Income Tax Deduction From Salary Circular 2022 23 CBDT has explained the obligation of employers with regard to the deduction of tax at source from salaries under section 192 of the Income tax Act 1961 for the Financial Year 2022 23 in a

Procedure format and standards for filling an application in Form No 15C or Form No 15D for grant of certificate for no deduction of income tax under sub section CBDT has issued a Circular on TDS from Salary under section 192 for AY 2022 23 FY 2021 22 vide Circular No 24 2022 dated 07 12 2022 detailing the procedure to be followed by an employer for

Income Tax Deduction From Salary Circular 2022 23

Income Tax Deduction From Salary Circular 2022 23

https://www.staffnews.in/wp-content/uploads/2022/12/income-tax-deduction-from-salaries-during-the-financial-year-2022-23.jpg

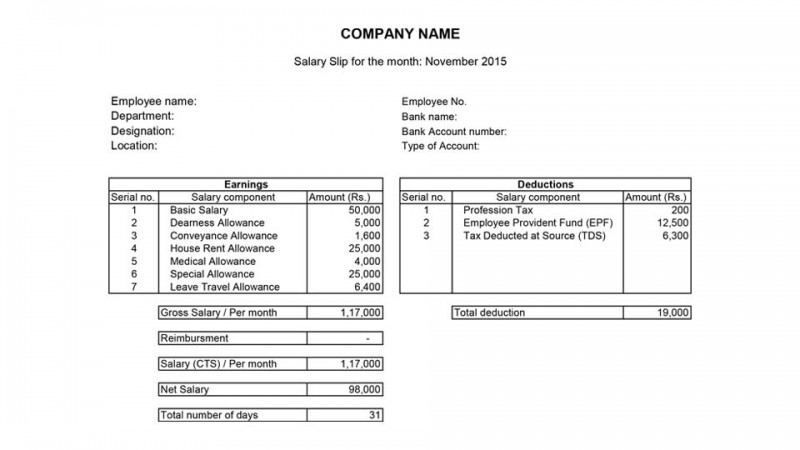

Calculate Salary Allowances And Tax Deduction In Excel By Learning

https://i.pinimg.com/736x/44/ae/9c/44ae9ce35dc58909cb61b8d410ca02dd.jpg

Income Tax Deduction From Salaries During The FY 2022 23 Under Section

https://www.gconnect.in/gc22/wp-content/uploads/2022/12/TDS-on-Salary-Section-192.jpg

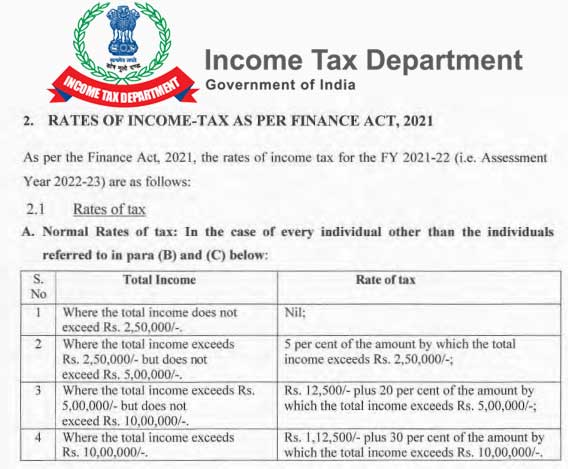

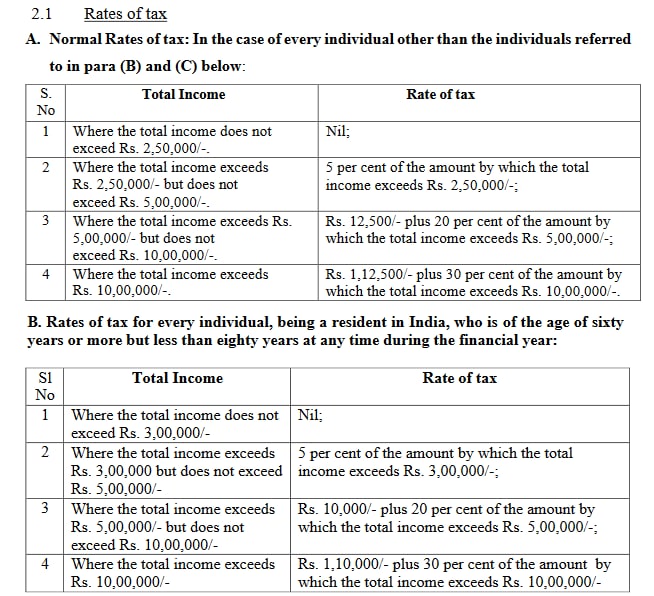

Rates of income tax on the basis of which tax has to be deducted at source and advance tax has to be paid during financial year 2022 23 and ii amended sections of the The present Circular contains the rates of deduction of Income tax from the payment of income chargeable under the head Salaries during the financial year 2022 23 and explains certain related

The Circular explained obligation of employers with regard to the deduction of tax at source from salaries under section 192 of the Income tax Act 1961 the IT Act for the Financial Year 2022 23 in a The present Circular contains the rates of deduction of Income tax from the payment of income chargeable under the head Salaries during the financial year 2022

Download Income Tax Deduction From Salary Circular 2022 23

More picture related to Income Tax Deduction From Salary Circular 2022 23

Income Tax IT Deduction From Salary During The FY 2022 2023

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjRGMbtD6SmLeIQ1gDYfWYlBhvMwL1OJAKCiXr-OPiispUaFcQdInhDySp-j3nuMbU-iSWko-oBkcPA4X9h8o0a3dLLkaEzgz2WCS9iWAsPeuKfaA0yABXCav7v5RHU1b406HYUYXlvty_fxKcSwYmKsylVda-W3awLee8UEWhsrUsltv-H4Ixv6h19GA/s16000/it.webp

Income From Salary Taxes Guide Learn By Quicko

https://learn.quicko.com/wp-content/uploads/2022/08/Salary-Slip.jpg

Income Tax Deduction From Salaries During The Financial Year 2021 22

https://www.gconnect.in/gc22/wp-content/uploads/2022/03/Tax-Deduction-768x575.jpg

The Circular comprehensively explained employers obligations regarding the deduction of tax at source from salaries under Section 192 of the Income tax Act The present Circular contains the rates of deduction of Income tax from the payment of income chargeable under the head Salaries during the financial year 2022

The circular was issued last week by CBDT The circular basically explains the obligation of employers with regard to the deduction of tax at source from salaries The present Circular contains the rates of deduction of Income tax from the payment of income chargeable under the head Salaries during the financial year 2022

Income Tax Deduction Card For 2018 Displaying Pay Benefits Taxable

https://imgv2-1-f.scribdassets.com/img/document/416426564/original/3658f09db5/1707494181?v=1

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

https://www.taxmann.com/post/blog/cbdt-is…

CBDT has explained the obligation of employers with regard to the deduction of tax at source from salaries under section 192 of the Income tax Act 1961 for the Financial Year 2022 23 in a

https://contents.tdscpc.gov.in/en/circulars-notifications-instructions.html

Procedure format and standards for filling an application in Form No 15C or Form No 15D for grant of certificate for no deduction of income tax under sub section

RATES OF INCOME TAX AS PER FINANCE ACT 2021 2022 INCOME TAX DEDUCTION

Income Tax Deduction Card For 2018 Displaying Pay Benefits Taxable

Publication 15 Federal Tax Withholding Tables Federal Withholding

Tax Rates Absolute Accounting Services

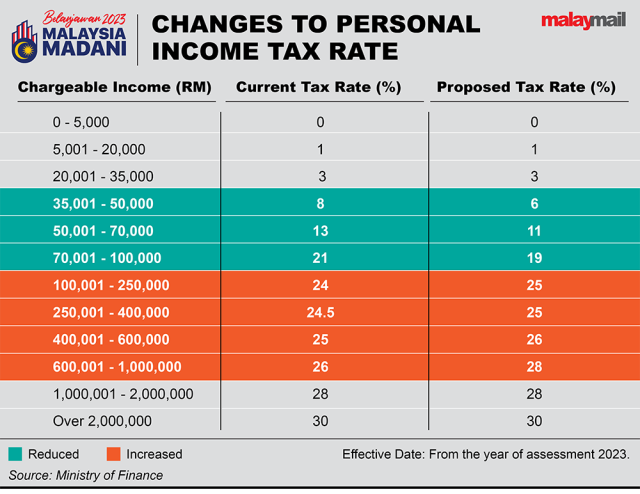

Special Tax Deduction Flexible Working Arrangement Mar 01 2022

Income Tax Deduction From Salary IndiaFilings

Income Tax Deduction From Salary IndiaFilings

Budget 2023 Income Tax Down For M40 Up For Those Earning Above RM100k

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

INCOME TAX DEDUCTION FROM SALARIES DURING THE FINANCIAL YEAR 2022 23

Income Tax Deduction From Salary Circular 2022 23 - The Circular explained obligation of employers with regard to the deduction of tax at source from salaries under section 192 of the Income tax Act 1961 the IT Act for the