Imputation Tax Credit Rebate Superannuation Web The benefit of imputation credits in an SMSF is a tax rate of 15 while imputation credits from fully franked dividends are 30 This means that the imputation credit

Web Dividend imputation with refundable credits is particularly valuable to superannuation fund members because the tax rates for investment income of superannuation funds Web A voucher for a franked dividend paid by an Australian company shows a gross amount an imputed tax credit or rebate and a net amount which is what the shareholder actually

Imputation Tax Credit Rebate Superannuation

Imputation Tax Credit Rebate Superannuation

https://ai2-s2-public.s3.amazonaws.com/figures/2017-08-08/8ee7299e095b6e96037afd7b180e0096c8c320b9/15-Table1-1.png

THE VALUE OF IMPUTATION TAX CREDITS

https://s3.studylib.net/store/data/008742005_1-7fc3f26cc5c2650288a9a9c326cfbce1-768x994.png

Figure 1 From THE VALUE OF IMPUTATION TAX CREDITS Semantic Scholar

https://ai2-s2-public.s3.amazonaws.com/figures/2017-08-08/8ee7299e095b6e96037afd7b180e0096c8c320b9/6-Figure1-1.png

Web This publication outlines the criteria for claiming a refund of imputation credits explains common terms and includes a worksheet and application forms NAT 4105 06 2022 Web 4 avr 2019 nbsp 0183 32 Many Self Managed Superannuation Funds SMSF have substantial investment in shares that pay dividends often with imputation credits Many

Web 8 mai 2018 nbsp 0183 32 In response to Labor s plans to disallow refunds for excess franking credits for many retirees Rice Warner has proposed an alternative policy to introduce a rebate Web The imputation credits distributed company tax collections are credited against this personal tax liability and the shareholder pays the net liability or in the case of an

Download Imputation Tax Credit Rebate Superannuation

More picture related to Imputation Tax Credit Rebate Superannuation

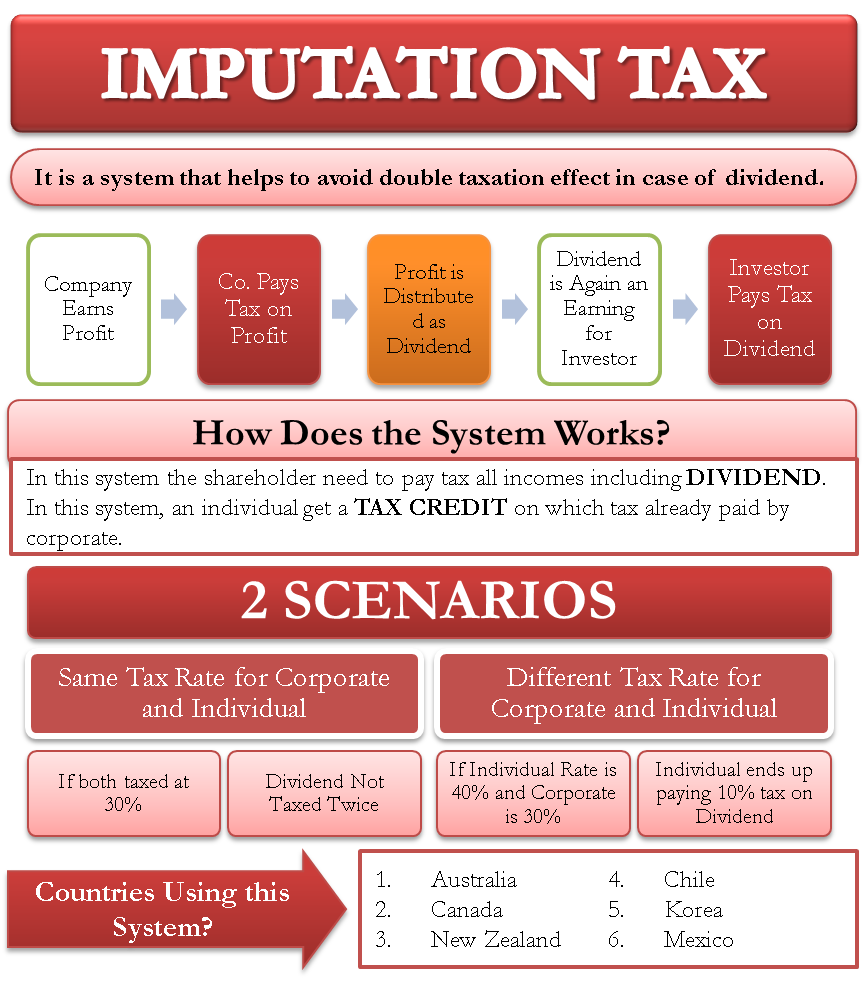

Imputation Tax Meaning How It Works And More

https://efinancemanagement.com/wp-content/uploads/2020/12/Imputation-Tax.png

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

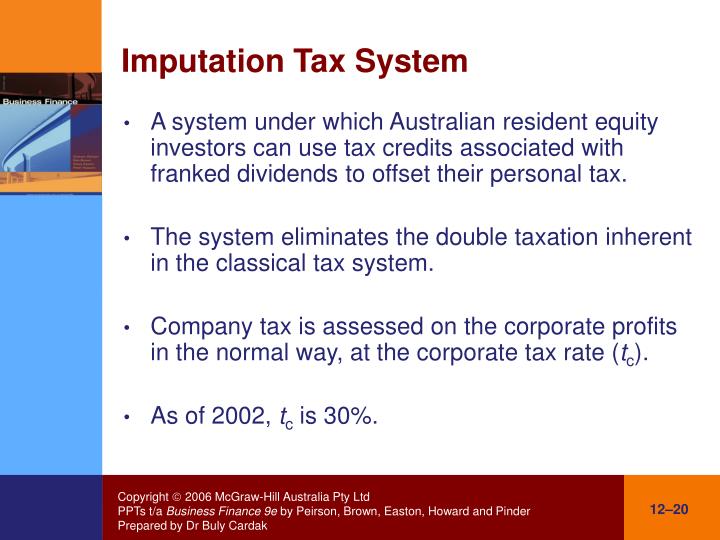

PPT Chapter 12 Dividend And Share Repurchase Decisions PowerPoint

http://image2.slideserve.com/3784492/imputation-tax-system-n.jpg

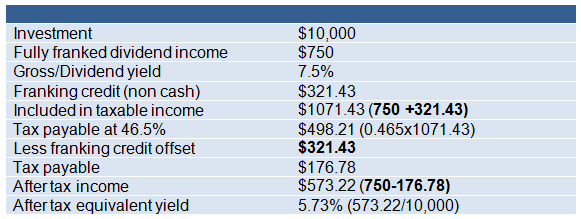

Web 1 juil 2004 nbsp 0183 32 A dividend imputation tax system provides shareholders with a credit for corporate tax paid that can be used to offset personal tax on dividend income This Web 27 ao 251 t 2009 nbsp 0183 32 The imputation credit of 30 is deducted from the tax otherwise payable For example if the shareholder s marginal tax rate is 45 per cent the tax payable on the

Web Shareholder who arc resIdent natural persons or resident superannuation funds include in taxable mcome the grossed up dividenci 5 These shareholders are thcn entItled to a ax Web 1 janv 2023 nbsp 0183 32 Si le montant du cr 233 dit d imp 244 t d 233 passe celui de votre imp 244 t le surplus vous est rembours 233 En revanche si vous ne payez pas d imp 244 t les services fiscaux vous

Pitch Of The Week 119 The Value Of Imputation Credits In Australia

https://media-exp1.licdn.com/dms/image/C5112AQGLOGmbUOXKRw/article-cover_image-shrink_720_1280/0/1521581148135?e=2147483647&v=beta&t=71wYeuNL8kngQujFqbhfwtfLS2Z4CN9xDdTXCq4XKiU

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/46/88/46088304/large.png

https://superannuationwarehouse.com.au/assets/imputation-credits-in-…

Web The benefit of imputation credits in an SMSF is a tax rate of 15 while imputation credits from fully franked dividends are 30 This means that the imputation credit

https://www.superannuation.asn.au/ArticleDocuments/359/…

Web Dividend imputation with refundable credits is particularly valuable to superannuation fund members because the tax rates for investment income of superannuation funds

IMPUTATION CREDITS Nicky Stafford Business Wealth Coaching

Pitch Of The Week 119 The Value Of Imputation Credits In Australia

Dividend Imputation Ducks The Tax Review Axe

Recovery Rebate Credit Worksheet Example Studying Worksheets

Dividend Imputation System Franking Credits Explained Calculations

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Dividend Imputation System Franking Credits Explained Calculations

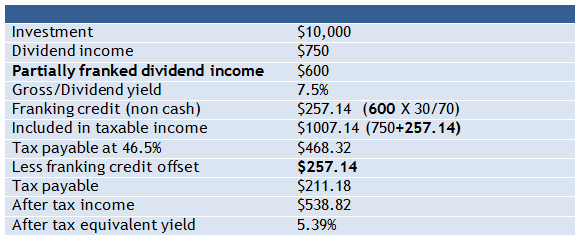

Tax Credits And Rebates Mauzy

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For

Imputation Tax Credit Rebate Superannuation - Web 6 avr 2023 nbsp 0183 32 Le cr 233 dit d imp 244 t s 233 l 232 ve 224 50 des d 233 penses engag 233 es pour les prestations de services 224 la personne dans la limite d un plafond qui varie entre 12 000 et 20 000