Income Tax Deductible Medical Expenses You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related work expenses and health insurance premiums if you are self employed

Key Takeaways You can only deduct unreimbursed medical expenses that exceed 7 5 of your adjusted gross income AGI found on line 11 of your 2023 Form 1040 For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

Income Tax Deductible Medical Expenses

Income Tax Deductible Medical Expenses

https://www.financialdesignsinc.com/wp-content/uploads/2020/11/Expenses-1.jpg

Claim Medical Expenses On Your Taxes Health For CA

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

https://i.pinimg.com/originals/7b/37/05/7b37052b2fb0ea107a6dd3af15498805.jpg

Most forms of medical spending from insurance premiums to treatment are tax deductible if you meet the IRS requirements To claim this deduction you must take itemized deductions rather than the standard deduction and must have spent more than 7 5 of your income on qualified medical bills You can claim eligible medical expenses on line 33099 or line 33199 of your tax return Step 5 Federal tax Line 33099 Medical expenses for self spouse or common law partner and your dependant children under 18

For tax years 2022 and 2023 individuals are allowed to deduct qualified and unreimbursed medical expenses that are greater than 7 5 of their adjusted gross income AGI for the specific tax Laboratory fees Transportation meals and lodging when the primary reason for your trip is to receive medical care Admission and transportation to a medical conference

Download Income Tax Deductible Medical Expenses

More picture related to Income Tax Deductible Medical Expenses

Medical Expenses You Can Deduct From Your Taxes Medical Tax Time

https://i.pinimg.com/originals/27/f7/8f/27f78f785ee4e5bf3dc13c6451ad6ed4.jpg

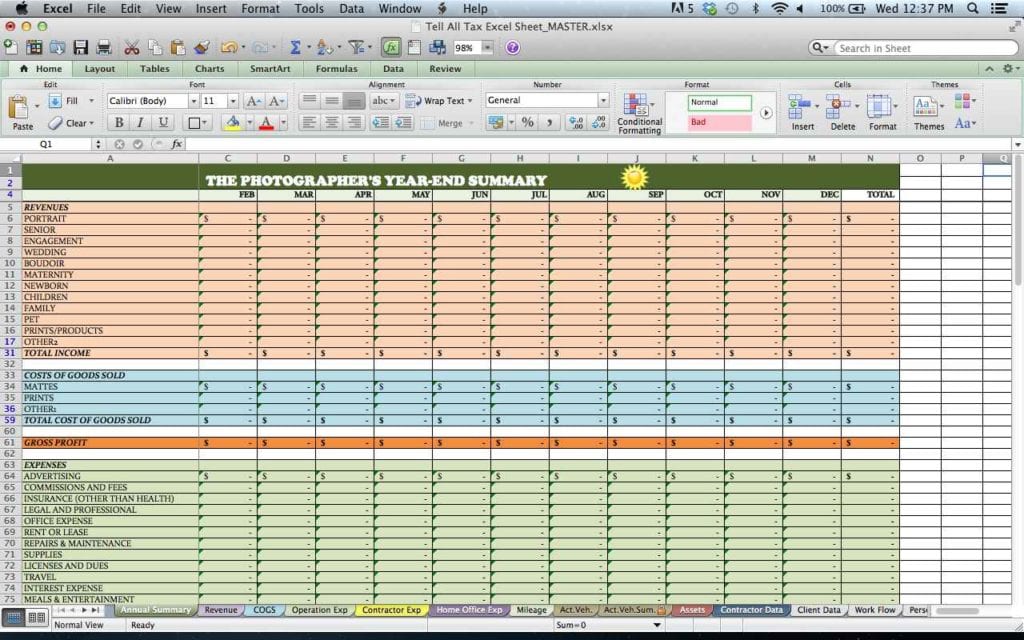

Template Expenses Sheet Excelxo

https://excelxo.com/wp-content/uploads/2017/07/template-expenses-sheet.jpg

Are Medical Expenses Tax Deductible Capital One

https://ecm.capitalone.com/WCM/learn-grow/card/lgc988_hero_are-medical-expenses-tax-deductible_v1.jpg

This interview will help you determine if your medical and dental expenses are deductible Information you ll need Filing status Type and amount of expenses paid The year in which the expenses were paid Your adjusted gross income If you were reimbursed or if expenses were paid out of a Health Savings Account or an Archer Medical Savings If the medical bills you pay out of pocket in a year exceed 7 5 percent of your adjusted gross income AGI you may deduct only the amount of your medical expenses that exceed 7 5 percent of

Medical expenses cost a bundle even with the help of health insurance and they rise astronomically year after year Luckily medical insurance premiums co pays and uncovered medical expenses are deductible as itemized deductions on your tax return and that can help defray the costs How much medical expense is tax deductible You can deduct qualifying medical expenses that exceed 7 5 of your adjusted gross income You must itemize your deductions to be able to claim medical expenses on your tax return

Printable Itemized Deductions Worksheet

https://www.anchor-tax-service.com/s/cc_images/cache_2322205.jpg?t=1395581512

Expired Tax Breaks Deductible Unreimbursed Employee Expenses

https://www.efile.com/image/Form-2016-employee-business-expenses.jpg

https://www.irs.gov/publications/p502

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related work expenses and health insurance premiums if you are self employed

https://turbotax.intuit.com/tax-tips/health-care/...

Key Takeaways You can only deduct unreimbursed medical expenses that exceed 7 5 of your adjusted gross income AGI found on line 11 of your 2023 Form 1040

Qualified Business Income Deduction And The Self Employed The CPA Journal

Printable Itemized Deductions Worksheet

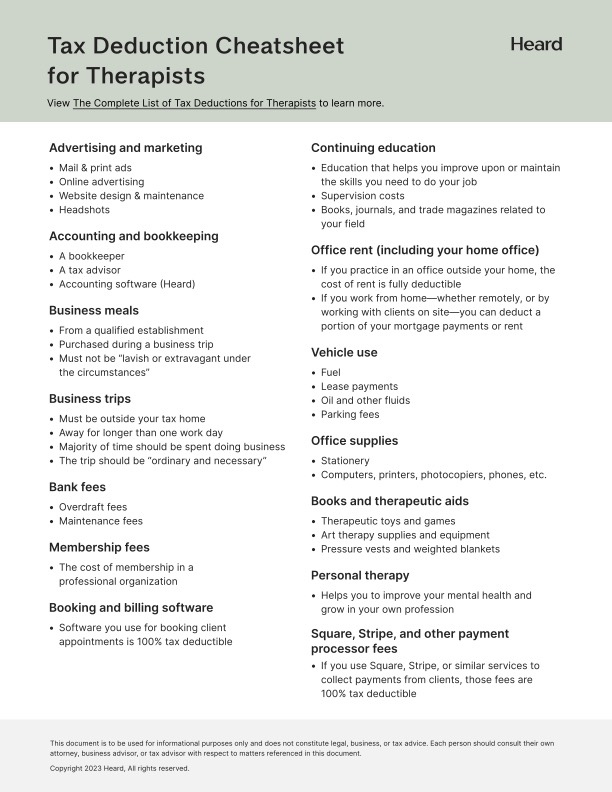

What Expenses Are 100 Tax Deductible Leia Aqui What Tax Deductions

Income Tax Deductible Expenses Timenews

2024 HSA HDHP Limits

Do You Have A Lot Of Medical Expenses In The US Learn How To Deduct

Do You Have A Lot Of Medical Expenses In The US Learn How To Deduct

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Business

What Kind Of Medical Finance Expenses Are Tax Deductible Medical

Personal Tax Relief 2021 L Co Accountants

Income Tax Deductible Medical Expenses - Laboratory fees Transportation meals and lodging when the primary reason for your trip is to receive medical care Admission and transportation to a medical conference