MyTax Illinois or by paper form by October 17 if your client s

To claim only the property tax rebate older adults must complete and submit Form IL 1040 PTR either by mail or electronically through MyTax Illinois on or before Oct 17 The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim their

Download Illinois Property Tax Credit Form

More picture related to Illinois Property Tax Credit Form

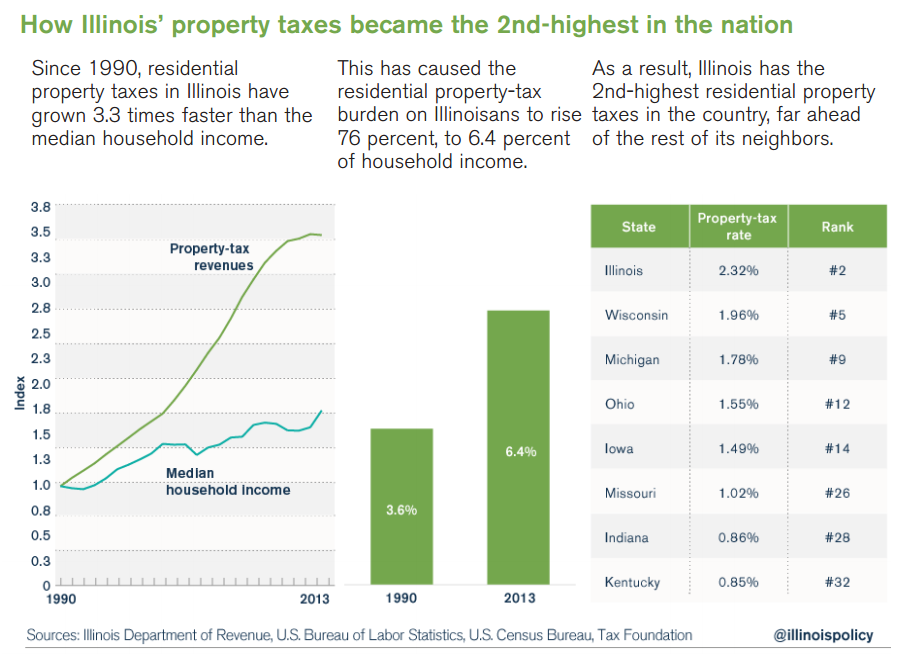

DuPage County Residents Pay Some Of The Nation s Highest Property Tax Rates

https://files.illinoispolicy.org/wp-content/uploads/2019/04/property-taxes-average-01.png

Meaningful Substantive Property Tax Relief In Illinois Is Critical

https://repweber.com/wp-content/uploads/sites/9/2020/01/Property-Taxes-in-Illinois01-683x1024.png

Guide To The Michigan Homestead Property Tax Credit Action Economics

https://actionecon.com/wp-content/uploads/2016/06/Michigan-Homestead-Property-Tax-Credit.jpg

The property tax credit is available to residents who paid taxes on their main home that was located in Illinois for the time you owned and lived in the home Nonresidents of You may figure a credit for the Illinois property taxes you paid in 2021 on your principal residence not a vacation home or rental property for the time you owned and lived at

You may figure a credit for the Illinois property taxes you paid in 2023 on your principal residence not a vacation home or rental property for the time you owned and lived at The Illinois Property Tax Credit is a credit on your individual income Prorated property tax you paid in the year you sold your tax return Form IL 1040 equal to 5 percent of Illinois

Illinois Schedule Icr Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/13/100013483/large.png

Property Taxes By State County Median Property Tax Bills

https://files.taxfoundation.org/20220912162330/Median-property-taxes-by-county-paid-property-tax-rankings.png

https://tax.illinois.gov/content/dam/soi/en/web/...

The Illinois Property Tax Credit is a credit on your individual income tax return Form IL 1040 equal to 5 percent of Illinois Property Tax real estate tax you paid on your

https://tax.illinois.gov/forms/incometax/current...

Schedule ICR Illinois Credits allows you to figure the total amount of property tax K 12 education expense and Volunteer Emergency Worker credits you may claim on Form IL

Illinois With Holding Income Tax Return Wiki Form Fill Out And Sign

Illinois Schedule Icr Fill Out Sign Online DocHub

Illinois Tax Brief The Policy Circle

Illinois Property Taxes Rank No 2 In The Nation For Third Year Running

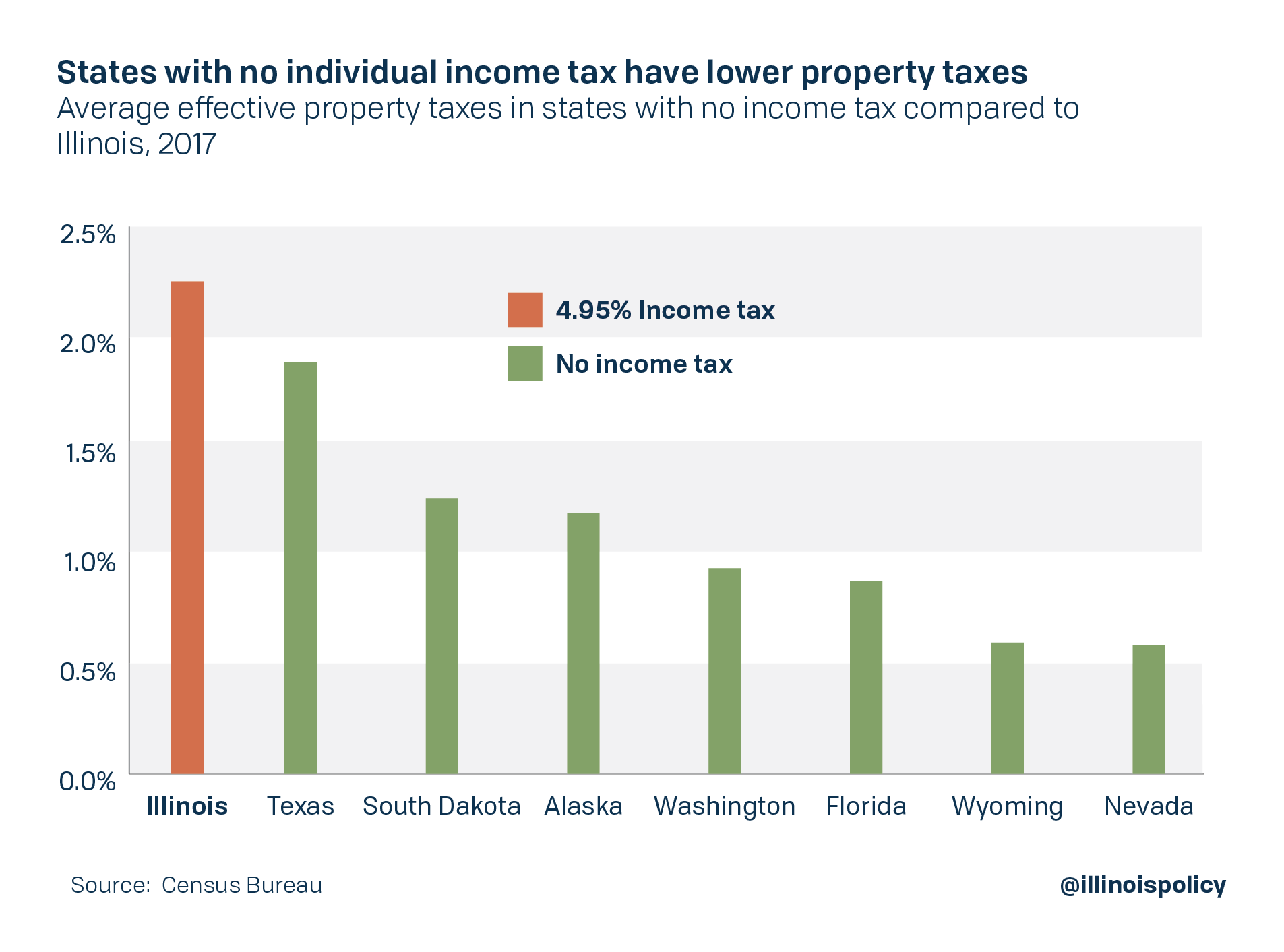

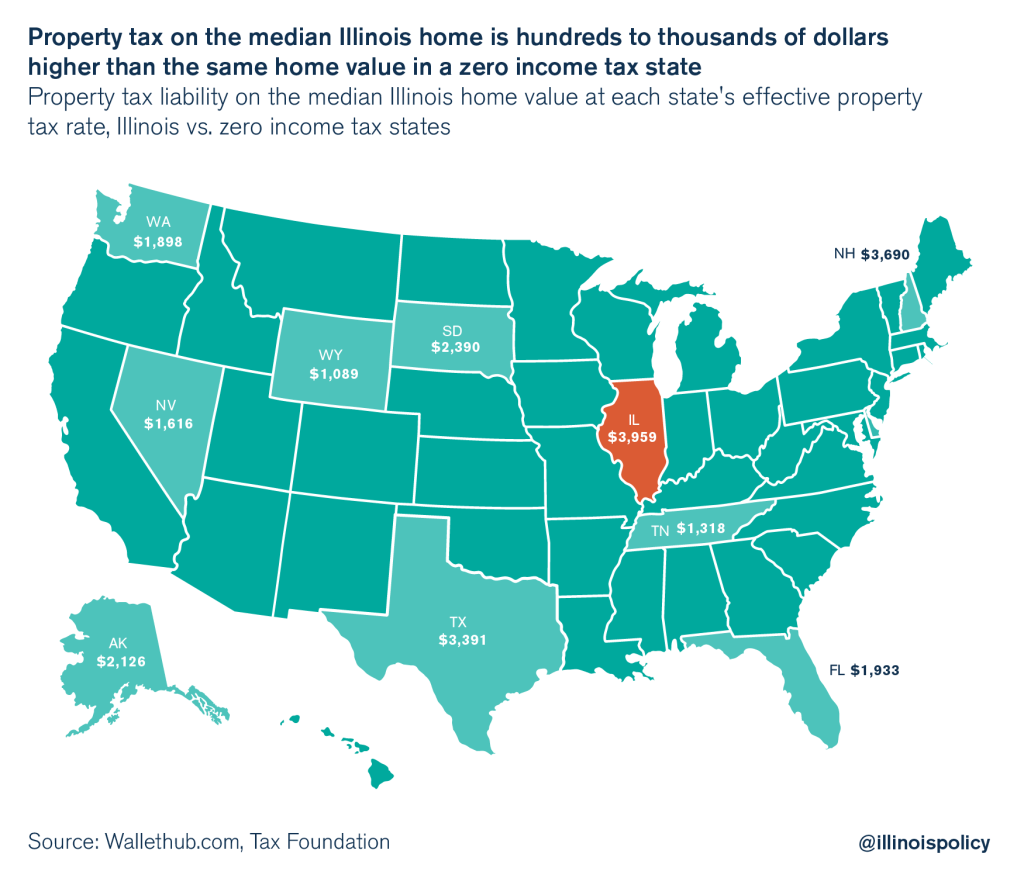

Illinois Has Higher Property Taxes Than Every State With No Income Tax

Illinois Financial Affidavit Fill Out Sign Online DocHub

Illinois Financial Affidavit Fill Out Sign Online DocHub

Get Your Full Illinois Property Tax Credit When Selling A Home

2022 Form MO DoR MO PTS Fill Online Printable Fillable Blank PdfFiller

How High Are Property Taxes In Your State American Property Owners

Illinois Property Tax Credit Form - The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim their