Income Tax Deduction For Health Insurance Premiums Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes depends on how much you spent on medical care and how you get

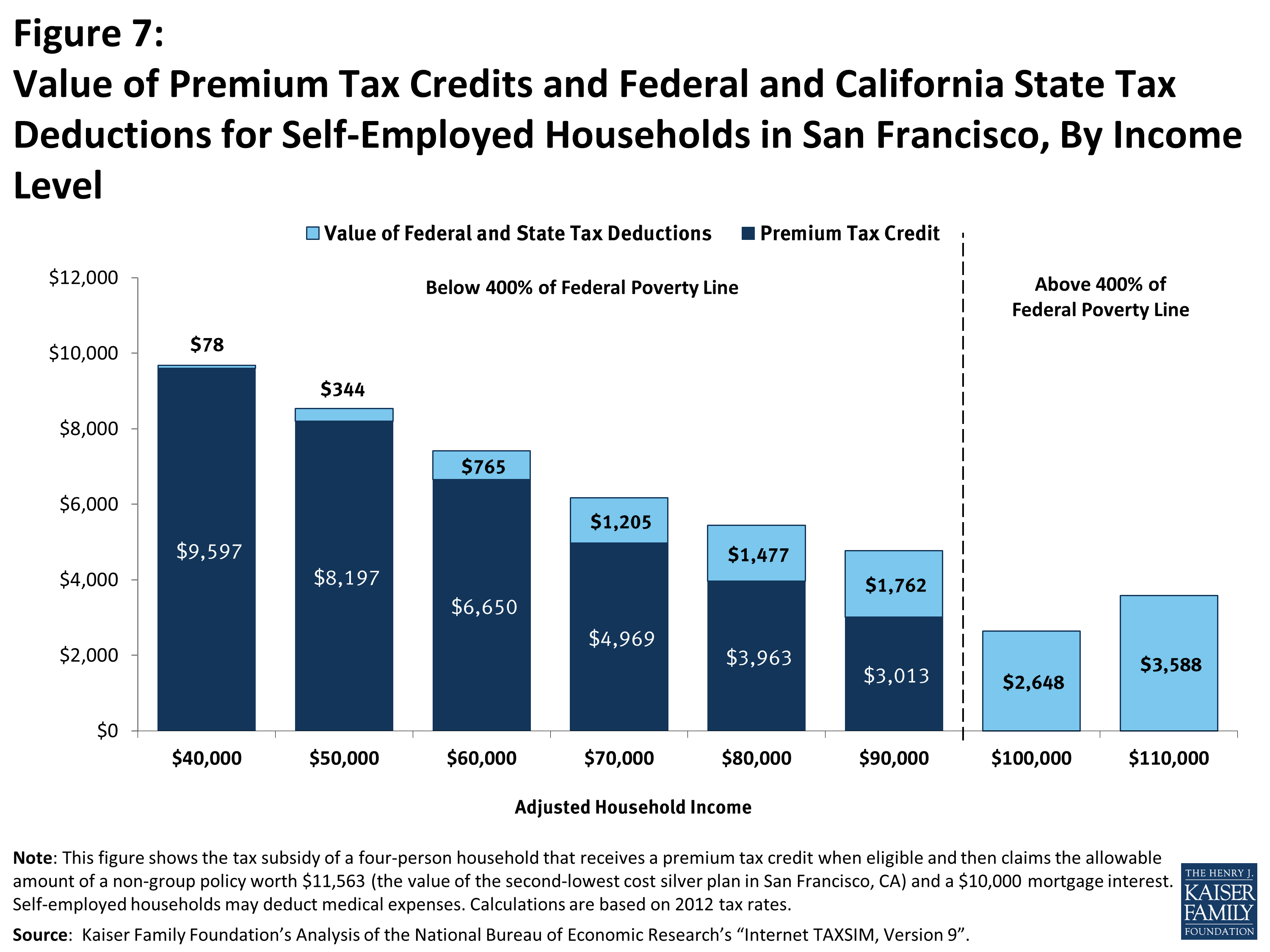

You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who meet certain Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health insurance exchange or directly from an insurance company the money you paid toward your monthly premiums can be taken as a tax deduction

Income Tax Deduction For Health Insurance Premiums

Income Tax Deduction For Health Insurance Premiums

https://www.kff.org/wp-content/uploads/2014/10/7779-02-figure-7.png?resize=698

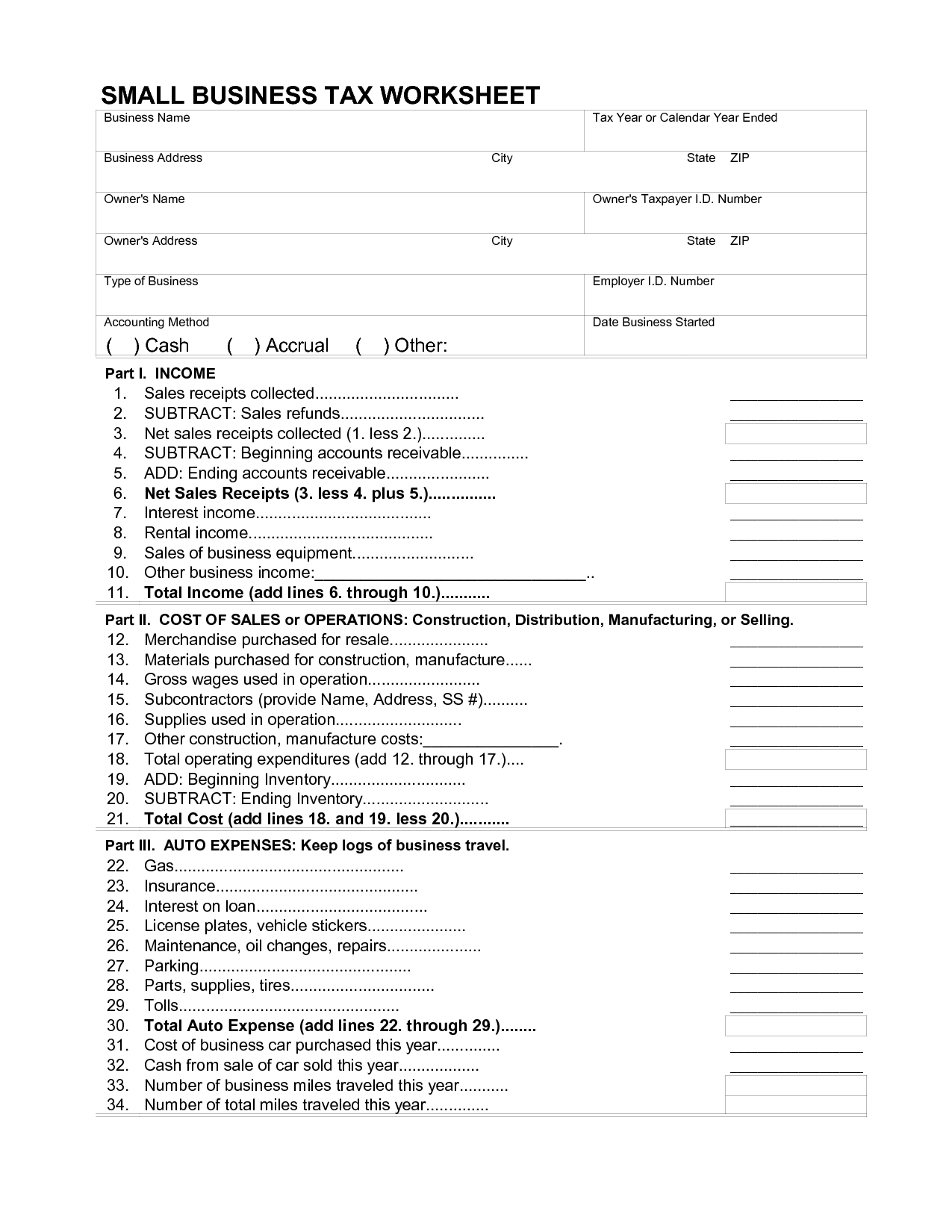

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

This is an adjustment to income rather than an itemized deduction for premiums you paid on a health insurance policy covering medical care including a qualified long term care insurance policy for yourself your spouse and dependents You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related work expenses and health insurance premiums if you are self employed

Your health insurance premiums can be tax deductible if you have income from self employment and you aren t eligible to participate in a health plan offered by an employer or your spouse s What is the Health Insurance Marketplace Q3 How do I get advance payments of the Premium Tax Credit updated Feb 24 2022 Q4 What happens if my income family size or other circumstances changes during the year updated Feb 24 2022 Eligibility Q5 Who is eligible for the Premium Tax Credit updated Feb 9 2024

Download Income Tax Deduction For Health Insurance Premiums

More picture related to Income Tax Deduction For Health Insurance Premiums

Printable Itemized Deductions Worksheet

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

Tax Deduction For Health Insurance When Can You Claim It Business News

https://i3.wp.com/ic-cdn.flipboard.com/thestreet.com/68fad7457e0ef3ddf6a0f261418e485cb5d16e9c/_xlarge.jpeg

Qualified Business Income Deduction And The Self Employed The CPA Journal

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t001.jpg

Health insurance premiums are tax deductible but only if your total health care expenses including premiums exceed 7 5 of your adjusted gross income and only the amount above that threshold Few taxpayers qualify for the deduction Taxes Tax Credits Deductions Are Health Insurance Premiums Tax Deductible By William Perez Updated on January 9 2023 Reviewed by Lea D Uradu Fact checked by David Rubin Photo The Balance Julie Bang You may be able to deduct the cost of health insurance premiums on your income tax return

You may qualify for an income based premium subsidy also called an advance premium tax credit APTC for coverage you bought through the Health Insurance Marketplace Any premium you pay that s reimbursed by an APTC can t be deducted from your taxes But any remaining premium can be deducted Health insurance premiums can be tax deductible under some circumstances Taxpayers who itemize may be able to use this deduction to the extent that their total medical and dental expenses including health insurance premiums exceed 7 5 of adjusted gross income

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

When Can You Claim A Tax Deduction For Health Insurance

https://static.wixstatic.com/media/b63c6f_c74351e3d6604e8bb40e4866f25fafe8~mv2.png/v1/fill/w_940,h_788,al_c,q_90/b63c6f_c74351e3d6604e8bb40e4866f25fafe8~mv2.png

https://www.forbes.com/advisor/health-insurance/is...

Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes depends on how much you spent on medical care and how you get

https://www.investopedia.com/are-health-insurance...

You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who meet certain

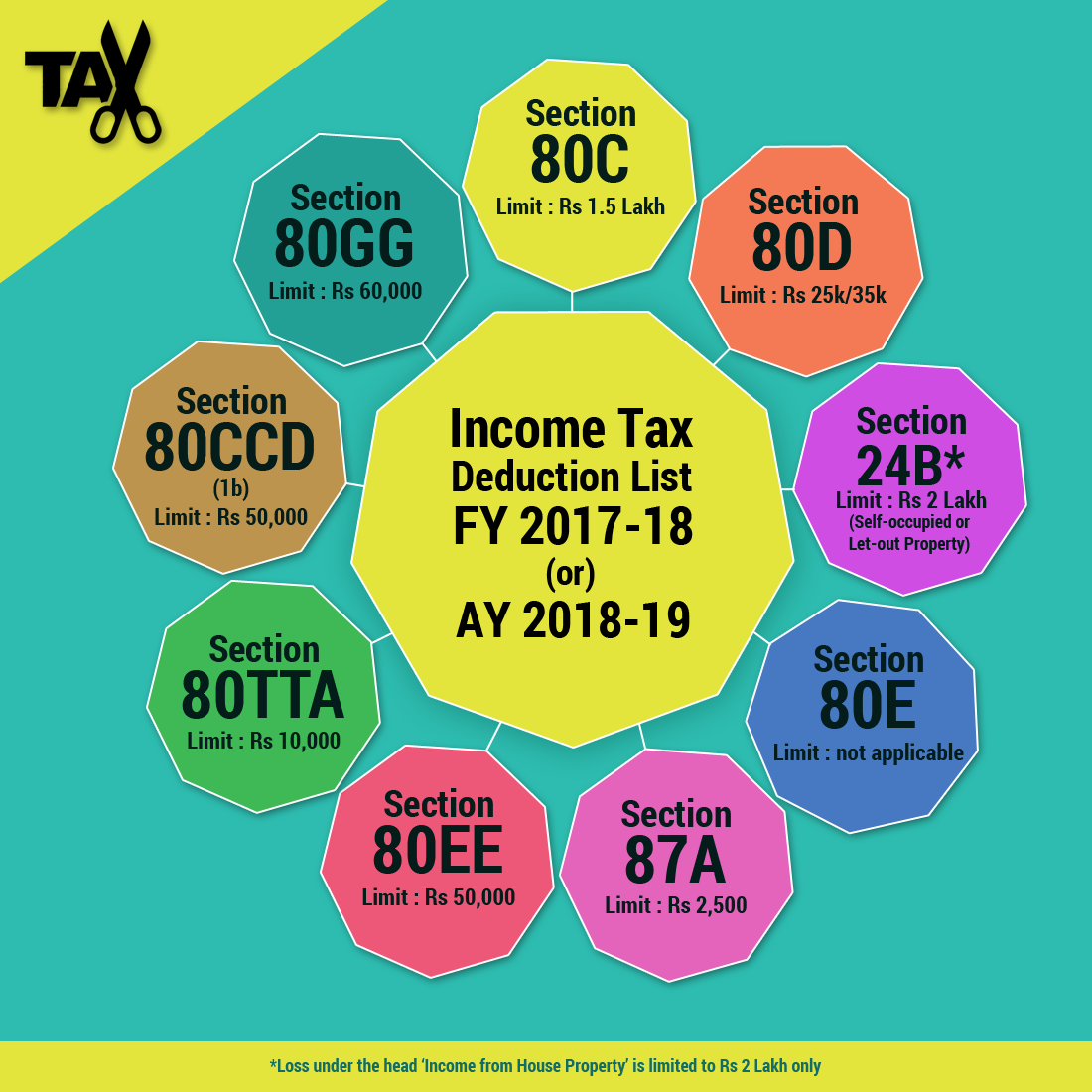

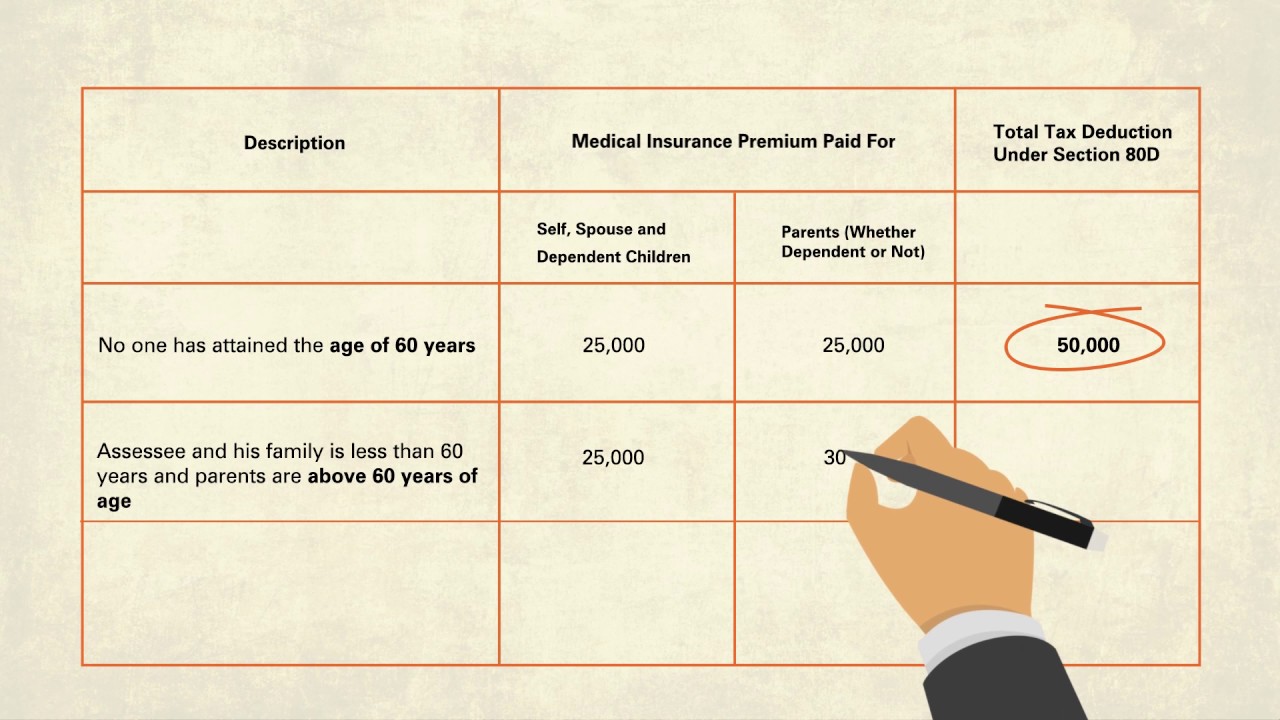

Deduction For Health Insurance U s 80D Of Income Tax 91 7838904326

Tax Deductions You Can Deduct What Napkin Finance

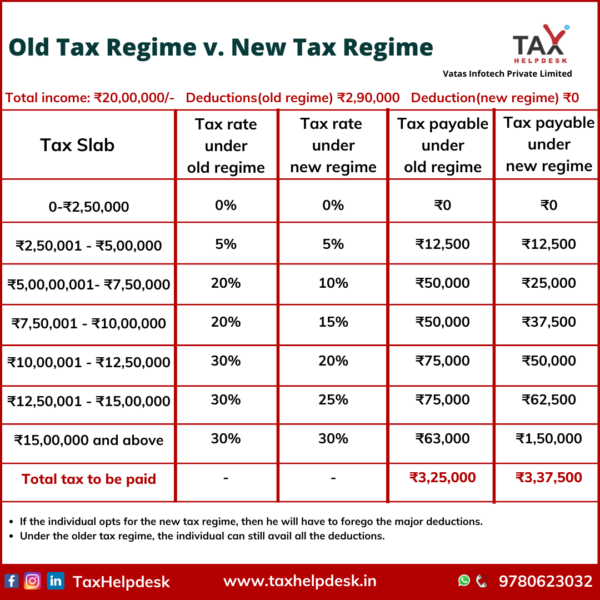

Income Tax Return Which Tax Regime Suits You Old Vs New

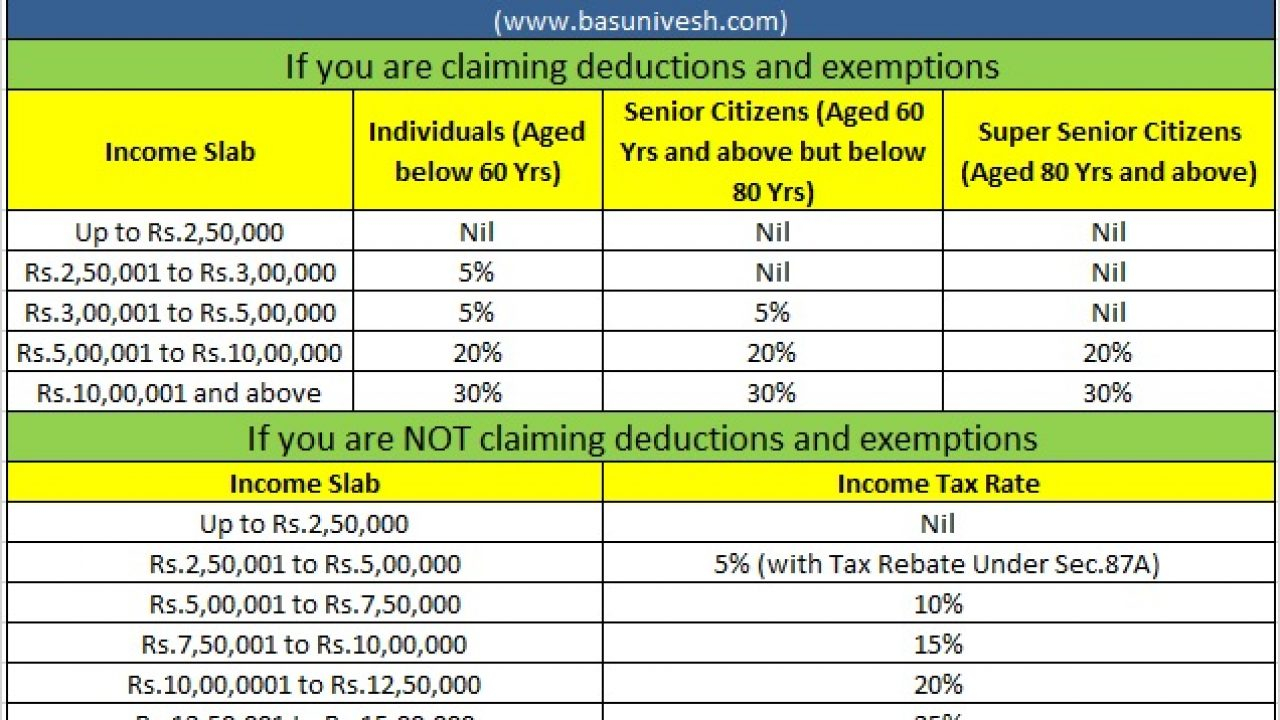

Standard Deduction Income Tax Ay 2021 22 Standard Deduction 2021

When Can You Claim A Tax Deduction For Health Insurance Yulianna FTP

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Epf Contribution Table For Age Above 60 2019 Frank Lyman

8 Tax Itemized Deduction Worksheet Worksheeto

Income Tax Deductions For The FY 2019 20 ComparePolicy

Tax Deduction Of Health Insurance Premium YouTube

Income Tax Deduction For Health Insurance Premiums - Your health insurance premiums can be tax deductible if you have income from self employment and you aren t eligible to participate in a health plan offered by an employer or your spouse s