Income Tax Deduction Calculator Ontario 2022 Estimate your provincial taxes with our free Ontario income tax calculator See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes owed

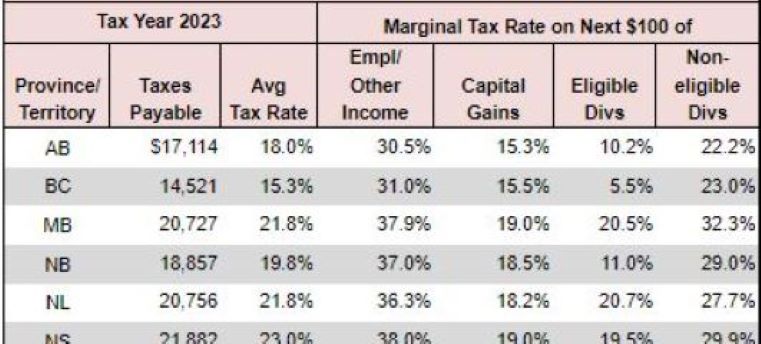

If you live in Ontario and earn a gross annual salary of 76 004 or 6 334 per month your monthly take home pay will be 4 758 This results in an effective tax rate of 25 as estimated by our Canadian salary calculator 2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory The calculator reflects known rates as of December 1 2022

Income Tax Deduction Calculator Ontario 2022

Income Tax Deduction Calculator Ontario 2022

https://www.taxtips.ca/calculators/enhanced-basic/2023-basic-tax-calculator-rates.jpg

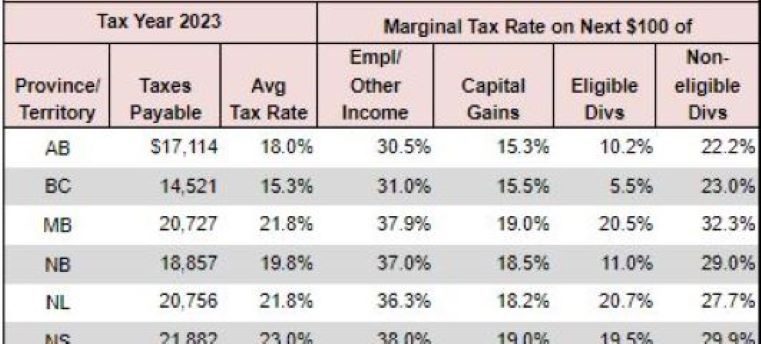

Weekly Deduction Tables 2021 Federal Withholding Tables 2021

https://federal-withholding-tables.net/wp-content/uploads/2021/06/sars-monthly-tax-tables-2021-mansa-digital-1.jpg

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-6.jpg

Estimate your net salary after tax paycheck deductions capital gains taxes RRSP savings and CRA taxes owed using our 2022 Ontario income tax calculator Calculate you Annual salary after tax using the online Ontario Tax Calculator updated with the 2022 income tax rates in Ontario Calculate your income tax social security

TurboTax s free Ontario income tax calculator Estimate your 2023 tax refund or taxes owed and check provincial tax rates in Ontario TaxTips ca 2022 Canadian income tax and RRSP savings calculator excellent tax planning tool calculates taxes shows RRSP savings includes most deductions and tax credits

Download Income Tax Deduction Calculator Ontario 2022

More picture related to Income Tax Deduction Calculator Ontario 2022

![]()

Ontario Income Tax Calculator For 2023

https://careerbeacon-canada.s3.amazonaws.com/job_board/og_images/og_income_tax_calculator.jpg

2023 Federal Tax Rates Cra Printable Forms Free Online

https://filingtaxes.ca/wp-content/uploads/2021/12/Screenshot_2.png

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Checklist Tax

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

How much tax will I pay on my income in Ontario Calculate your after tax salary in Ontario for the 2022 tax season Ontario Income Tax Calculator 2023 2024 This Page Was Last Updated April 29 2024 WOWA Simply Know Your Options Estimate your 2022 2023

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions It will confirm the deductions you Discover Talent s income tax calculator tool and find out what your payroll tax deductions will be in Ontario for the 2024 tax year

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

Tax Rates Absolute Accounting Services

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

https://www.wealthsimple.com/en-ca/too…

Estimate your provincial taxes with our free Ontario income tax calculator See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes owed

https://salaryaftertax.com/ca

If you live in Ontario and earn a gross annual salary of 76 004 or 6 334 per month your monthly take home pay will be 4 758 This results in an effective tax rate of 25 as estimated by our Canadian salary calculator

Monthly Federal Income Tax Calculator 2021 Tax Withholding Estimator 2021

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

Income Tax Deduction From Salaries During The Financial Year 2022 23

Exercise Calculate A Refund Or A Balance Owing Learn About Your

Ca Tax Brackets Chart Jokeragri

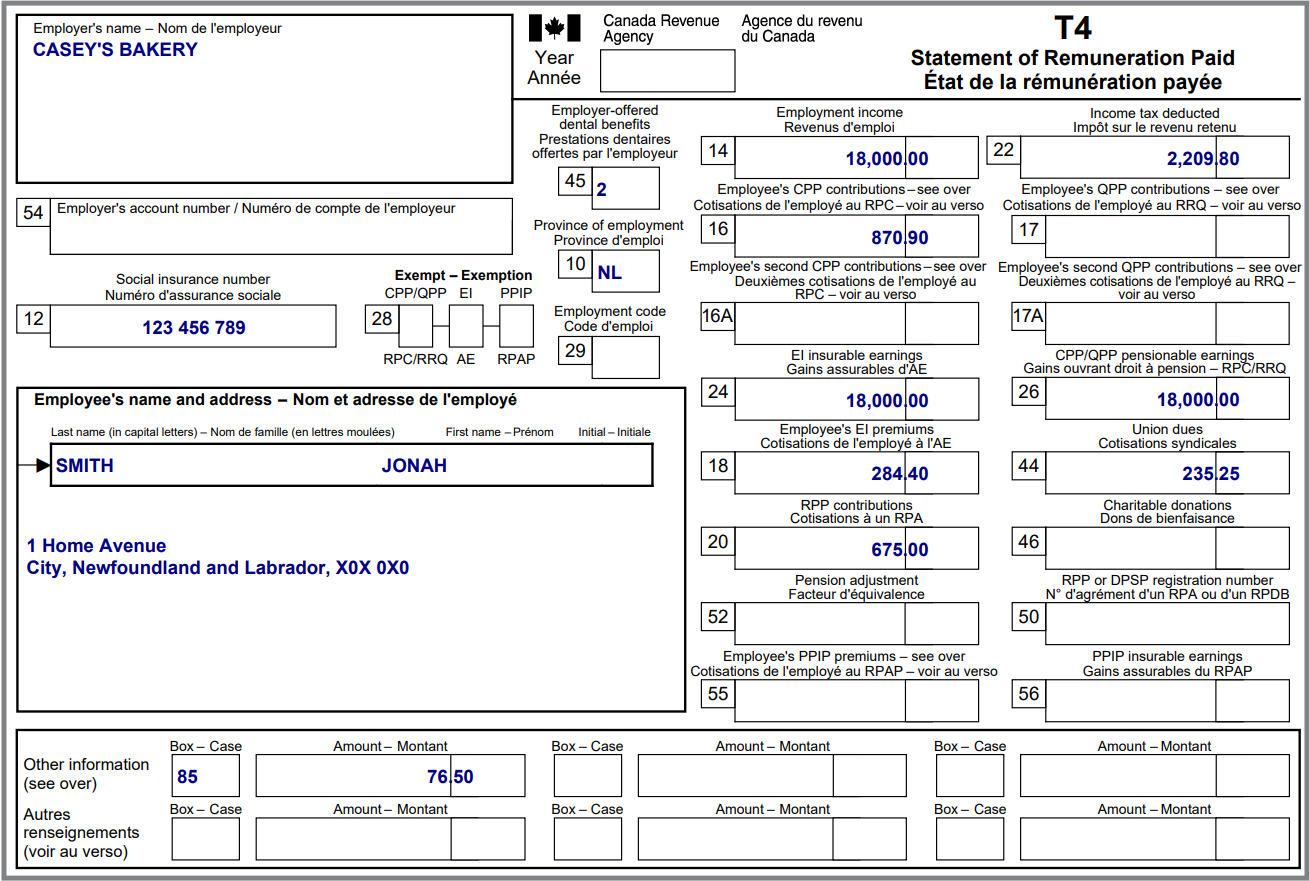

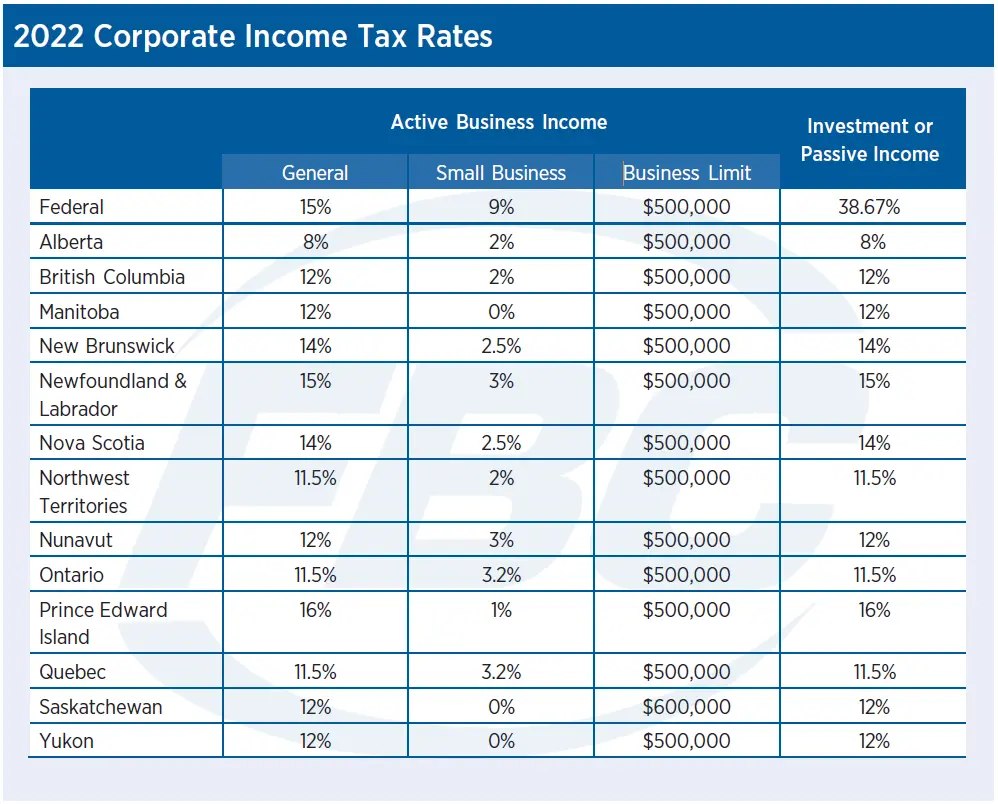

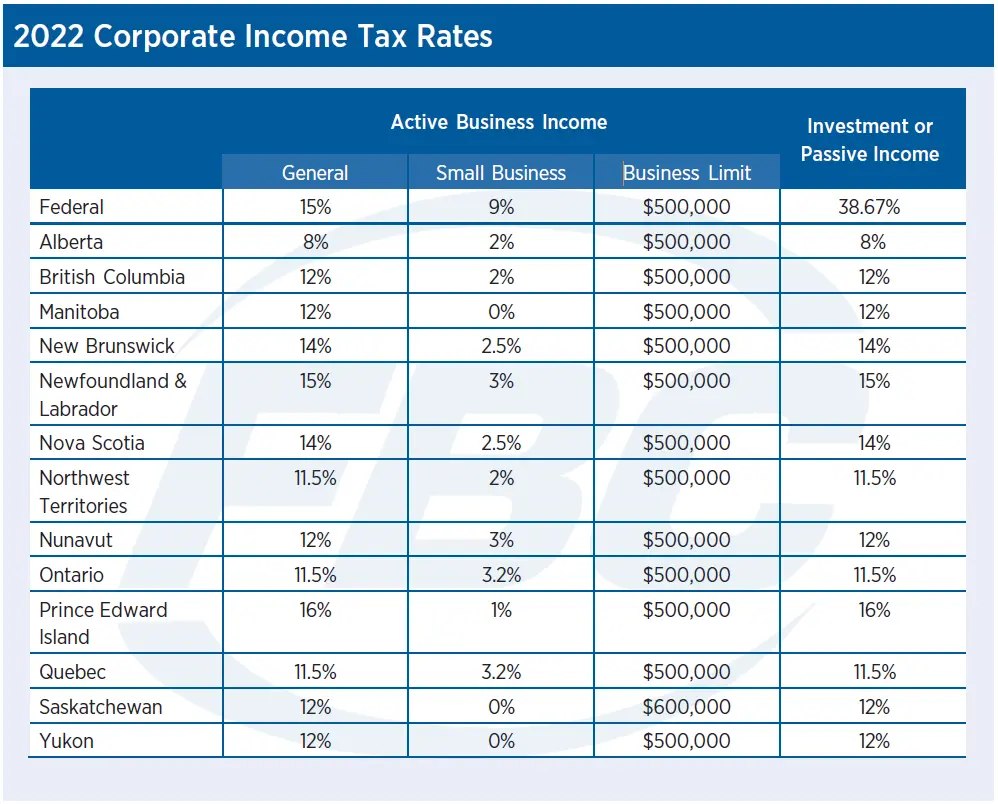

2022 Canadian Corporate Tax Rates And Deadlines FBC

2022 Canadian Corporate Tax Rates And Deadlines FBC

Oct 19 IRS Here Are The New Income Tax Brackets For 2023

Excel Income Tax Calculator How To Make Income Tax SexiezPix Web Porn

Tax Deduction 2021 Everything You Should Know About TDS And VDS In

Income Tax Deduction Calculator Ontario 2022 - Estimate your net salary after tax paycheck deductions capital gains taxes RRSP savings and CRA taxes owed using our 2022 Ontario income tax calculator