Income Tax Credit For Disability As a person with a disability you may qualify for certain tax deductions income exclusions and credits More detailed information may be found in the IRS publications

Earned Income Tax Credit EITC is a tax credit for certain people who work and have low to moderate earned income A tax credit usually means more money in your pocket It OVERVIEW The elderly and disabled can receive a tax credit that could reduce and even potentially eliminate the tax they owe for the entire year Here s how to figure out if you qualify TABLE OF

Income Tax Credit For Disability

Income Tax Credit For Disability

https://www.debt.ca/wp-content/uploads/2022/01/disability-tax-credit.jpg

Disability Tax Credit For Canadians YouTube

https://i.ytimg.com/vi/mLGnq5PI8VE/maxresdefault.jpg

2017 Disability Tax Credit Guide T2201 Form Eligibility Child

https://disabilitycreditcanada.com/wp-content/uploads/2017_Disability_Tax_Credit_Guide.jpg

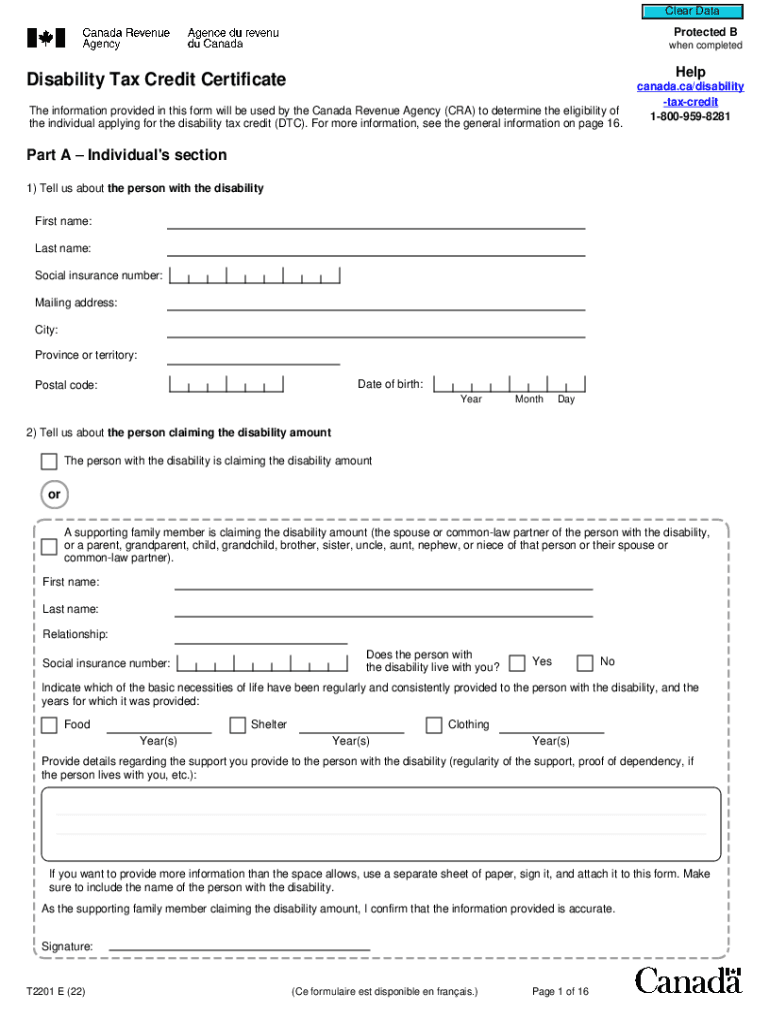

The disability tax credit DTC is a non refundable tax credit that helps people with disabilities or their supporting family member reduce the amount of income tax they How to claim the DTC on your tax return To claim the credit for the current tax year you must enter the disability amount on your tax return Any unused amount may be

What can persons with disabilities claim as a deduction or credit GST HST Information Goods and services that are exempt supplies or zero rated for the GST HST Excise gasoline tax refund Free tax clinics Taxpayers with disabilities can qualify for the earned income credit if they have earned income and it falls within certain limits If you have no children the income

Download Income Tax Credit For Disability

More picture related to Income Tax Credit For Disability

Earned Income Tax Credit EITC Get Your Payment IL

https://getmypaymentil.org/wp-content/uploads/2022/10/gmpil-website-poll-banner.jpg

T2201 Form Disability Tax Credit Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/612/211/612211030/large.png

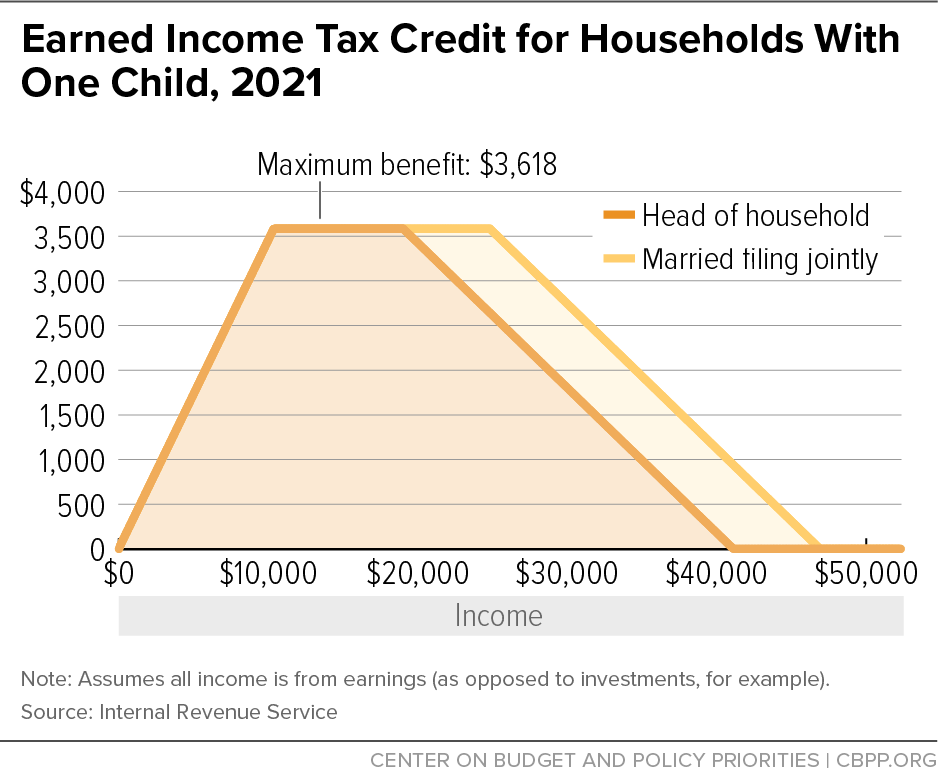

Earned Income Tax Credit For Households With One Child 2021 Center

https://www.cbpp.org/sites/default/files/2022-02/Jan 2022 EITC paper updates_f5.png

Updated 1 03 2024 If you re disabled and receive Social Security disability benefits either SSDI or SSI you can qualify for certain tax credits These credits will reduce the taxes Elderly and disabled tax credit Available to every U S citizen who has reached age 65 during the tax year or those under 65 who are retired on permanent and total disability and received taxable

People age 65 or older and those who have retired early due to disability can be eligible for a federal tax credit ranging from 3 750 to 7 500 The credit for the elderly or the disabled reduces federal income If you re considering taking the tax credit used by millions of Americans the Earned Income Tax Credit EIC then you probably want to know if you can claim it if you are

The Disability Tax Credit Your Online Guide For 2023

https://www.resolutelegal.ca/wp-content/uploads/2022/11/the-disability-tax-credit2.jpg

Earned Income Tax Credit EITC Eligibility And Benefits Stealth

https://stealthcapitalist.com/wp-content/uploads/2023/02/AdobeStock_551436661-scaled.jpeg

https://www.irs.gov/individuals/more-information...

As a person with a disability you may qualify for certain tax deductions income exclusions and credits More detailed information may be found in the IRS publications

https://www.irs.gov/pub/irs-pdf/p3966.pdf

Earned Income Tax Credit EITC is a tax credit for certain people who work and have low to moderate earned income A tax credit usually means more money in your pocket It

Do I Qualify For The CRA Disability Tax Credit Blueprint Accounting

The Disability Tax Credit Your Online Guide For 2023

Earned Income Tax Credit EITC Can It Help You Kiplinger

Disability And Earned Income Tax Credit

And Taxes Fonrevem My Nean Do Your Federal Taxes While Romancing Your

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

Disability Tax Credit SSI And SSDI Benefits OpenLoans

Is Disability Income Taxable Credit Karma

Details From IRS About Enhanced Child Tax Credits

Income Tax Credit For Disability - The Credit for the Elderly and Disabled ranges from 3 750 to 7 500 depending on your income and filing status If you owe 4 000 in taxes before the credit