Illinois Property Tax Rebates 2024 Your Property Taxes column with Cook County Treasurer Maria Pappas By Maria Pappas Illinois offers senior citizens a property tax relief program that works like a loan The Senior Citizens Real Estate Tax Deferral program allows qualifying seniors to defer up to 7 500 per year in property taxes The 3 interest rate charged for 2023 taxes

The Illinois Property Tax Credit is a credit on your individual income tax return equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence You must own and reside in your residence in order to take this credit Property tax On top of the income tax rebates some homeowners may receive more assistance Qualified property owners will receive a rebate equal to the property tax credit claimed

Illinois Property Tax Rebates 2024

Illinois Property Tax Rebates 2024

https://d2dv7hze646xr.cloudfront.net/wp-content/uploads/2015/08/01_PropertyTaxes_JobsGrowth.png

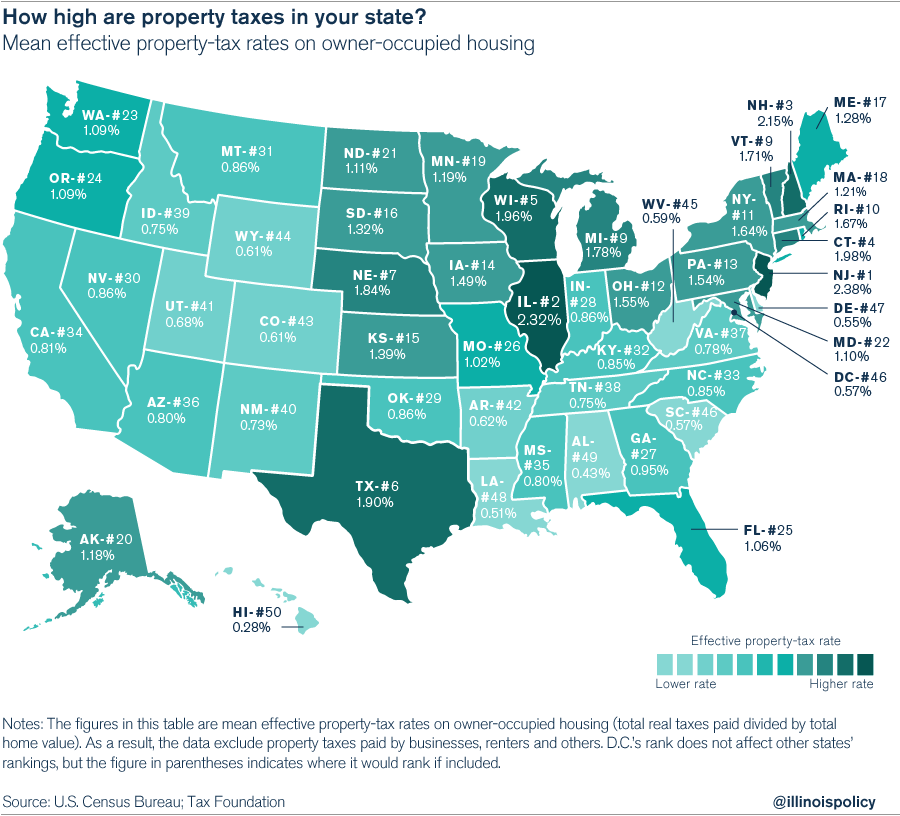

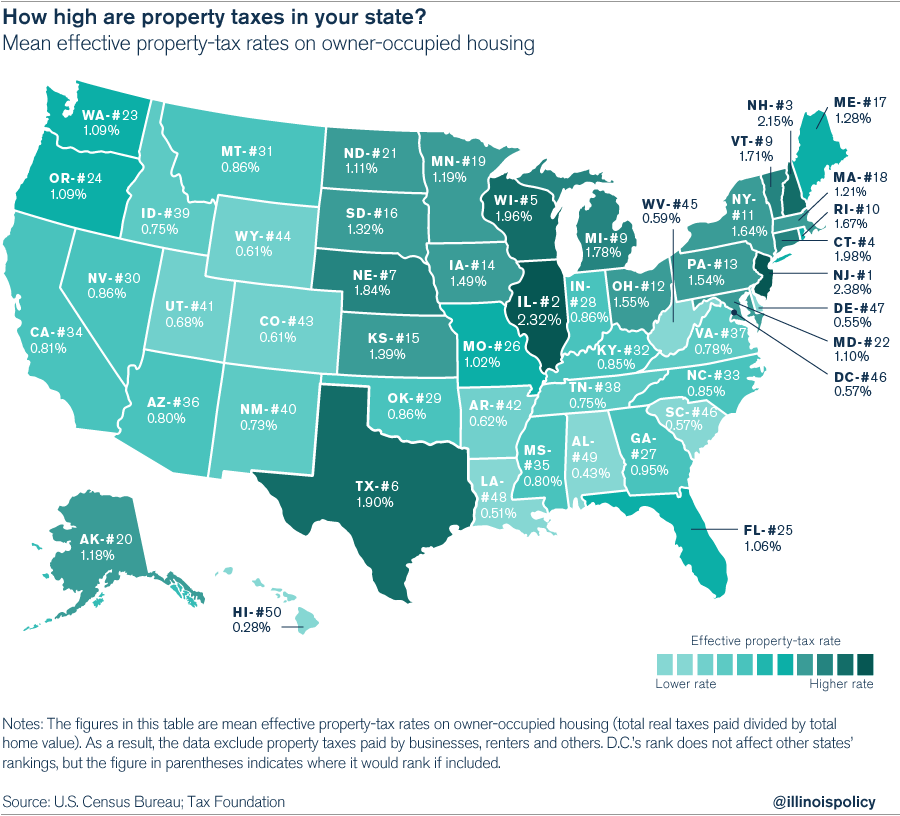

Meaningful Substantive Property Tax Relief In Illinois Is Critical

https://repweber.com/wp-content/uploads/sites/9/2020/01/Property-Taxes-in-Illinois01-683x1024.png

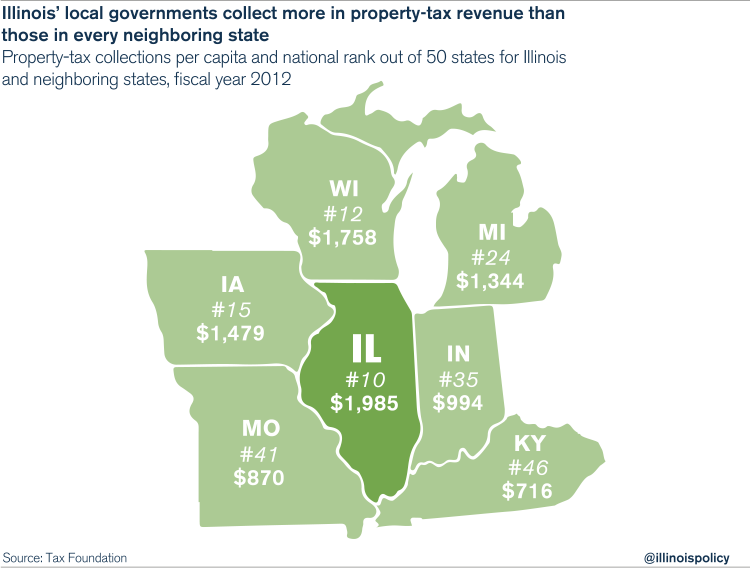

Illinois State Government Takes In More Tax Dollars Per Person Than Every Neighboring State

https://d2dv7hze646xr.cloudfront.net/wp-content/uploads/2015/10/PropertyTaxesOCT_2-e1444743834460.png

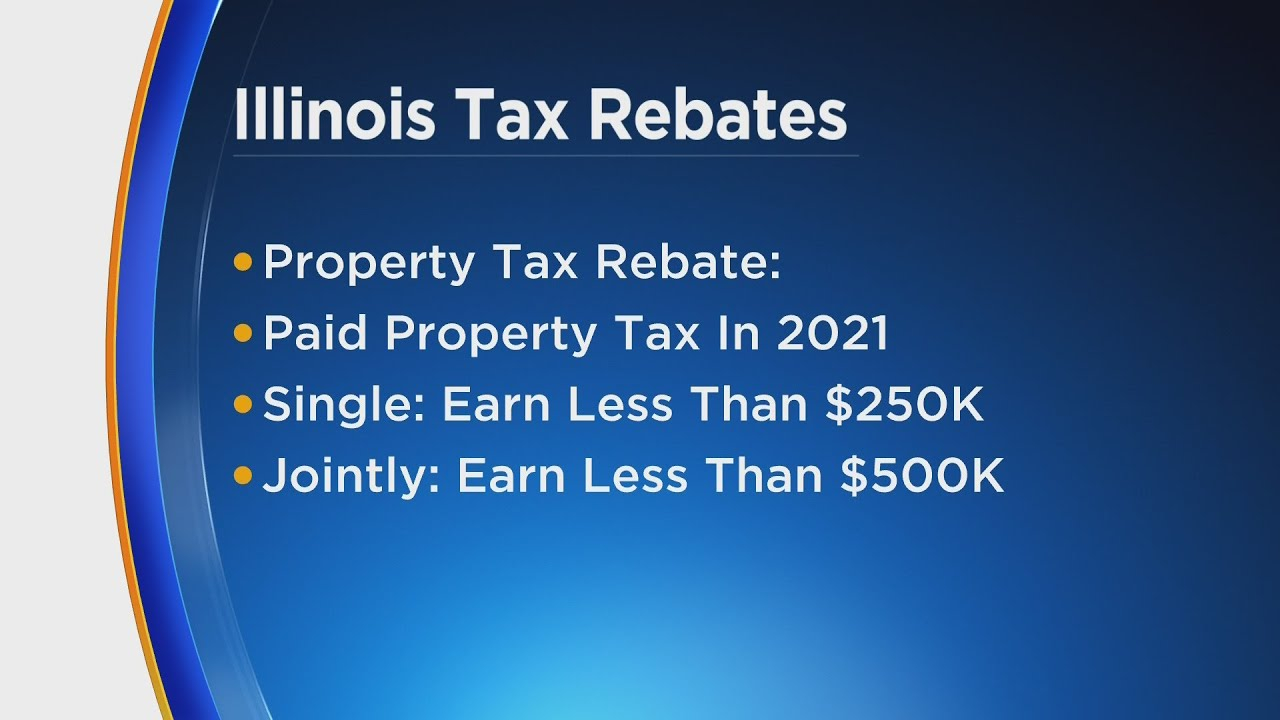

Harrisburg With the filing period now open for the Property Tax Rent Rebate January 26 2024 3 57 pm Full Forecast Friday January 26 2024 Illinois Hancock Journal Pilot Property tax Illinois Property Tax Rebate How Much You Could Get and How to Know If You re Eligible The income tax rebate calls for a single person to receive 50 dollars while

The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a maximum credit of 300 State of Illinois The income tax rebate works in a similar manner allowing individuals to claim a credit of 50 each with an additional 100 per dependent up to 300 The maximum for the individual income and property tax rebates is 300 with up to three dependents qualifying as a dependent for the income tax rebate Who is eligible for 2022

Download Illinois Property Tax Rebates 2024

More picture related to Illinois Property Tax Rebates 2024

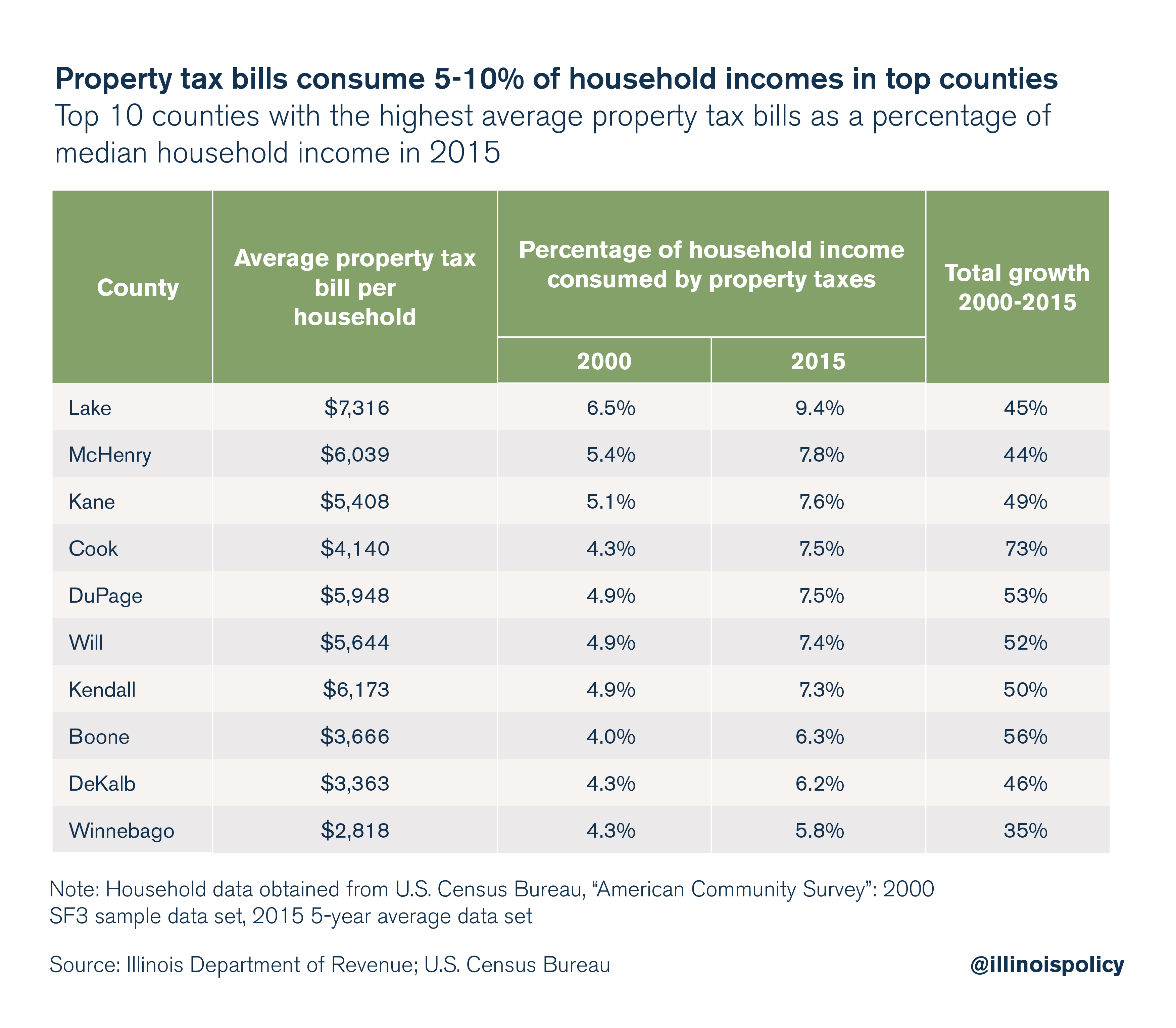

Property Taxes Grow Faster Than Illinoisans Ability To Pay For Them

https://files.illinoispolicy.org/wp-content/uploads/2017/07/2-1.png

How Does Illinois s Property Tax Rebate Work

https://media.marketrealist.com/brand-img/SxFDcHPyG/1600x837/illinois-property-tax-rebate-1659496759243.jpg?position=top

4 Things To Know About Illinois Income Property Tax Rebates

https://townsquare.media/site/723/files/2022/09/attachment-You.jpg?w=980&q=75

The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim their property tax rebate of up to 300 by submitting Form IL 1040 PTR to the Illinois Department of Revenue To receive both the property tax and income rebates or just the income tax rebate by itself you must file IL 1040 including Schedule ICR Illinois Credits as well as Schedule

The tax filing deadline is April 15 2024 Tax Credits Depending on circumstances taxpayers may be able to reduce the amount of taxes owed through tax credits said IDOR Director David Harris Existing credits like the Illinois K 12 Education Expense Credit Property Tax Credit and Illinois Earned Income Tax Credit EITC remain English New Payment Equals Agreement Statute Effective January 1 2024 for Sales Use and Excise Taxes and Fees To All taxpayers with an Illinois sales use or excise tax payment and reporting obligation Public Act 103 0009 Article 100 amends the meaning of payments made for sales use and excise taxes and fees What is the new law

Illinois Property Tax Income Rebates Here s How To Check Yours

https://townsquare.media/site/671/files/2022/09/attachment-gettyimages-182741891-170667a.jpg?w=980&q=75

Property Taxes Grow Faster Than Illinoisans Ability To Pay For Them

https://files.illinoispolicy.org/wp-content/uploads/2017/07/5.png

https://suburbanchicagoland.com/2024/01/21/illinois-program-lets-senior-citizens-defer-up-to-7500-per-year-in-property-taxes/

Your Property Taxes column with Cook County Treasurer Maria Pappas By Maria Pappas Illinois offers senior citizens a property tax relief program that works like a loan The Senior Citizens Real Estate Tax Deferral program allows qualifying seniors to defer up to 7 500 per year in property taxes The 3 interest rate charged for 2023 taxes

https://tax.illinois.gov/individuals/credits/propertytaxcredit.html

The Illinois Property Tax Credit is a credit on your individual income tax return equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence You must own and reside in your residence in order to take this credit

Illinois Tax Rebates 2022 Property Income Rebate Checks Being Sent To 6M Taxpayers Governor

Illinois Property Tax Income Rebates Here s How To Check Yours

Nj Property Tax Rebates 2023 PropertyRebate

Illinois Income And Property Tax Rebates Begin In Less Than 1 Month NBC Chicago Patabook News

Illinois Property Tax Rebate Form 2023 PrintableRebateForm

/cloudfront-us-east-1.images.arcpublishing.com/gray/JWN5HIT5AZABVOENKVEEIJW4GM.jpg)

Illinois Rolls Out Income Property Tax Rebates

/cloudfront-us-east-1.images.arcpublishing.com/gray/JWN5HIT5AZABVOENKVEEIJW4GM.jpg)

Illinois Rolls Out Income Property Tax Rebates

NJ ANCHOR Property Tax Rebates Who Can Qualify In 2024

As Illinois Income And Property Tax Rebates Near Here s What To Know About Distribution

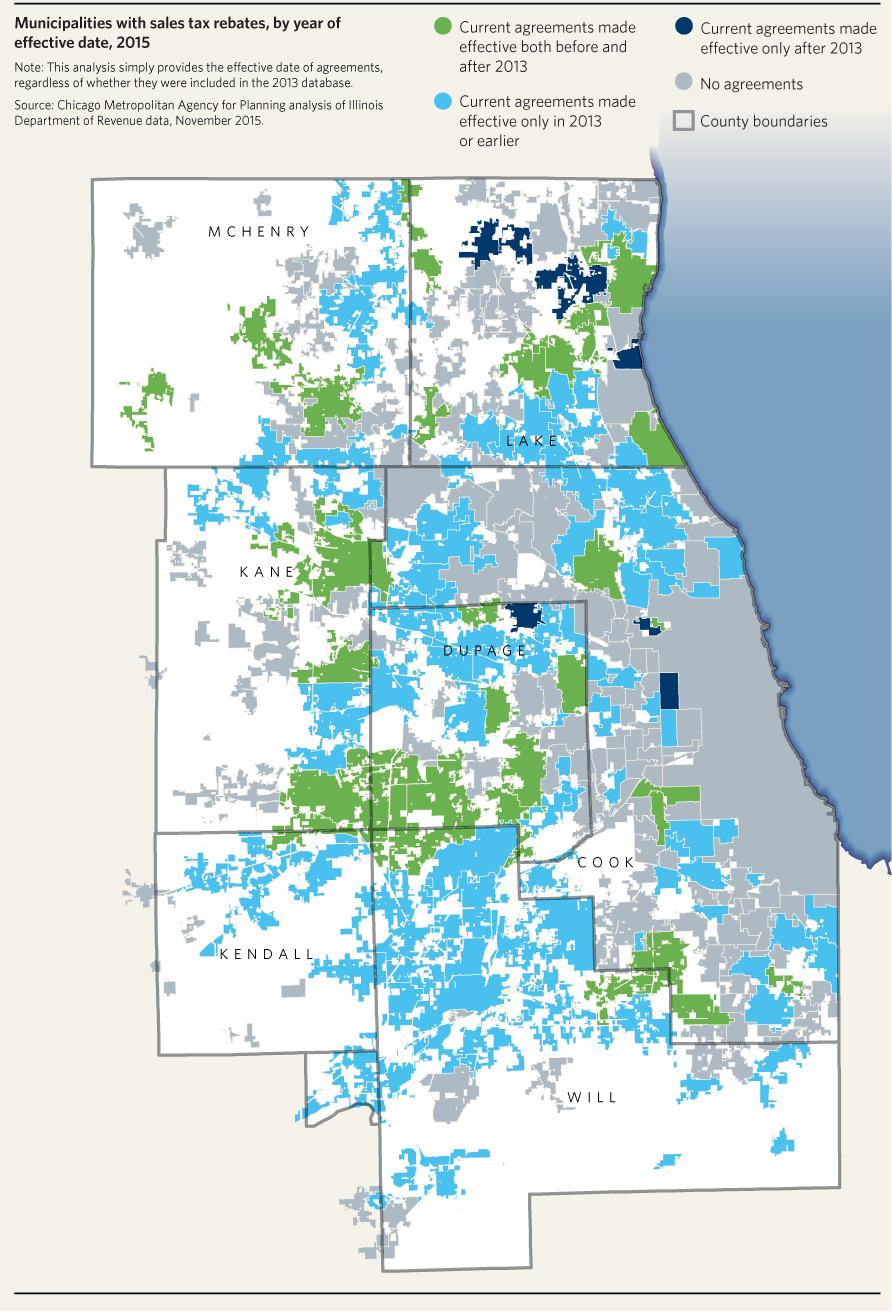

Sales Tax Rebates Remain Prevalent In Northeastern Illinois CMAP

Illinois Property Tax Rebates 2024 - Harrisburg With the filing period now open for the Property Tax Rent Rebate January 26 2024 3 57 pm Full Forecast Friday January 26 2024 Illinois Hancock Journal Pilot