Incentives And Rebates For Solar Projects Web 13 mars 2023 nbsp 0183 32 Available incentives There are several types of solar incentives available for residential solar across the country Here are the ones most commonly used by homeowners to reduce their solar panel

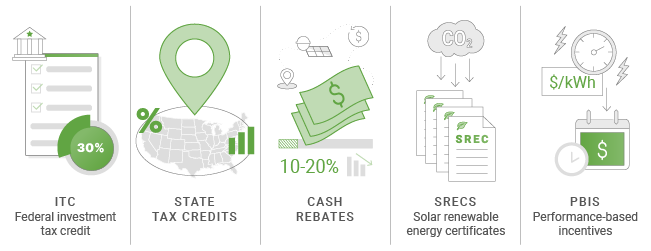

Web First some basic terms Solar Incentives Incentives provided to a homeowner or business installing solar by a government agency or utility in order to accelerate solar Web 18 nov 2021 nbsp 0183 32 These commonly take the form of tax credits rebates and performance based incentives In fact they can reduce the total cost of a solar PV system by 26 to 50 Understanding the local and federal

Incentives And Rebates For Solar Projects

Incentives And Rebates For Solar Projects

https://www.1energysystems.com/wp-content/uploads/2021/03/Solar-Panel-Rebates-and-Incentives.jpg

See How Much You Can Save By Switching To Solar Solar Solar

https://i.pinimg.com/originals/e9/27/80/e9278098ac41f9655d8aa14b78afb9df.jpg

Solar Panel Rebates And Incentives A Comprehensive Guide

https://www.1energysystems.com/wp-content/uploads/2021/03/Incentives-and-rebates-for-solar.jpg

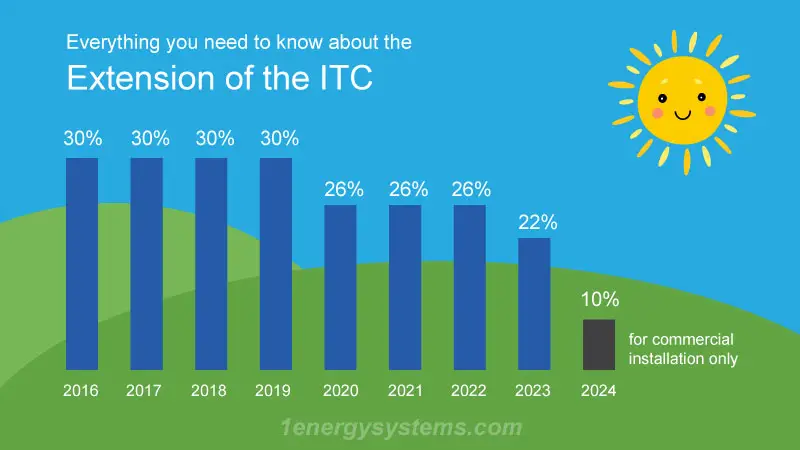

Web 8 sept 2022 nbsp 0183 32 Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already installed Web Under most circumstances subsidies provided by your utility to you to install a solar PV system are excluded from income taxes through an exemption in federal law 7 When this

Web 16 ao 251 t 2023 nbsp 0183 32 How Much Can You Save The size of the rebates will vary based on your household income and where you live as the program will be administered separately by Web 28 ao 251 t 2023 nbsp 0183 32 This is huge news for homeowners as this tax credit officially known as the Residential Clean Energy Credit is the greatest financial incentive available for solar and battery storage projects At

Download Incentives And Rebates For Solar Projects

More picture related to Incentives And Rebates For Solar Projects

Solar Panel Deals Rebates And Incentives In Australia Solar Market

https://i0.wp.com/www.powerrebate.net/wp-content/uploads/2023/05/solar-panel-deals-rebates-and-incentives-in-australia-solar-market.jpg?resize=768%2C510&ssl=1

2018 Guide To Ohio Home Solar Incentives Rebates And Tax Credits

https://solarpowerrocks.com/wp-content/uploads/2016/10/OH-rebates-ring.png

Solar Rebates By State In 2021 Solar

https://s3.amazonaws.com/solarassets/wp-content/uploads/2019/06/NY-Solar-incentives.jpg

Web 13 sept 2023 nbsp 0183 32 Sept 13 2023 Private investment in clean energy projects like solar panels hydrogen power and electric vehicles surged after President Biden signed an Web 4 ao 251 t 2023 nbsp 0183 32 Tax exemptions Why the Investment Tax Credit is the best solar incentive The federal investment tax credit ITC is far and away the best solar incentive providing 30 of your solar project costs as a

Web 1 ao 251 t 2023 nbsp 0183 32 In some cases the solar tax credit can be combined with state incentives and utility funded programs that support clean energy The amount available for solar Web 22 ao 251 t 2023 nbsp 0183 32 2023 Solar Incentives and Rebates Top 9 Ranked States In this EcoWatch guide on solar incentives you ll learn How do you take advantage of solar

CPS Energy Solar Rebate 2020 Wells Solar

https://wellssolar.com/wp-content/uploads/2020/02/CPS-Energy-Solar-Rebate-Incentive-2020-sm.jpg

Through Government Rebates And Tax Incentives This Solar Program Is

https://i.pinimg.com/originals/d2/29/17/d229173fd3591329bf6586d0ecd4bf80.jpg

https://www.solarreviews.com/solar-incentives

Web 13 mars 2023 nbsp 0183 32 Available incentives There are several types of solar incentives available for residential solar across the country Here are the ones most commonly used by homeowners to reduce their solar panel

https://www.solar.com/learn/solar-rebates-incentives

Web First some basic terms Solar Incentives Incentives provided to a homeowner or business installing solar by a government agency or utility in order to accelerate solar

Missouri Solar Rebates And Incentives Incentive Ohio Missouri

CPS Energy Solar Rebate 2020 Wells Solar

Latest Solar Rebates And Payments

Minnesota Solar Rebates And Incentives Incentive Rebates Solar

California Solar Incentives And Rebates 2023 Solar Metric

Solar Panel Rebates Solar Tax Incentives GreenLight Solar Roofing

Solar Panel Rebates Solar Tax Incentives GreenLight Solar Roofing

Perth Solar Rebate Incentives How Does It Work

Minnesota Solar Power For Your House Rebates Tax Credits Savings

Solar Rebates And Incentives EnergySage

Incentives And Rebates For Solar Projects - Web Funding Opportunities The U S Department of Energy DOE Solar Energy Technologies Office SETO supports funding opportunities on photovoltaics concentrating solar