Income And Property Tax Rebates Web 17 ao 251 t 2023 nbsp 0183 32 The state government said in 2022 that some six million residents would receive income and property tax rebates beginning September last year under the

Web What s New Starting in mid January 2024 the Department of Revenue will open the filing period for eligible applicants to submit applications for rebates on property taxes and Web 11 mars 2023 nbsp 0183 32 There were no federal stimulus checks in 2022 but at least 22 states gave money back to residents primarily in the form of income and property tax rebates

Income And Property Tax Rebates

Income And Property Tax Rebates

http://dailysignal.com/wp-content/uploads/property_taxes-01-1024x893.png

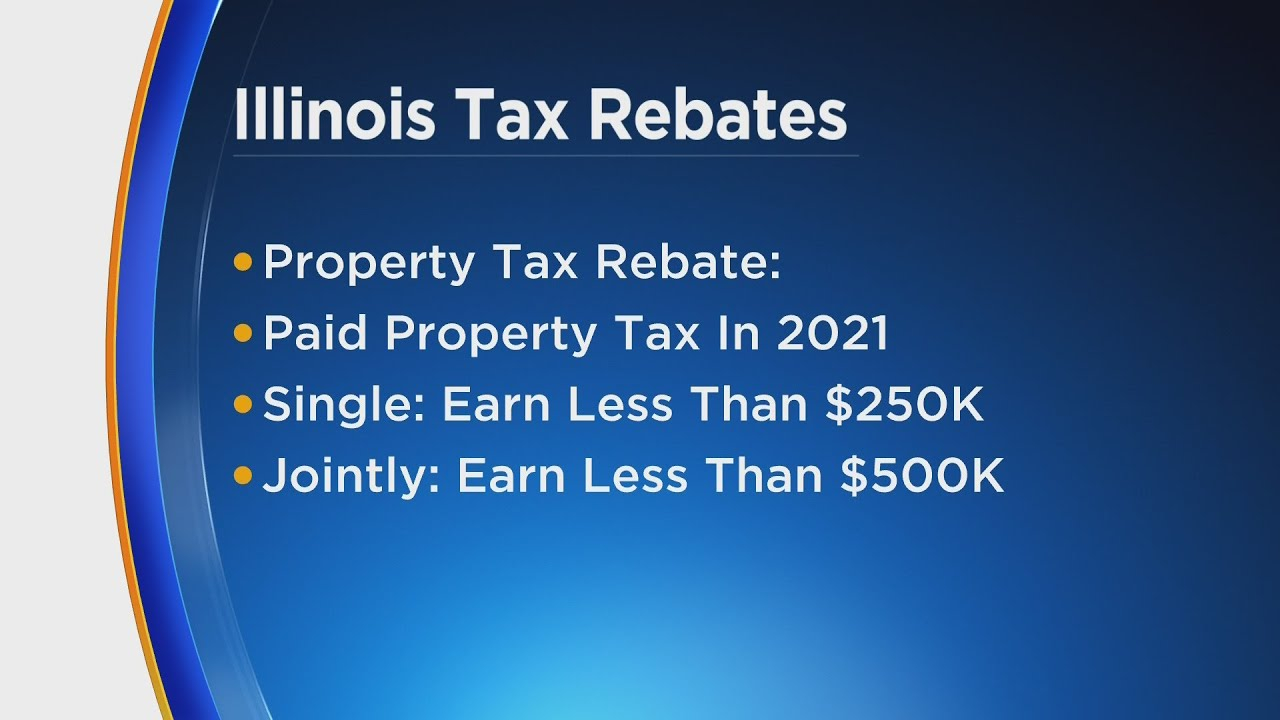

Deadline To Fill Out Form For Illinois Income And Property Tax Rebates

https://ic-cdn.flipboard.com/nbcchicago.com/743ca2ac42da3431ceb693caf903fa4244b05978/_medium.jpeg

What To Know About Montana s New Income And Property Tax Rebates

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA18ZJcd.img?w=1280&h=720&m=4&q=50

Web 11 sept 2022 nbsp 0183 32 Residents with dependents will receive a rebate of up to 300 100 per dependent with a maximum of three Income limits of 200 000 per individual taxpayer or 400 000 for joint filers Web 5 juil 2023 nbsp 0183 32 If you are looking for Income And Property Tax Rebates you ve come to the right place We have 34 rebates about Income And Property Tax Rebates including

Web 16 oct 2022 nbsp 0183 32 Residents with dependents will receive a rebate of up to 300 100 per dependent with a maximum of three Income limits of 200 000 per individual taxpayer Web income and property tax rebates will be issued to taxpayers who meet certain income requirements You may be eligible to receive one or both of the following rebates

Download Income And Property Tax Rebates

More picture related to Income And Property Tax Rebates

Today Is The Final Day To Qualify For Illinois Income And Property Tax

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA133fb8.img?h=630&w=1200&m=6&q=60&o=t&l=f&f=jpg

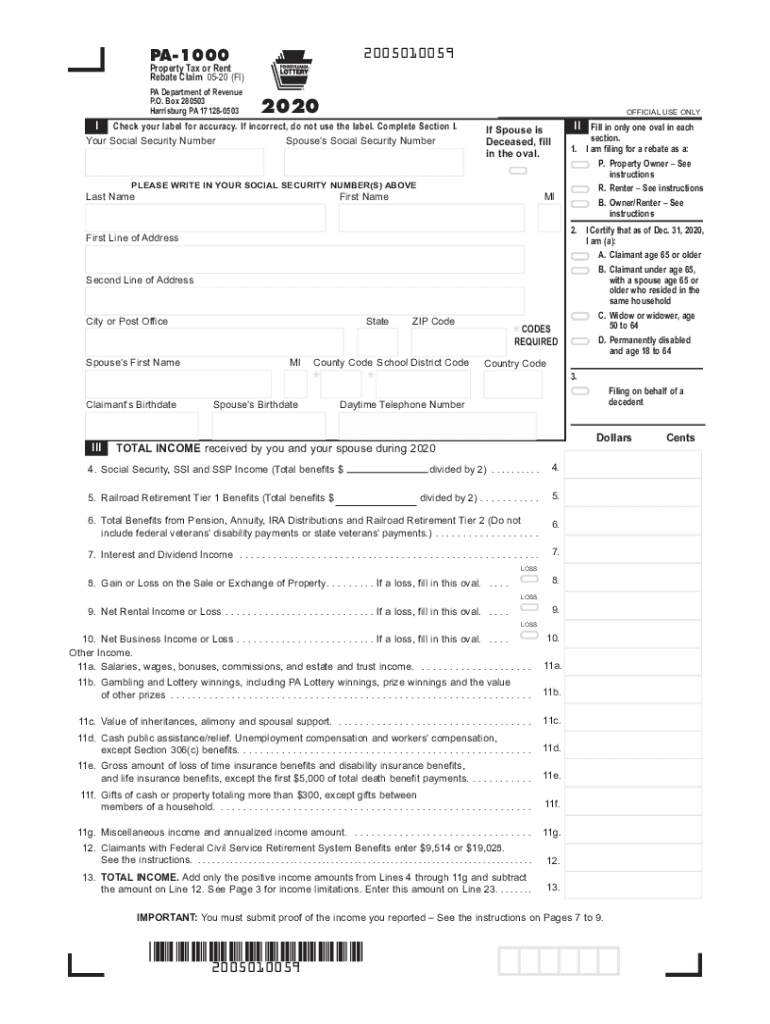

2020 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/540/488/540488148/large.png

Nj Property Tax Rebates 2023 PropertyRebate

https://www.propertyrebate.net/wp-content/uploads/2023/05/illinois-to-begin-sending-out-property-tax-and-income-tax-rebates-youtube-3.jpg

Web Il y a 1 jour nbsp 0183 32 Supplied Supplied Payments of 260 are going out to Minnesotans whose adjusted gross income in 2021 was 75 000 or less Married couples who file jointly and Web 5 sept 2023 nbsp 0183 32 September 5 2023 By Manish Bhatt Should municipal payments to a taxpayer under a public private financing agreement be considered a tax rebate This

Web The Property Tax Rebate is a rebate of up to 675 per year of property taxes paid on a principal residence There is a rebate available for property taxes paid for Tax Year Web 23 ao 251 t 2022 nbsp 0183 32 The maximum for the individual income and property tax rebates is 300 with up to three dependents qualifying as a dependent for the income tax rebate Who

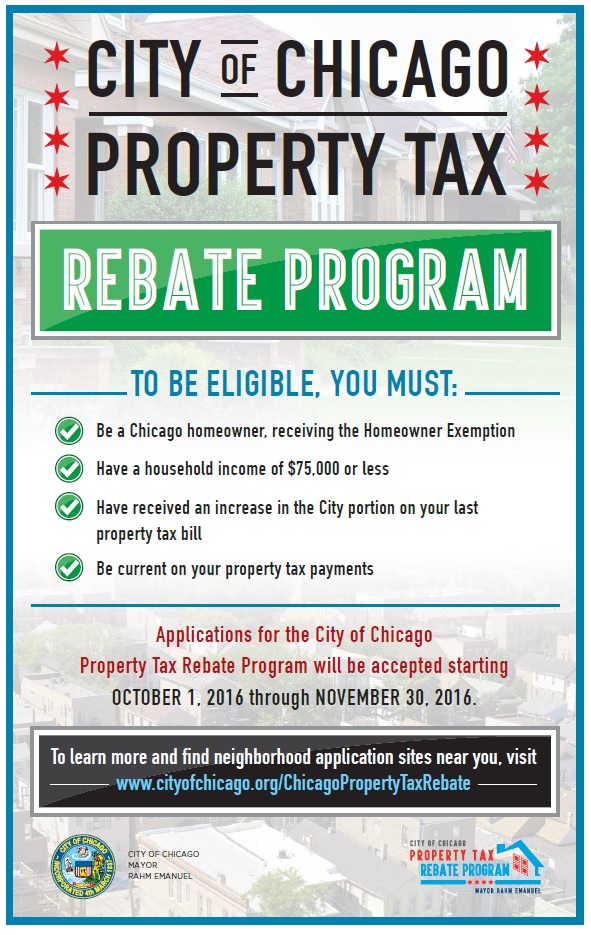

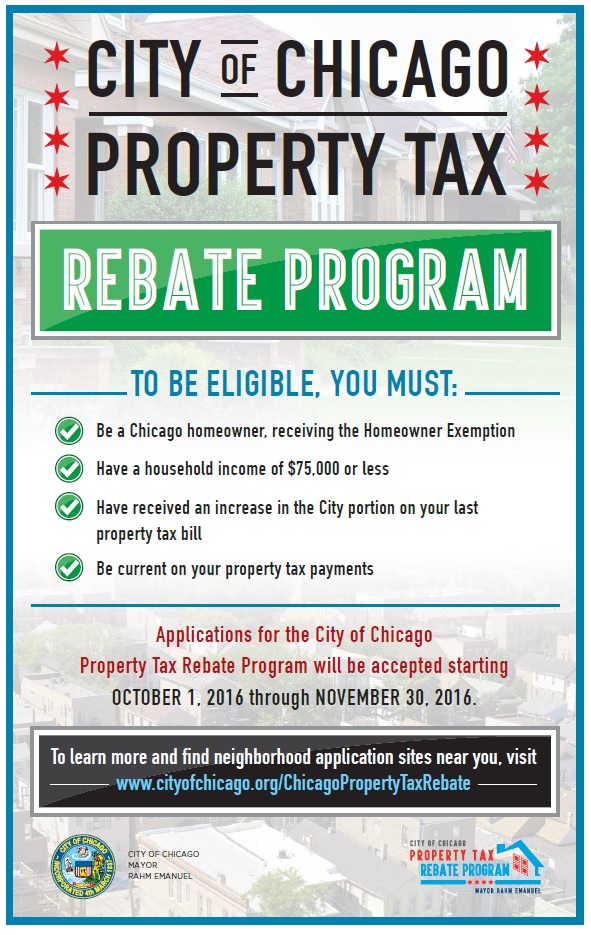

Uptown Update Property Tax Rebate Program Open Through November

https://4.bp.blogspot.com/-O9R4XCiPJUQ/WBWQyxv0nRI/AAAAAAAAN-M/A4WEO8G29mgbbWYzJj03YfOk_WrrHF4_wCLcB/s1600/TaxRebateProgram.jpg

Compare Sales Income And Property Taxes By State US Map 2011 My

http://www.mymoneyblog.com/wordpress/wp-content/uploads/2010/03/2011stateincome.gif

https://en.as.com/latest_news/these-five-states-are-giving-income-and...

Web 17 ao 251 t 2023 nbsp 0183 32 The state government said in 2022 that some six million residents would receive income and property tax rebates beginning September last year under the

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRent...

Web What s New Starting in mid January 2024 the Department of Revenue will open the filing period for eligible applicants to submit applications for rebates on property taxes and

There s Still Time Left To Fill Out A Form For Income And Property Tax

Uptown Update Property Tax Rebate Program Open Through November

2021 Illinois Property Tax Rebate Printable Rebate Form

Proposal To Update Ailing PA Rent Property Tax Rebate Program Would

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

Stadelman Encourages Older Adults To Claim Their Property Tax Rebate

Stadelman Encourages Older Adults To Claim Their Property Tax Rebate

How To Get Property Tax Rebate PropertyRebate

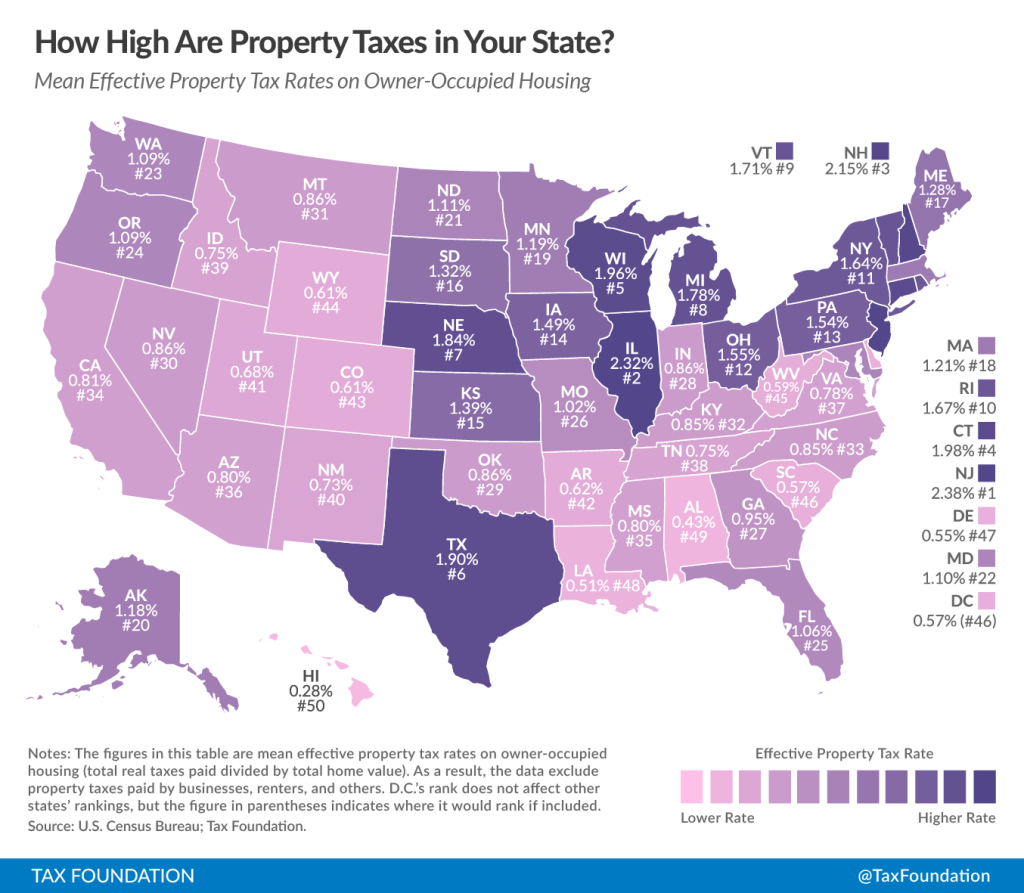

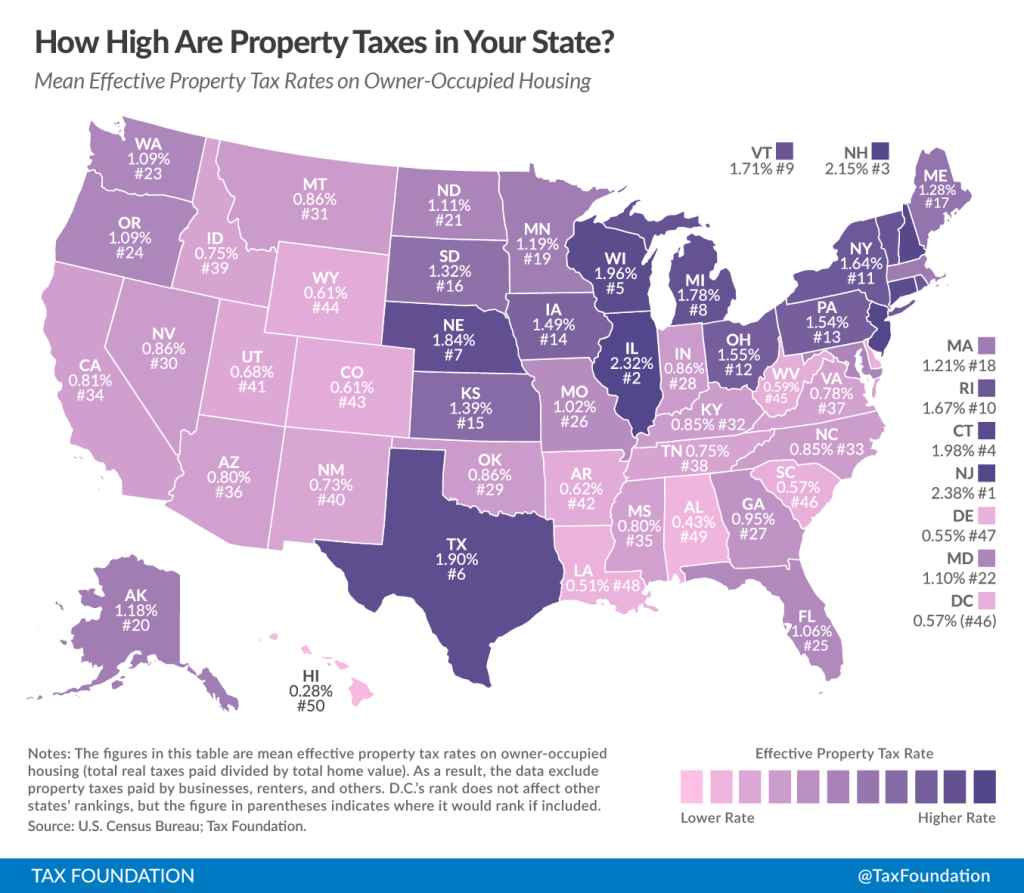

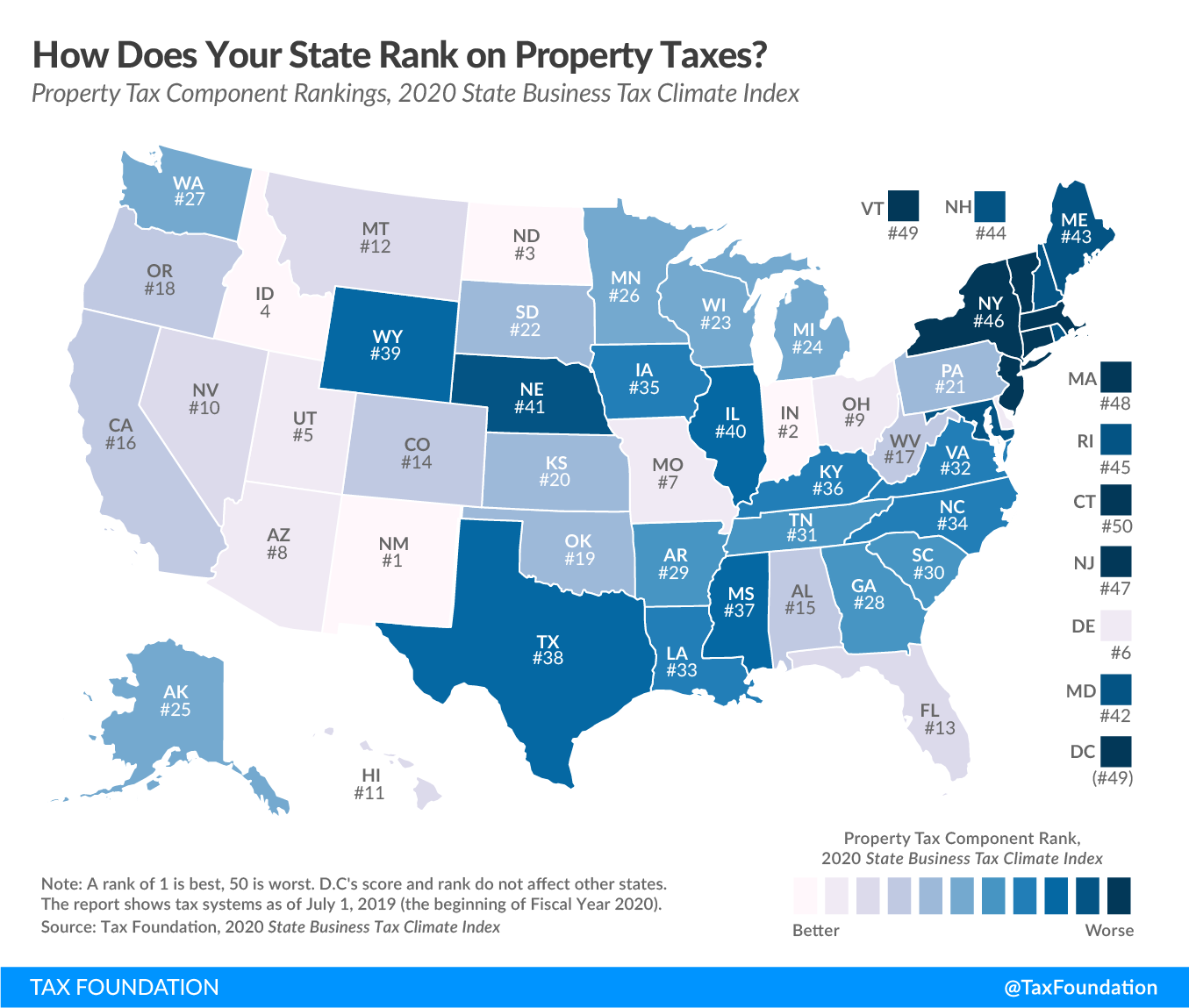

Best Worst Property Tax Codes In The U S Tax Foundation

Laguhan At Kabilaan Halimbawa

Income And Property Tax Rebates - Web Il y a 1 jour nbsp 0183 32 Property tax S 5 1 billion betting taxes S 2 8 billion and withholding tax S 2 1 billion accounted for the remaining tax revenue IRAS added that it audited and