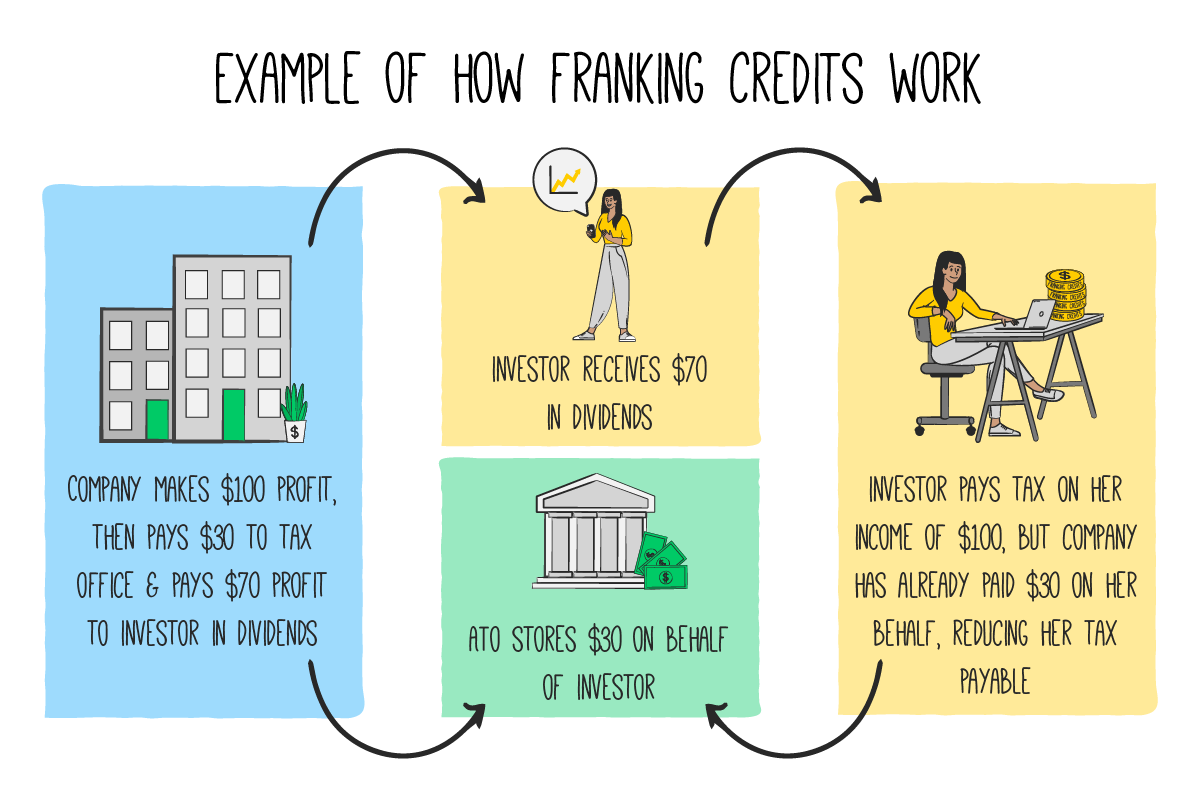

Imputation Credits Explained A franking credit also known as an imputation credit is a type of tax credit paid by corporations to their shareholders along with their dividend payments Australia and several other

Franking credits also known as imputation credits are tax credits that represent the amount of tax already paid by a company on its profits When a company distributes dividends to its shareholders it can attach these franking credits to the dividends to prevent double taxation When corporate tax entities distribute to their members profits on which income tax has already been paid such as when a company pays a dividend to its shareholders they have the option of passing on or imputing credits for the tax This is called franking the distribution

Imputation Credits Explained

Imputation Credits Explained

https://www.paragonconsultants.com.au/wp-content/uploads/bfi_thumb/post-gst-ovazed40ljmwdgqe8rab0khup2i42fuxyrd4opxvi0.jpg

2 Missing Data Imputation With Interpolation Methods Download

https://www.researchgate.net/publication/337324927/figure/fig14/AS:826531333025794@1574071834949/Missing-data-imputation-with-interpolation-methods.png

PDF Are Imputation Credits Capitalised Into Stock Prices

https://i1.rgstatic.net/publication/255173258_Are_Imputation_Credits_Capitalised_Into_Stock_Prices/links/004635271d88ca49cd000000/largepreview.png

A franking credit also known as an imputation credit is a type of tax credit that allows the company s income tax to flow through to its shareholders It is a system in place to avoid or eliminate doubling taxing dividends An imputation credit is a credit for tax already paid by the company it s passed onto the shareholders and attached to the dividend generally at 28 Dividends must be taxed at 33 As the New Zealand company tax rate is 28 the company needs to top up tax paid to Inland Revenue

When you invest in shares hopefully you will receive dividends paid out of company profits When you receive a dividend you also receive a credit for any tax that the company has already paid on its profits These are In this guide Part 1 of this guide is a general explanation of how the imputation system works and gives a basic explanation of a M ori authority credit Part 2 explains the ICA imputation credit account

Download Imputation Credits Explained

More picture related to Imputation Credits Explained

Retained Earnings Imputation Credits

https://cleaverpartners.co.nz/wp-content/uploads/2022/11/RetainedEarnings_ImputationCredits.jpg

THE VALUE OF IMPUTATION TAX CREDITS

https://s3.studylib.net/store/data/008742005_1-7fc3f26cc5c2650288a9a9c326cfbce1-768x994.png

Franking Credit Refund 2023 Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2021/11/franking-credit-calculators.jpg

1 1 Imputation is central to New Zealand s tax system Every resident company independent of size is affected by the imputation tax credit rules and every shareholder in a New Zealand company is eligible to receive imputation credits Imputation lets shareholders receive tax credits with the dividends they receive by allowing the company to pass on credits for the income tax it has already paid Companies keep track of how much income tax they pay and can attach this as an imputation credit to the dividends they pay out

[desc-10] [desc-11]

Streaming And Refundability Of Imputation Credits

https://s3.studylib.net/store/data/008486325_1-e8c58c40bb4e3470a493126f1b841a91-768x994.png

Franking Credits Explained What Are They And How Do They Work

https://www.halo-technologies.com/hubfs/feature image-4.jpg

https://www.investopedia.com/terms/f/frankingcredit.asp

A franking credit also known as an imputation credit is a type of tax credit paid by corporations to their shareholders along with their dividend payments Australia and several other

https://fastercapital.com/content/Imputation...

Franking credits also known as imputation credits are tax credits that represent the amount of tax already paid by a company on its profits When a company distributes dividends to its shareholders it can attach these franking credits to the dividends to prevent double taxation

Introduction To Regression Imputation For Missing Data Bigdata

Streaming And Refundability Of Imputation Credits

Multiple Imputation FourWeekMBA

A Guide To Dividends And Imputation Credits Beany New Zealand

Loss Grouping And Imputation Credits Tax Policy Website

Imputations OpenFisca UK Data Documentation

Imputations OpenFisca UK Data Documentation

GitHub Ivivan Imputation Review Code For Imputation Review Paper

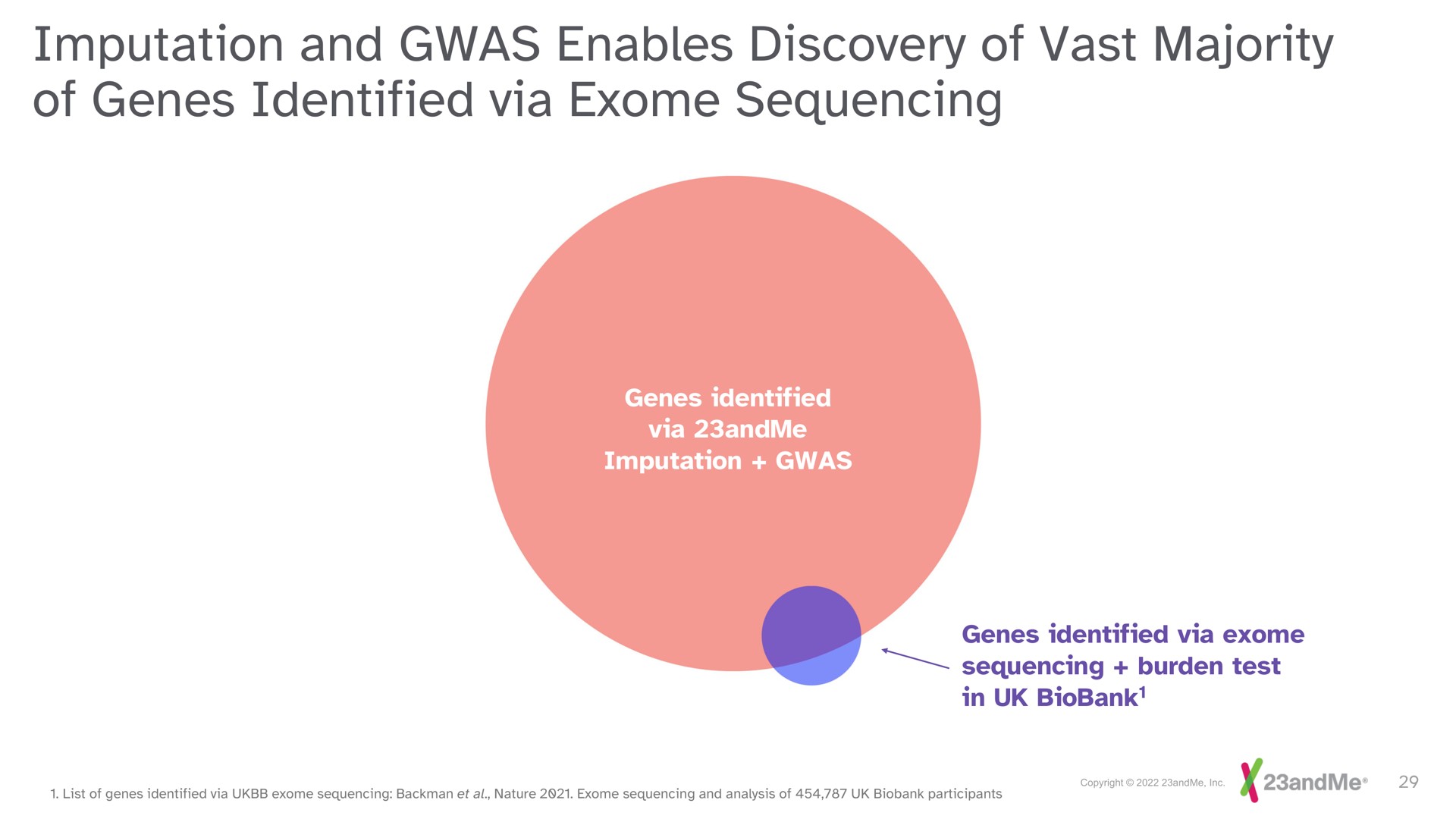

23andMe Investor Day Presentation Deck Slidebook io

ETF Tax Distributions DRPs And Franking Credits EVERYTHING Explained

Imputation Credits Explained - [desc-13]