Income Rebate 2024 Key provisions include Increased Refundable Portion The refundable portion of the child tax credit will gradually increase over the years 2023 2025 offering more financiaTax assistance to families Fairness for Larger Families Adjustments will be made to ensure fairness for families with multiple children

A new pilot tax filing service called Direct File that gives eligible taxpayers a new choice to file their 2023 federal tax returns online for free directly with the IRS It will be rolled out in phases and is expected to be widely available in mid March Stimulus check update Residents in this state qualify for 1 500 savings Stimulus check update this state s residents qualify for tax credits In 2024 Gov Josh Shapiro said that older

Income Rebate 2024

Income Rebate 2024

https://i0.wp.com/arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rebate-US-87A-for-AY-2024-25-FY-2023-24-1-1.png?w=1280&ssl=1

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of What You Should Claim

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

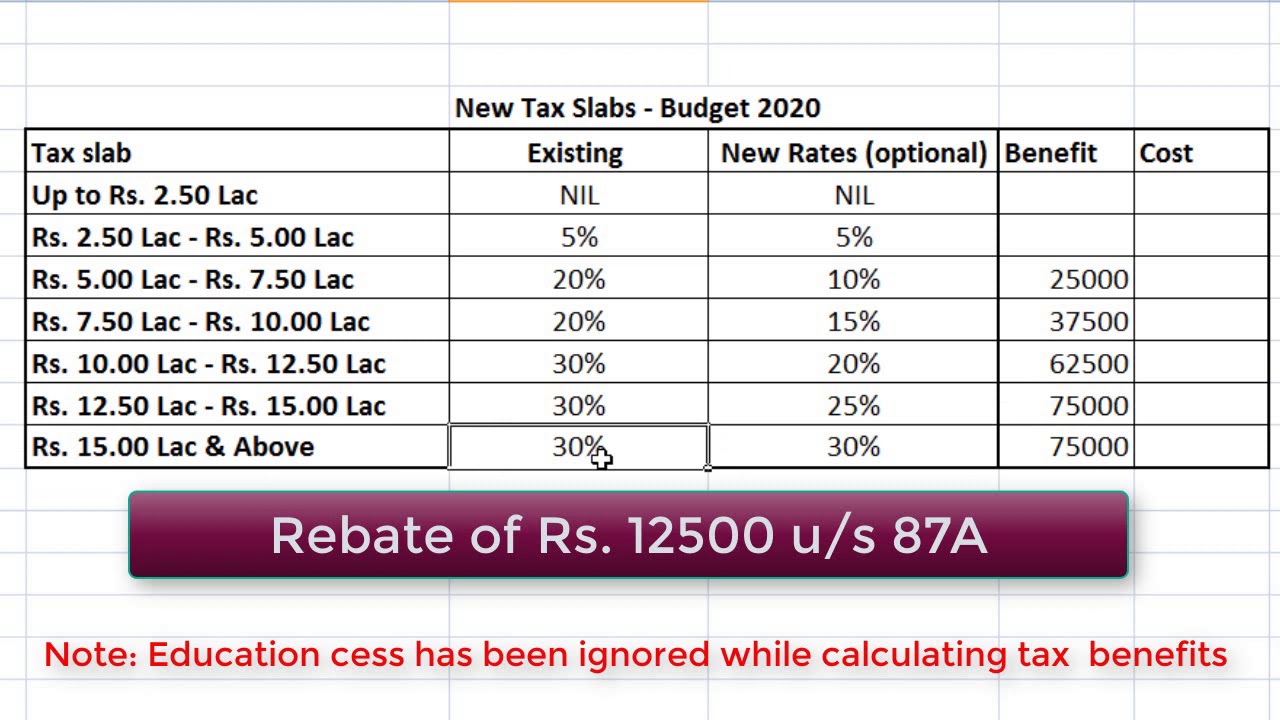

Union Budget 2023 24 Highlights Vision Priorities Tax Slabs

https://s3-ap-south-1.amazonaws.com/adda247jobs-wp-assets-adda247/articles/wp-content/uploads/2023/02/01150822/Budget-2023-24.jpg

January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to New Jersey s ANCHOR tax rebate program was a hallmark of the 2023 budget and the Department of the Treasury is already looking ahead to 2024 As of last month more than 1 638 million

Tax Tip 2024 01 Jan 4 2024 Tax credits and deductions change the amount of a person s tax bill or refund People should understand which credits and deductions they can claim and the records they need to show their eligibility A tax credit reduces the income tax bill dollar for dollar that a taxpayer owes based on their tax return 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes

Download Income Rebate 2024

More picture related to Income Rebate 2024

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

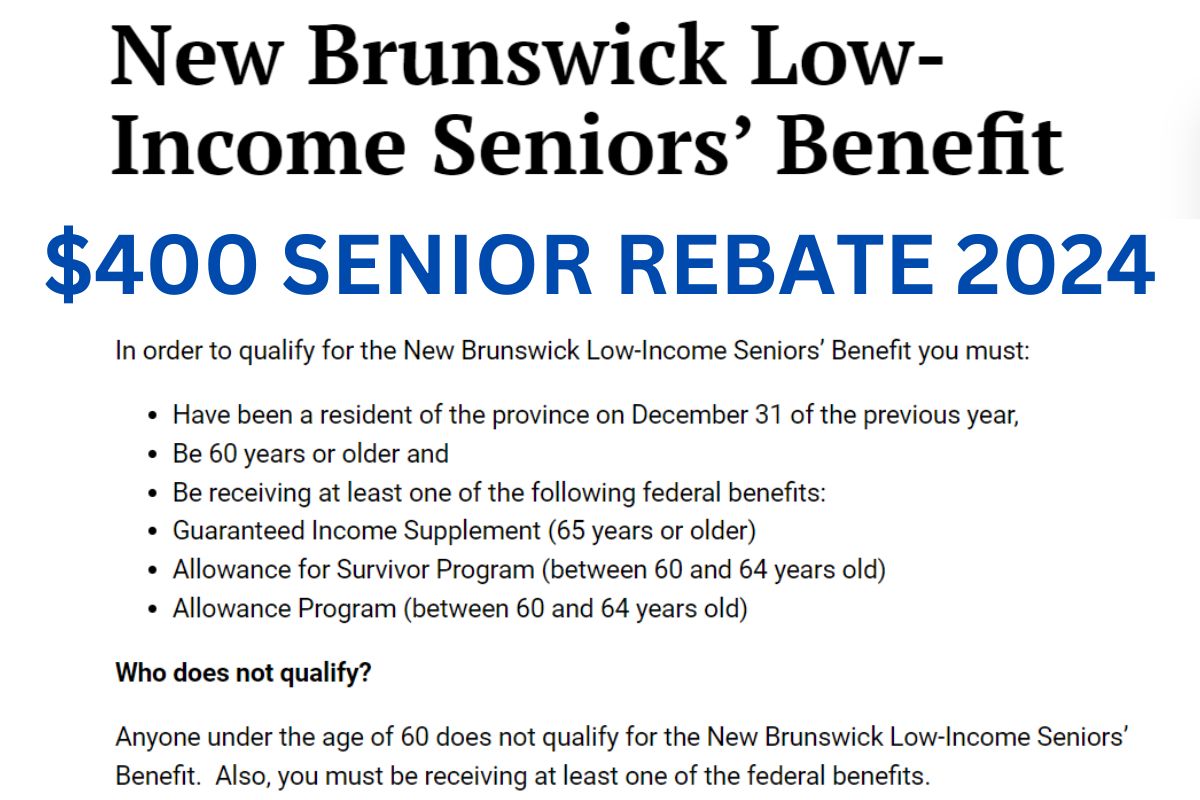

400 Senior Rebate 2024 Low Income Senior Benefits How To Apply

https://cwccareers.in/wp-content/uploads/2023/11/400-Senior-Rebate-2024.jpg

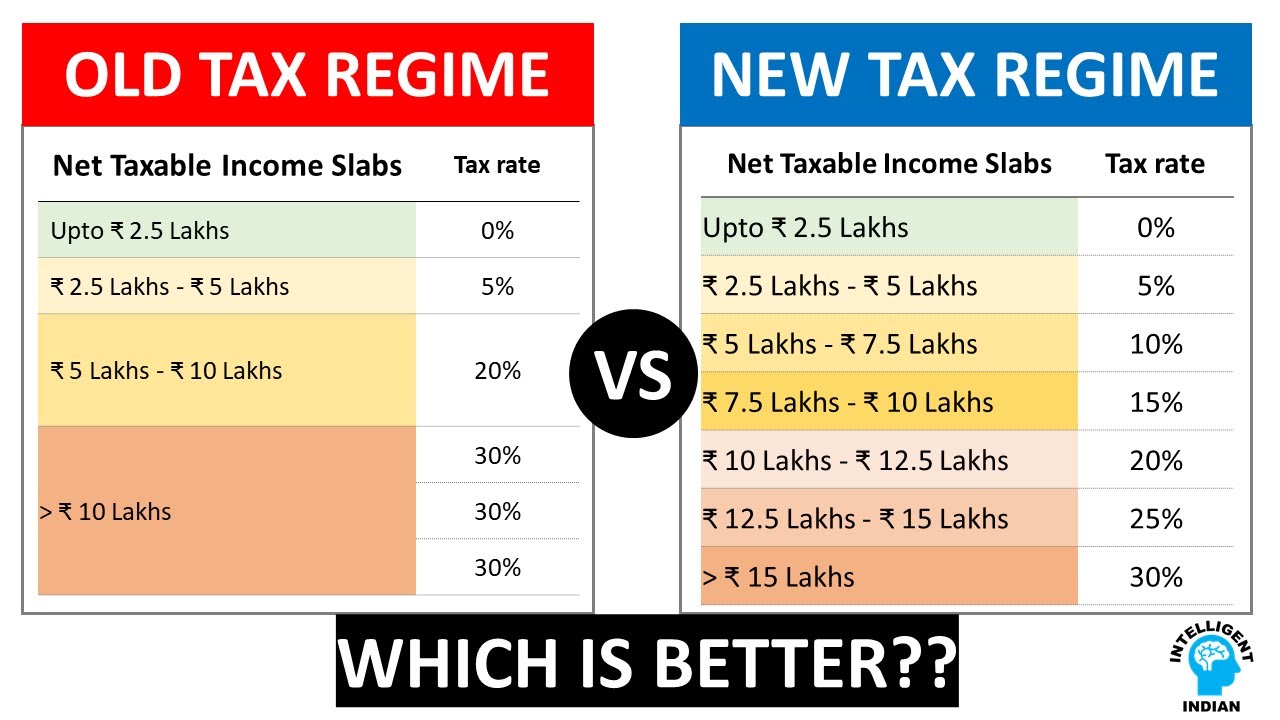

New Income Tax Slab 2023 24

https://moneyexcel.com/wp-content/uploads/2023/02/incometax-slab-2023-24.jpg

What s new for 2024 instant rebate Starting in January EV buyers won t have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead Application deadline JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX

For 2024 returns filed in 2025 if you incur adoption related expenses you can have a modified adjusted gross income of up to 252 150 and still qualify for the full credit The amount of the If you have not received your benefit by January 12 2024 contact us This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current filing season for the ANCHOR benefit is based on 2020 residency income and age

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

Primary Rebate South Africa Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/02/Primary-Rebate-South-Africa-2022-1536x651.png

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

Key provisions include Increased Refundable Portion The refundable portion of the child tax credit will gradually increase over the years 2023 2025 offering more financiaTax assistance to families Fairness for Larger Families Adjustments will be made to ensure fairness for families with multiple children

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

A new pilot tax filing service called Direct File that gives eligible taxpayers a new choice to file their 2023 federal tax returns online for free directly with the IRS It will be rolled out in phases and is expected to be widely available in mid March

Income Tax Rebate U s 87A For The Financial Year 2022 23

Individual Income Tax Rebate

Income Tax Calculator New Regime 2023 24 Excel Printable Forms Free Online

What Is The Income Tax Slab Income Tax Slab Rate For The Year 2021 22 Gambaran

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

Georgia Income Tax Rebate 2023 Printable Rebate Form

Georgia Income Tax Rebate 2023 Printable Rebate Form

Section 87A Tax Rebate Under Section 87A Rebates Financial Management Income Tax

IRS How To Avoid A Surprise Tax Bill Before January 17 Marca

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And Rebate

Income Rebate 2024 - 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes