Income Tax Act Regulations Tanzania 1 Income tax shall be charged and is payable for each year of income in accordance with the procedure in Part VII by every person a who has total income

This section consists of the main tax laws These are the fundamental laws to be read in conjunction with their respective Regulations and Finance Acts Tax Administration Act An Act to make provisions for the charge assessment and collection of Income Tax for the ascertainment of the income to be charged and for matters incidental thereto

Income Tax Act Regulations Tanzania

Income Tax Act Regulations Tanzania

https://sortingtax.com/wp-content/uploads/2023/03/Screenshot-2023-03-21-at-4.50.42-PM.png

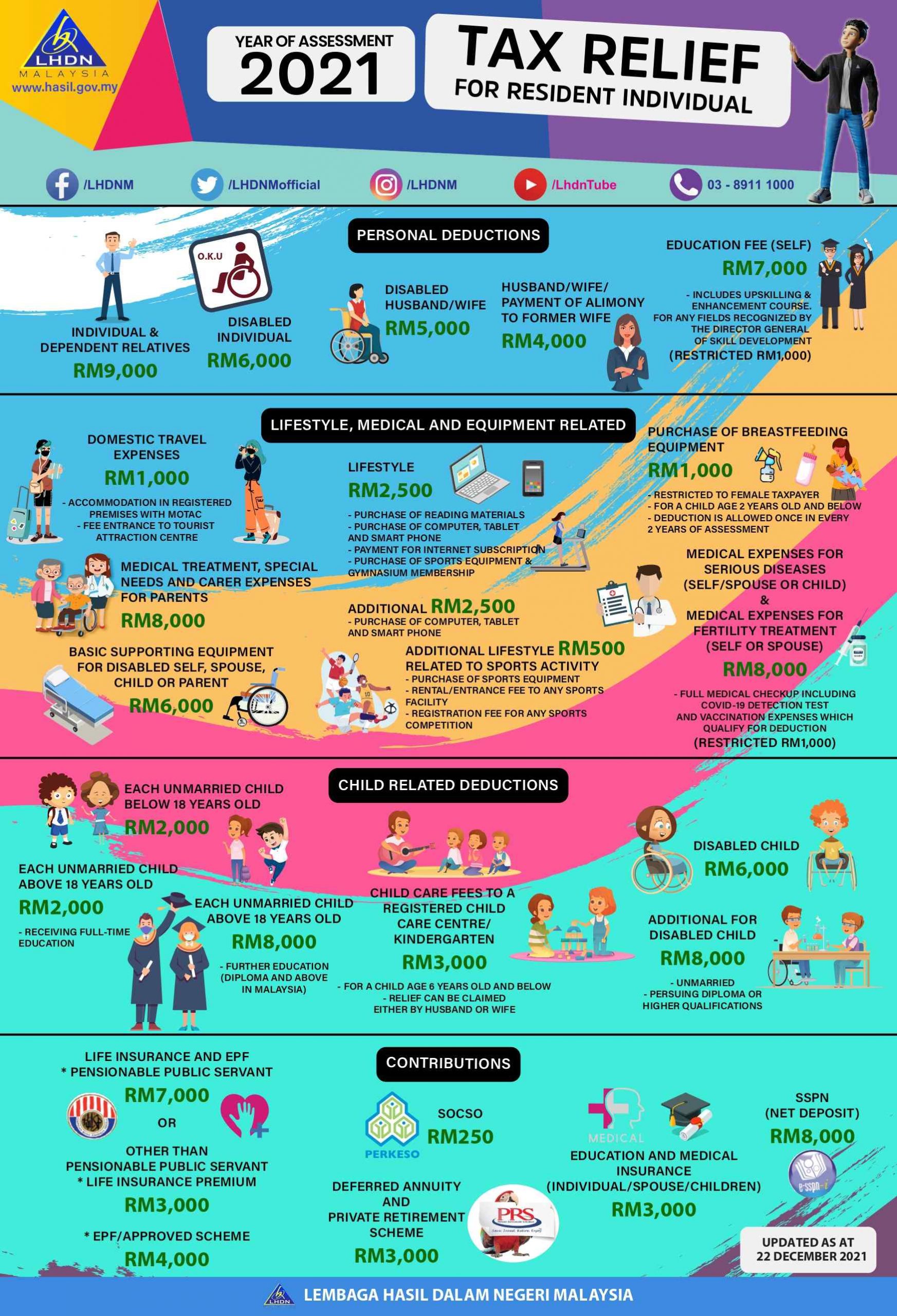

Income Tax Act Malaysia Samuel Gutierrez

https://soyacincau.com/wp-content/uploads/2022/03/220324-efiling-tax-relief-scaled.jpeg

Income Tax Act POCKET Edition Finance Act 2023 By Taxmann s

https://ttpl.imgix.net/9789356226982L.jpg?w=1200

Rules Governing Amounts Used in Calculating the Income Tax Base Subdivision A Tax Accounting and Timing 20 Year of income 21 Basis of accounting for income tax These Regulations may be cited as the Tax Administration General Regulations 2016 and shall come into operation on the date of publication Interpretation 2 In these

This Revised edition of 2008 of the Income Tax Act Cap 332 replaces the Revised Edition of 2006 and incorporates all amendments made to this Act up to and including 30th This Act may be cited as the Income Tax Act 1973 and shall subject to the Sixth Schedule come into operation on 1st January 1974 and apply to assessments for the

Download Income Tax Act Regulations Tanzania

More picture related to Income Tax Act Regulations Tanzania

Income TAX ACT 1961 INCOME TAX ACT 1961 BASIC INTRODUCTION

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4f4a5f4f29e334284480cf9bd8b7ae33/thumb_1200_1697.png

The Income Tax Act 1961 Bare Act Pocket For AIBE Exams

http://mandjservice.com/cdn/shop/files/9789356035508.jpg?v=1693288122

Section 194M Of Income Tax Act 1961 Sorting Tax

https://sortingtax.com/wp-content/uploads/2022/08/blogimg1.png

Every employer who is required by section 36 of the Act to deduct tax from emoluments paid or payable to his employee shall within seven days from the date of deduction pay CHAPTER 332INCOME TAX ACT An Act to make provision for the charge assessment and collection of Income Tax for the ascertainment of the income to be charged and for

An Act to make provision for the charge assessment and collection of Income Tax for the ascertainment of the income to be charged and for matters incidental thereto Category THE TAX ADMINISTRATION GENERAL REGULATIONS 2016 GN Number 101 Publication Date 2016 03 18 Commencement Date 2016 03 18 Revised

44ae Of Income Tax Act Everything You Need To Know

https://housing.com/news/wp-content/uploads/2023/01/Provisions-under-Section-44AE-of-the-Income-Tax-Act-that-you-must-know.jpg

How To File Withholding Tax Return As Per New Income Tax Act 2023 FM

https://fmskillsharing.com/wp-content/uploads/2023/07/আয়কর-আইন-২০২৩.jpg

https://tanzlii.org/akn/tz/act/2004/11/eng@2019-11-30

1 Income tax shall be charged and is payable for each year of income in accordance with the procedure in Part VII by every person a who has total income

https://www.tra.go.tz/index.php/laws

This section consists of the main tax laws These are the fundamental laws to be read in conjunction with their respective Regulations and Finance Acts Tax Administration Act

Master Income Tax ACT 2023 Inklogy

44ae Of Income Tax Act Everything You Need To Know

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

Outstanding 26as Of Income Tax Act Balance Sheet A Level Business

Income Tax Act 1973 Edition 2022 LAWS OF KENYA THE INCOME TAX ACT

New Guidelines On Tax Deduction At Source Under 194 O Of The Income Tax

New Guidelines On Tax Deduction At Source Under 194 O Of The Income Tax

Section 56 of The Income Tax Act 1961 Rajesh Page 1 21 Flip PDF

Basic Concepts Under Income Tax Act Notes Basic Concepts Under

INTIMATION UNDER 143 1 OF INCOME TAX ACT Msa

Income Tax Act Regulations Tanzania - Rules Governing Amounts Used in Calculating the Income Tax Base Subdivision A Tax Accounting and Timing 20 Year of income 21 Basis of accounting for income tax