Illinois Tax Rebate Irs Web 12 f 233 vr 2023 nbsp 0183 32 The IRS said in a press release that in the interest of sound tax administration residents in most states including Illinois will not be required to report

Web 10 f 233 vr 2023 nbsp 0183 32 Idaho 2022 Tax Rebate 2022 Tax Rebates Frequently Asked Questions State Tax Commission idaho gov Illinois Individual Income Tax Rebate 2022 State of Web 8 f 233 vr 2023 nbsp 0183 32 For residents from states such as California and Illinois the agency is recommending that they hold off on filing their tax returns until they receive further

Illinois Tax Rebate Irs

Illinois Tax Rebate Irs

https://repsnessil66.com/wp-content/uploads/2022/09/2022-State-Tax-Rebate-Info_1-post.jpg

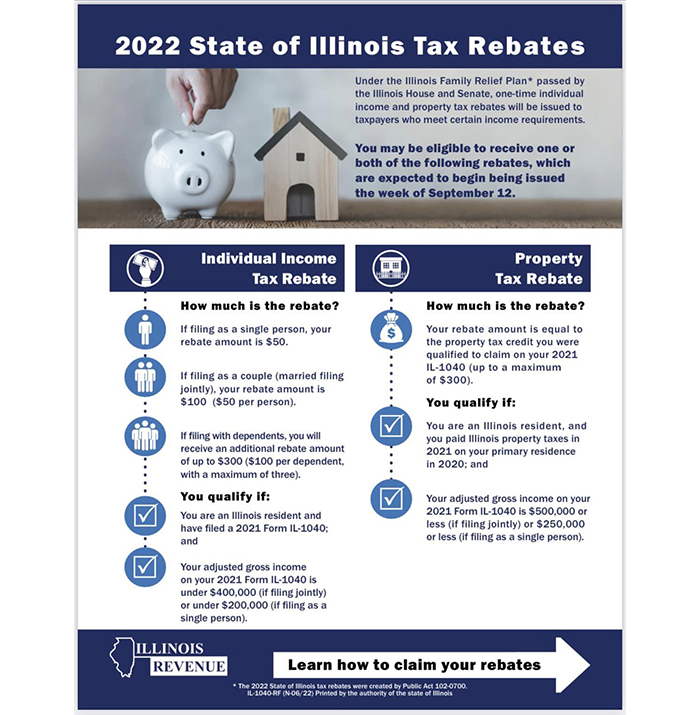

2022 State Of Illinois Tax Rebates Scheffel Boyle

https://scheffelboyle.com/wp-content/uploads/2022/07/2022-State-of-IL-Tax-Rebates-1382x1536.png

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

https://npr.brightspotcdn.com/dims4/default/42b0372/2147483647/strip/true/crop/758x413+0+0/resize/1760x958!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2Fcf%2F92%2Fc1613a8b4b4ba9b8b28ebd901285%2Ftaxrebate.png

Web 10 f 233 vr 2023 nbsp 0183 32 This means that people in the following states do not need to report these state payments on their 2022 tax return California Colorado Connecticut Delaware Web and Your adjusted gross income on your 2021 Form IL 1040 is under 400 000 if filing jointly or under 200 000 if filing as a single person How much is the rebate Your

Web 12 sept 2022 nbsp 0183 32 Income Tax Rebate The income tax rebate calls for a single person to receive 50 while those who file taxes jointly are poised to receive a total of 100 Web 9 sept 2023 nbsp 0183 32 State stimulus check 2023 update Clarity from the IRS on so called state stimulus checks is essential because millions of taxpayers across the U S have

Download Illinois Tax Rebate Irs

More picture related to Illinois Tax Rebate Irs

2021 Illinois Property Tax Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Illinois-Property-Tax-Rebate-Form-2023-768x668.jpg

Illinois Unemployment 941x Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/552/420/552420071/large.png

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

https://repsnessil66.com/wp-content/uploads/2022/09/2022-IL-Tax-Rebates_post.jpg

Web Effective June 7 2023 Public Act 103 0009 maintained the 2022 Individual Income Tax personal exemption allowance at 2 425 for 2023 Resources pertaining to this change Web 8 ao 251 t 2022 nbsp 0183 32 To qualify for the property tax rebate you must be an Illinois resident have paid property taxes in Illinois in 2020 and 2021 and your adjusted gross income on the

Web 10 f 233 vr 2023 nbsp 0183 32 Treatment for Illinois Taxpayers The IRS News Release indicates that people in the following states do not need to report these state payments on their 2022 Web 16 oct 2022 nbsp 0183 32 The income tax rebate calls for a single person to receive 50 while those who file taxes jointly are poised to receive a total of 100 Mendoza s office said in a

Printable Illinois Income Tax Forms Printable Forms Free Online

https://www.pdffiller.com/preview/453/611/453611818/large.png

Up To 700 For IL Residents How To Get Your Tax Rebate Check WIBQ

https://www.mywabashvalley.com/wp-content/uploads/sites/62/2022/10/IL-Check.jpg?w=900

https://www.nbcchicago.com/news/local/irs-issues-clarification-on...

Web 12 f 233 vr 2023 nbsp 0183 32 The IRS said in a press release that in the interest of sound tax administration residents in most states including Illinois will not be required to report

https://www.irs.gov/newsroom/state-payments

Web 10 f 233 vr 2023 nbsp 0183 32 Idaho 2022 Tax Rebate 2022 Tax Rebates Frequently Asked Questions State Tax Commission idaho gov Illinois Individual Income Tax Rebate 2022 State of

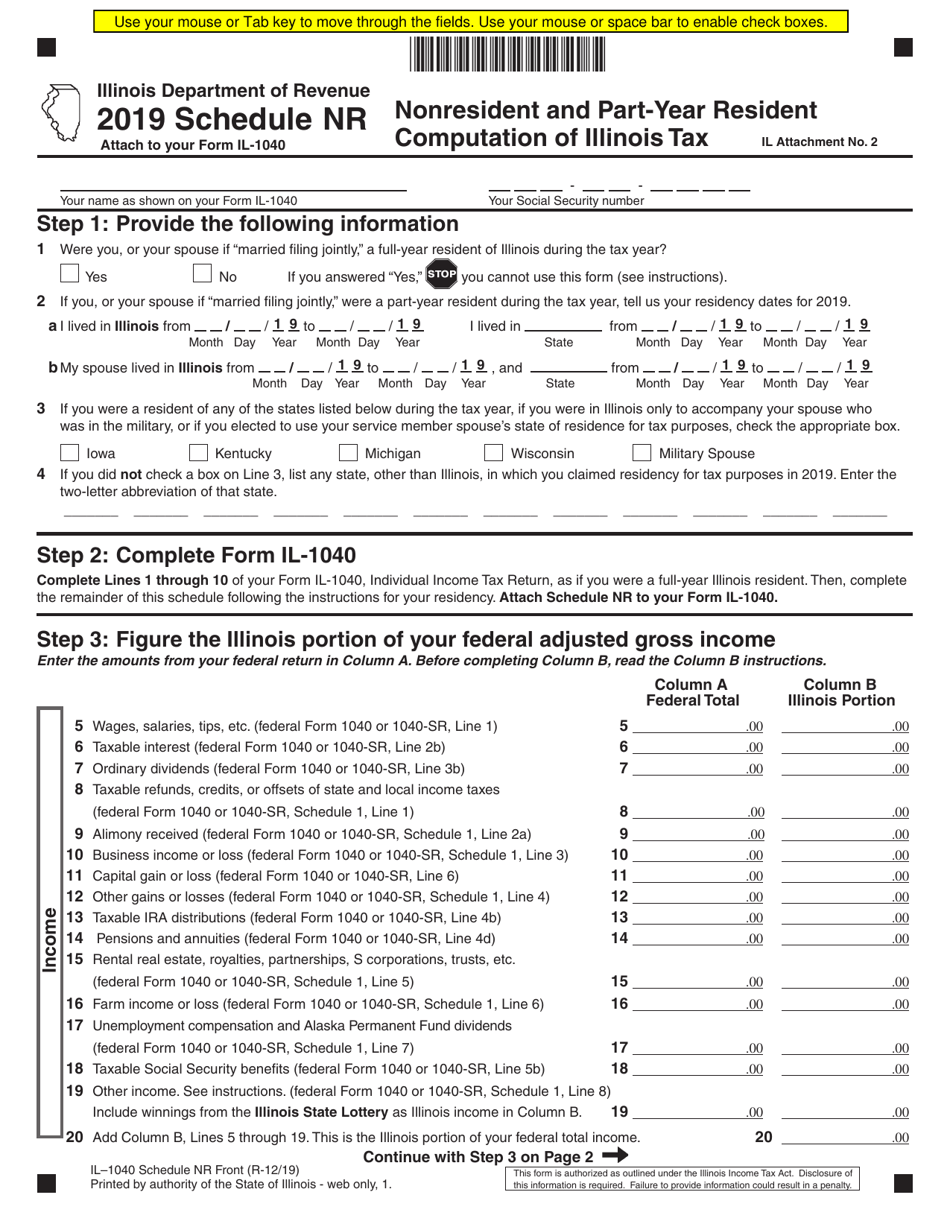

Form IL 1040 Schedule NR Download Fillable PDF Or Fill Online

Printable Illinois Income Tax Forms Printable Forms Free Online

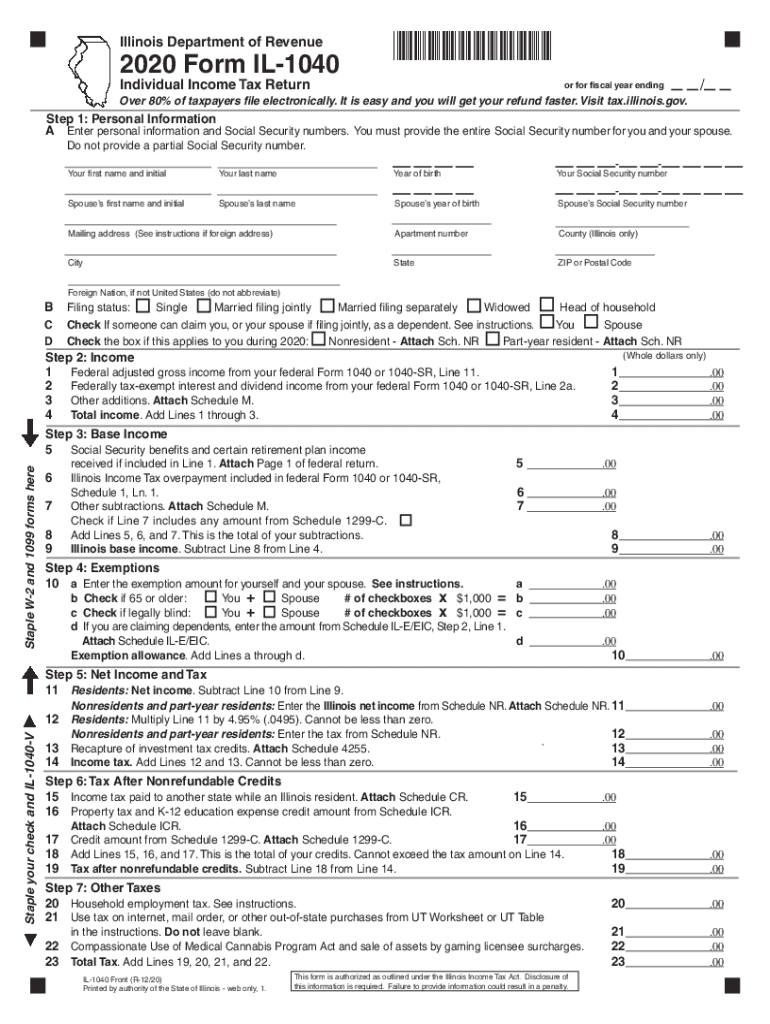

2020 Form IL DoR IL 1040 Fill Online Printable Fillable Blank

Loughran Cappel backed Measure Sends Tax Rebates To Illinois Families

2017 Form IL DoR IL 1040 X Fill Online Printable Fillable Blank

No Those Illinois Tax Rebate Checks Aren t Bouncing WGN TV

No Those Illinois Tax Rebate Checks Aren t Bouncing WGN TV

Form IL 1040 X Download Fillable PDF Or Fill Online Amended Individual

Deadline To Fill Out Form For Illinois Income And Property Tax Rebates

2022 State Of Illinois Tax Rebates Kakenmaster Tax Accounting

Illinois Tax Rebate Irs - Web 9 sept 2023 nbsp 0183 32 State stimulus check 2023 update Clarity from the IRS on so called state stimulus checks is essential because millions of taxpayers across the U S have