Illinois Tax Credits For Education Expenses How should I figure a credit for education expenses and what must I attach to my Form IL 1040 when I claim this credit You must complete Schedule ICR Illinois Credits

Schedule ICR Illinois Credits allows you to figure the total amount of property tax K 12 education expense and Volunteer Emergency Worker credits you may claim on Form IL The Illinois Education Expense Credit allows parents or legal guardians of a full time K 12 student under the age of 21 to take a 25 tax credit on qualified education expenses

Illinois Tax Credits For Education Expenses

Illinois Tax Credits For Education Expenses

https://imageio.forbes.com/specials-images/imageserve/6382a9dd088a90f846f35930/0x0.jpg?format=jpg&crop=3207,3207,x0,y0,safe&width=1200

Bill To Increase Tax Credits For Education Clears House Daily Montanan

https://dailymontanan.com/wp-content/uploads/2023/01/GettyImages-1383546236.jpg

Tax Credits MJA Associates

https://mja-associates.com/wp-content/uploads/2023/12/AdobeStock_124656824.jpg

Qualified education expenses Education expenses that qualify for this credit include tuition including summer school classes meeting elementary or secondary graduation The Illinois Education Expense Credit allows parents or legal guardians of a full time K 12 student under the age of 21 to take a 25 tax credit on qualified education expenses

Illinois Education Expense Credit The Illinois Education Expense Credit allows parents or legal guardians of a full time K 12 student under the age of 21 to take a 25 tax credit on qualified education expenses over 250 The Illinois Education Expense Credit allows parents or legal guardians of a full time K 12 student under the age of 21 to take a 25 tax credit on qualified education

Download Illinois Tax Credits For Education Expenses

More picture related to Illinois Tax Credits For Education Expenses

Exploring Tax Credits For Education Expenses Fiscal Freedom Blog

https://pix4free.org/assets/library/2021-09-29/originals/tax-credits.jpg

Here s What The Average American Is Saving For College The Motley Fool

https://g.foolcdn.com/editorial/images/413503/college-savings_gettyimages-491855944.jpg

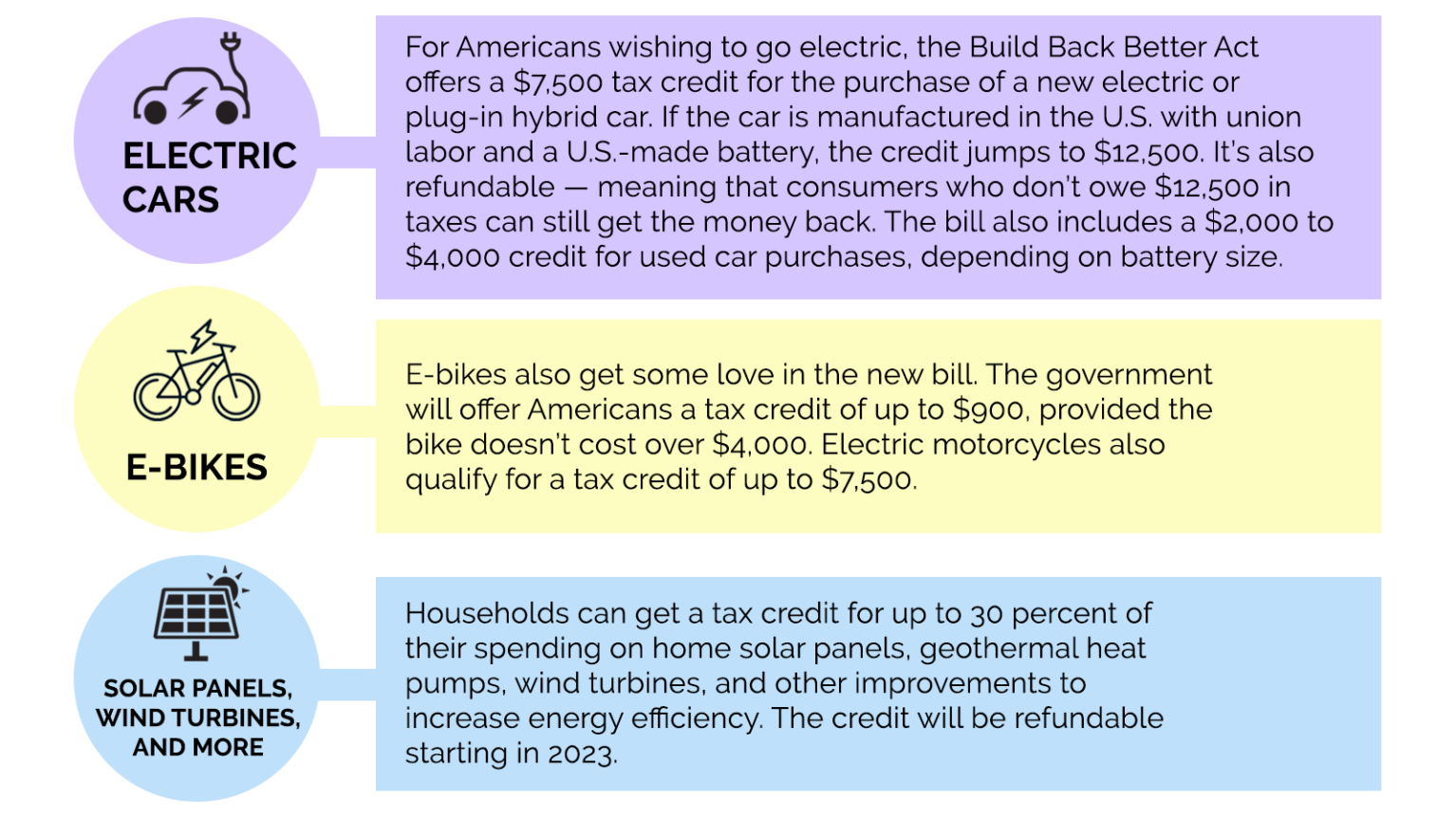

Green Incentives Usually Help The Rich Here s How The Build Back

https://grist.org/wp-content/uploads/2021/12/tax-credits-chart.png?w=1536

The Illinois Education Expense Credit allows parents or legal guardians of a full time K 12 student under the age of 21 to take a 25 tax credit on qualified education expenses Illinois offers a tax credit worth up to 750 for qualified education expenses at both public and private schools including book rental lab fees and tuition in excess

The Illinois Education Expense Credit allows parents or legal guardians of a full time K 12 student under the age of 21 to take a 25 tax credit on qualified education If you paid qualified education expenses is excess of 250 in 2023 you may qualify for a credit if you are the parent or guardian of a student under age 21 that is enrolled in

Chapter 9 Tax Credits For Foreign Estate Tax TAX CREDIT FOR FOREIGN

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/13670d83508fce97953b9582fddf4f67/thumb_1200_1553.png

When Are Tax Credits Ending How To Apply For Universal Credit

https://static.standard.co.uk/2023/09/29/10/PA-73040434.jpg?width=1200&width=1200&auto=webp&quality=75

https://tax.illinois.gov/content/dam/soi/en/web/...

How should I figure a credit for education expenses and what must I attach to my Form IL 1040 when I claim this credit You must complete Schedule ICR Illinois Credits

https://tax.illinois.gov/content/dam/soi/en/web/...

Schedule ICR Illinois Credits allows you to figure the total amount of property tax K 12 education expense and Volunteer Emergency Worker credits you may claim on Form IL

The Big Push To Restore R D Tax Credits FI Group USA

Chapter 9 Tax Credits For Foreign Estate Tax TAX CREDIT FOR FOREIGN

Tax Credits For Higher Education Don t Help

Tax Credits For Paid Sick And Paid Family And Medical Leave Questions

Georgia Tax Credits For Workers And Families

How Do Student Loans Affect Taxes LiveWell

How Do Student Loans Affect Taxes LiveWell

TAX CREDITS FOR FAMILIES US Taxes TV

Government Pushes For Sustainable Aviation Tax Credits On SAF Bluebiz

Tax Credit Bill For Rural Physicians Passes House Committee

Illinois Tax Credits For Education Expenses - Qualified education expenses Education expenses that qualify for this credit include tuition including summer school classes meeting elementary or secondary graduation