Illinois Solar Rebates 2024 As of April 2022 the average solar panels cost in Illinois before tax is 3 04 W according to EnergySage The average solar panel cost varies by system size more panels means a higher

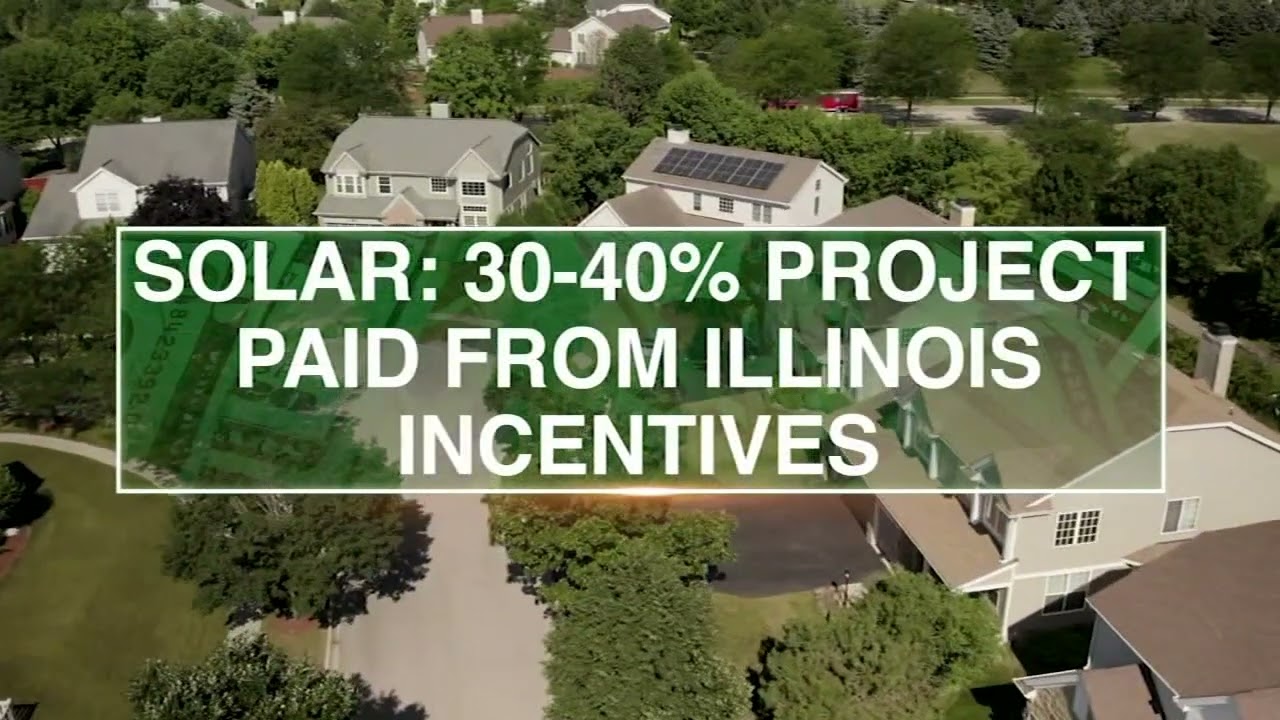

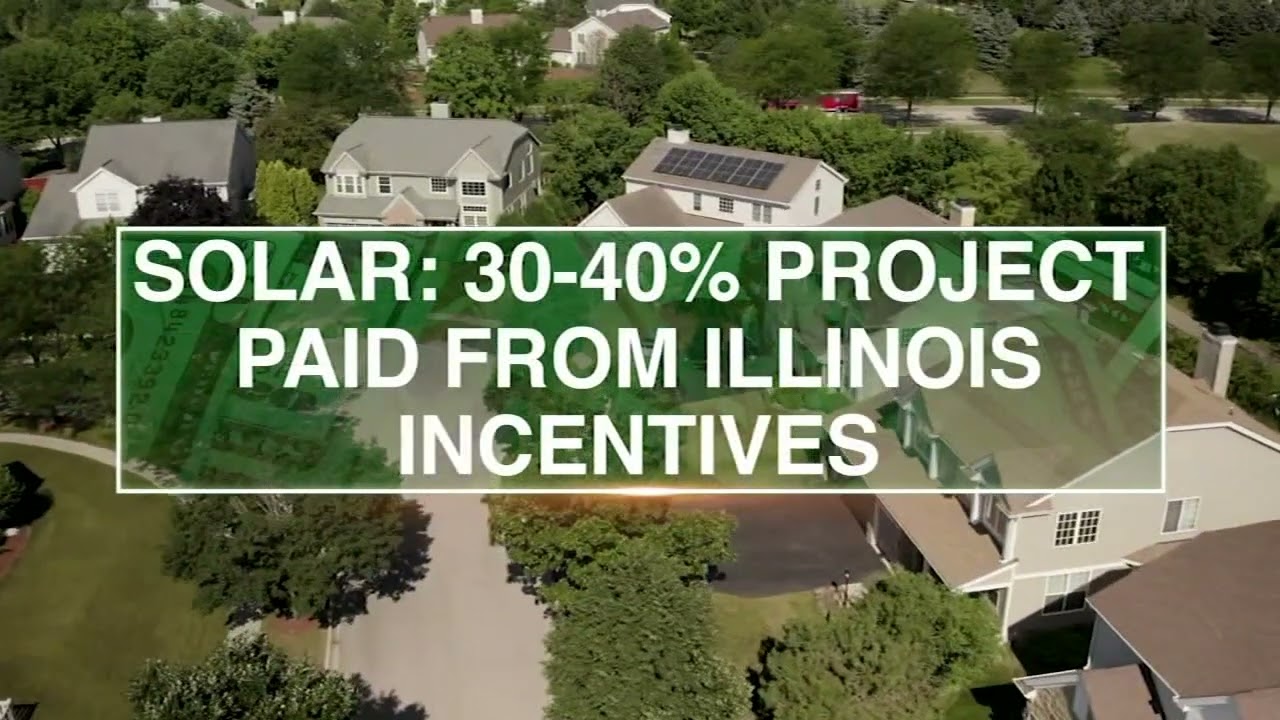

ComEd one of IL s largest utility companies provides rebates for commercial and industrial C I customers to help decrease the out of pocket costs of installing solar If you re a ComEd customer and install solar on your business you re eligible for 250 per kilowatt kW of installed solar power To receive the rebate your solar The federal ITC is the largest solar tax credit available to Illinois residents allowing them to claim 30 of the cost of their rooftop solar installation as a tax credit An average 7 5 kilowatt kW system costs 20 475 in Illinois That means the average Illinois homeowner installing solar can save 6 143 by claiming the federal ITC

Illinois Solar Rebates 2024

Illinois Solar Rebates 2024

https://d7fcfvvxwoz9e.cloudfront.net/dom43635/wp-content/uploads/2023/07/roof-with-solar-panels.png

Illinois Tax Rebates For Solar Panels Electric Cars And Chargers Save Money And Environment

https://cdn.abcotvs.com/dip/images/12292823_100322-wls-iteam-knowles-tax-credits-green-power-10p-vid.jpg?w=1600

Al Byrd Viral Solar Eclipse 2024

https://i.pinimg.com/originals/0b/fd/6b/0bfd6b9d307a206497fd5bfb1db6f4da.png

Illinois Power Agency Releases 2023 2024 Renewable Energy Credit Prices and Rationale for Illinois Shines and Illinois Solar for All Programs April 20 2023 Illinois Solar for All and formula errors in the scaling of NREL capital costs 2 The federal bonus depreciation rate used in the REC Pricing Model was reduced from The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Illinois If you install your photovoltaic system before the end of 2032 the federal tax credit is 30 of the cost of your solar panel system This is 30 off the entire cost of the system including equipment labor and permitting

The Federal Investment Tax Credit ITC also known as the Green Energy Tax Credit provides a 30 tax credit to eligible individuals and businesses in Illinois who install solar energy systems This credit allows taxpayers to deduct 30 of the cost of their solar installation from their federal taxes The ITC has been a significant driver in Federal Solar Tax Credit All Illinois homeowners qualify for the federal solar investment tax credit or ITC Those who install their home solar systems by Dec 31 2032 are eligible for a tax deduction equal to 30 of the purchase price This percentage will drop to 26 in 2033

Download Illinois Solar Rebates 2024

More picture related to Illinois Solar Rebates 2024

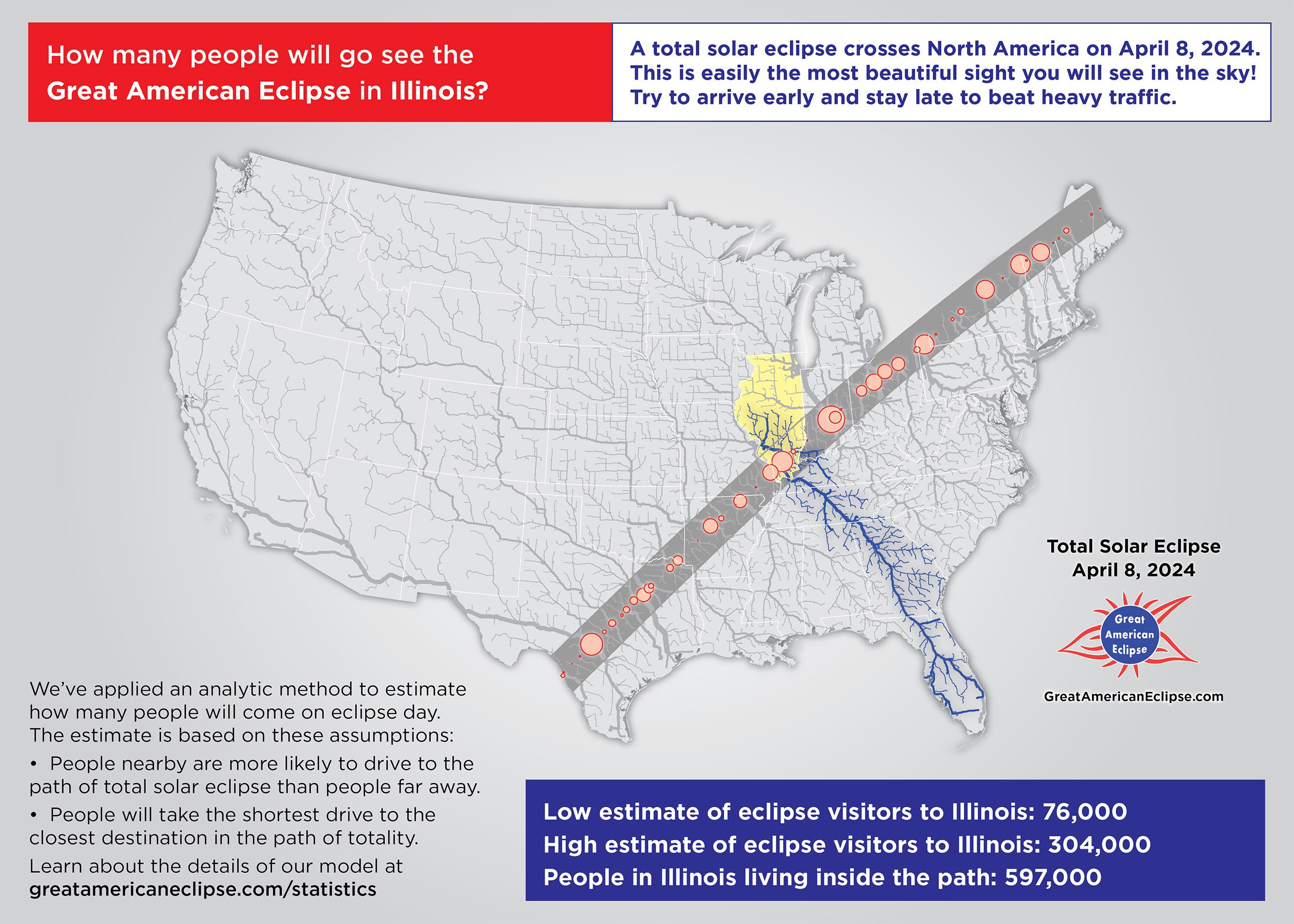

Total Solar Eclipse 2024 Illinois Great American Eclipse

https://images.squarespace-cdn.com/content/v1/53c358b6e4b01b8adb4d5870/558a0997-7178-4af3-a8f5-5902a5a07d33/TSE2024+Illinois+driveshed.jpg

-1920w.webp)

Empowering Your Solar Journey In Missouri Illinois Sunsent Solar Blog

https://irp.cdn-website.com/dca01595/dms3rep/multi/Untitled-design-(71)-1920w.webp

2020 Solar Rebates And Incentives Statistics

https://goingsolar.com/stats/assets/images/countries/Illinois.png

The average home solar system in Illinois costs around 16 000 so you can claim 4 800 as a valid tax form expense for a total investment of 11 200 Only those who own their system can apply This includes the expenses for equipment labor and necessary permits The federal solar investment tax credit drops to 26 in 2033 and 22 in 2034 For instance if you invest in a solar panel

Chicago residents 100 per permit City of Naperville Electric Utility solar installation rebates Utility customers can receive between 1 000 and 3 000 in rebates for installing solar panels The Inflation Reduction Act IRA a federal law established in 2022 allocates 391 billion dollars for energy and climate change actions nationwide Under this law Illinois EPA Office of Energy will administer two US Dept of Energy USDOE programs the Home Energy Performance Based Whole House Rebates or Home Efficiency Rebates Section 50121 and the High Efficiency Electric Home Rebate

Illinois Tax Rebates For Solar Panels Electric Cars Save Money And The Environment YouTube

https://i.ytimg.com/vi/mr40gun4sVo/maxresdefault.jpg

Solar Rebates Solar Incentives Help Make Solar Affordable Solar Sam

https://www.solarsam.com/wp-content/uploads/2020/07/Federal-Tax-Credit-ITC-Solar-Rebates-Solar-Incentives-Make-Green-Energy-Affordable-Professional-Installers-Solar-Sam-Missouri-Illinois-1.jpg

https://www.forbes.com/home-improvement/solar/illinois-solar-incentives/

As of April 2022 the average solar panels cost in Illinois before tax is 3 04 W according to EnergySage The average solar panel cost varies by system size more panels means a higher

https://www.energysage.com/local-data/solar-rebates-incentives/il/

ComEd one of IL s largest utility companies provides rebates for commercial and industrial C I customers to help decrease the out of pocket costs of installing solar If you re a ComEd customer and install solar on your business you re eligible for 250 per kilowatt kW of installed solar power To receive the rebate your solar

The Next Solar Eclipse Is In 2024 And Illinois Is In The Path Of Totality NBC Chicago

Illinois Tax Rebates For Solar Panels Electric Cars Save Money And The Environment YouTube

Illinois Solar Incentives Tax Credits For 2023 LeafScore

2024 Illinois Solar Incentives Guide Tax Credits Rebates EcoWatch

Solar Eclipse 2024 Illinois Map

How Do Solar Rebates Work A Guide For Beginners

How Do Solar Rebates Work A Guide For Beginners

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

Complete Guide For WA Solar Panel Rebates 2023

Illinois Solar Renewable Energy Credits 2019 ZenSolar Changing Solar For Good

Illinois Solar Rebates 2024 - The Federal Investment Tax Credit ITC also known as the Green Energy Tax Credit provides a 30 tax credit to eligible individuals and businesses in Illinois who install solar energy systems This credit allows taxpayers to deduct 30 of the cost of their solar installation from their federal taxes The ITC has been a significant driver in