Income Tax Benefit On Medical Expenses Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can

Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a dependent person A dependent person can be To benefit from medical expense deductions your total itemized deductions deductible medical expenses state and local taxes home mortgage interest and charitable contributions must be

Income Tax Benefit On Medical Expenses

Income Tax Benefit On Medical Expenses

https://akm-img-a-in.tosshub.com/indiatoday/images/story/202209/Tax_Benefits.jpg?VersionId=KA.W.Wl1CpsUjL4.dw1jXJ24fvBRYd1v

Income Tax Benefit On Second Home Loan Complete Guide

https://assetyogi.b-cdn.net/wp-content/uploads/2017/06/income-tax-benefit-on-second-home-loan-889x500-768x432.jpg

Medical Expenses Tax Back Get 20 Tax Back Today My Tax Rebate

https://www.mytaxrebate.ie/wp-content/uploads/2020/09/Medical-Expenses-Blog-Image-e1602500412593.png

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10 For tax years 2022 and 2023 individuals are allowed to deduct qualified and unreimbursed medical expenses that are greater than 7 5 of their adjusted gross income AGI for the specific tax

Medical care expenses include payments for the diagnosis cure mitigation treatment or prevention of disease or payments for treatments affecting any structure Medical Reimbursement is an arrangement under which employers reimburse the portion of the health expenses incurred by the employee The Income Tax Act allows

Download Income Tax Benefit On Medical Expenses

More picture related to Income Tax Benefit On Medical Expenses

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

https://i.pinimg.com/originals/7b/37/05/7b37052b2fb0ea107a6dd3af15498805.jpg

How To Calculate Tax On Salary Wholesale Deals Save 40 Jlcatj gob mx

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/02/15150753/Apple-Effective-Tax-Rate.jpg

Income Tax Filing Income Tax India Income Tax Return Income Tax Benefit

https://static.india.com/wp-content/uploads/2021/07/income-tax-benefits.jpg

Contributions you make to a health savings account HSA aren t medical expenses For employer sponsored plans HSA contributions are made pre tax Otherwise contributions are deducted above the line as Section 80D of the Income Tax Act 1961 offers deduction for money spent on health insurance and maintaining your health and is significant for your tax planning and

On his tax returns Richardson declared over 1 1 million in medical expenses overstating those expenses by more than 945 000 He received tax Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn about eligibility limits and how to maximize your tax benefits for yourself and your family

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

How To Save On Medical Expenses Small Steps With Big Results Hosbeg

https://hosbeg.com/wp-content/uploads/2019/07/f34999a9e347487d34cd4e79041efc25-1024x682.jpeg

https://economictimes.indiatimes.com › wealth › tax › ...

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can

https://www.livemint.com › insurance › news › income-tax...

Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a dependent person A dependent person can be

KolkataTimes

Income Tax Benefits On Housing Loan In India

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

Income Tax Benefit On Home Loan Your Quick Guide On Tax Exemption

Home Loan Comparison Chart Of Leading Banks Loanfasttrack

Home Loan Comparison Chart Of Leading Banks Loanfasttrack

What Are The Tax Benefit On Home Loan FY 2020 2021

If You Choose The New Option Of Income Tax Then There Can Be A Big

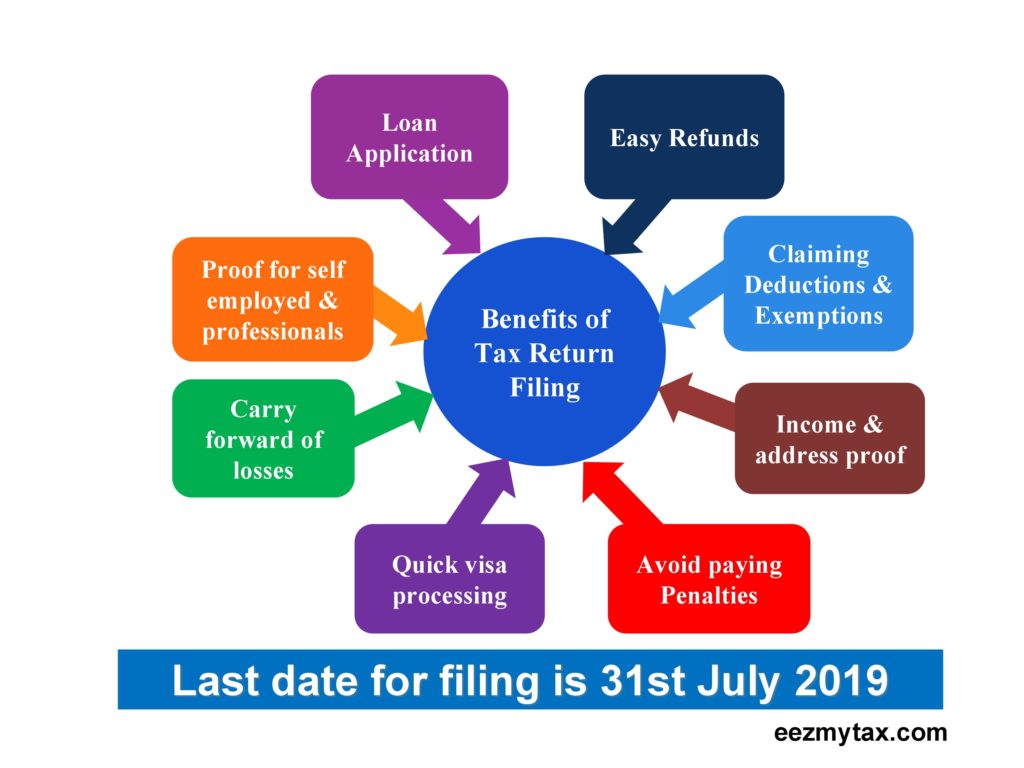

8 Reasons To File Income Tax Return In India Eezmytax NRI Tax Services

Income Tax Benefit On Medical Expenses - Medical Reimbursement is an arrangement under which employers reimburse the portion of the health expenses incurred by the employee The Income Tax Act allows