Income Tax Credit For Solar Panels Verkko The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Verkko 28 elok 2023 nbsp 0183 32 About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit Verkko The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but

Income Tax Credit For Solar Panels

Income Tax Credit For Solar Panels

https://tampabaysolar.com/wp-content/uploads/2022/04/AdobeStock_201159810-2048x1365.jpeg

How Does The Federal Solar Tax Credit Work Nicki Karen

https://nickiandkaren.com/wp-content/uploads/2019/12/photo-1566093097221-ac2335b09e70.jpeg

Solar Tax Credit 2022 Incentives For Solar Panel Installations

https://quickelectricity.com/wp-content/uploads/2020/12/Federal-Solar-Tax-Credit-Extension-2022.jpg

Verkko 11 jouluk 2023 nbsp 0183 32 Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses Verkko 6 p 228 iv 228 228 sitten nbsp 0183 32 What Is the Federal Solar Tax Credit Installing solar panels earns you a federal tax credit That means you ll get a credit for your income taxes that actually lowers your

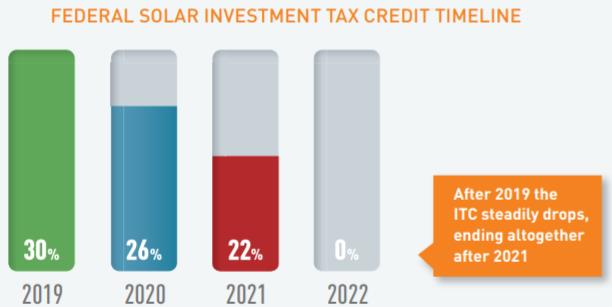

Verkko 19 lokak 2023 nbsp 0183 32 In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems The Inflation Reduction Act renamed and extended the existing solar tax credit through 2034 for solar system installations on residential property It also increased the credit s value Verkko Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

Download Income Tax Credit For Solar Panels

More picture related to Income Tax Credit For Solar Panels

California Solar Tax Credit LA Solar Group

https://la-solargroup.com/wp-content/uploads/2020/10/Calculating-Solar-Tax-Credit.jpg

When Does Solar Tax Credit End SolarProGuide 2022

https://www.solarproguide.com/wp-content/uploads/when-does-the-federal-solar-tax-credit-expire.png

What Solar Tax Form Is Used To Claim Credits

http://www.skippingstonesdesign.com/wp-content/uploads/2022/03/load-image-2022-03-29T235018.174.jpg

Verkko 30 marrask 2023 nbsp 0183 32 The Residential Clean Energy Credit is a dollar for dollar income tax credit equal to 30 of solar installation costs An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035 Verkko 8 syysk 2022 nbsp 0183 32 President Biden signed the Inflation Reduction Act into law on Tuesday August 16 2022 One of the many things this act accomplishes is the expansion of the Federal Tax Credit for Solar Photovoltaics also known as the Investment Tax Credit ITC This credit can be claimed on federal income taxes for a percentage of the cost

Verkko The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your federal tax bill If it costs 10 000 to install your solar panel system you ll receive a 3 000 credit which directly reduces your tax bill Verkko 3 marrask 2023 nbsp 0183 32 Either way the process of claiming the 30 solar tax credit is painless If you re claiming a tax credit for a solar power system installed after 2022 you ll need to complete IRS form 5695 Insert the total installation purchase and sales tax costs of your residential power system on line 1 of form 5695

26 Federal Solar Tax Credit Extended SolarTech

https://solartechonline.com/wp-content/uploads/011022-Fed-Solar-Tax-Credit.jpg

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

https://southfacesolar.com/wp-content/uploads/2021/01/136682227_5076885039018728_2629942985947998441_n-600x503.png

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Verkko The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Verkko 28 elok 2023 nbsp 0183 32 About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

Federal Tax Credit For Solar Panels In 2023

26 Federal Solar Tax Credit Extended SolarTech

How The Solar Tax Credit Works California Sustainables

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

Congress Gets Renewable Tax Credit Extension Right Institute For

Does A New Roof Qualify For The Solar Investment Tax Credit Florida

Does A New Roof Qualify For The Solar Investment Tax Credit Florida

Federal Solar Tax Credit For Residential Solar Energy

Federal Solar Tax Credits For Businesses Department Of Energy

Federal Tax Credit For Solar Panels The Energy Miser

Income Tax Credit For Solar Panels - Verkko 26 huhtik 2023 nbsp 0183 32 What Do I Need to File for the Federal Solar Tax Credit The Residential Clean Energy Credit also known as the solar investment tax credit or ITC is a tax credit for homeowners who invest in solar and or battery storage Thanks to the Inflation Reduction Act the 30 credit is available for homeowners that install solar