Income Cap For Child Care Rebate Web 30 juin 2021 nbsp 0183 32 Families earning more than 190 015 and under 354 305 will have a subsidy cap of 10 655 per year per child Families earning under 190 015 will not have their

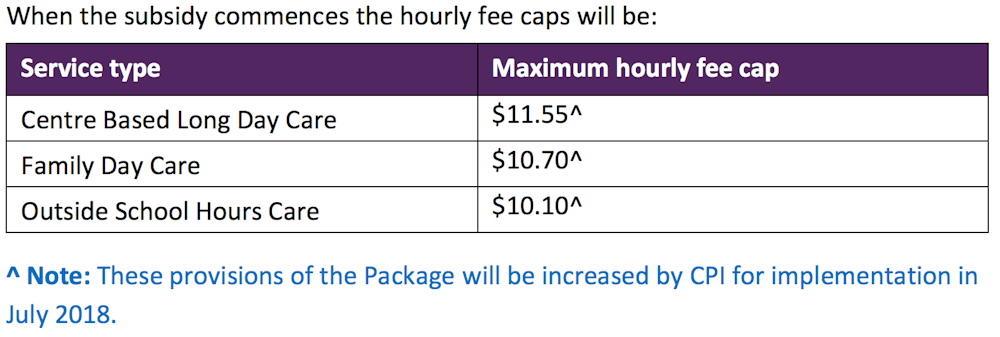

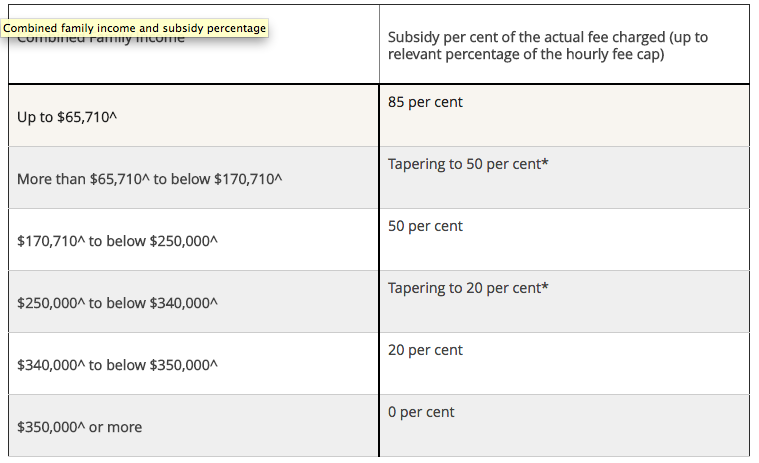

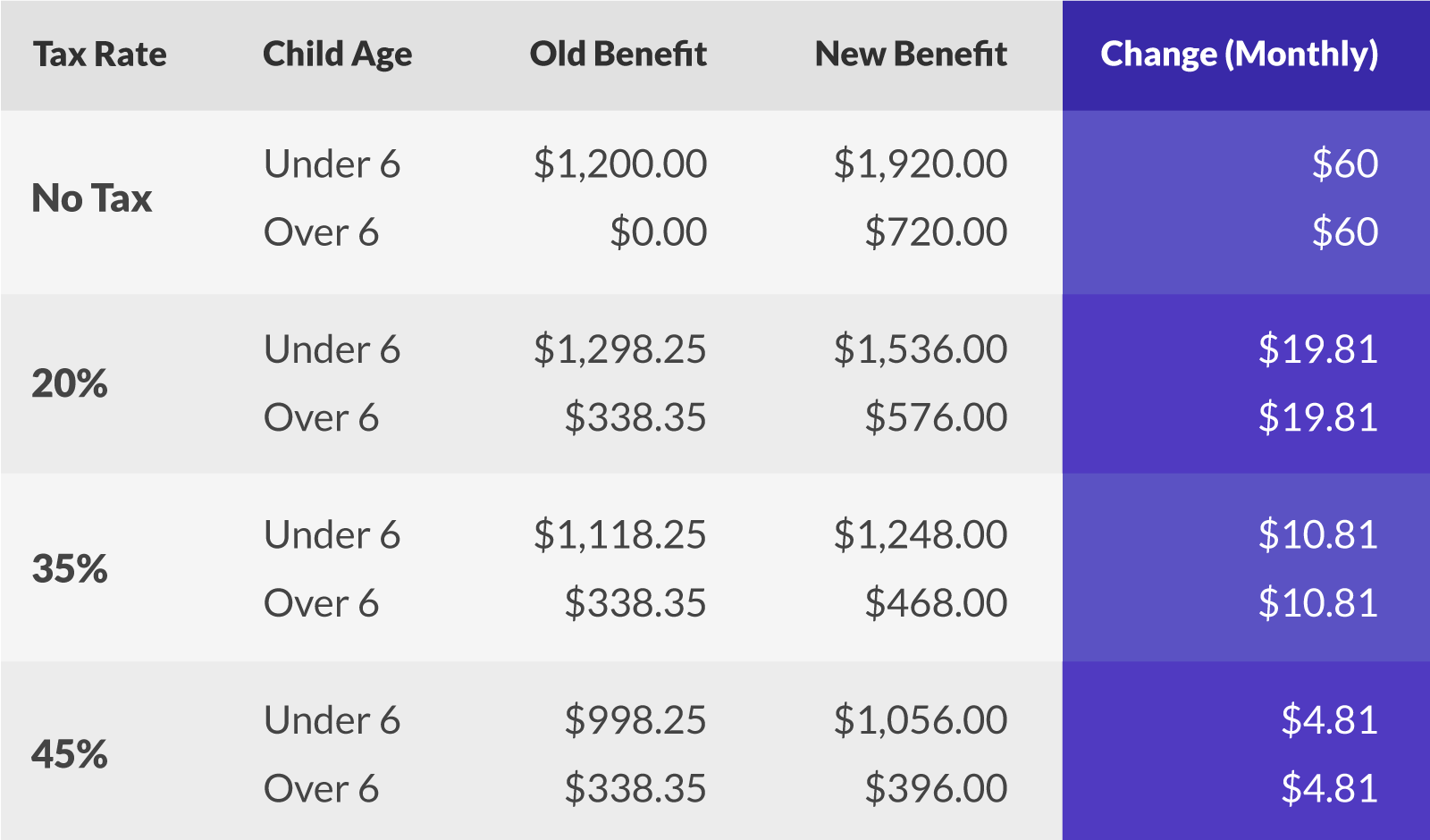

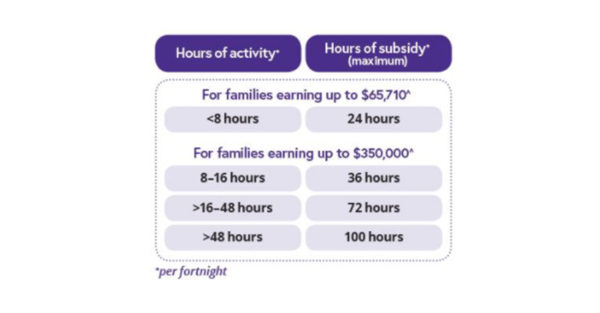

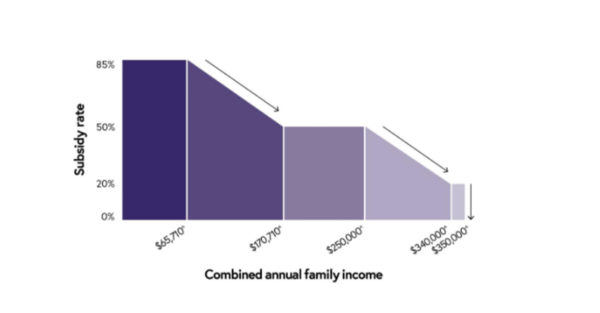

Web The Child Care Subsidy percentage you re entitled to depends on your family s income Your number of children in care can affect it You may get a higher Child Care Subsidy Web 10 juil 2023 nbsp 0183 32 The income cap for eligibility has been increased from 356 756 to 530 000 That will mean more higher income families will be eligible Caregivers don t need to do anything to get the increased rate

Income Cap For Child Care Rebate

Income Cap For Child Care Rebate

https://cdn.newsapi.com.au/image/v1/30e248ff2877200e614bc2ca3adf011b

Child Care Rebate Tax Brackets 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/how-canada-s-revamped-universal-child-care-benefit-affects-you.png

Luxon Announces Childcare Tax Rebate Policy Expected To Benefit

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA18ebJ5.img?w=1120&h=640&m=4&q=74

Web If a family earns more than 189 390 per year and less than 353 680 then the total amount of CCS they can receive in 2020 21 is 10 560 per child the annual cap Families earning less than 189 390 per year do Web If you pay child support you can deduct the amount you pay when working out your adjusted taxable income Child support you pay can include all of these child support

Web Child Care Subsidy Income Test 2023 Updates From July 2023 The maximum CCS rate will be lifted to 90 for families earning 80 000 or less CCS rates will be increased for Web 5 juin 2016 nbsp 0183 32 The opposition says the higher cap would leave families up to 2500 per child better off a year Some 107 800 families that would hit the cap this financial year would benefit it says The rebate

Download Income Cap For Child Care Rebate

More picture related to Income Cap For Child Care Rebate

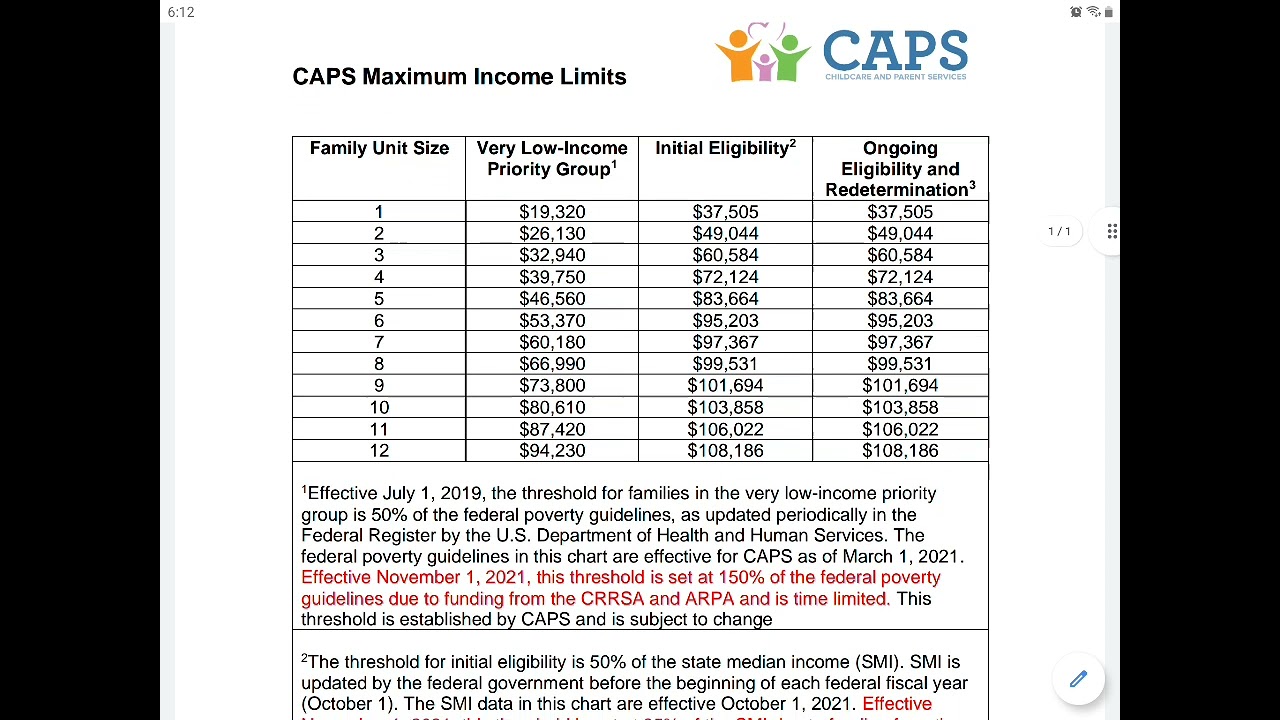

GEORGIA CAPS CHILDREN PARENTS SERVICES ELIGIBILITY

https://i.ytimg.com/vi/U3MtQ5nANMs/maxresdefault.jpg

PolicyCheck The Government s New Child Care Plan

https://images.theconversation.com/files/162587/original/image-20170327-3283-994gq6.png?ixlib=rb-1.1.0&q=45&auto=format&w=1000&fit=clip

Child Care Expenses Tax Credit Colorado Free Download

http://www.formsbirds.com/formimg/child-care-rebate-form/3306/child-care-expenses-tax-credit-colorado-l2.png

Web 10 juil 2023 nbsp 0183 32 Families earning up to 80 000 can get an increased maximum CCS amount from 85 to 90 If you earn over 80 000 you may get a subsidy starting from 90 Web From 10 December 2021 the Victorian Government is removing the annual cap for all families earning over 190 015 2021 22 terms This gives families more choice about

Web 10 oct 2021 nbsp 0183 32 Families earning more than 190 015 2021 22 terms have an annual subsidy cap of 10 655 per child each financial year From 10 December 2021 we re Web Families Earning Less than 65 710 With the current 7 500 cap now redundant the new Child Care Subsidy will cover up to 85 per cent of childcare costs A family earning

2022 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/fb/source_images/child-care-rebate-application-form-d1.png

New Childcare Rebates And What They Mean For You Ellaslist Ellaslist

https://www.ellaslist.com.au/ckeditor_assets/pictures/1682/content_family_income_subsidy_childcare.png

https://www.education.gov.au/early-childhood/announcements/child-care...

Web 30 juin 2021 nbsp 0183 32 Families earning more than 190 015 and under 354 305 will have a subsidy cap of 10 655 per year per child Families earning under 190 015 will not have their

https://www.servicesaustralia.gov.au/how-much-child-care-subsidy-you...

Web The Child Care Subsidy percentage you re entitled to depends on your family s income Your number of children in care can affect it You may get a higher Child Care Subsidy

Child Care Benefit Claim Form Notes Australia Free Download

2022 Child Care Rebate Form Fillable Printable PDF Forms Handypdf

Child Care Benefit Claim Form Notes Australia Free Download

Child Care And Early Childhood Learning Future Options PC News And

Five Things You Need To Know About The New Child Care Subsidy

Childcare Rebate Calculator 2022 Printable Rebate Form

Childcare Rebate Calculator 2022 Printable Rebate Form

Five Things You Need To Know About The New Child Care Subsidy

Child Care Benefit Claim Form Notes Australia Free Download

How To Manage Your Childcare Center Budget with A Free Excel Template

Income Cap For Child Care Rebate - Web 7 janv 2020 nbsp 0183 32 4 3 3 50 Income from Child Care Work related child care rebate Income from child care includes money earned informally from baby sitting in the carer s home