Illinois State Income Tax Increase 2023 Individual taxpayers who make estimated payments and typically annualize their income may need to increase their payment amounts for the third and fourth quarters of 2023

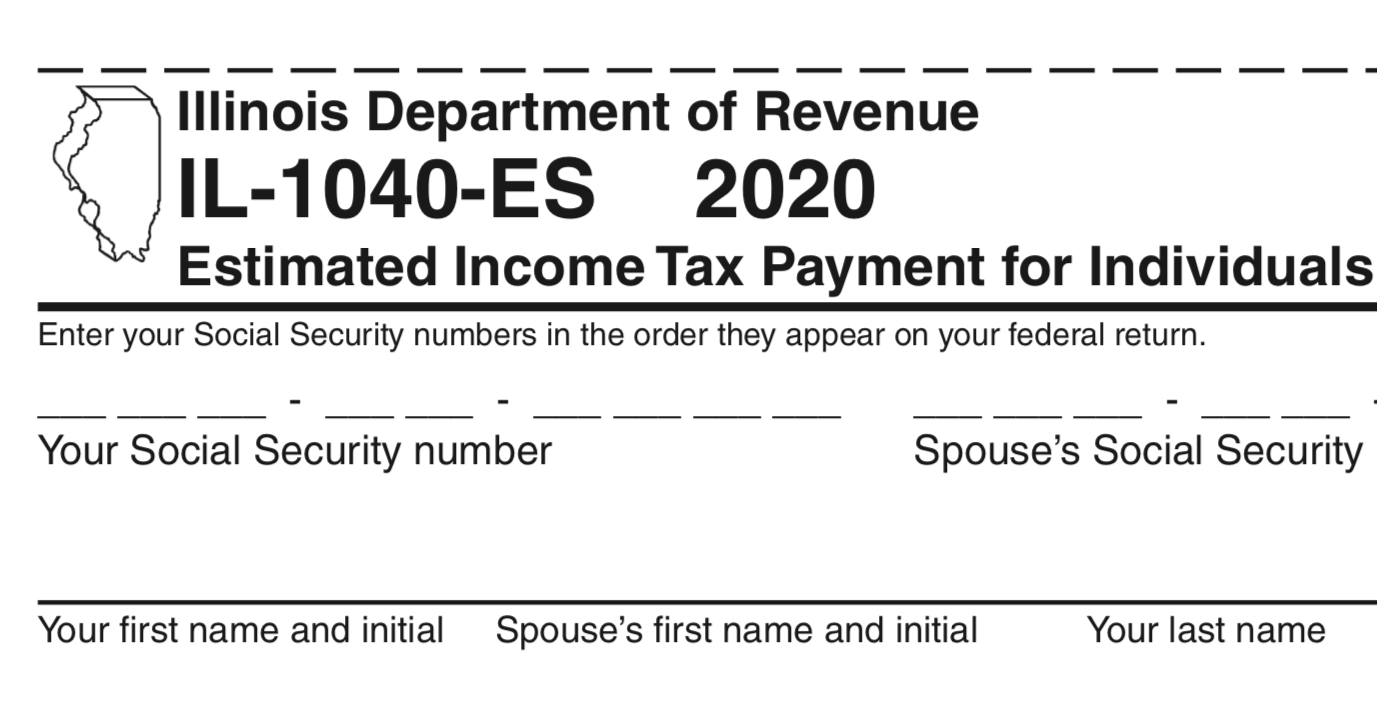

This booklet contains Illinois Income Tax withholding tables The tables begin on Page 5 It also explains how to figure the amount of Illinois Income Tax that you should withhold using the What are the changes to the 2023 Form IL 1040 Illinois Individual Income Tax Return and schedules The 2023 personal exemption amount is 2 425 The original due date for filing

Illinois State Income Tax Increase 2023

Illinois State Income Tax Increase 2023

https://files.illinoispolicy.org/wp-content/uploads/2016/04/shutterstock_400299121.jpg

2021 Nc Standard Deduction Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/2020-state-individual-income-tax-rates-and-brackets-tax.png

State Corporate Income Tax Rates And Brackets For 2023 CashReview

https://files.taxfoundation.org/20230123172533/2023-state-corporate-income-tax-rates-and-brackets-see-state-corporate-tax-rates-by-state.png

The Illinois Department of Revenue has released Booklet IL 700 T for 2023 Illinois withholding information and tax tables effective January 1 2023 are presented in this The State of Illinois individual income tax rate remains at 4 95 but the statencome tax exemption i has decreased from 2 625 to 2 425 for the 202 3 tax year This

Notable 2023 State Individual Income Tax Changes Last year continued the historic pace of income tax rate reductions In 2022 12 states enacted individual income tax rate reductions a continuation from 2021 when Some Illinois taxes are set to increase in July Here are the taxes that will increase and how much more you can expect to pay

Download Illinois State Income Tax Increase 2023

More picture related to Illinois State Income Tax Increase 2023

Voters Okay State Income Tax Hikes For The Rich

https://imageio.forbes.com/specials-images/imageserve/458195635/0x0.jpg?format=jpg&width=1200

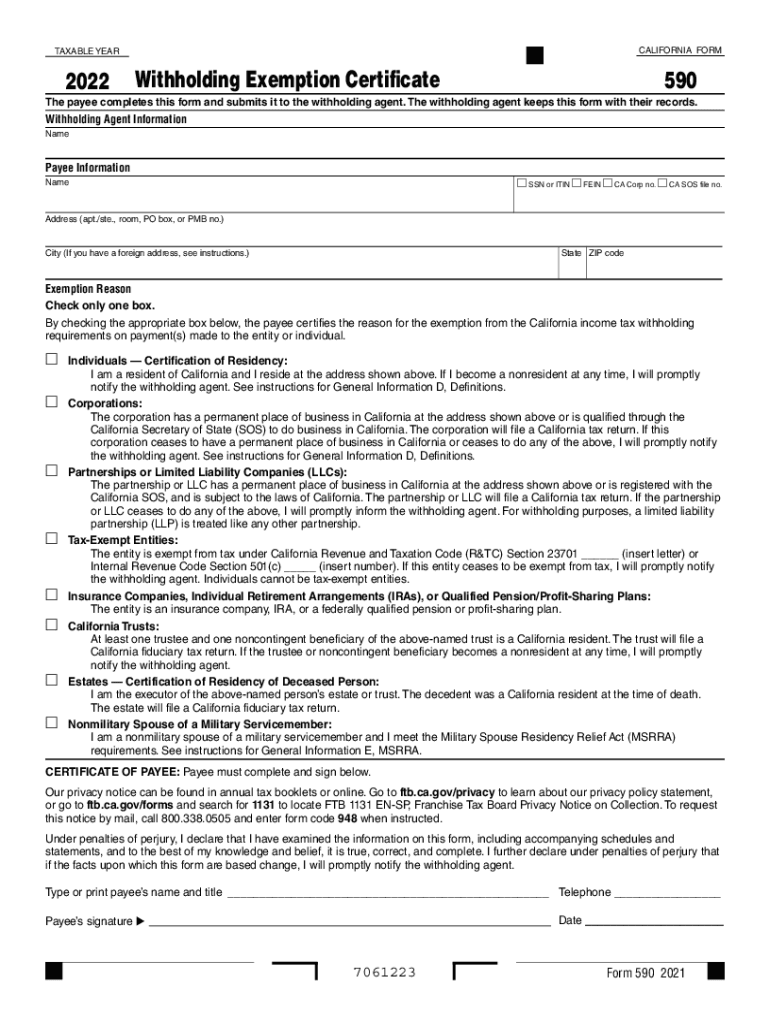

California State Income Tax Form 2023 Printable Forms Free Online

https://www.pdffiller.com/preview/579/720/579720412/large.png

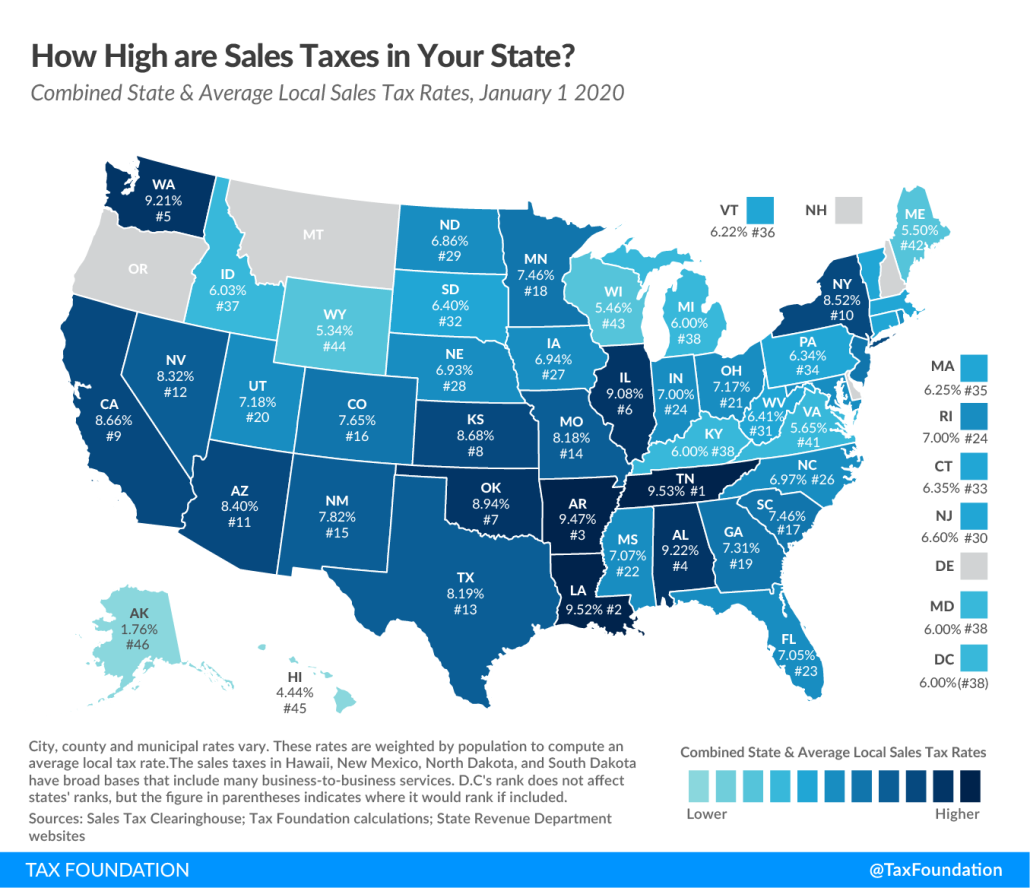

ILLINOIS SALES TAX RATES AMONG THE HIGHEST IN THE COUNTRY Taxpayer

https://www.taxpayereducation.org/wp-content/uploads/2020/01/2020-State-and-Local-Sales-Tax-Rates1-1030x888.png

Unlike the federal government and many other states Illinois does not have tax brackets that impose higher rates on people who earn more Illinois state income taxes are due on the same day as federal income taxes April 18 2023 for tax According to the text of the budget Pritzker is proposing that the state increase its exemption allowance to 2 550 for Tax Year 2024 Since that increase is less than what was originally called

Use our income tax calculator to estimate how much tax you might pay on your taxable income Your tax is 0 if your income is less than the 2023 2024 standard deduction determined by your What are the changes to the 2022 Form IL 1040 Illinois Individual Income Tax Return and schedules The 2022 personal exemption amount is 2 425 The original due

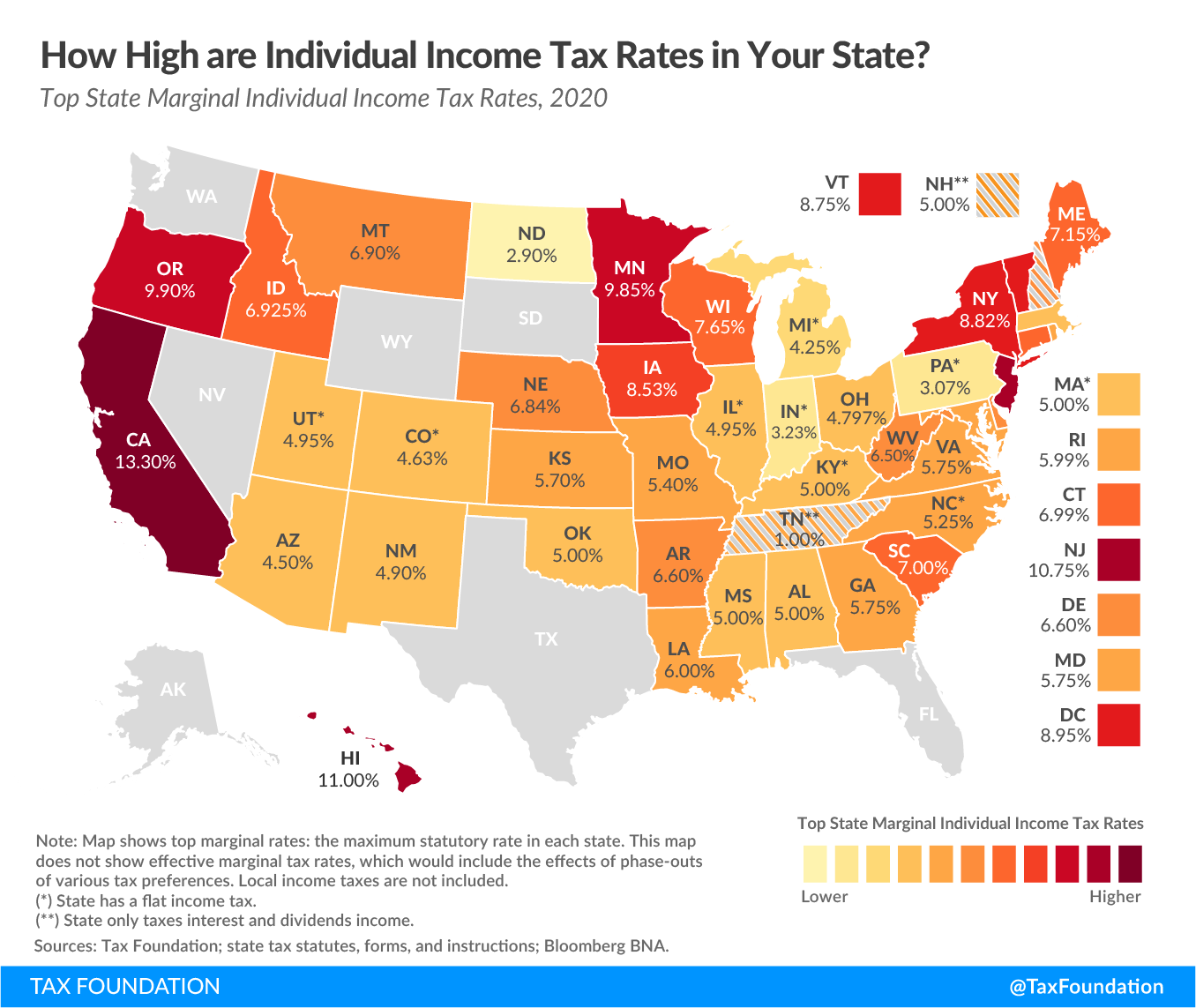

How High Are Income Tax Rates In Your State

https://www.richardcyoung.com/wp-content/uploads/2016/02/income-tax-rate-map.png

How Illinois Income Tax Stacks Up Nationally For Earners Making 100K

https://assets.website-files.com/5c2678bffd28a75624f00dde/5cd31a526475f07f02aced80_State Income Tax Rates for those Earning %24100%2C000-5.png

https://tax.illinois.gov › content › dam › soi › en › web › ...

Individual taxpayers who make estimated payments and typically annualize their income may need to increase their payment amounts for the third and fourth quarters of 2023

https://tax.illinois.gov › ...

This booklet contains Illinois Income Tax withholding tables The tables begin on Page 5 It also explains how to figure the amount of Illinois Income Tax that you should withhold using the

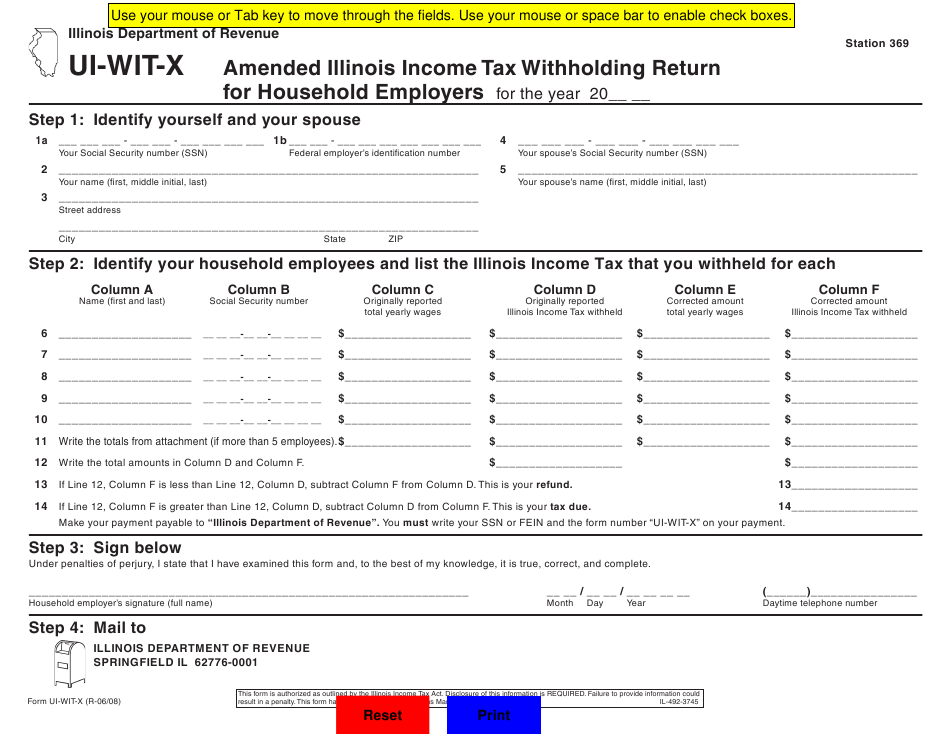

Illinois Income Tax Withholding Forms 2022 W4 Form

How High Are Income Tax Rates In Your State

Income Tax Calculator 2023 Illinois Salary After Tax Indian Diary

How To File An Income Tax Return Extension In Illinois TaxHeaven

The Caucus Blog Of The Illinois House Republicans Calculating

Earned Income Tax Credit For Households With One Child 2023 Center

Earned Income Tax Credit For Households With One Child 2023 Center

Maximize Your Paycheck Understanding FICA Tax In 2023

State Income Tax Filing Deadline Is Monday

Illinois With Holding Income Tax Return Wiki Form Fill Out And Sign

Illinois State Income Tax Increase 2023 - State revenue projections were cut by more than 800 million in new fiscal year 2023 estimates from the state legislature s Commission on Government Forecasting and