Income Tax Deduction For Travelling Allowance The Income Tax Department introduced a standard deduction in place of transport and medical allowance From the financial year 2019 2020 the standard

The criteria for and amounts of allowances for travel expenses to be considered exempt from tax in the 2024 taxation shall be as prescribed in this decision below Leave Travel Allowance LTA or Leave Travel Concession LTC The income tax law also provides for an LTA LTC exemption to salaried employees

Income Tax Deduction For Travelling Allowance

Income Tax Deduction For Travelling Allowance

https://www.501c3.org/wp-content/uploads/2020/04/income-tax-return-deduction-refund-concept.jpg

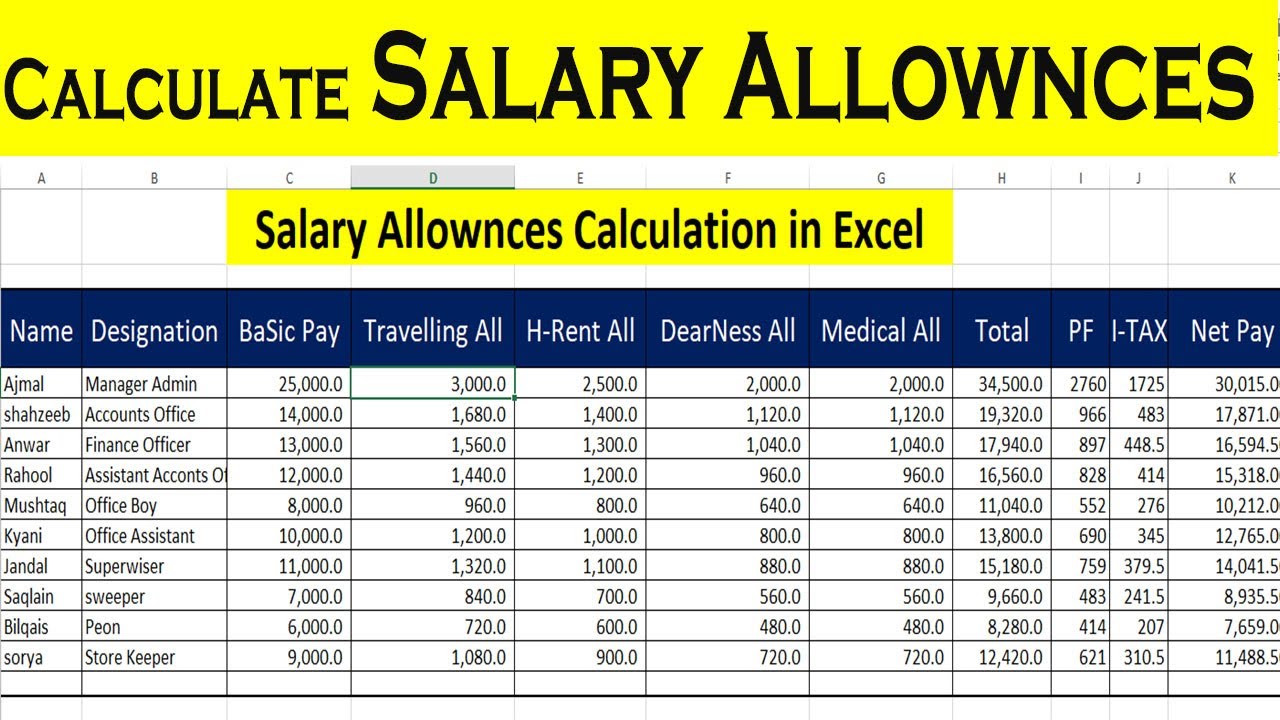

Calculate Salary Allowances And Tax Deduction In Excel By Learning

https://i.ytimg.com/vi/mOQDkRDhPjE/maxresdefault.jpg

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

Can t claim any deduction for your travel allowance expenses don t need to keep written evidence or travel records If you do this you will not pay any income tax on your travel Individuals receiving conveyance allowance can claim tax deductions while filing IT returns Read on to learn the exemption limit calculation and eligibility

For travel by car or motorcycle you are entitled to claim deductions for your expenses if the distance involved is at least 5 km You must also save at least two hours of travelling Per diem allowance refers to the daily allowance given to employees on overseas trips i e either out of Singapore or into Singapore for business purposes This payment is

Download Income Tax Deduction For Travelling Allowance

More picture related to Income Tax Deduction For Travelling Allowance

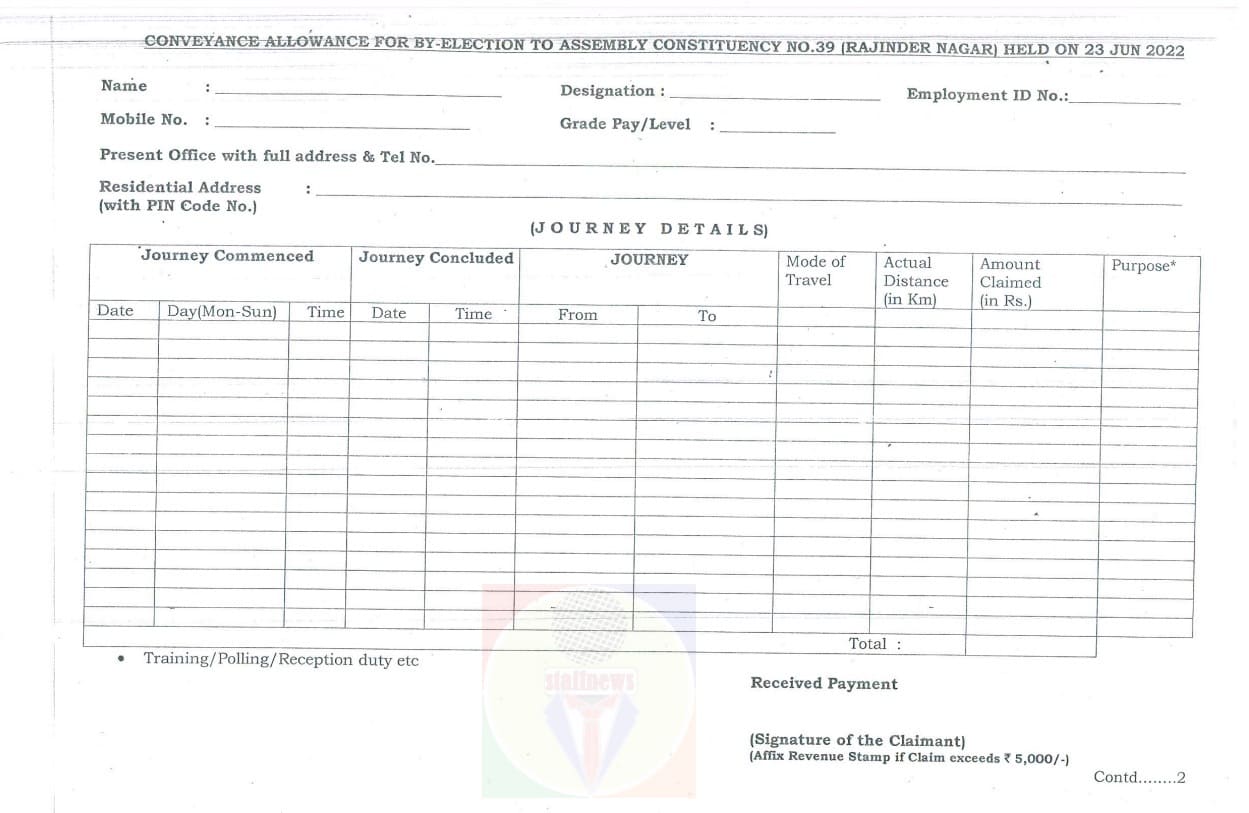

Travelling Allowance To The Officials Deployed For Election Duty

https://www.staffnews.in/wp-content/uploads/2022/09/travelling-allowance-to-the-officials-deployed-for-election-duty-claim-form.jpg

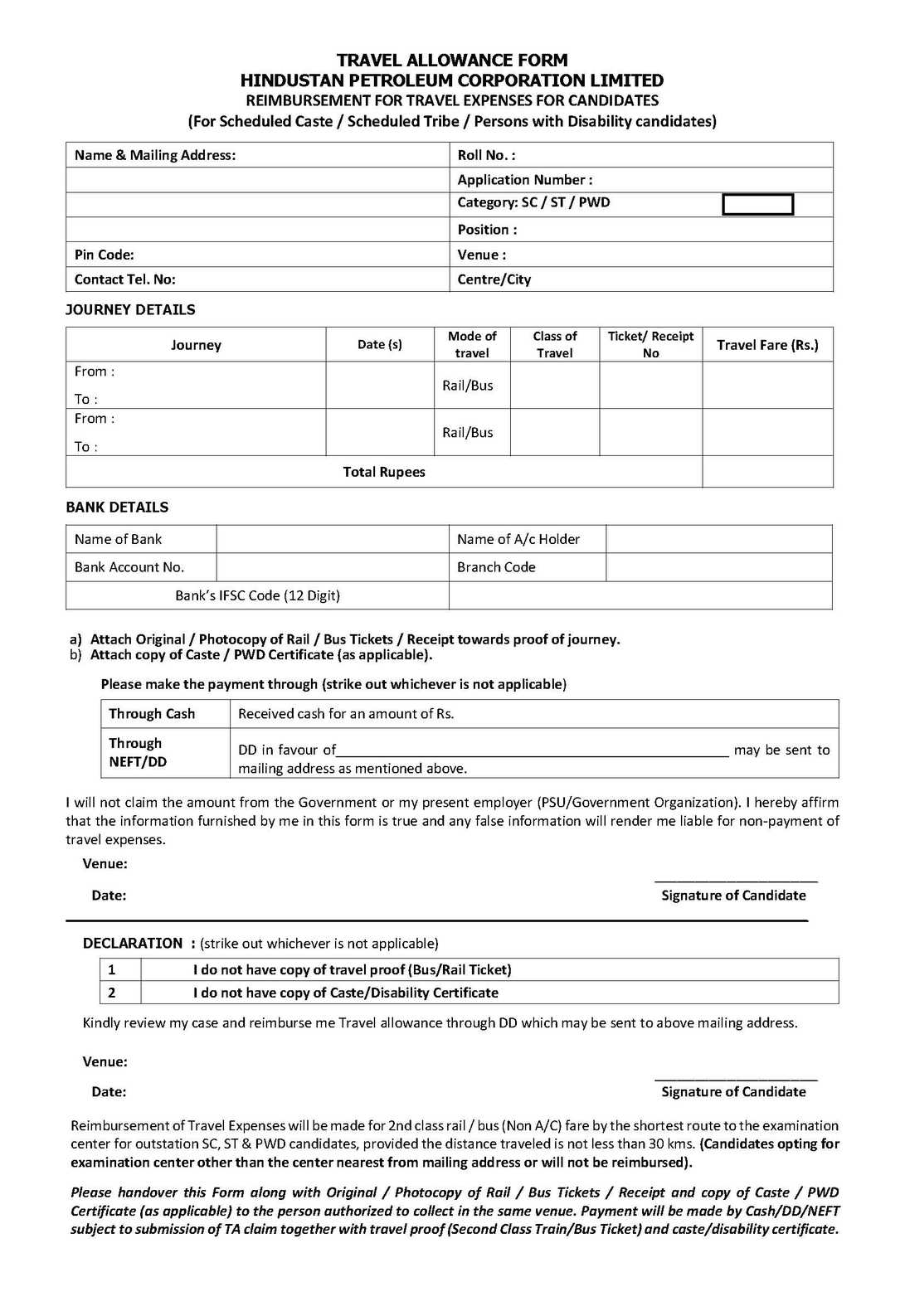

Travel Allowance Form For HPCL 2024 2025 EduVark

https://eduvark.com/img/f/Travel-Allowance-Form-For-HPCL-.jpg

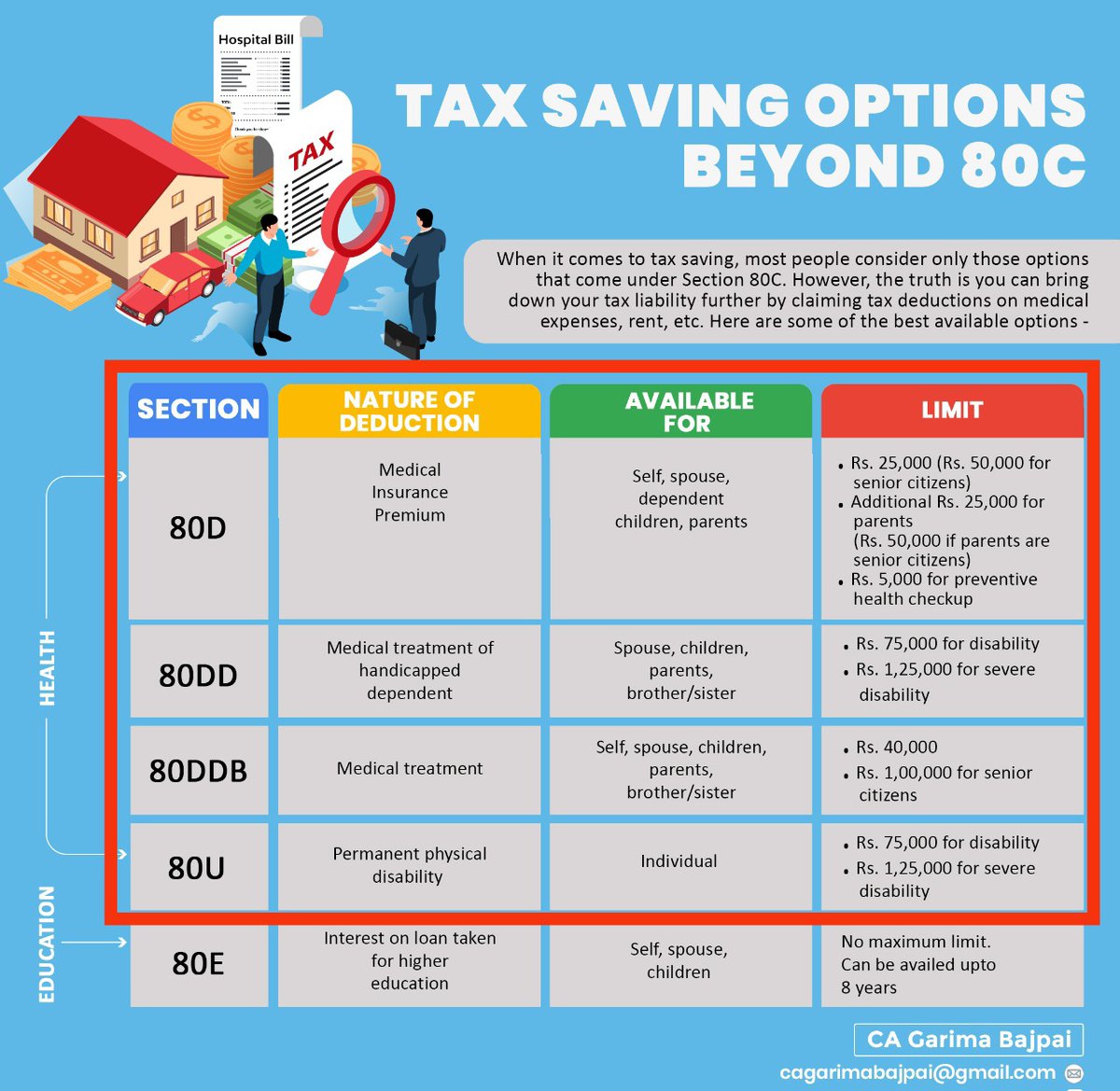

Income Tax Deductions Related To Health Deduction For Medical

https://pbs.twimg.com/media/Fq1e6leWIAE3ioW.jpg

Find out how to optimise the Travel Allowance section on your Tax Return for the Maximum Tax Deduction How to claim Transport Allowance while filing Income Tax Return Generally your employer takes care that you receive the benefit of tax exemption on transport

Alternative travelling expenses deductions Deductions for travelling expenses depend mainly on the wholly and exclusively rule outlined at PIM2010 Revenue costs of In general a taxpayer is required to pay tax on all kinds of earning including incomes from Business or Profession Employment Dividends Interest Discounts Rent Royalties

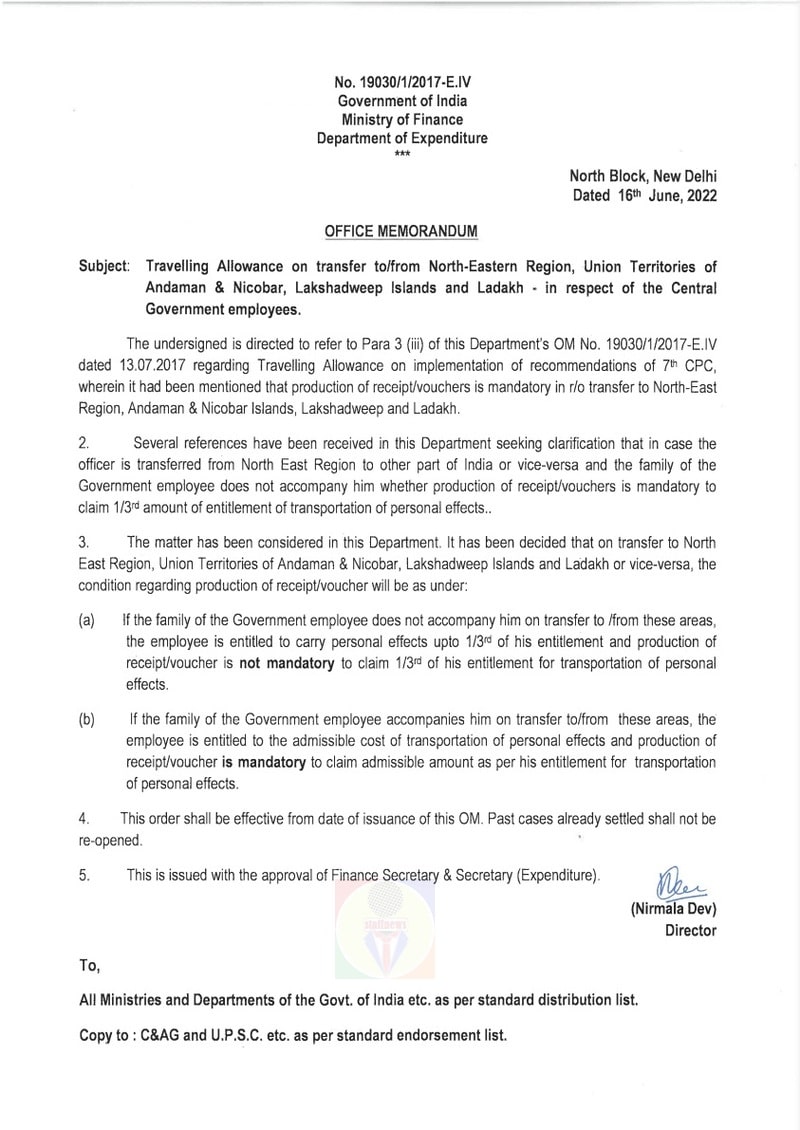

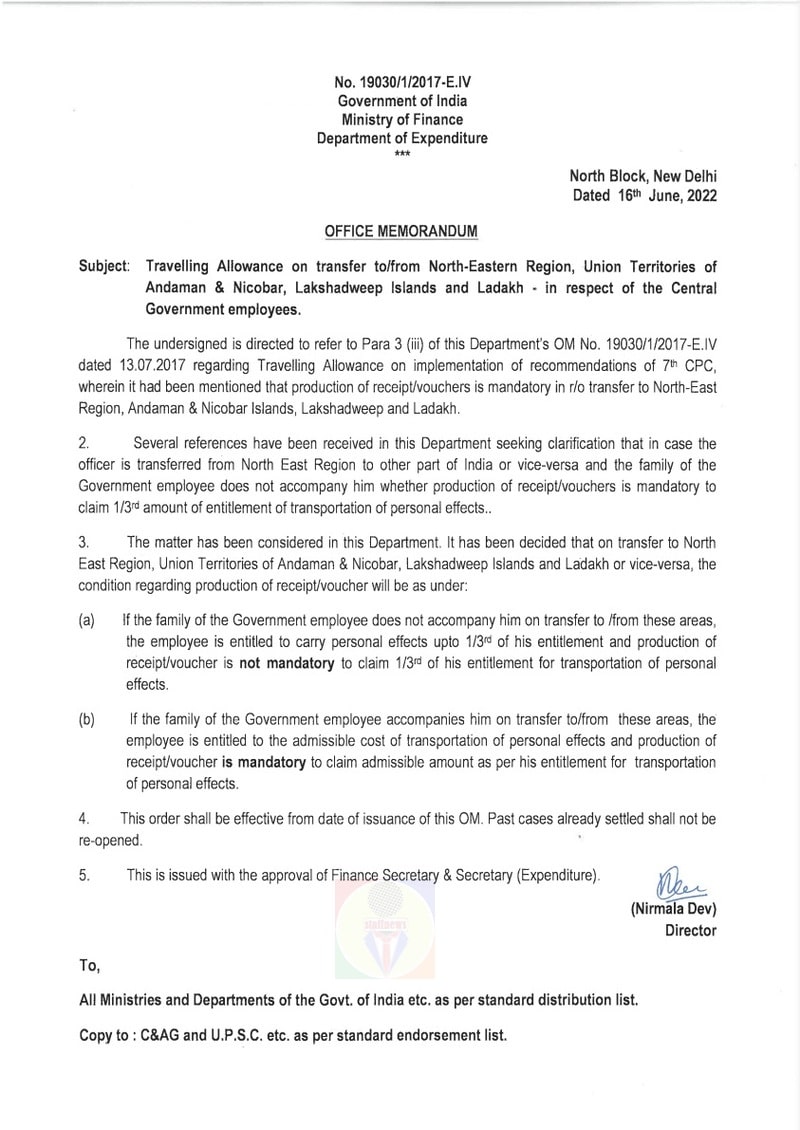

7th CPC Travelling Allowance On Transfer To from North Eastern Region

https://www.staffnews.in/wp-content/uploads/2022/06/travelling-allowance-on-transfer-to-from-ner-anlakshadweep-ladakh.jpg

Section 80GGA Deduction For Donation For Research Development

https://www.charteredclub.com/wp-content/uploads/2020/08/tax-deductions-1536x1153.png

https://cleartax.in/s/transport-allowance

The Income Tax Department introduced a standard deduction in place of transport and medical allowance From the financial year 2019 2020 the standard

https://www.vero.fi/en/detailed-guidance/decisions/47405

The criteria for and amounts of allowances for travel expenses to be considered exempt from tax in the 2024 taxation shall be as prescribed in this decision below

The Deductions You Can Claim Hra Tax Vrogue

7th CPC Travelling Allowance On Transfer To from North Eastern Region

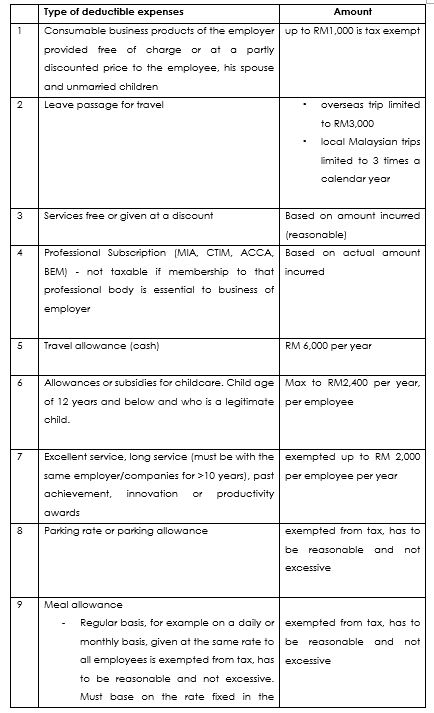

Car Allowance Taxable In Malaysia JorgefvSullivan

From Pan To Crypto New Income Tax Reforms That Take Effect On July 1

2 Easy Steps To Get Tax Deduction For Your Personal Vehicle Blue Rock

Tax Deduction For New Or Used Equipment Learn More About Section 179

Tax Deduction For New Or Used Equipment Learn More About Section 179

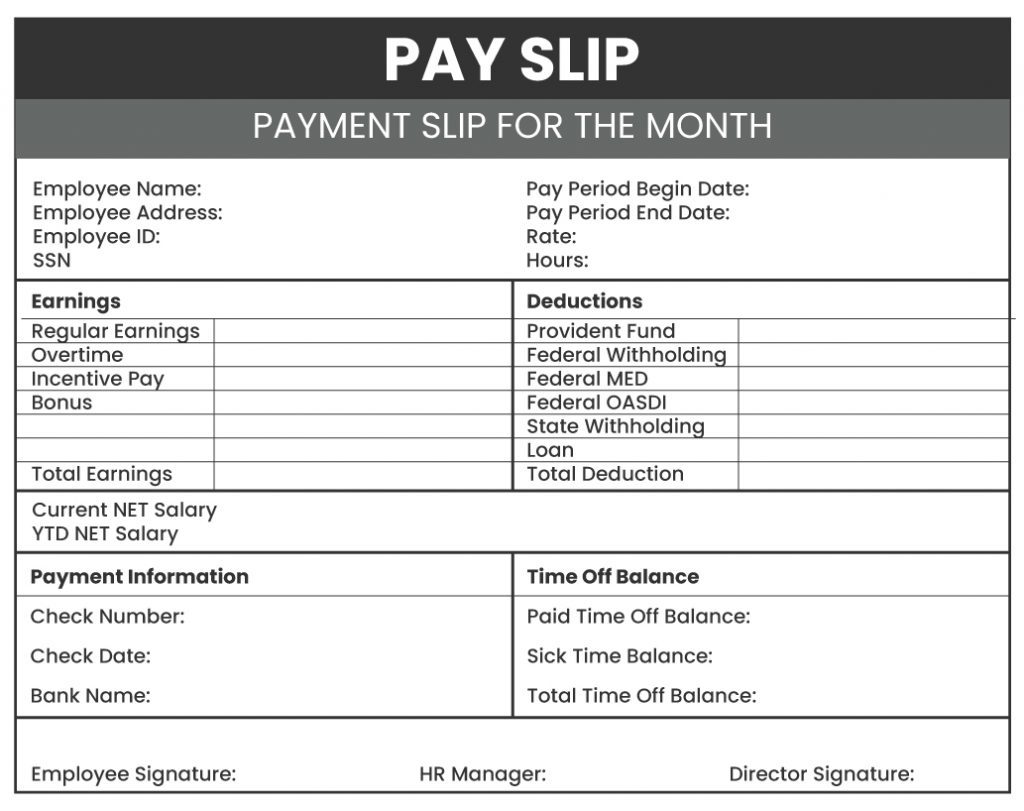

How To Read Your Payslip Otosection Vrogue co

Salary Payments That Need To Contribute To Payroll L Co

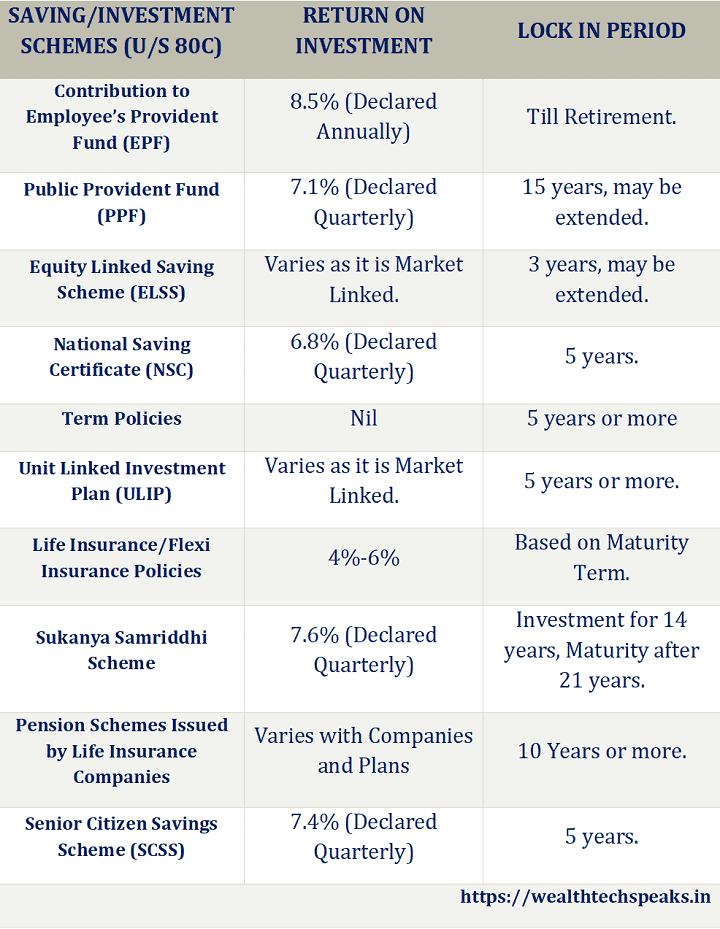

Income Tax Deductions Financial Year 2022 2023 WealthTech Speaks

Income Tax Deduction For Travelling Allowance - If you are a salaried person you have a right to claim the benefits of an exemptions available on your few parts of the salary components given either in the form of