Illinois Property Tax Rebates Web 8 ao 251 t 2022 nbsp 0183 32 Who Qualifies for the Property Tax Rebate To qualify for the property tax rebate you must be an Illinois resident have paid property taxes in Illinois in 2020

Web Filing Help for Requesting Individual Income Tax Rebate and Property Tax Rebate By law Monday October 17 2022 was the last day to submit information to receive the Illinois Web 11 ao 251 t 2022 nbsp 0183 32 To be eligible you must have paid Illinois property taxes in 2021 on your primary residence and your adjust gross income must be 500 000 or less if filing jointly

Illinois Property Tax Rebates

Illinois Property Tax Rebates

https://d2dv7hze646xr.cloudfront.net/wp-content/uploads/2015/08/01_PropertyTaxes_JobsGrowth.png

Illinois Property Tax Rebate Form 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Illinois-Property-Tax-Rebate-Form-2023-768x668.jpg

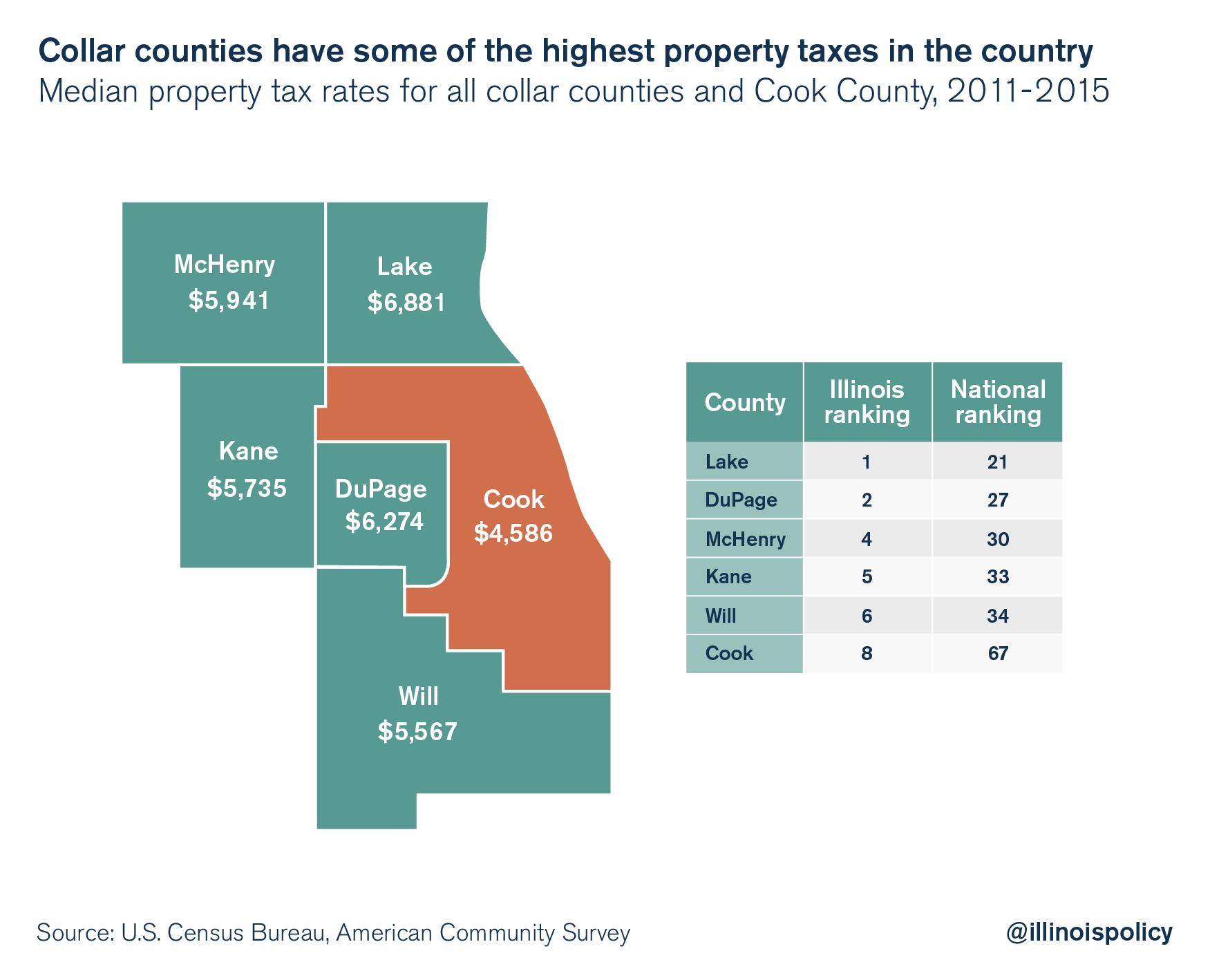

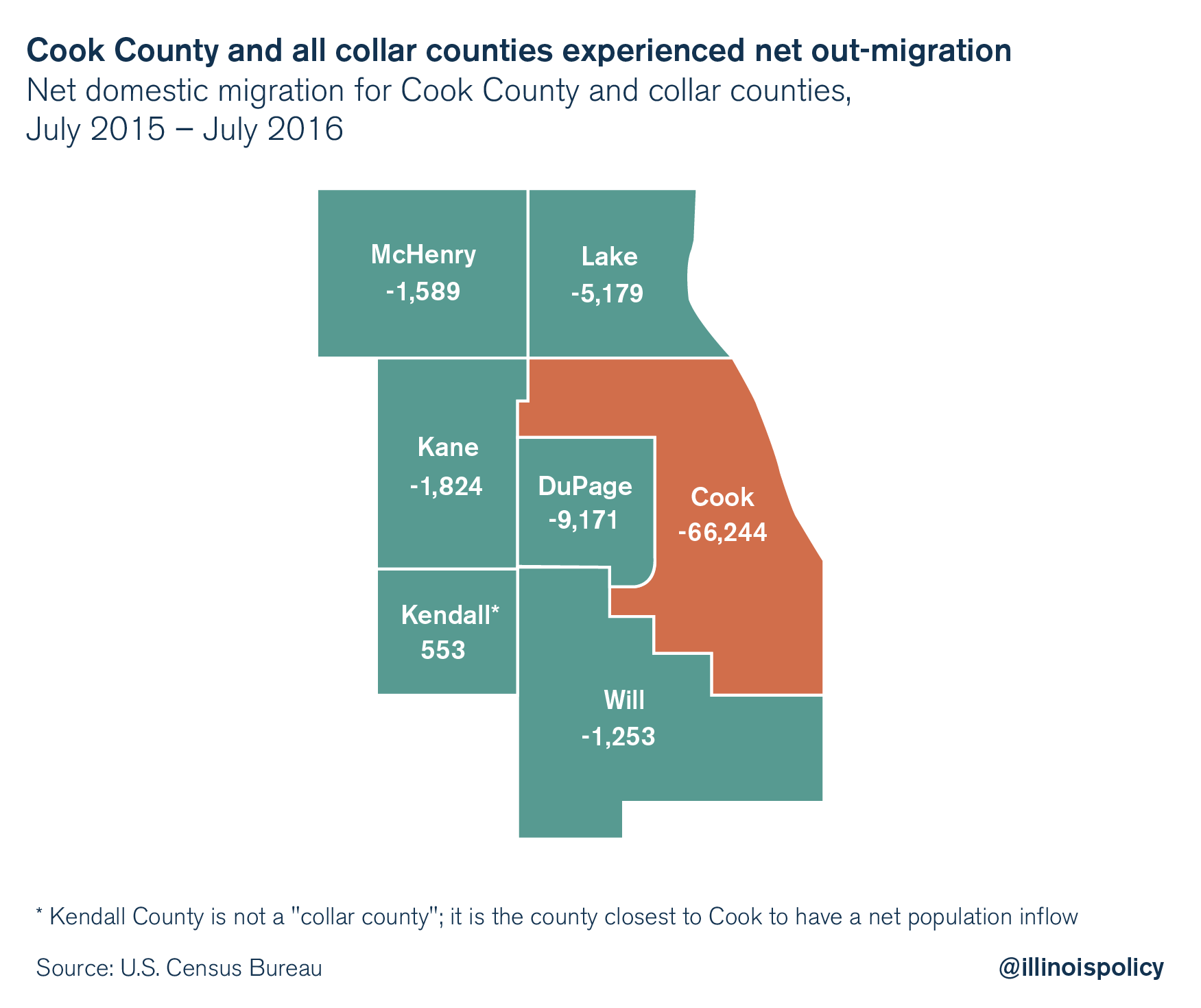

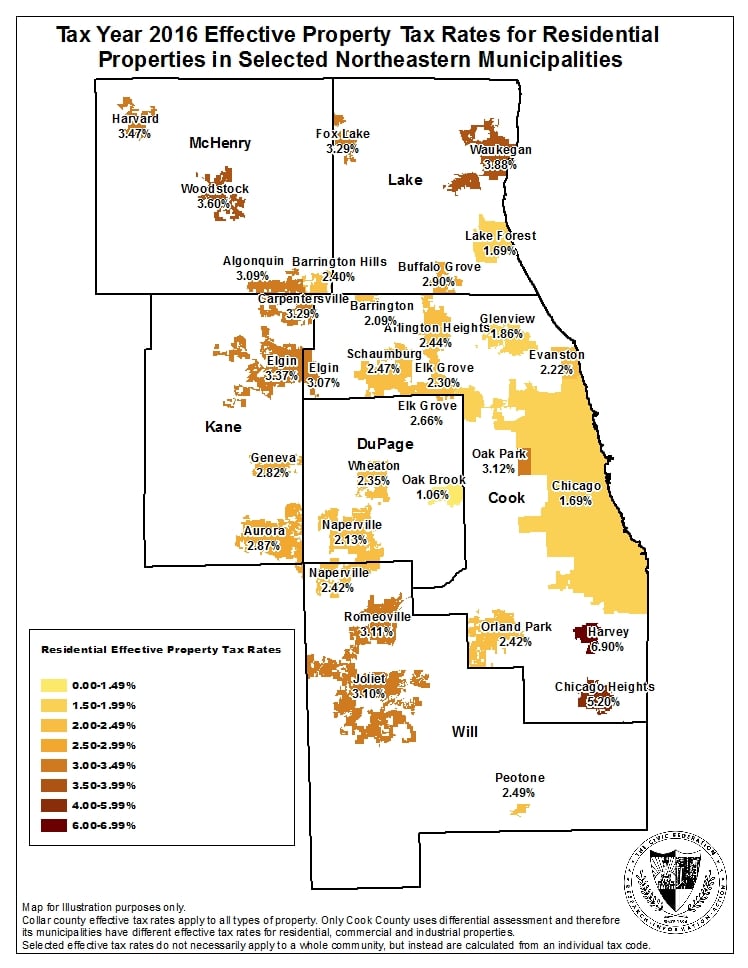

Homeowners In Collar Counties Pay Highest Property Taxes In Illinois

https://files.illinoispolicy.org/wp-content/uploads/2017/04/Collar-counties.png

Web 28 sept 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To Web 12 sept 2022 nbsp 0183 32 Illinois is also providing property tax rebates for eligible homeowners Those rebates will be equal to the property tax credit they qualified for on their 2021

Web 23 sept 2022 nbsp 0183 32 The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim their Web 23 ao 251 t 2022 nbsp 0183 32 The maximum for the individual income and property tax rebates is 300 with up to three dependents qualifying as a dependent for the income tax rebate Who is eligible for 2022

Download Illinois Property Tax Rebates

More picture related to Illinois Property Tax Rebates

Federal Reserve Bank Of Chicago Proposes An Illinois Special Property

https://i1.wp.com/www.wirepoints.com/wp-content/uploads/2018/05/IL-highest-property-taxes-C.png?resize=594%2C518

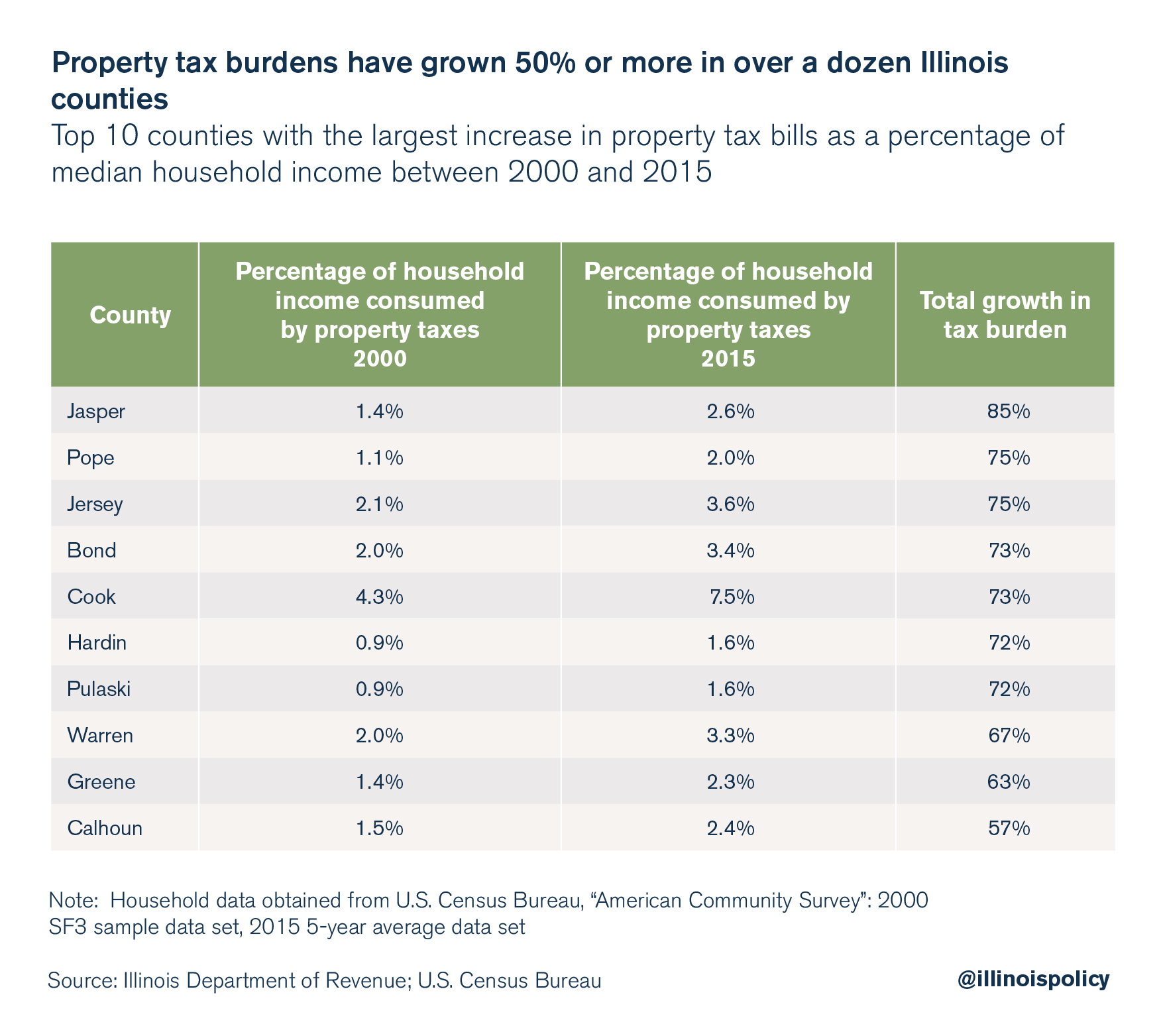

Property Taxes Grow Faster Than Illinoisans Ability To Pay For Them

https://files.illinoispolicy.org/wp-content/uploads/2017/07/5.png

Homeowners In Collar Counties Pay Highest Property Taxes In Illinois

https://files.illinoispolicy.org/wp-content/uploads/2017/04/County_graphic-2_REV-1-1.png

Web What is the Property Tax Rebate The property tax rebate was created by Public Act 102 0700 and is equal to the lesser of the property tax credit you could qualify for 2020 Web 29 sept 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be

Web Property Tax Rebate How much is the rebate Your rebate amount is equal to the property tax credit you were qualified to claim on your 2021 IL 1040 up to a maximum Web 3 oct 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be

Il 1040 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/453/14/453014487/large.png

Putnam County Property Tax Rate Lynwood Parr

http://www.northcentralillinois.org/clientuploads/property-taxes-by-state-2020-FV-01.png

https://taxschool.illinois.edu/post/navigating-the-illinois-income-and...

Web 8 ao 251 t 2022 nbsp 0183 32 Who Qualifies for the Property Tax Rebate To qualify for the property tax rebate you must be an Illinois resident have paid property taxes in Illinois in 2020

https://tax.illinois.gov/programs/rebates/rebates-filing-guide.html

Web Filing Help for Requesting Individual Income Tax Rebate and Property Tax Rebate By law Monday October 17 2022 was the last day to submit information to receive the Illinois

Property Taxes Grow Faster Than Illinoisans Ability To Pay For Them

Il 1040 Fill Out Sign Online DocHub

2022 State Of Illinois Tax Rebates Scheffel Boyle

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

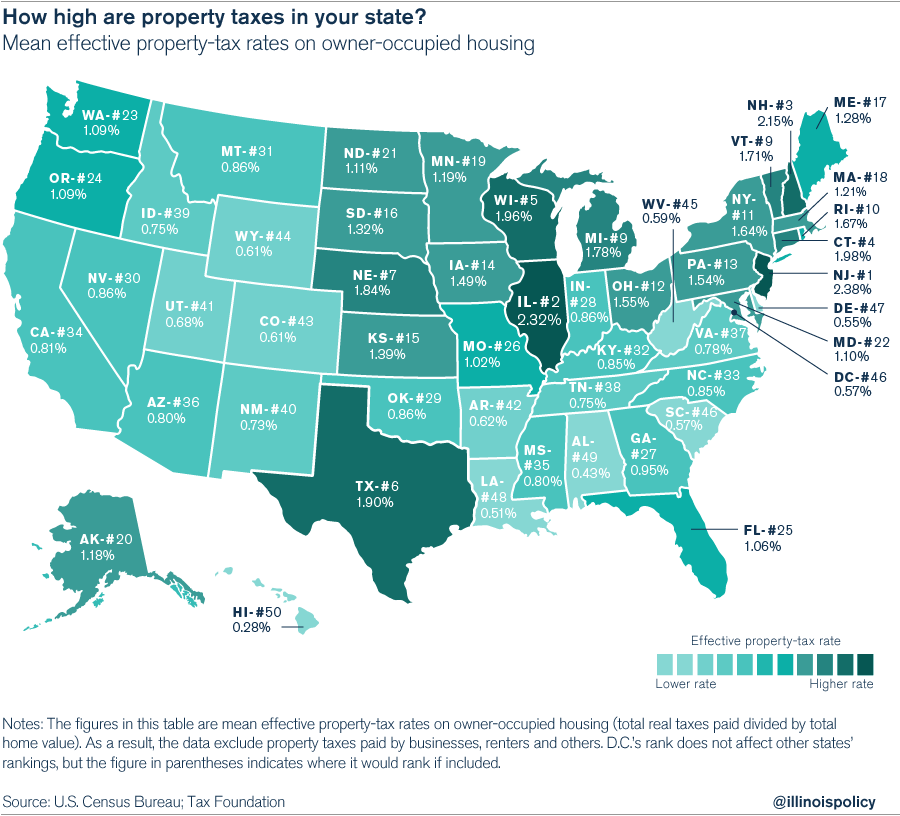

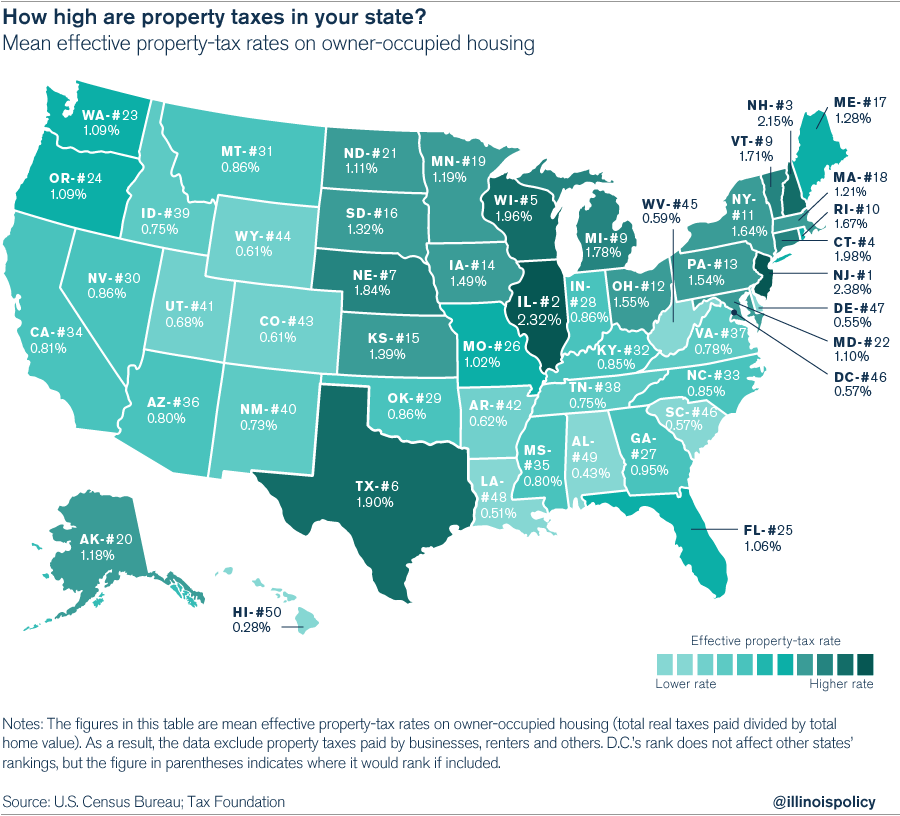

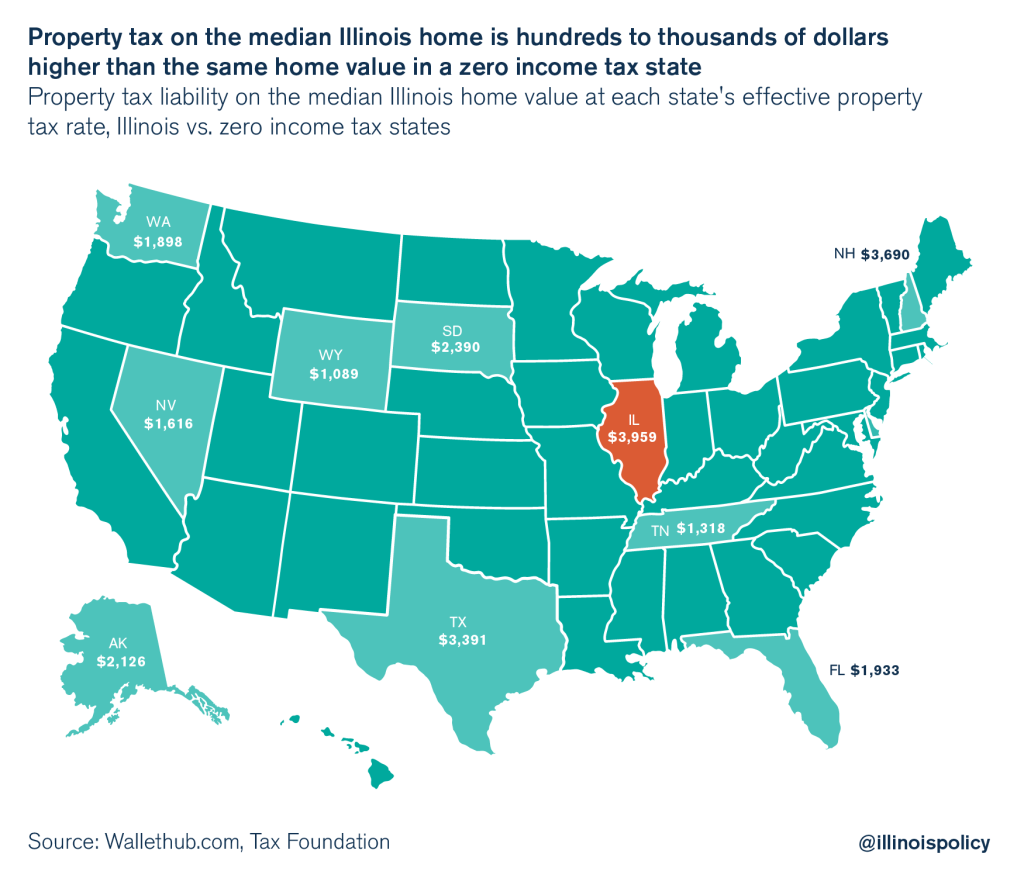

Illinois Has Higher Property Taxes Than Every State With No Income Tax

DuPage County Residents Pay Some Of The Nation s Highest Property Tax Rates

DuPage County Residents Pay Some Of The Nation s Highest Property Tax Rates

Estimated Effective Property Tax Rates 2007 2016 Selected

Deadline To Fill Out Form For Illinois Income And Property Tax Rebates

Why Your Property Tax Bill Is So High And How To Fix It

Illinois Property Tax Rebates - Web 28 sept 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To