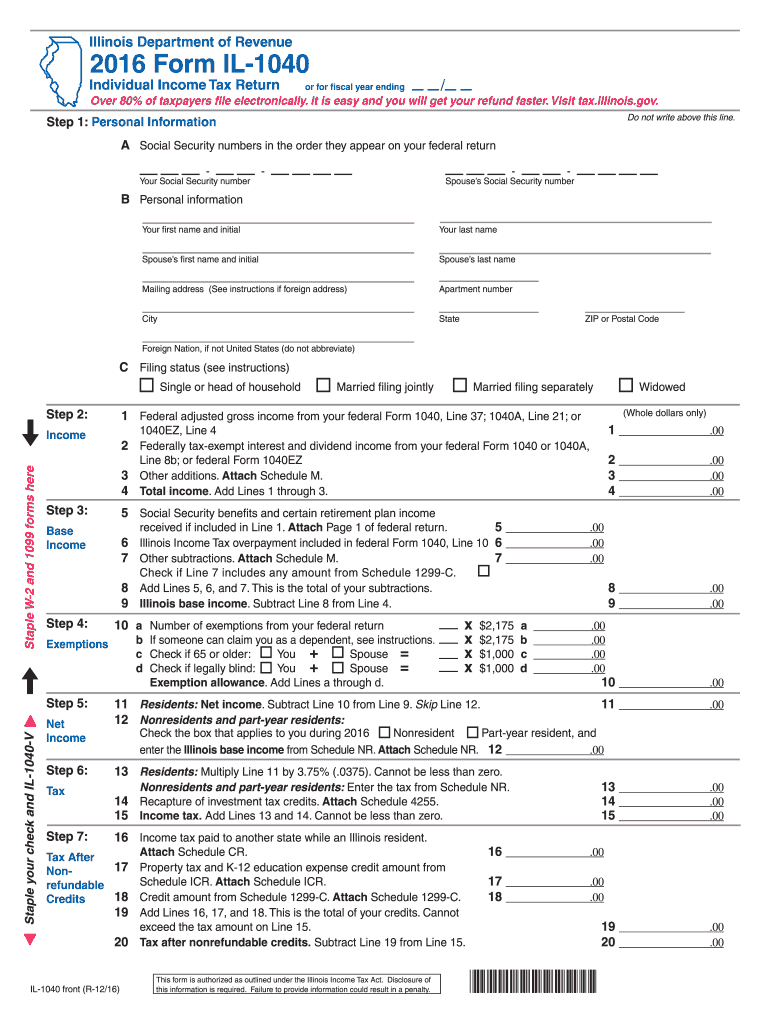

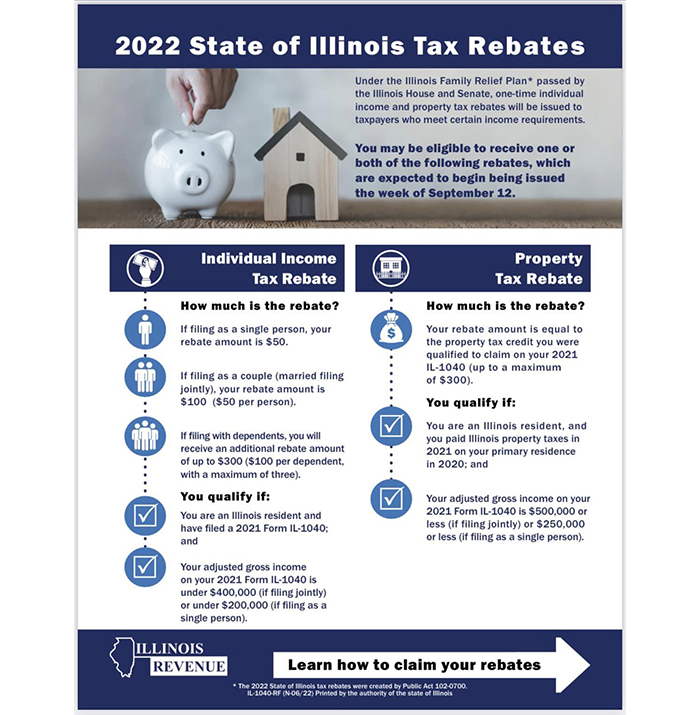

Illinois Tax Rebate For Homeowners Web 8 ao 251 t 2022 nbsp 0183 32 Who Qualifies for the Property Tax Rebate To qualify for the property tax rebate you must be an Illinois resident have paid property taxes in Illinois in 2020

Web 23 sept 2022 nbsp 0183 32 The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim their Web 11 ao 251 t 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be

Illinois Tax Rebate For Homeowners

Illinois Tax Rebate For Homeowners

https://printablerebateform.net/wp-content/uploads/2023/02/Illinois-Property-Tax-Rebate-Form-2023-768x668.jpg

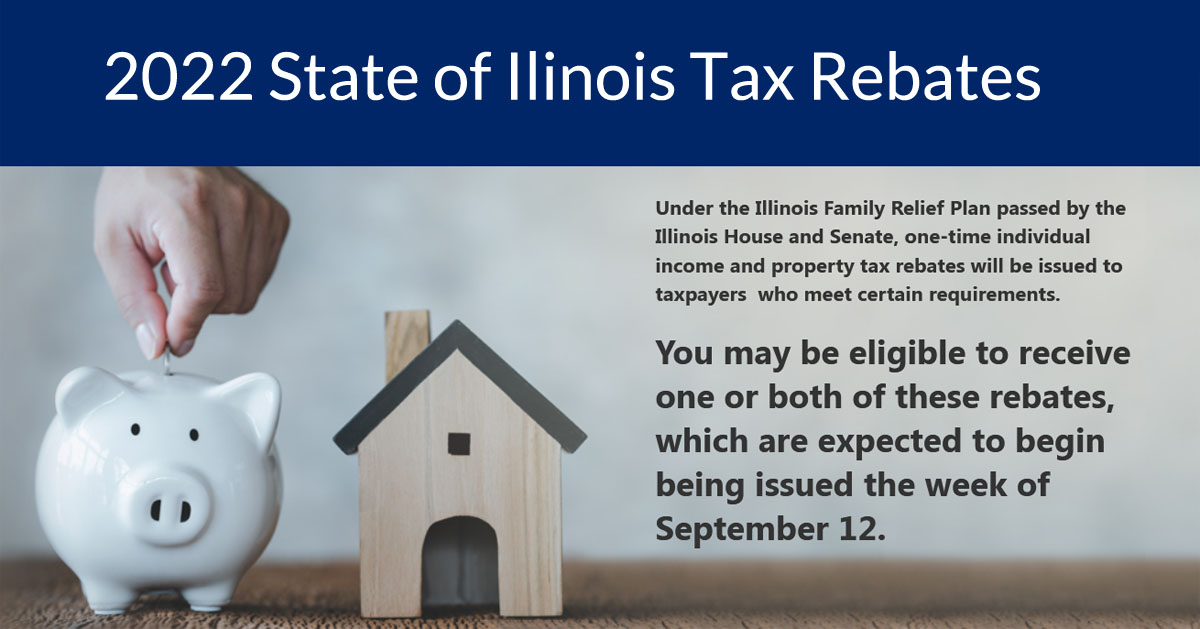

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

https://repsnessil66.com/wp-content/uploads/2022/09/2022-State-Tax-Rebate-Info_1-post.jpg

Illinois Tax Rebate Check Status Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/reminder-illinois-tax-rebate-program-filing-due-date-is-october-17.jpg?w=691&h=363&ssl=1

Web 6 sept 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be Web 12 sept 2022 nbsp 0183 32 Illinois is also providing property tax rebates for eligible homeowners Those rebates will be equal to the property tax credit they qualified for on their 2021

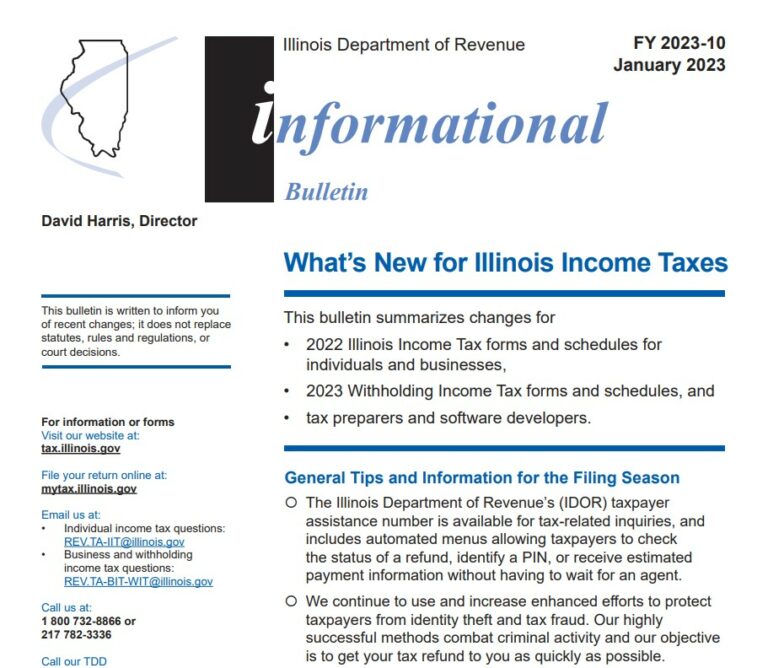

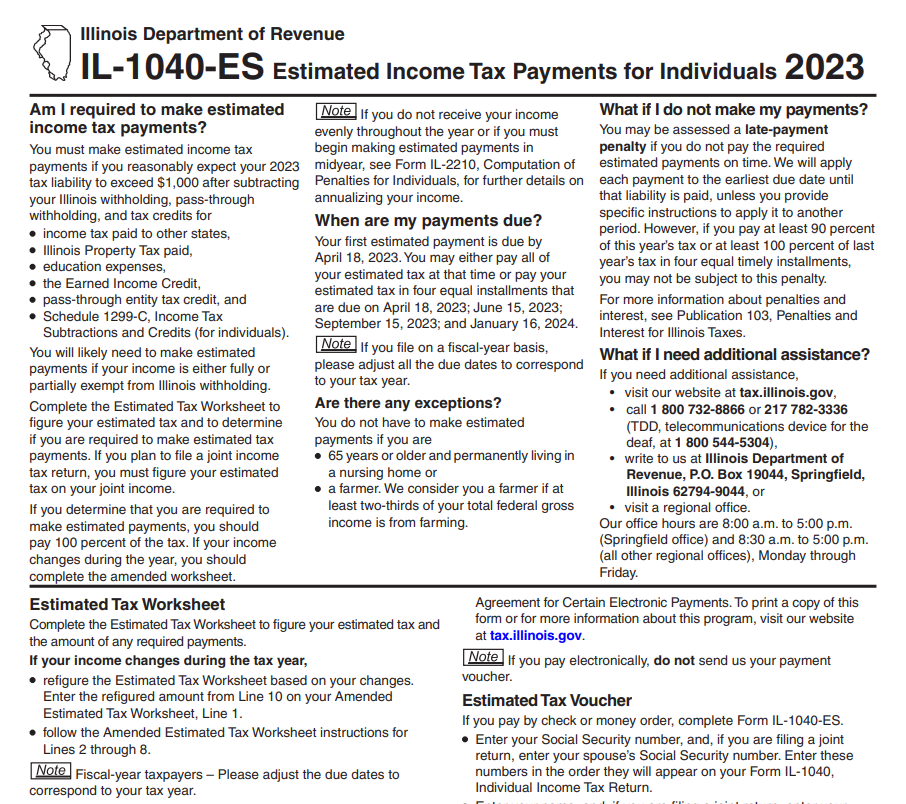

Web 16 oct 2022 nbsp 0183 32 The income tax rebate calls for a single person to receive 50 while those who file taxes jointly are poised to receive a total of 100 Mendoza s office said in a Web 30 juin 2022 nbsp 0183 32 Property tax rebates for eligible homeowners will be issued up to 300 It is reserved for individuals who made less than 500 000 for returns with a federal filing status of married filing

Download Illinois Tax Rebate For Homeowners

More picture related to Illinois Tax Rebate For Homeowners

Loughran Cappel backed Measure Sends Tax Rebates To Illinois Families

https://www.senatorloughrancappel.com/images/taxrebategrpahic.jpg

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

https://www.eztaxreturn.com/blog/wp-content/uploads/2022/08/Screenshot-2022-08-29-at-17-11-37-2022-State-of-Illinois-Tax-Rebates.png

Illinois Form Tax 2016 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/396/726/396726807/large.png

Web 17 oct 2022 nbsp 0183 32 If you qualify your rebate is equal to the property tax credit you were able to claim on your 2021 IL 1040 form up to 300 Property owners can still receive a rebate if they file an IL 1040 Web 30 juin 2022 nbsp 0183 32 A sales tax holiday on back to school items to run from Aug 5 to Aug 14 when the rate will be imposed at 1 25 percent instead of the regular 6 25 percent And an

Web The Illinois Property Tax Credit is a credit on your individual income tax return equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence Web 13 sept 2022 nbsp 0183 32 The income tax rebate calls for a single person to receive 50 while those who file taxes jointly are poised to receive a total of 100 Mendoza s office said in a

Deadline To File For Illinois Tax Rebates Monday YouTube

https://i.ytimg.com/vi/BXRW9zJWmVA/maxresdefault.jpg

Illinois Tax Rebates Are Coming In Time For The Election

https://s.yimg.com/ny/api/res/1.2/G6igSmNjSH3AFB1N9gaPnw--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/ap.org/92db876ff34dc7a7fb334182e1e1ff00

https://taxschool.illinois.edu/post/navigating-the-illinois-income-and...

Web 8 ao 251 t 2022 nbsp 0183 32 Who Qualifies for the Property Tax Rebate To qualify for the property tax rebate you must be an Illinois resident have paid property taxes in Illinois in 2020

https://www.nprillinois.org/economy-business/2022-09-23/retirees-need...

Web 23 sept 2022 nbsp 0183 32 The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim their

2022 State Of Illinois Tax Rebates Scheffel Boyle

Deadline To File For Illinois Tax Rebates Monday YouTube

Illinois Tax Rebate 2023 Everything You Need To Know Printable

Illinois Tax Exemption Form

Illinois Tax Forms 2021 Printable State IL 1040 Form And IL 1040

Illinois Tax Rebate Check Status Rebate2022

Illinois Tax Rebate Check Status Rebate2022

Illinois To Issue Tax Rebates Republic Times News

Illinois With Holding Income Tax Return Wikiform Fill Out And Sign

Tax Rebate FAQs Rep Thaddeus Jones

Illinois Tax Rebate For Homeowners - Web 3 oct 2022 nbsp 0183 32 Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be