Income Max For Nj Tax Rebate Web 3 mars 2022 nbsp 0183 32 The proposal would apply to 1 8 million residents to help offset the nation s highest property taxes averaging 9 284 last year Governor Phil Murphy is including property tax relief checks in

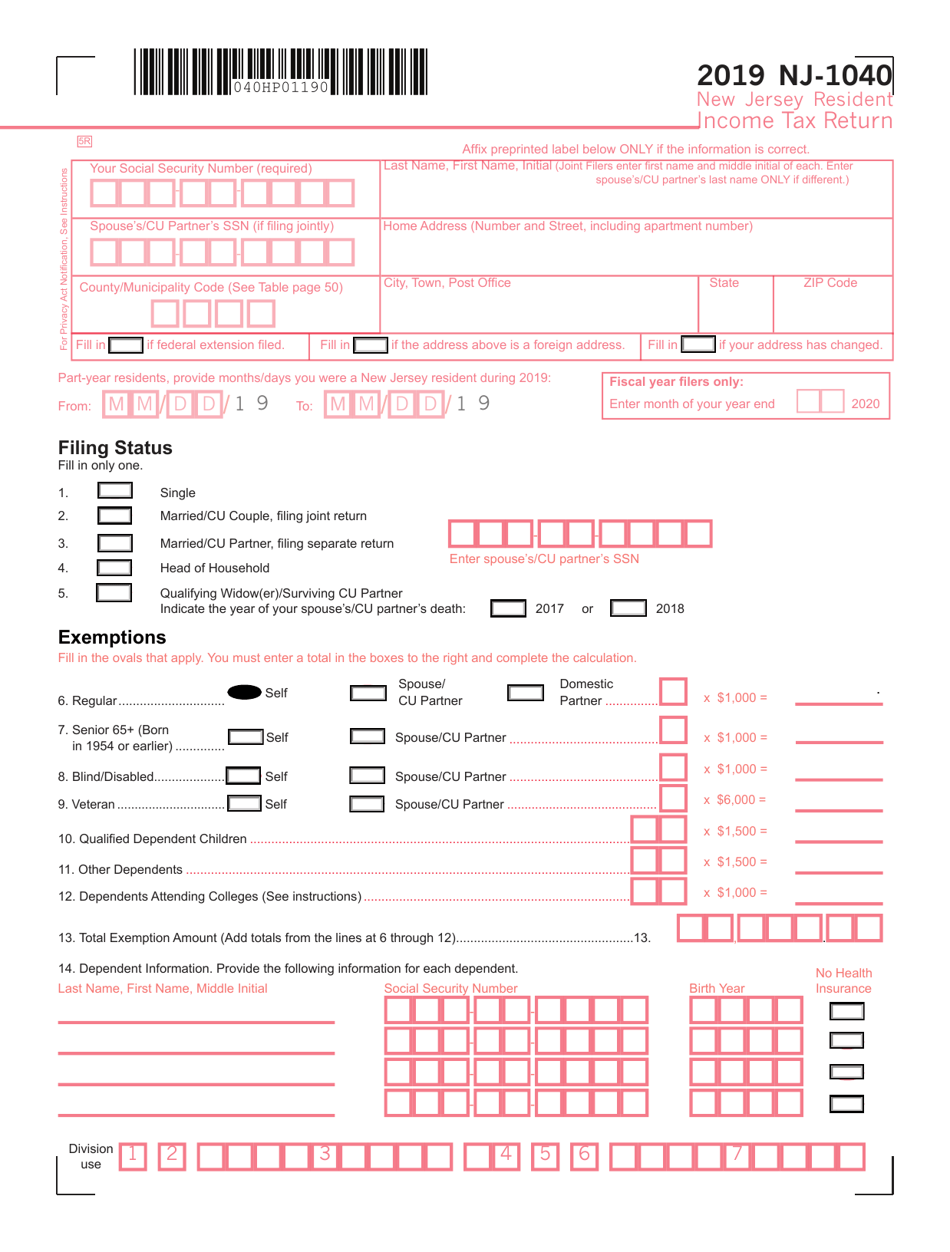

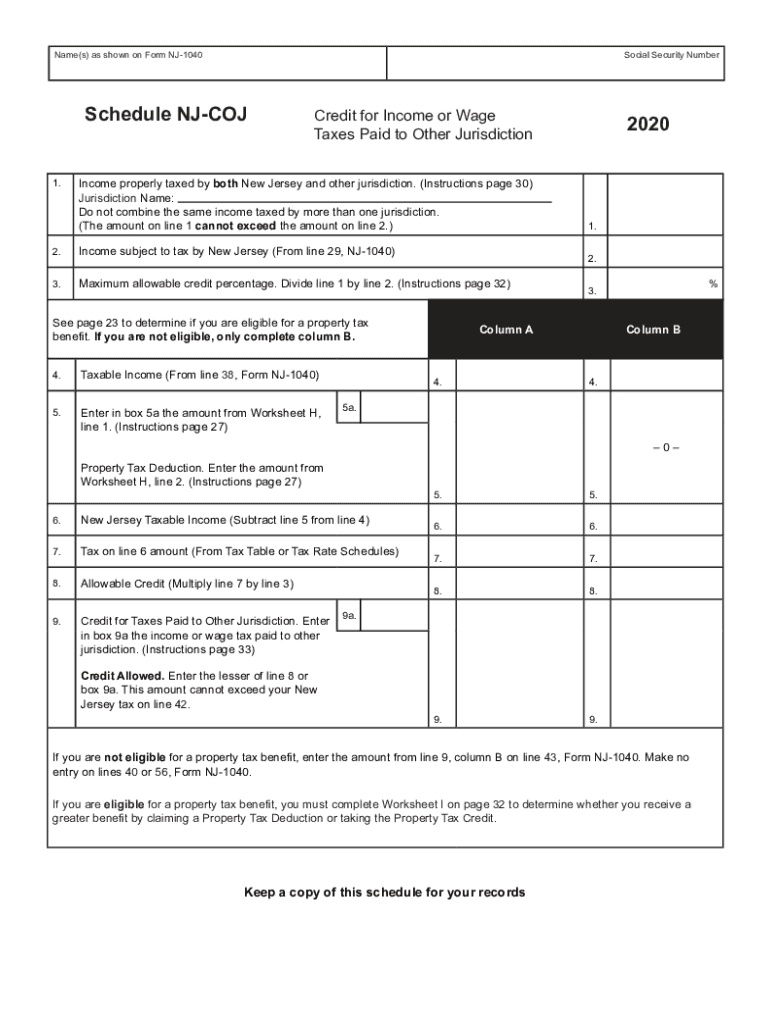

Web Your 2020 New Jersey gross income can be found on line 29 of your 2020 New Jersey Income Tax return NJ 1040 If you do not have access to your 2020 NJ 1040 you may use the amount from your 2022 NJ 1040 Report your income as 0 if you did not file an Web 19 sept 2022 nbsp 0183 32 You must have been a New Jersey resident your 2019 New Jersey gross income must not have exceeded 150 000 and you must have rented and occupied a residence in the state that was your principal

Income Max For Nj Tax Rebate

Income Max For Nj Tax Rebate

https://www.njpp.org/wp-content/uploads/2017/09/NJ-income-tax-brackets-01.jpg

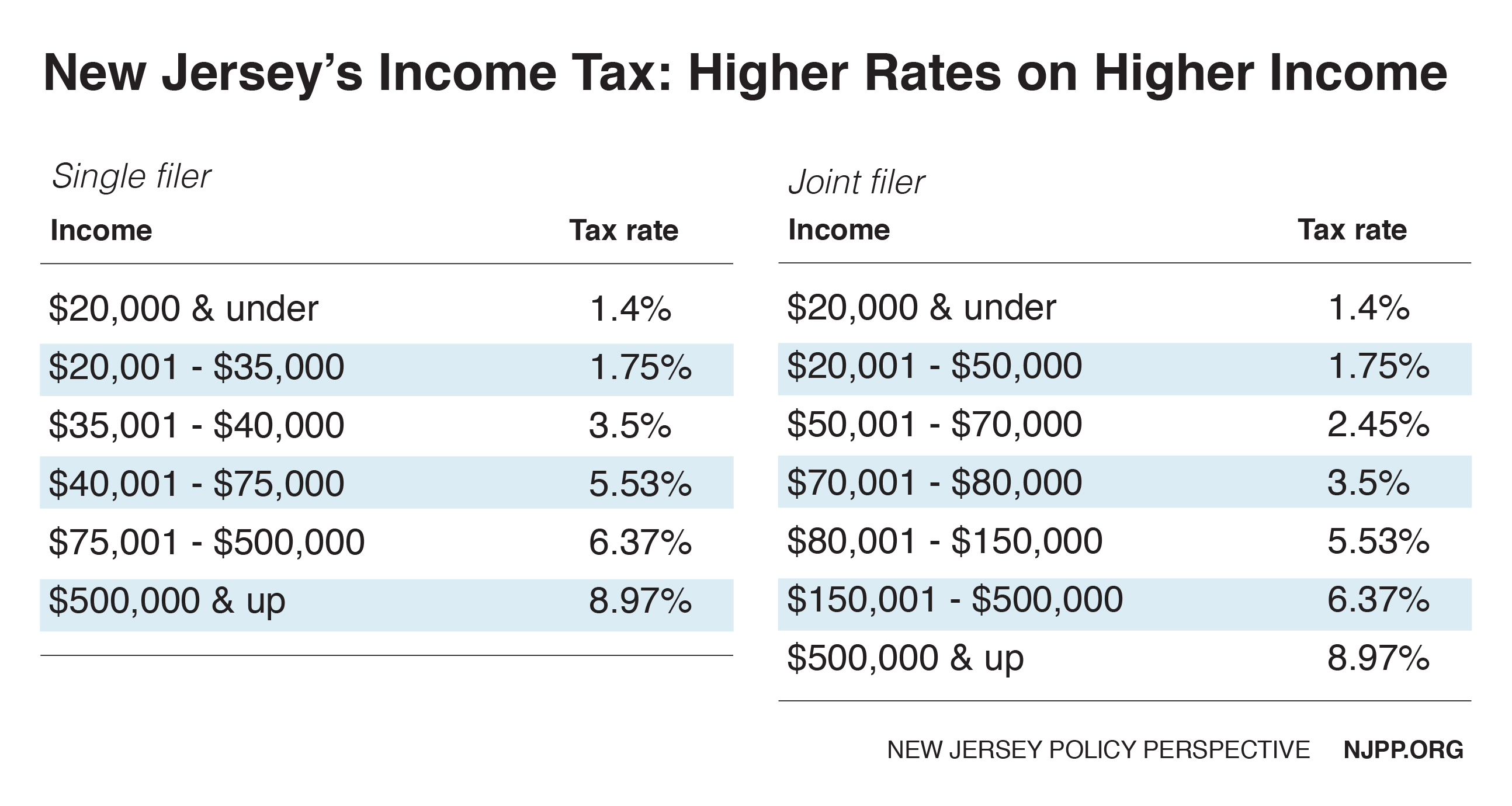

NJ Division Of Taxation 2018 Income Tax Changes

http://www.state.nj.us/treasury/taxation/div-assets/images/2018-chart.png

New Jersey Imposes Millionaire s Tax Residents Earning More Than

https://i.dailymail.co.uk/1s/2020/09/17/21/33316636-8745201-image-a-48_1600375430060.jpg

Web Benefit Amount For 2020 applicants who were age 65 or older by December 31 2020 will receive an additional 250 New Jersey Homeowners who are not required to file a New Jersey Gross Income Tax return NJ 1040 are eligible for a Property Tax Credit of up Web 6 juil 2022 nbsp 0183 32 2 How much of a benefit can I receive Homeowners with a household income of less than 150 000 can get a 1 500 rebate Homeowners with a household income between 150 000 and 250 000 can

Web Income Limit Your total annual income combined if you were married or in a civil union and lived in the same home was 2021 94 178 or less and 2022 99 735 or less See Income Limits History for past years income limit amounts Web 21 f 233 vr 2023 nbsp 0183 32 The rebate amount is equal to the tax paid after credits line 50 up to a maximum amount of 500 That means if the amount on line 50 is less than 500 you will receive a check for the amount shown on line 50 If the amount on line 50 is 500 or

Download Income Max For Nj Tax Rebate

More picture related to Income Max For Nj Tax Rebate

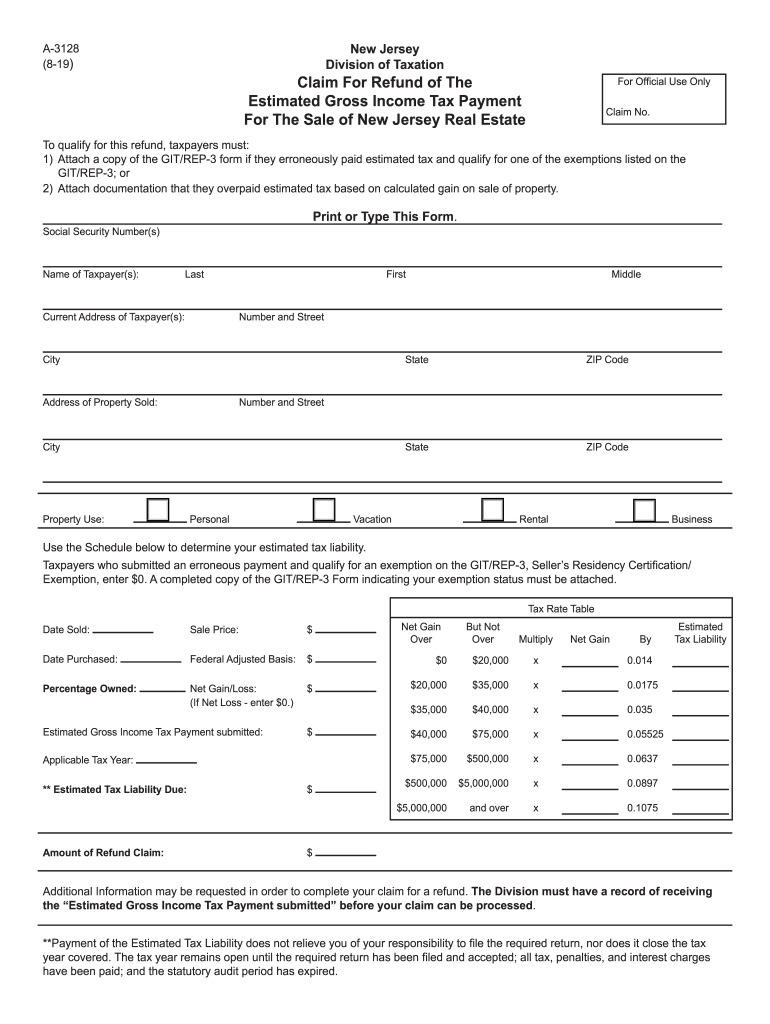

2019 Form NJ DoT A 3128 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/495/147/495147677/large.png

Nj 1040 Form 2016 Pdf Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/0/128/128406/large.png

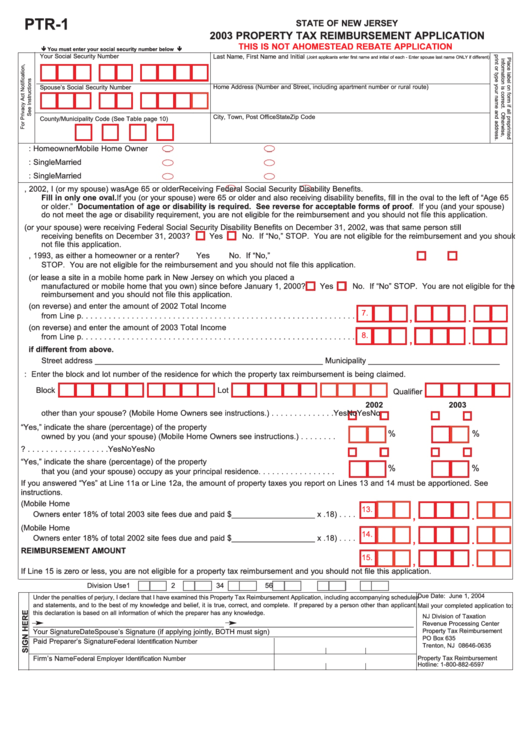

Fillable Form Ptr 1 Property Tax Reimbursement Application State Of

https://data.formsbank.com/pdf_docs_html/342/3422/342230/page_1_thumb_big.png

Web 1 juil 2021 nbsp 0183 32 Who is eligible for the 2021 child tax credit Fully expanded benefits go to Single filers with an adjusted gross income below 75 000 Heads of households with income below 112 000 Web The New Jersey EITC amount is 40 of the federal Earned Income Tax Credit for 2021 The age requirement for an NJEITC has expanded to those as young as 18 years of age as well as those over age 65 with no dependents Child and Dependent Care Credit The

Web So directly to your question it s gross income that matters There are additional rules for a tenant to qualify for an ANCHOR benefit he said You must have been a New Jersey resident your 2019 New Jersey gross income must not have exceeded 150 000 and Web 21 juin 2021 nbsp 0183 32 The state Treasury Department last week raised its revenue forecast for this fiscal year by 4 1 billion and next year s by 1 1 billion That follows a 3 2 billion increase in projected tax

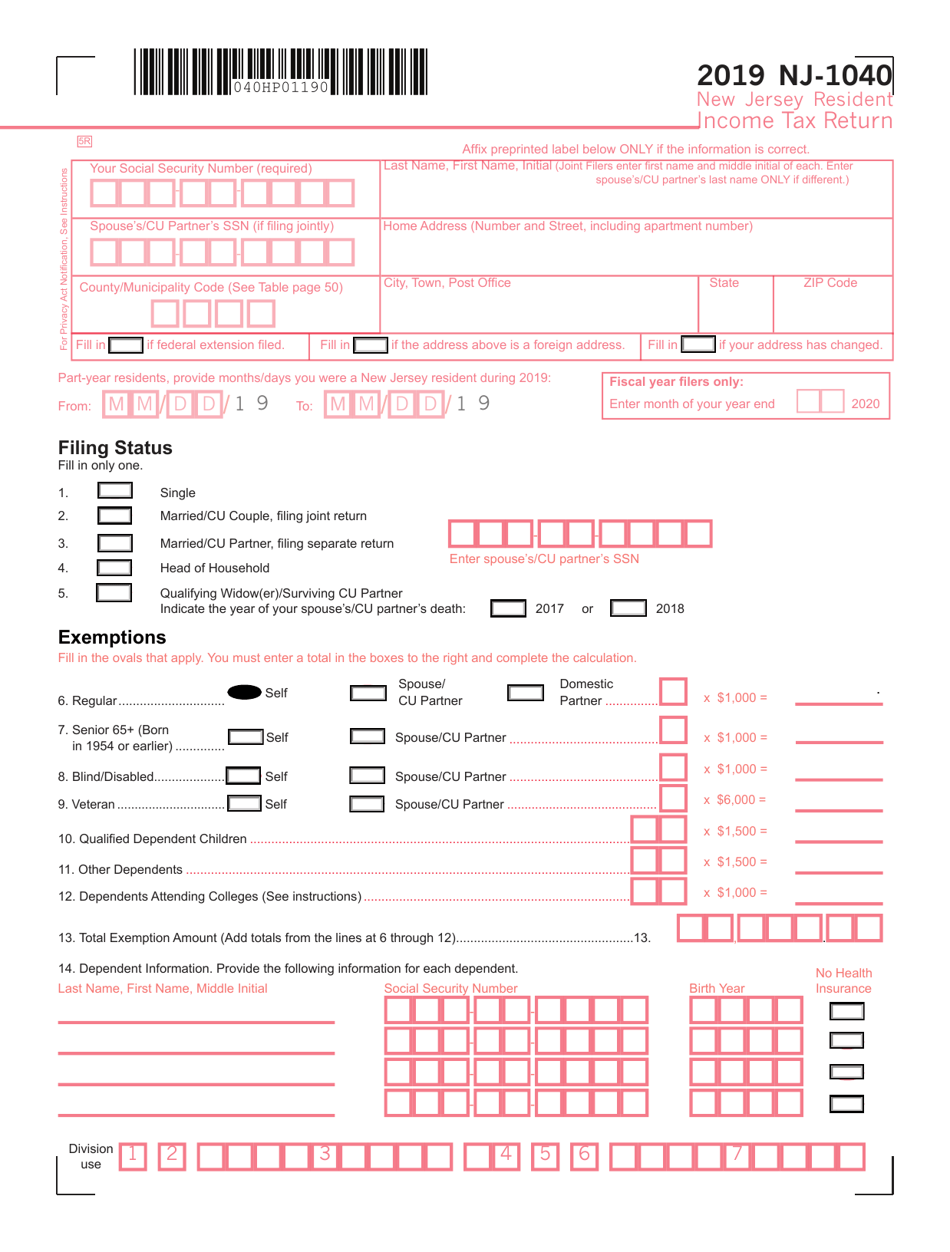

Nj 1040 Printable Form Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/2018/20183/2018363/form-nj-1040-new-jersey-resident-income-tax-return-new-jersey_print_big.png

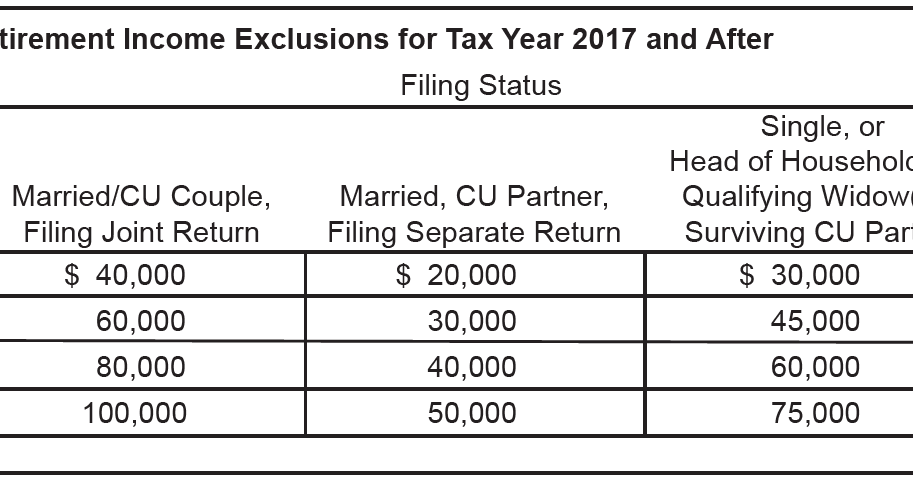

THE WANDERING TAX PRO ATTENTION NEW JERSEY TAXPAYERS

https://3.bp.blogspot.com/--ZM_0wTLglE/Wlu1AfgzJdI/AAAAAAAACHA/FwY9-Zl1AL033sBoR39fBs4eLl6Cy5vfQCLcBGAs/w1200-h630-p-k-no-nu/NJ%2BRETIREMENT%2BINCOME%2BEXCLUSION.png

https://www.thinkadvisor.com/2022/03/03/new-jerseys-governor-proposes...

Web 3 mars 2022 nbsp 0183 32 The proposal would apply to 1 8 million residents to help offset the nation s highest property taxes averaging 9 284 last year Governor Phil Murphy is including property tax relief checks in

https://nj.gov/treasury/taxation/anchor/home-faq.shtml

Web Your 2020 New Jersey gross income can be found on line 29 of your 2020 New Jersey Income Tax return NJ 1040 If you do not have access to your 2020 NJ 1040 you may use the amount from your 2022 NJ 1040 Report your income as 0 if you did not file an

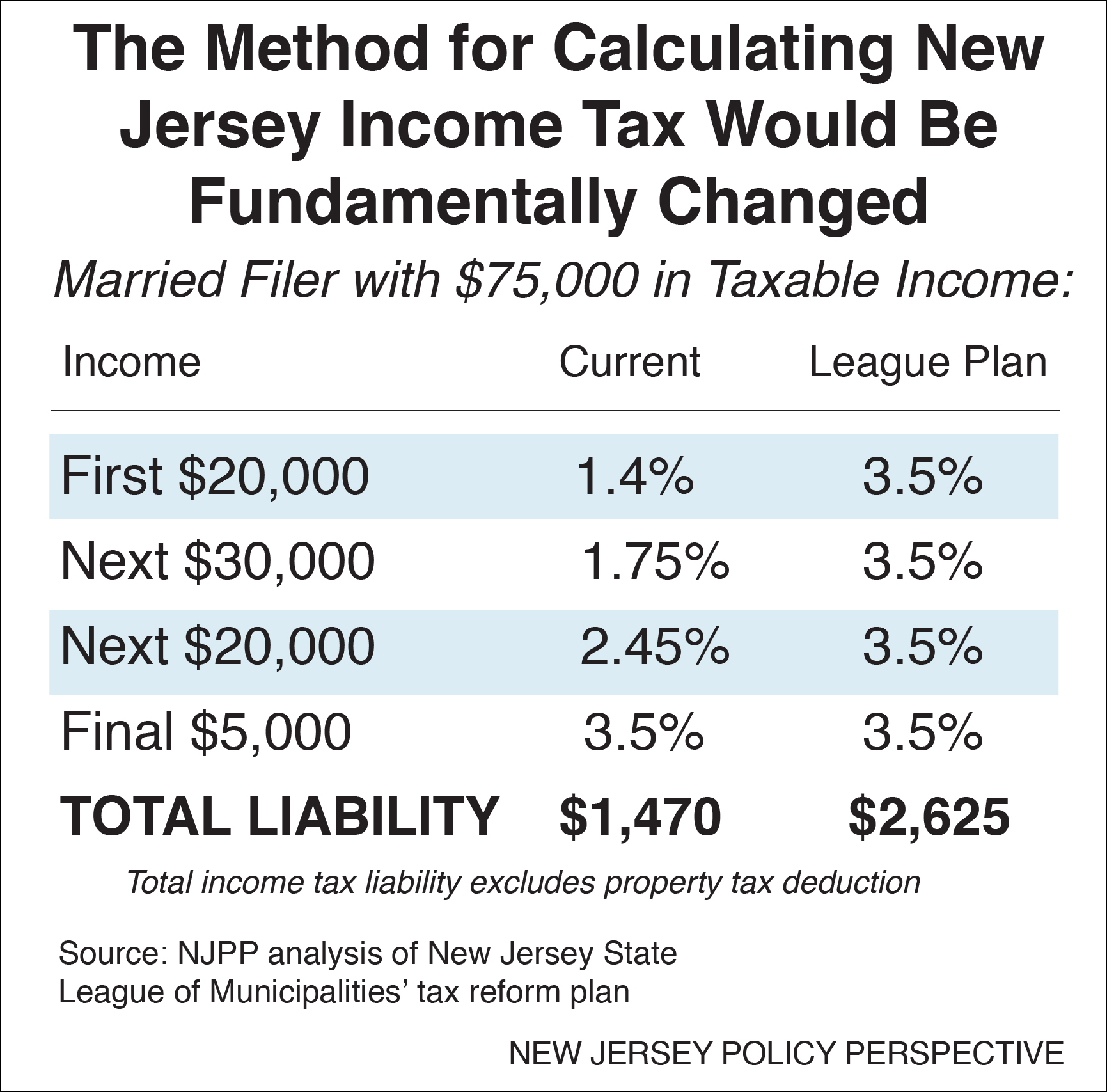

Why Significant Lasting Property Tax Reform Is So Difficult New

Nj 1040 Printable Form Printable Forms Free Online

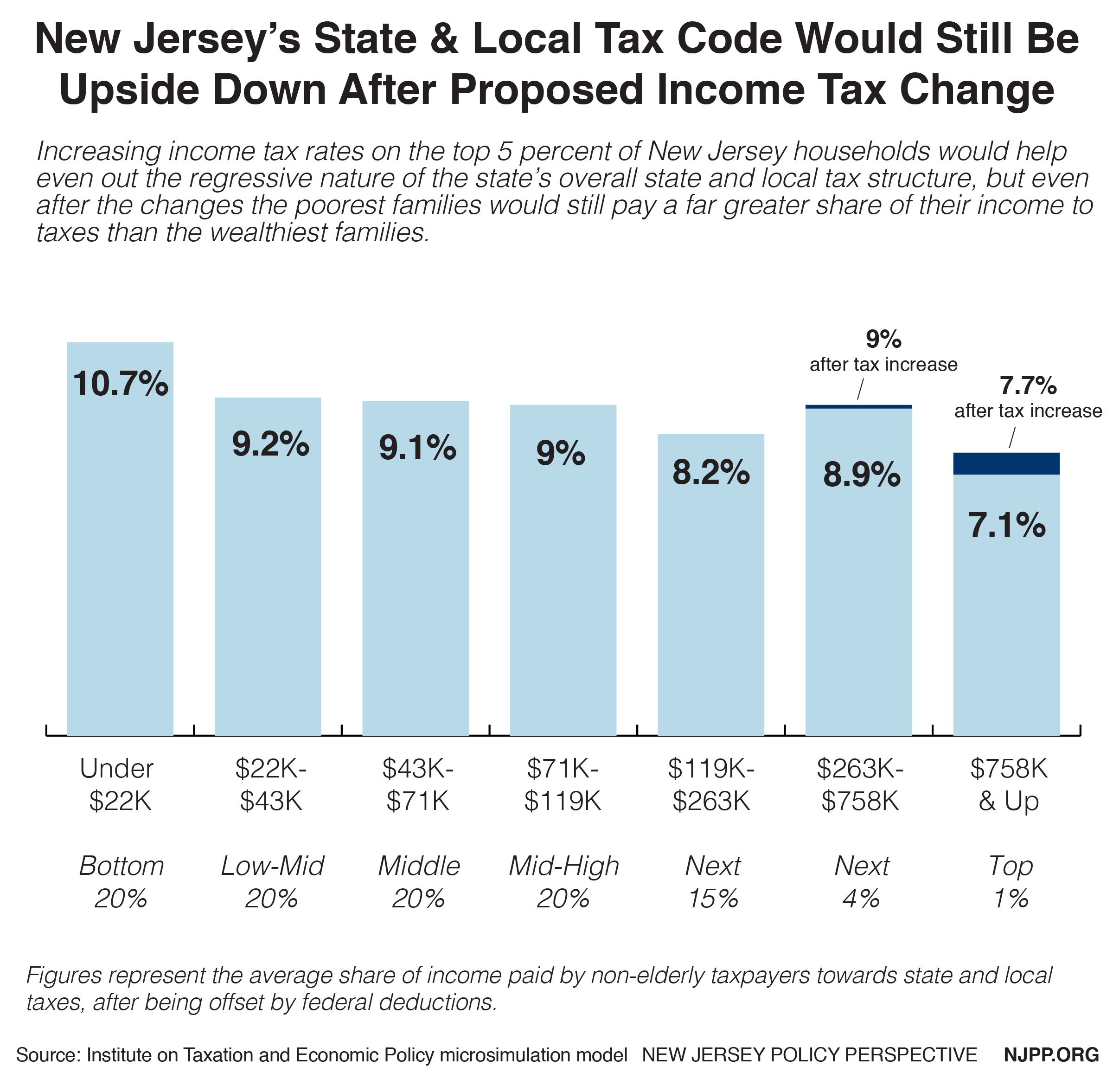

New Jersey Policy Perspective Road To Recovery Reforming New Jersey s

2020 Form NJ NJ 1040 Schedule NJ COJ Fill Online Printable Fillable

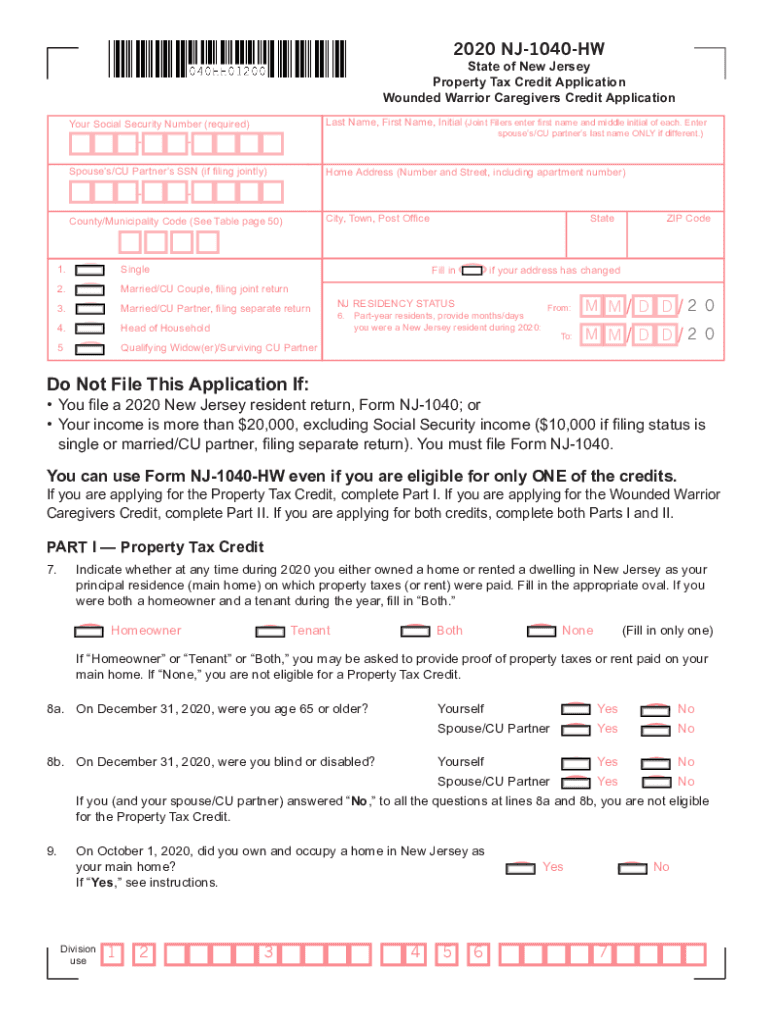

Nj 1040 Hw Fill Out Sign Online DocHub

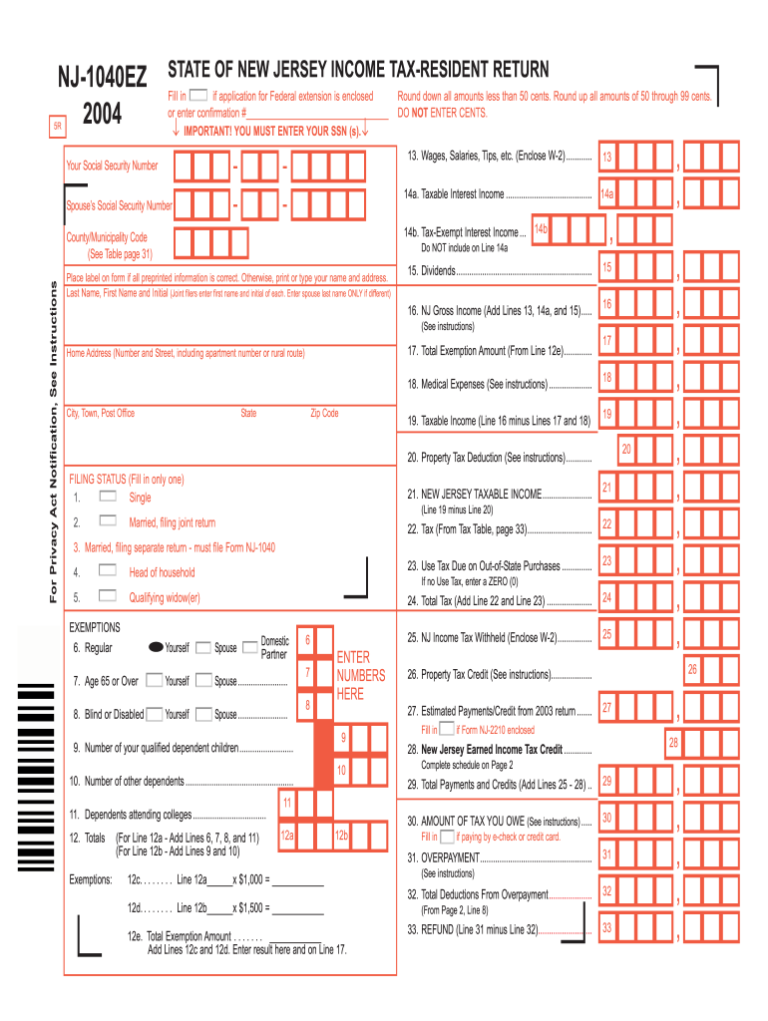

Nj 1040 Fill Online Printable Fillable Blank PDFfiller 1040 Form

Nj 1040 Fill Online Printable Fillable Blank PDFfiller 1040 Form

Reforming New Jersey s Income Tax Would Help Build Shared Prosperity

Maximize Your Savings New Jersey Tax Rebate 2023 Tax Rebate

New Jersey ITEP

Income Max For Nj Tax Rebate - Web 19 juil 2021 nbsp 0183 32 How NJ s budget has grown Those eligible for the new tax rebates include single parents with up to 75 000 in annual income and spouses with dependent children earning up to 150 000 annually The rebate checks go directly to those who ve already